Category Archive: 6a) Gold & Monetary Metals

JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’

◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch

Read More »

Read More »

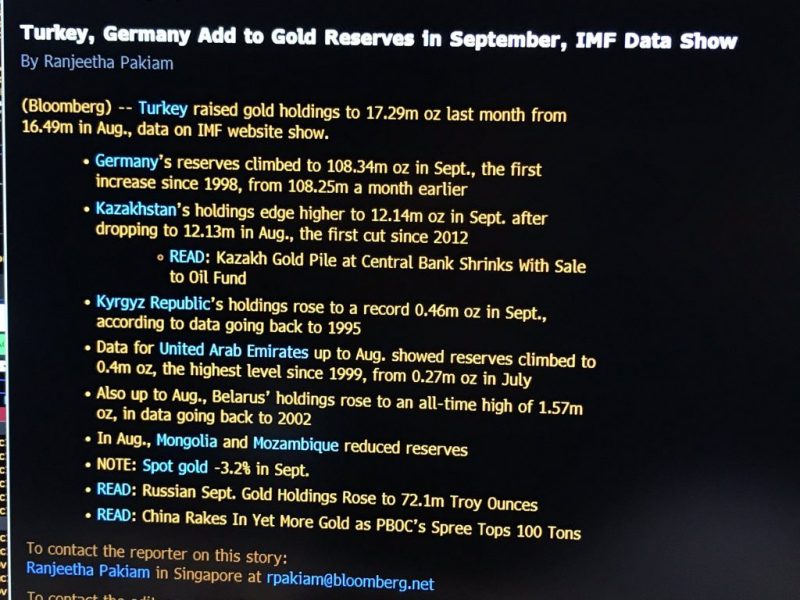

Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB

Read More »

Read More »

Do Mining Operations Affect the Price of Platinum?

https://www.moneymetals.com/precious-metals-charts/platinum-price#do-mining-operations-affect-the-price-of-platinum –Platinum supplies are highly dependent on mining operations out of a single country, South Africa. In fact, it provides more than 70% of world platinum supply. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤...

Read More »

Read More »

Is the Spot Platinum Price the Price I Pay When I Buy from a Dealer?

https://www.moneymetals.com/precious-metals-charts/platinum-price#is-the-spot-platinum-price-the-price-i-pay-when-i-buy-from-a-dealer –A dealer will charge a premium above the spot price of platinum for platinum coins and bars. The premium reflects the costs associated with minting, acquiring, and storing products, plus the dealer’s profit. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Yes, Gold “Just Sits There” and That’s Quite a Feat

The Wall Street Journal’s Jason Zweig famously referred to gold as a “Pet Rock” in 2015. He was blasted by people who understand that gold is no passing fad, and it serves some very important roles in an investment portfolio. The valuable roles played by gold have been well covered here. It’s a hedge against both inflation and deflation, it represents true diversification for portfolios stuffed with conventional securities, and it is a way of...

Read More »

Read More »

What Influences the Price of Platinum?

https://www.moneymetals.com/precious-metals-charts/platinum-price#what-influences-the-price-of-platinum – On the supply side, platinum is an extremely scarce metal. It is more than twenty times rarer than gold. It is so rare that all of the platinum ever mined could fit into a room measuring 25 feet by 25 feet. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW …...

Read More »

Read More »

What is Platinum?

https://www.moneymetals.com/precious-metals-charts/platinum-price#what-is-platinum Platinum is a dense, malleable metal represented by the symbol Pt and atomic number 78. This metal is also ductile, corrosion resistant, and highly unreactive with a very high melting point. The name comes from the Spanish term “platina,” which translates into little silver. According to historians, South Americans discovered this rare, valuable metal …...

Read More »

Read More »

Bill Holter: Credit Seizure Could Someday Shut Down Supply Chains

Interview begins at ➡️➡️6:20 Full transcript here: https://www.moneymetals.com/podcasts/2019/10/18/fed-qe-scheme-transfers-wealth-to-banks-001888 Check out gold & silver live prices ?: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

IMF Warning: ‘World’s Financial System Is More Stretched, Unstable and Dangerous Than It Was On the Eve of the Lehman Crisis’

The International Monetary Fund (IMF) has again warned that the world’s financial system is more stretched, unstable and dangerous than it was on the eve of the Lehman crisis. Quantitative easing, zero percent interest rates and massive financial repression has pushed investors – and in the case of pension funds or life insurers, actually forced them – into taking on ever more risk.

Read More »

Read More »

What Is The Dow To Gold Ratio?

https://www.moneymetals.com/precious-metals-charts/gold-price#what-is-the-dow-to-gold-ratio – The Dow:gold ratio measures how highly valued the stock market is compared to gold. The Dow:gold ratio tends to move lower during both deflationary depressions (as in the 1930s) and inflationary panics (as in the late 1970s). At the bottom of the Great Depression, Dow:gold reached a 1:1 ratio. That same 1:1 ratio …

Read More »

Read More »

100 oz Silver Bars – The Most Cost Effective Way to Purchase Silver

https://www.moneymetals.com/100-oz-silver-bars/36 – 100 oz silver bars available at Money Metals Exchange are one of the most cost effective ways of purchasing silver. There are many types of 100 oz bars, but all should be stamped with weight, purity and the name of the manufacturer. This popular form of silver has been around for decades, and …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.18.19

Eric Sprott discusses the ongoing bank liquidity crisis and the Fed’s renewed QE program. He also answers listener questions regarding the ETFs and the mining shares.

