Category Archive: 6a) Gold & Monetary Metals

Yahoo Hacking Highlights Cyber Risk and Increasing Importance of Physical Gold

Yahoo admits every single one of 3 billion accounts hacked in 2013 data theft. Equifax hacking and security breach exposes half of the U.S. population. Some 143 million people vulnerable to identity theft. Deloitte hack compromised sensitive emails and client data. JP Morgan hacked and New York Fed hacked and robbed. International hacking group steals $300 million. Global digital banking and financial system not secure

Read More »

Read More »

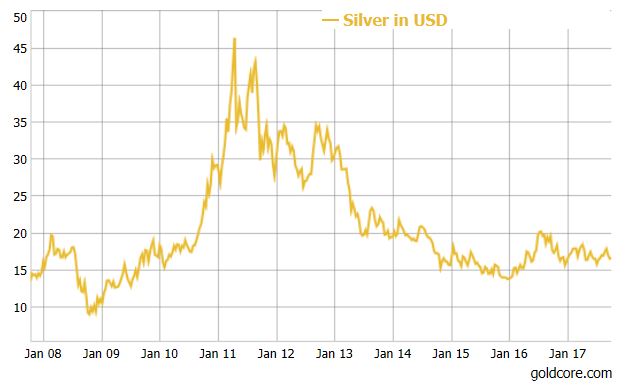

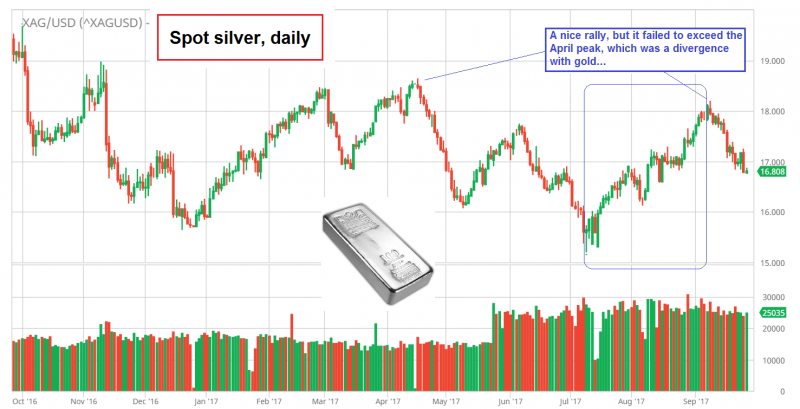

Safe Haven Silver To Outperform Gold In Q4 And In 2018

Safe haven silver to outperform gold in Q4 and 2018. “Expect silver to eventually outperform gold” say Metals Focus. 2017 YTD, silver has underperformed gold, climbing by 5% versus 11%. Silver undervalued versus gold and especially stocks, bonds and many property markets. Will follow gold’s reactions to macroeconomic & geopolitical factors and should outperform gold. Special report on India shows it accounts for just 16% of global silver demand....

Read More »

Read More »

