Category Archive: 6a) Gold & Monetary Metals

Global Debt Crisis II Cometh

Global Debt Crisis II Cometh

– Global debt ‘area of weakness’ and could ‘induce financial panic’ – King warns

– Global debt to GDP now 40 per cent higher than it was a decade ago – BIS warn

– Global non-financial corporate debt grew by 15% to 96% of GDP in the past six years

– US mortgage rates hit highest level since May 2014

– US student loans near $1.4 trillion, 40% expected to default in next 5 years

– UK consumer debt hit £200b, highest...

Read More »

Read More »

Sovereign Wealth Funds Investing In Gold For “Long Term Returns” – PwC

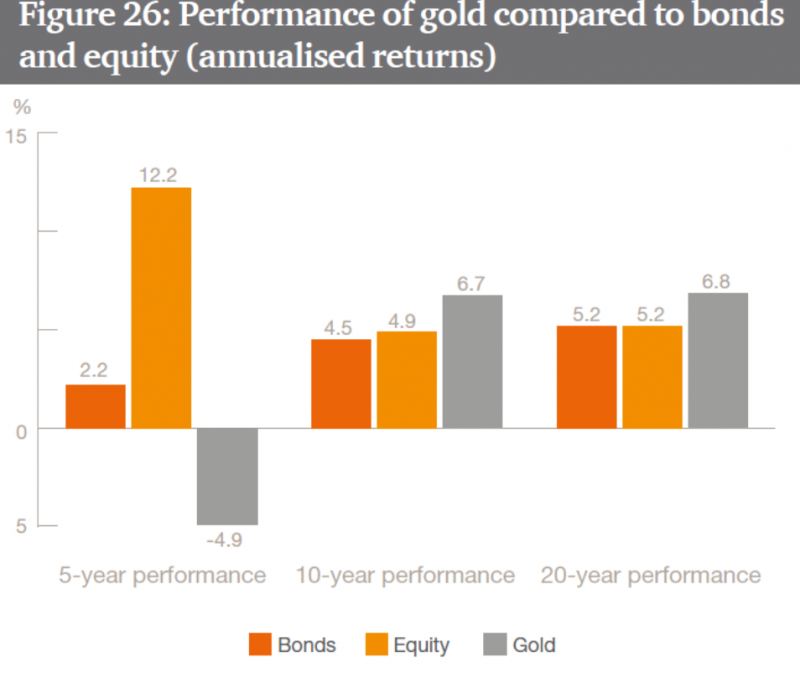

Sovereign wealth funds investing in gold for long term returns – PwC. Gold has outperformed equities and bonds over the long term – PwC Research. Gold is up 6.7% and 6.8% per annum over 10 and 20 year periods; Stocks and bonds returned less than 5.2% respectively over same period (see PwC table). From 1971 to 2016 (45 years), “gold real returns were approximately 10% while inflation increased 4%”.

Read More »

Read More »

Ronan Manly Will Economics Dictate a Gold Price Rise?

The Matterhorn Interview- April 2016 For Matterhorn Asset Management, Lars Schall spoke with Ronan Manly, who is an investment professional and research analyst with an interest in the monetary. Subscribe to our Free Financial Newsletter: We have an expert in Gold with us today, Ronan Manly from BullionStar will be discussing the disconnection between Physical. …

Read More »

Read More »

