Category Archive: 6a) Gold & Monetary Metals

PM Modi Is On The Right Track: Marc Faber

On sidelines of the #TradersCarnival in Thailand, Anuj Singhal caught up with Marc Faber for an exclusive interaction. Faber is all praises for Governor Rajan and says he has a very high opinion about PM Modi. Listen in.

Read More »

Read More »

A Day With Marc Faber – Part 2

CNBC-TV18’s Anuj Singhal gets up, close & personal with Marc Faber at the latter’s beautiful home in Chiang Mai in Thailand. Apart from discussing global markets, central banks’ actions and commodities, the investment guru opens up about his personal a…

Read More »

Read More »

A Day With Marc Faber – Part 1

CNBC-TV18’s Anuj Singhal gets up, close & personal with Marc Faber at the latter’s beautiful home in Chiang Mai in Thailand. Apart from discussing global markets, central banks’ actions and commodities, the investment guru opens up about his personal a…

Read More »

Read More »

Mr. Marc Faber: The Risk of Global Collapse

We are pleased that Mr. Marc Faber has agreed to be our guest to discuss the stability of the world’s financial situation. Mr. Faber is a Swiss investor based in Thailand and publisher of the Gloom Boom & Doom Report and is the director of Marc Faber Ltd. which acts as an investment advisor and … Continue reading...

Read More »

Read More »

Arizona Governor Ducey Vetoes Gold

Unpersuaded by either the plight of the pensioners or the prospect of business growth in Arizona, Ducey vetoed gold. This is his second time to shoot down gold.

Read More »

Read More »

Keith Weiner: Gold Standard etc.

The Gold Standard Institute starts posting on snbchf.com. It is based in Phoenix AZ, is a 501(c)3 tax-exempt educational organization dedicated to spreading awareness and knowledge of gold, and to promoting the use of gold as money.

Read More »

Read More »

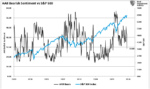

Commodities – Will the Rally Continue?

Pros and Cons The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to c...

Read More »

Read More »

Paper Gold Is Rising

The Metals Take Off The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if...

Read More »

Read More »

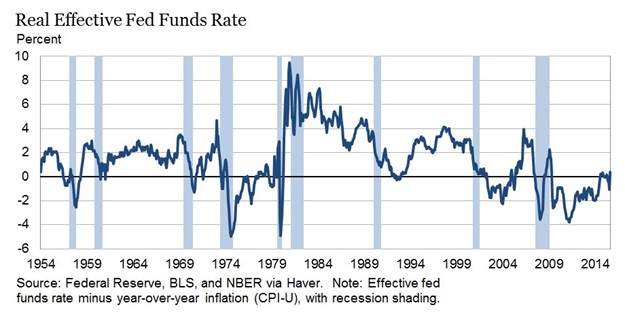

How Unsound Money Fuels Unsound Government Spending

Stefan Gleason shows the major slides that may predict a collapse of the dollar. The Trade Deficit after the abandonment of gold, the explosion of entitlements like social security, Medicare, Obamacare, subsidies and the explosion of the federal deficit to 1 trillion in 2022. The reason: Unsound money.

Read More »

Read More »