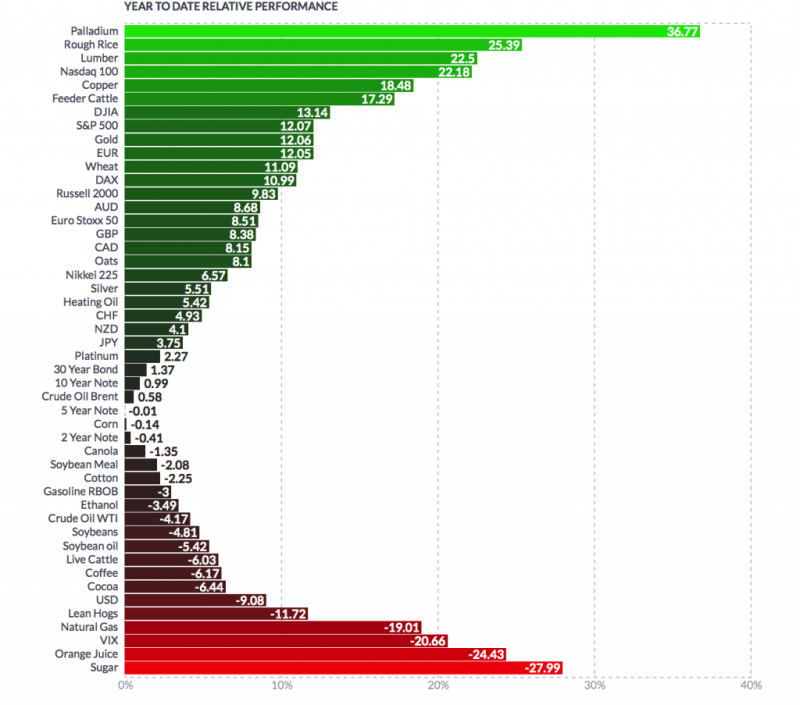

Gold Matches S&P 500 Performance In First 3 Quarters; Up 12% 2017 YTD

Gold climbs over 12% in YTD, matching S&P500 performance. Palladium best performing market, surges 36% 2017 YTD. Gold outperforms Nikkei 225, Euro Stoxx 50, FTSE and ISEQ. Geo-political concerns including Trump and North Korea supporting gold. Safe haven demand should push gold higher in Q4. Owning physical gold not dependent on third party websites and technology remains essential.

Read More »

Read More »

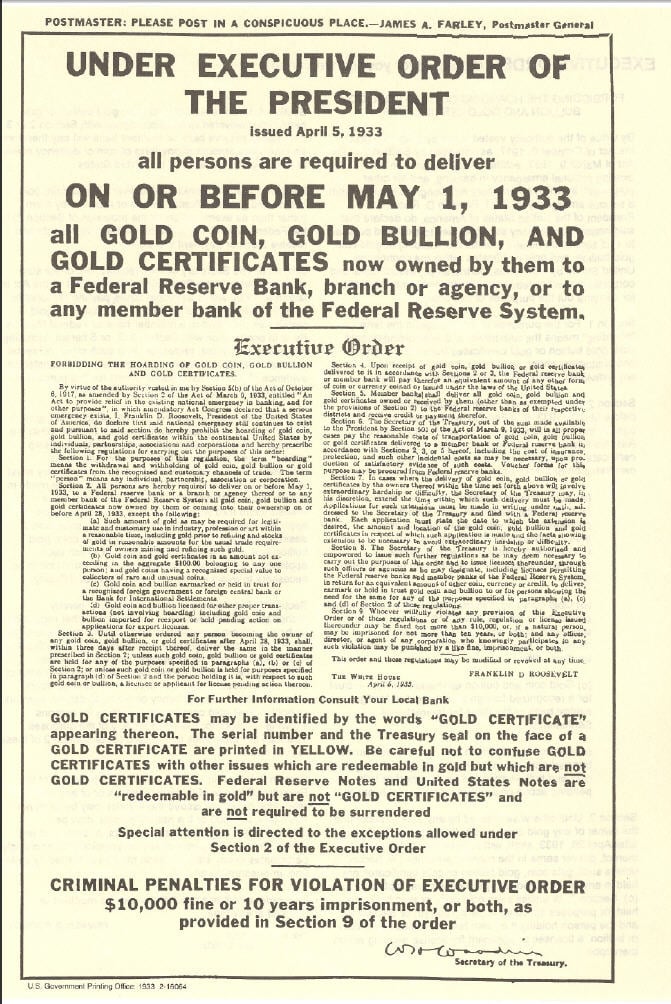

Gold Standard Resulted In “Fewer Catastrophes” – FT

“Going off gold did the opposite of what many people think” – FT Alphaville. “Surprising” findings show benefits of Gold Standard. Study by former Obama advisor in 1999 and speech by Bank of England economist in 2017 make case for gold. UK economy was ‘much less prone to extremes’ under than the gold standard – research shows. ‘Gold standard seems to have produced fewer catastrophes for Britain’ – data shows . FT still wary of gold standard arguing...

Read More »

Read More »

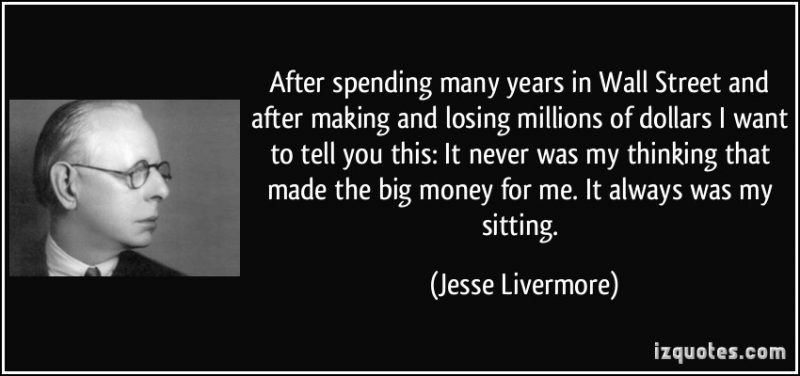

Financial Advice From Man Who Made $1+ Billion in 1929 – Importance Of Being Patient and “Sitting”

Listen to Jesse Livermore and ignore the noise of short term market movements, central bank waffle and daily headlines. Stock and bond markets are overvalued but continue to climb… for now. What goes up must come down and investors should diversify and rebalance portfolios despite market noise. Behavioural biases currently drive markets, prompting legendary investors to be confused and opt out.