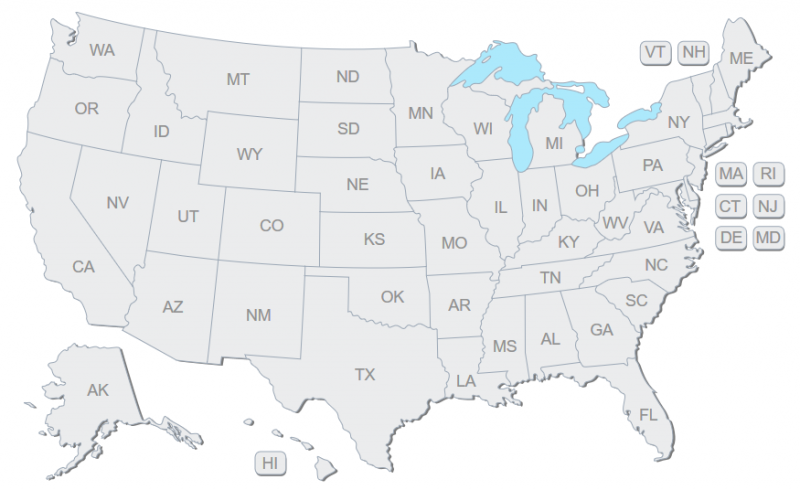

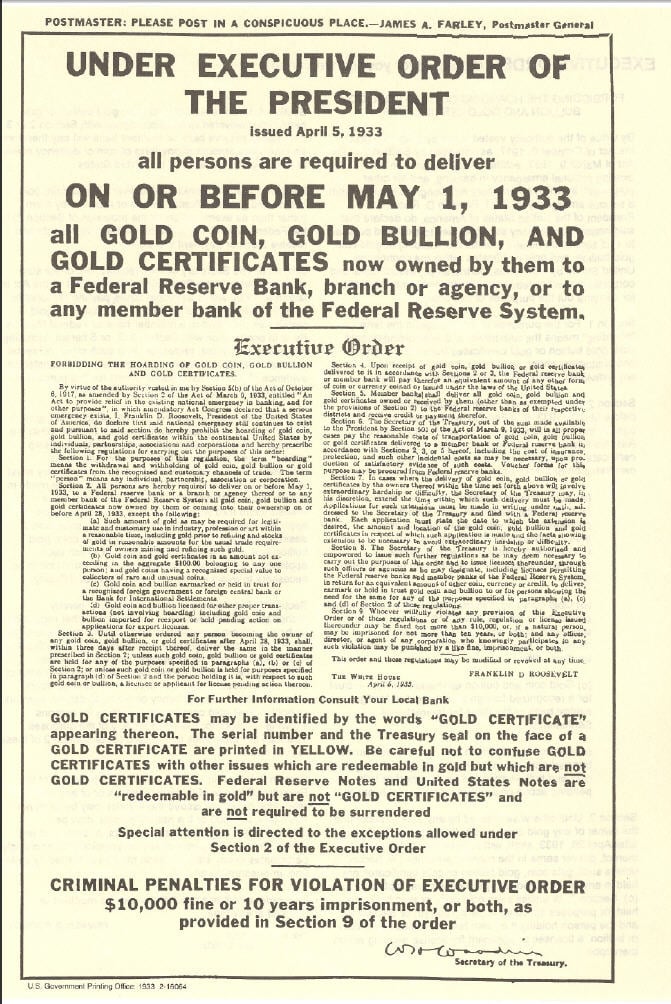

Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State. State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation Committee.

Read More »

Read More »

Jan Skoyles and John Butler about weak hands in gold

The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset Management, Lars Schall talks with both Jan Skoyles and John Butler. They both. The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset Management, Lars Schall talks …

Read More »

Read More »

Bitcoin and Crypto Prices Being Manipulated Like Precious Metals?

Bitcoin and Crypto Prices Being Manipulated Like Precious Metals? – FSN Interview GoldCore. Kerry Lutz of the Financial Survival Network (FSN) interviewed GoldCore’s Mark O’Byrne about the outlook for crypto currencies, financial markets and precious metals. Are bitcoin and crypto prices being manipulated like precious metals? Is there a coordinated backlash against bitcoin from JPM and powerful interests?

Read More »

Read More »

