Category Archive: 6a) Gold & Monetary Metals

Marc Faber – The Coming Pension Crisis And Its Subsequent Fallout

Returning SBTV guest Marc Faber, editor and publisher of “The Gloom, Boom & Doom Report”, warns about the under-funding in public and private pensions. Will there be pitchforks when pensioners realize there is no money available for their retirement? Discussed in this interview: 01:31 State and public pensions are a disaster 05:11 When pensioners realize …

Read More »

Read More »

Stock Markets – Bob Hoye. Globalism, China, USD – Marc Faber. Gold, Silver – Ed Steer. AMY.TSX.V

Air Date: June 1, 2019 Bob Hoye – Stock Markets. Guest’s website: https://chartsandmarkets.com/ Marc Faber – Globalism, China, USD, Political Class. Guest’s website: https://www.gloomboomdoom.com/ Ed Steer – Gold and Silver. Guest’s website: https://edsteergoldsilver.com/ Larry Reaugh President & CEO of American Manganese Inc. on Company Showcase – Big News This Week on China’s Threat to Impose …

Read More »

Read More »

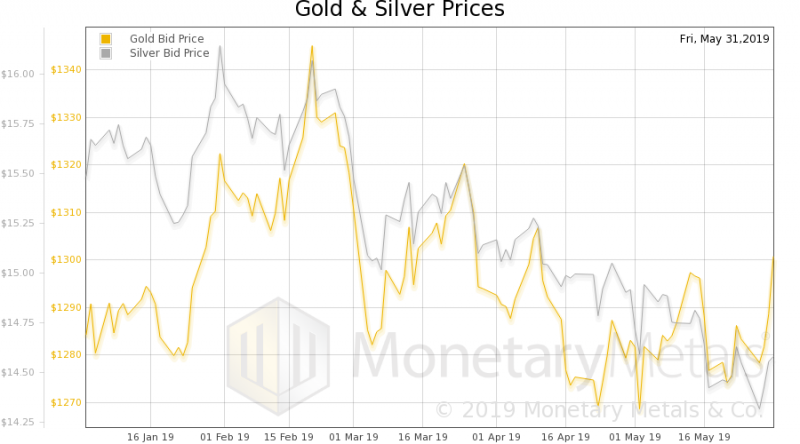

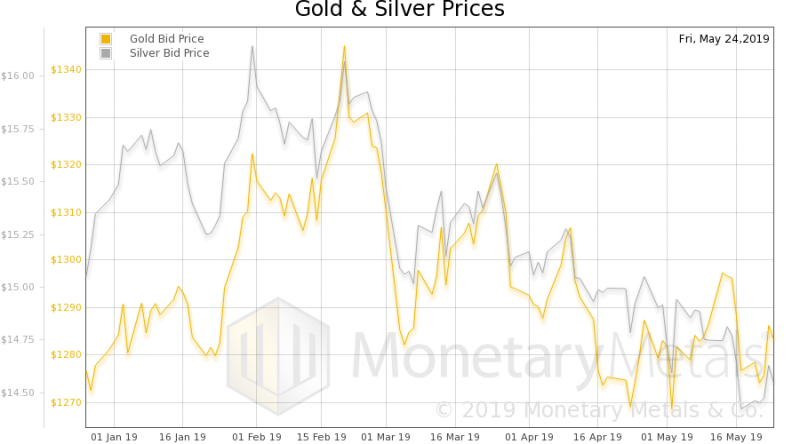

Sprott Money News Weekly Wrap-up – 5.31.19

Eric Sprott discusses the renewed rally in precious metals, the turbulence in global markets and answers a few listener questions.

Read More »

Read More »

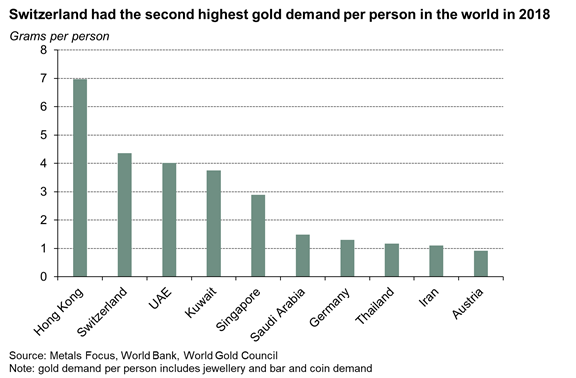

Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate20% plan to invest in gold in the next 12 monthsAlmost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online

Read More »

Read More »

Gerald Celente: An Oil Shock Could Be the Black Swan That Finally Drives Gold Higher

Read the full transcript here ➤ https://t.co/vY0J0Ic2D3 Check gold and silver prices here ➤ https://www.moneymetals.com/precious-metals-charts Listen on SoundCloud ➤ https://soundcloud.com/moneymetals/gerald-celente-an-oil-shock-could-be-the-black-swan-that-finally-drives-gold-higher Coming up the top trends forecaster Gerald Celente of the Trends Journal joins me to discuss a myriad of topics. Gerald gives us more insight on why the precious...