Read More »

Read More »

“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

Read More »

Read More »

Stefan Gleason Speaks on Managing Risks, Selling Metals, and Demystifying IRAs

Fed Spooks Metals Markets; Governments Attack Bitcoin

Thanks for Watching!!!!!

-----------------------------------------------------

Read More »

Read More »

Stefan Gleason Speaks on Managing Risks, Selling Metals, and Demystifying IRAs

Fed Spooks Metals Markets; Governments Attack Bitcoin Thanks for Watching!!!!! —————————————————–

Read More »

Read More »

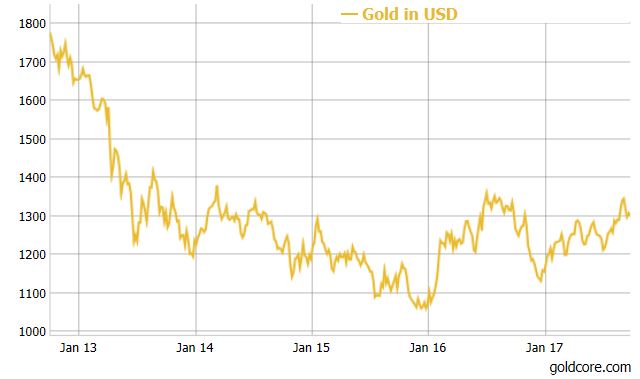

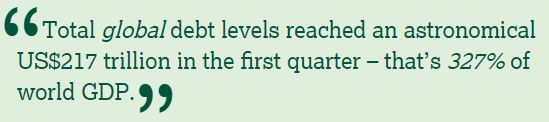

Gold Investment “Compelling” As Fed Likely To Create Next Recession

Gold Investment “Compelling” As Fed Likely To Create Next Recession. Is the Fed about to kill the business cycle? 16 out of 19 rate-hike cycles in past 100 years ended in recession. Total global debt at all time high – see chart. Global debt is 327% of world GDP – ticking timebomb. Gold has beaten the market (S&P 500) so far this century. Safe haven demand to increase on debt and equity risk. Gold looks very cheap compared to overbought markets....

Read More »

Read More »

Pensions and Debt Time Bomb In UK: £1 Trillion Crisis Looms

£1 trillion crisis looms as pensions deficit and consumer loans snowball out of control. UK pensions deficit soared by £100B to £710B, last month. £200B unsecured consumer credit “time bomb” warn FCA. 8.3 million people in UK with debt problems. 2.2 million people in UK are in financial distress. ‘President Trump land’ there is a savings gap of $70 trillion.

Read More »

Read More »

Sprott Money News Ask The Expert September 2017 – Brent Cook

Brent Cook is an independent geologist with over 30 years of experience in the field. He is co-publisher of ExplorationInsights.com.

Read More »

Read More »

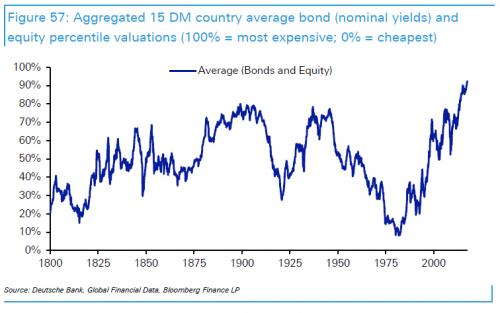

“This Is Where The Next Financial Crisis Will Come From” – Deutsche Bank

In an extensive, must-read report published on Monday by Deutsche Bank’s Jim Reid, the credit strategist unveiled an extensive analysis of the “Next Financial Crisis”, and specifically what may cause it, when it may happen, and how the world could respond assuming it still has means to counteract the next economic and financial crash.In our first take on the report yesterday, we showed one key aspect of the “crash” calculus: between bonds and...

Read More »

Read More »