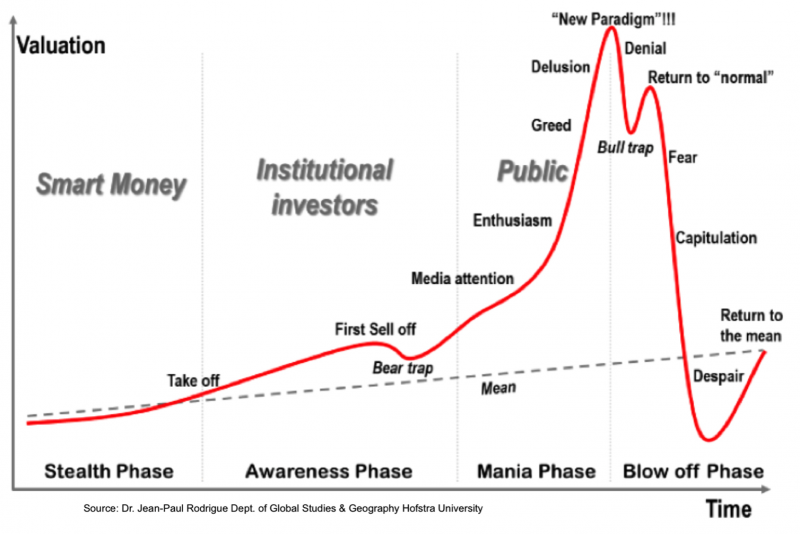

“This Is Where They Completely Lost Their Minds” – Hussman

“This Is Where They Completely Lost Their Minds” – Hussman. Hussman warns ‘the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle’. ‘the market has lost value, even since 2009, when overvalued, overbought, overbullish conditions were joined by divergent internals’. Believes the market is going to learn lessons about the crash ‘the hard way’.

Read More »

Read More »

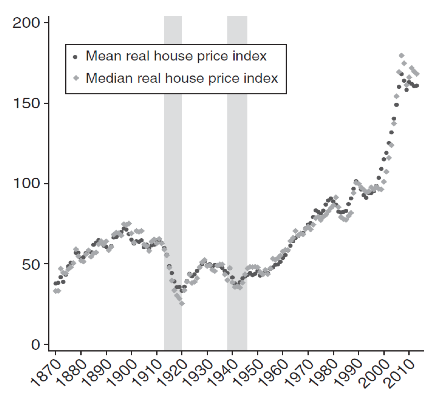

Brexit Risks Increase – London Property Market and Pound Vulnerable

Brexit Risks Increases – London Property Market and Pound Vulnerable. Brexit uncertainty deepens as UK government in disarray. BOE warns of earlier and larger rate hikes for Brexit-hit UK. UK property prices fall second month in row, London property under pressure. No deal Brexit estimated to cost UK £80bn according to government analysis. Transition period causing major uncertainty for UK and pound. Pound expected to fall as Brexit fears remain...

Read More »

Read More »

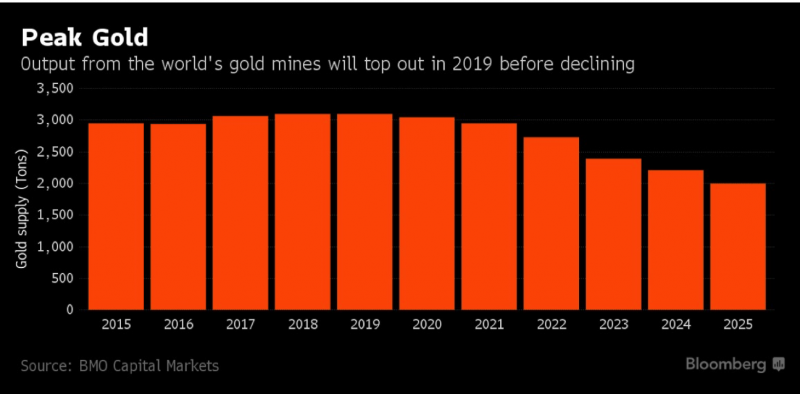

Peak Gold: Global Gold Supply Flat In 2017 As China Output Falls By 9 percent

Peak Gold: 2017 Supply Flat As China Output Falls By 9%. China gold production falls by 9% to 420.5t in 2017. Chinese gold demand rose 4% to 953.3t in same period. China is largest producer and accounts for 15% of global gold production. China does not export gold. Increasing foreign gold acquisitions to meet demand. Global gold production flat – 3,269t in ’17 from 3,263t in ’16, smallest increase since ’08. Peak Gold is here: supply set to fall...