Read More »

Read More »

Prepared Now? Great Upside For Gold In Jun 2019- Wait For (Bron Suchecki)

Channel Not Monetized If you have any issue about their copyright, please contact me by email: [email protected] . Thank you ! Thank

Read More »

Read More »

Bron Suchecki – Australian Politics, Mining and Gold #4355

Our old friend Bron Suchecki joined us from the land down under. He’s still writing and is in the bullion space. We had a lengthy discussion about the surprise win for the conservative party under Scott Morrison. Seems just like Donald Trump 2.0, no expert was expecting it. It really was a referendum on climate …

Read More »

Read More »

Sprott Money News Ask The Expert – Andrea Lang of the Austrian Mint

Andrea Lang of the Austrian Mint joins us to discuss The Mint’s history, gold demand and the value of owning Austrian Mint bullion products.

Read More »

Read More »

British Pound To Devalue Sharply Due To Massive £5 Trillion Plus Debt

- While all the focus is on Brexit, the UK faces a debt and currency crisis

- Total UK national debt surges over £2 trillion - increasing at over £5k per second

- True level of UK government debt exceeds £5 trillion as pension liabilities not in official numbers

- Diversify and own gold in the most cost effective way (CGT free gold sovereigns and gold and silver Britannias in the UK) and safest way (fully segregated)...

Read More »

Read More »

British Pound To Devalue Sharply Due To Massive £5 Trillion Plus Debt

– While all the focus is on Brexit, the UK faces a debt and currency crisis – Total UK national debt surges over £2 trillion – increasing at over £5k per second – True level of UK government debt exceeds £5 trillion as pension liabilities not in official numbers – Diversify and own gold in …

Read More »

Read More »

Axel Merk Interview: Economy to Die a Traditional Death Inflation Is Going to Move Higher

Read the full transcript here ➤ https://www.moneymetals.com/podcasts/2019/05/17/banning-currency-alternatives-to-prop-up-dollar-001773 Check gold and silver prices here ➤ https://www.moneymetals.com/precious-metals-charts Later in today’s program we’ll hear from Axel Merk of Merk Investments. Axel breaks down the trade war with China and gives us some keen insights on the likely strategy being employed by President Donald Trump there, and also...

Read More »

Read More »

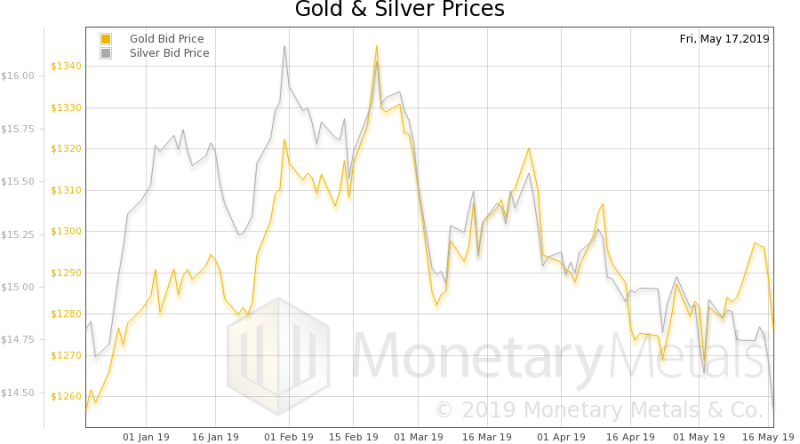

Sprott Money News Weekly Wrap-up – 5.17.19

Eric Sprott discusses the precious metals and the factors that influenced prices over the past week.

Read More »

Read More »

We Have The Power To End Gold Price Suppression – Chris Powell of GATA Interview Part 2

- "Over the long term, justice, fairness and decency will prevail ... that is the history of mankind...as seen in the ascent of man ... things tend to get better over the long term ..."

- The price suppression of gold and other natural resources has "real world consequences for the majority of the people on this planet ..."

- "We are fighting all the money and the power in the world ..."

- CALL To ACTION: Precious...

Read More »

Read More »

We Have The Power To End Gold Price Suppression – Chris Powell of GATA Interview Part 2

– “Over the long term, justice, fairness and decency will prevail … that is the history of mankind…as seen in the ascent of man … things tend to get better over the long term …” – The price suppression of gold and other natural resources has “real world consequences for the majority of the people …

Read More »

Read More »

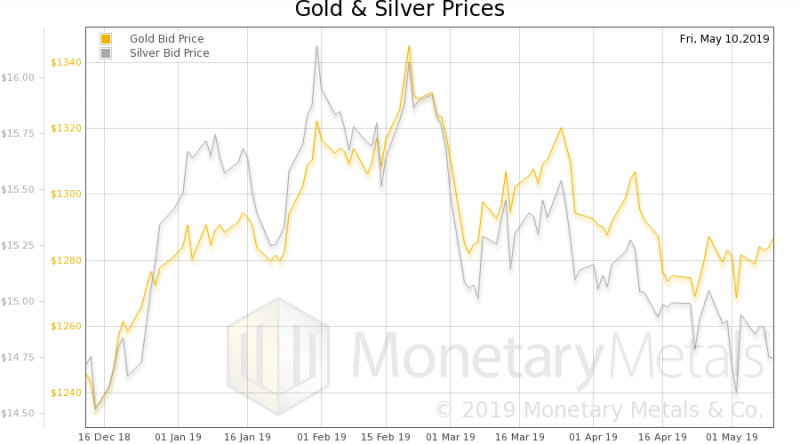

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels. U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods. Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S.

Read More »

Read More »