Read More »

Read More »

How Many Grams Are in an Ounce of Gold?

https://www.moneymetals.com/precious-metals-charts/gold-price#how-many-grams-are-in-an-ounce-of-gold One troy ounce of gold is equivalent to 31.1 grams. Although gold prices are most commonly quoted in ounces, gold bullion is also bought and sold by the gram. Grams can be a more convenient unit for pricing when trading gold in small quantities or using gold for everyday barter transactions. ? SUBSCRIBE TO …

Read More »

Read More »

Libra cryptocurrency soldiers on despite key departures

Facebook’s cryptocurrency payments project, Libra, has suffered a major blow with the withdrawal of seven key partners. But the Geneva-based Libra Association continues to battle on against a regulatory onslaught by adopting a charter and forming an executive team.

Read More »

Read More »

Dutch Central Bank: Gold Bars ‘Always Retain Their Value, Crisis Or No Crisis’

◆ “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system” says the Central Bank of the Netherlands ◆ “If the system collapses, the gold stock can serve as a basis to build it up again” astutely and prudently observes the Dutch Central Bank ◆ The Dutch people “hold more than 600 tonnes of gold. A bar of gold always retains its value, crisis or no crisis”

Read More »

Read More »

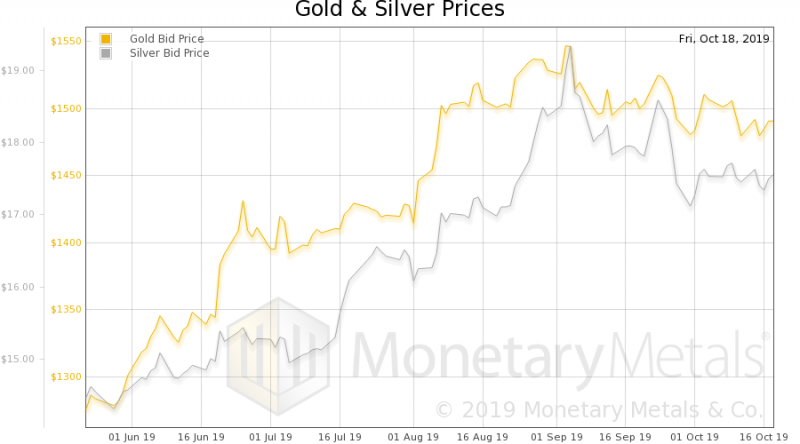

What Was the Highest Price of Gold Per Ounce Ever?

https://www.moneymetals.com/precious-metals-charts/gold-price#when-did-gold-prices-peak-what-was-the-all-time-high-for-gold Gold prices hit an all-time high of $1,900/oz. in August 2011. However, that nominal high wasn’t actually a new high in real terms. The January 1980 peak of $850/oz still hasn’t been surpassed when adjusted for inflation. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Why Does the Gold Price Fluctuate?

https://www.moneymetals.com/precious-metals-charts/gold-price#why-does-the-gold-price-fluctuate – Excessive money printing tends to drive gold prices up, as there are more currency units chasing basically the same number of gold ounces. On the other hand, the price of gold does not tend to perform as well as compared to other assets when governments are behaving responsibly and living within their means. …

Read More »

Read More »

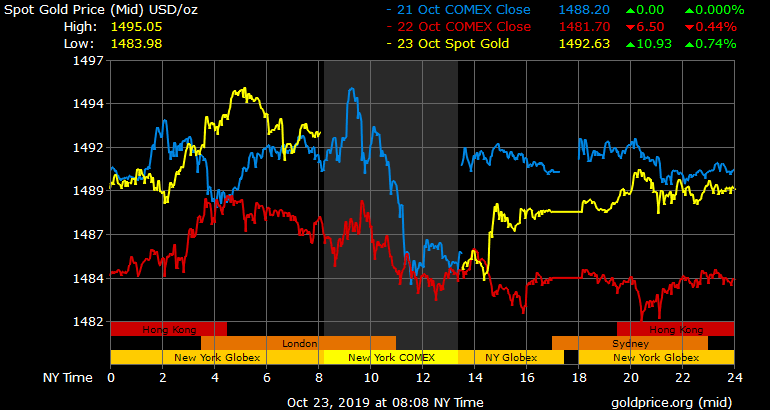

What Is The Gold Spot Price And How Is It Determined?

https://www.moneymetals.com/precious-metals-charts/gold-price#what-is-the-gold-spot-price-and-how-is-it-determined – Traders determine the spot price of gold on futures exchanges. Metals contracts change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price. ?...

Read More »

Read More »