Read More »

Read More »

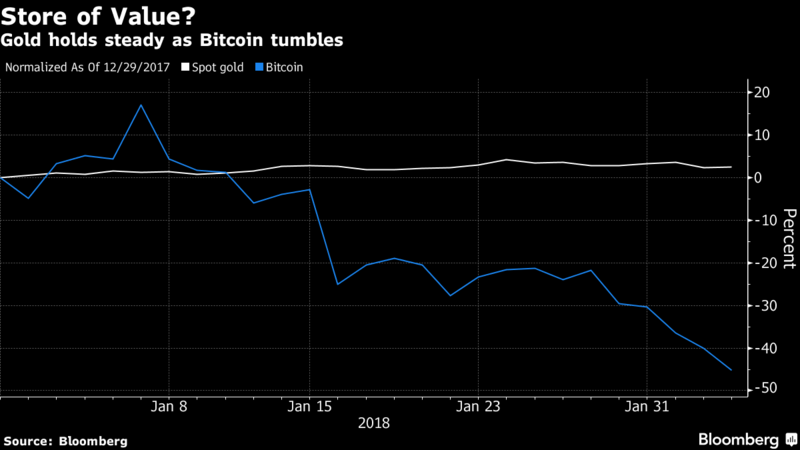

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin. Bitcoin falls from $20,000 to below $6,000 and bounces back to $8000. Top 50 crypto currencies lost over 50% of value in 24 hours. Over $60 billion wiped off entire crypto currency market in 24 hours. Markets concerned about increased regulation, manipulation & country-wide bans. ‘Growing global unease about risks virtual currencies pose to investors and financial system’.

Read More »

Read More »

Marc Faber befürchtet 20 Prozent Crash

Schweizer Doom-Prophet sieht Aktien trotz Absturz auf übertriebenem Niveau, rät zu Verkäufen, rechnet mit baldiger Welt-Rezession.

Read More »

Read More »

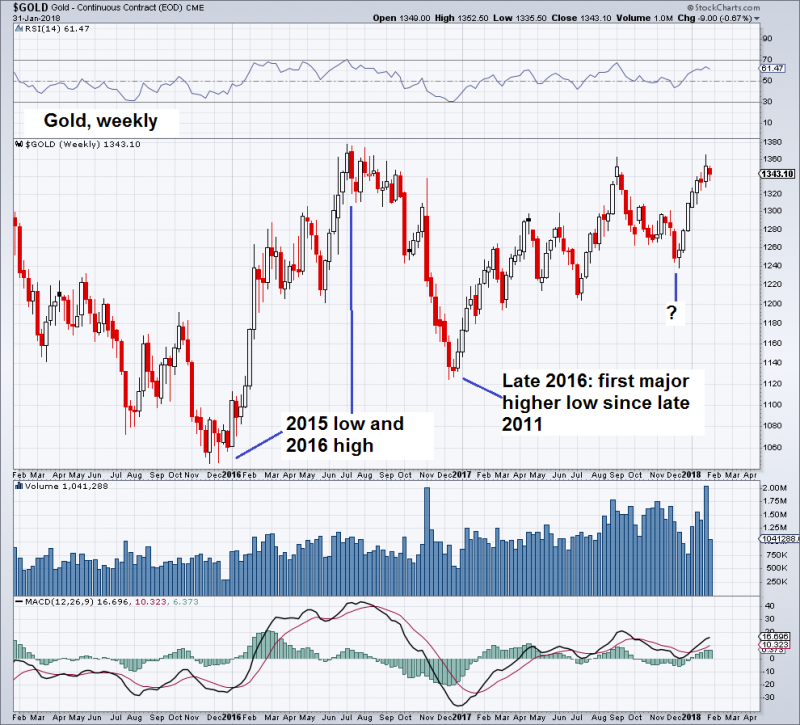

Gold Rises As Global Stocks Plunge and Bitcoin Crashes 70 percent

Gold gains 0.6% in USD and surges 1.7% in euros and pounds. European stocks fall more than 3% at the open after sharp falls in Asia. DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7%. Gold rises from $1,330 to $1,342, £942 to £960 and €1,067 to €1,085 /oz. Bitcoin crashes another 10% and has now plummeted by 70% to below $6,000. Increased risk aversion will drive safe haven demand for gold as its hedging properties are appreciated...

Read More »

Read More »

Shrinkflation Intensifies – Stealth Inflation As Thousands of Food Products Shrink In Size, Not Price

Shrinkflation continues to take hold across UK, Ireland and US for sixth year running. Shrinkflation sees consumers gets less product, but at the same or increased price. 2,500 products have shrunk according to Office of National Statistics in UK. Reported inflation is between 1.7% and 3% but actually much higher. Shrinkflation is financial fraud, unreported inflation in stealth mode. Gold is hedging inflation and shrinkflation.

Read More »

Read More »

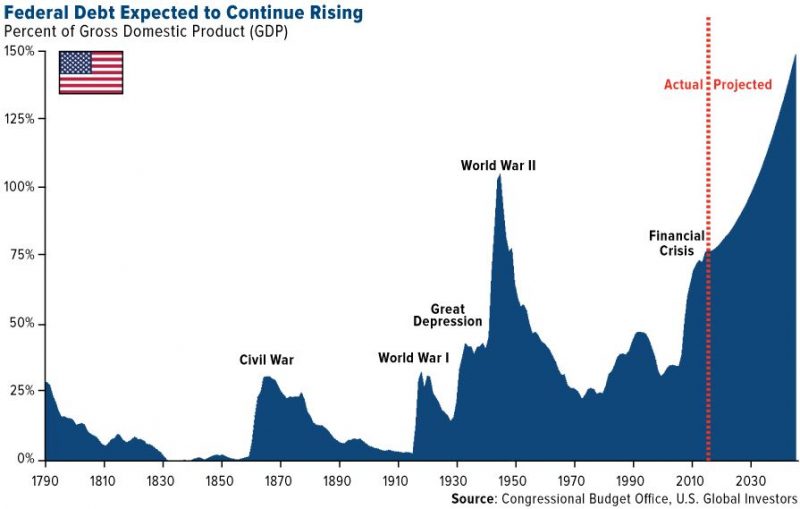

U.S. Debt Is “Extraordinarily High” and Are Stock And Bond Bubbles – Greenspan

“We have a stock market bubble” warns Greenspan. “Bond bubble will be the big issue” he tells Bloomberg TV (see video). “Fiscally unstable long-term outlook in which inflation will take hold”. “Ratio of federal debt to GDP which is extraordinarily high” (see chart). Higher interest rates, inflation and stagflation coming. Gold is the “ultimate insurance policy” – Greenspan

Read More »

Read More »

Central Banks and The Gold Markets – Ronan Manly Interview

The Matterhorn Interview- April 2016 For Matterhorn Asset Management, Lars Schall spoke with Ronan Manly, who is an investment professional and research analyst with an interest in the monetary. Subscribe to our Free Financial Newsletter: We have an expert in Gold with us today, Ronan Manly from BullionStar will be discussing the disconnection between Physical. …

Read More »

Read More »

Silver Bullion: Once and Future Money

Silver Bullion: Once and Future Money. “Silver is as much a monetary metal as gold” – Rickards. U.S. following footsteps of Roman Empire which collapsed due to currency debasement (must see table). Silver bullion is set to rally due to a combination of supply/demand fundamentals, geopolitical pressures creating safe haven demand, and increasing inflation expectations as confidence in central banking and fiat money erodes.

Read More »

Read More »

Jim Rickards: N. Korea Close to Being Able to Destroy US (Part 2)

Read the full transcript here: https://goo.gl/o7Y7cu Listen to Part 1: https://youtu.be/fgW6b4ZEbvo Listen to the explosive conclusion of my two part interview with Jim Rickards. Find out what Jim has to say about not just gold but also silver, and where he thinks things are headed between the U.S. and North Korea. Don’t miss this fascinating …

Read More »

Read More »

Jim Rickards: Next Financial Panic Will Be the Biggest of All (Part 1)

Read the full transcript here: https://goo.gl/Ka6292 Read more about the Next Global Financial Crisis: https://www.moneymetals.com/news/2017/05/08/next-financial-crisis-china-001065 Jim Rickards examines what the next financial crisis will look like and how it will be different from previous panics, gives us his outlook for gold and the key drivers for the yellow metal in part one of a tremendous …

Read More »

Read More »