Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 3.13.20

Eric Sprott discusses the collapsing global markets and the impact this having on gold, silver, and the mining shares.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.13.20

Eric Sprott discusses the collapsing global markets and the impact this having on gold, silver, and the mining shares.

Read More »

Read More »

Marc Faber and Mre – The Economic COLLAPSE 2020

Credit Suisse, Deutsche Bank, Petro-Dollar, Interest Rate Swaps, Gold price, Euro-Swissy, Consider JPMorgue, REPO market, subprime bond crisis, Chinese bitch coulee, Gold in their reserves, major banks, Global Economic RESET, golden crypto-currencies, Gold Trade, Chinese cryptos, The Dollar Crisis, Causes, Consequences, Cures, Revised Global recession, Silver, Stocks, Dollar Crash-Gold, Stock Market, real economy, global financial crisis, currency...

Read More »

Read More »

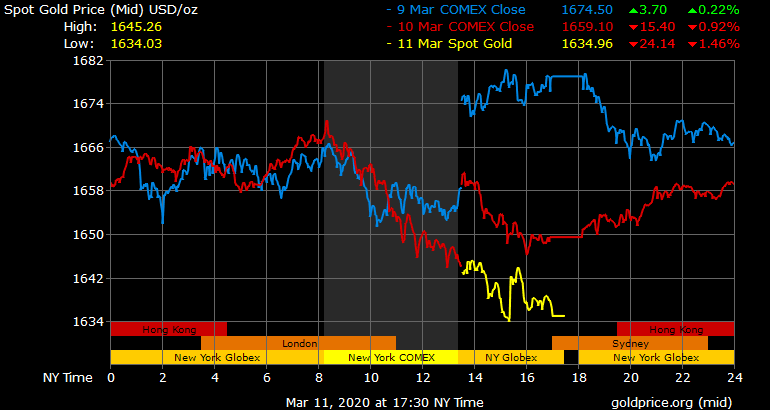

Gold Gains As Bank of England Slashes to Emergency Rate of 0.25percent and ECB Warns Of 2008 Style “Great Financial Crisis”

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy.

Read More »

Read More »

Marc Faber (Investment Legend) Rebel Capitalist Show Ep. 22!

Marc Faber reveals insights ? YOU CAN’T AFFORD TO MISS! ? Especially in these tumultuous times Marc Faber offers a voice of sanity. His analysis is always backed up by data and extensive research. He has seen it all in the world of finance, investing and economics. I have been following Marc Faber since the …

Read More »

Read More »

Marc Faber: Die Blase platzt jetzt

Stehen wir am Beginn einer neuen Finanzkrise? Ist der Kurssturz an den Börsen erst der Anfang? Müssen Banken verstaatlicht werden? Bewegen wir uns in Richtung Sozialismus? Investor-Legende Marc Farber im Gespräch mit Michael Mross. Der Faber Report: www.gloomboomdoom.com

Read More »

Read More »

Goldmoney 2020 Outlook Roundtable

As it has become tradition, Goldmoney’s leadership team – Roy Sebag, James Turk, Alasdair Macleod and Stefan Wieler – was joined by a special guest, former Member of the European Parliament Godfrey Bloom, to discuss the state of global economy, financial and systemic risks, and outlook for gold and financial markets. This video was filmed on February 29, 2020.

Learn more, visit: www.goldmoney.com.

Read More »

Read More »

FOMO to GMO – Ross Clark. Corona, Corruption, China, Gold – Marc Faber. PDAC – John Kaiser. AMY.V

Air Date: March 7, 2020 Ross Clark – From Fear of Missing Out to Get Me Out Guest’s website: https://chartsandmarkets.com/ Marc Faber – Corona Virus, Corruption, China, Gold Guest’s website: https://www.gloomboomdoom.com/ John Kaiser – Mood at PDAC Mining Conference Guest’s website: https://secure.kaiserresearch.com/ Larry Reaugh – President & CEO of American Manganese Inc. on Company Showcase …

Read More »

Read More »

Jacob Hornberger: Let the Free Market Determine Rates, Pick the Best Money

Interview ?️begins at 6:20 Full transcript here ?: https://www.moneymetals.com/podcasts/2020/03/06/fed-panic-boosts-gold-bonds-stock-market-dives-001978 Gold & Silver prices ?: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.6.20

Legendary Canadian investor Eric Sprott discusses the impact of the coronavirus on the global economy and the precious metals.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.6.20

Legendary Canadian investor Eric Sprott discusses the impact of the coronavirus on the global economy and the precious metals.

Read More »

Read More »

Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

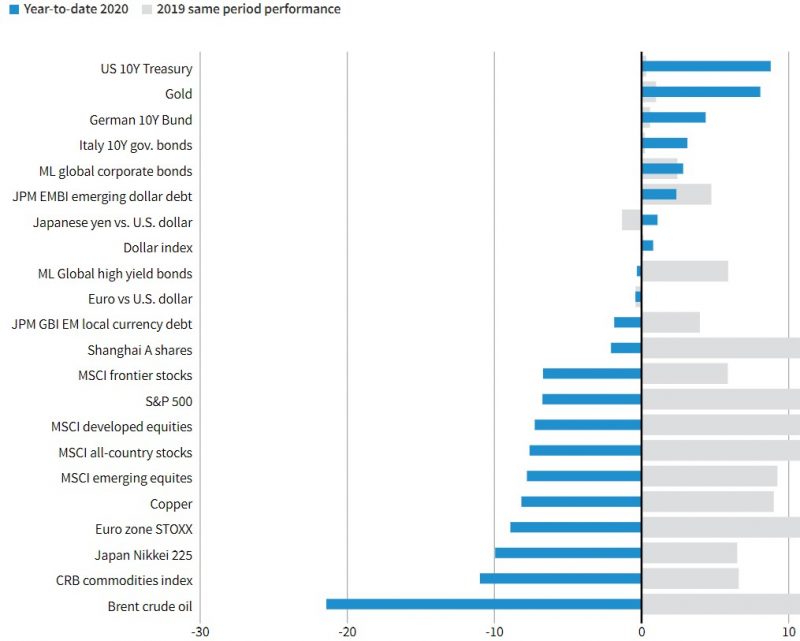

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table)

Read More »

Read More »

Marc Faber – Investors Complacent To Economic Fallout From Coronavirus

Returning SBTV guest Marc Faber, editor and publisher of “The Gloom, Boom & Doom Report”, believes the biggest economic issue today is the spread of the coronavirus and its psychological impact on people’s habits causing detrimental effects on the economy. Discussed in this interview: 01:48 Doom and gloom in 2020 06:37 How plagues have influenced …

Read More »

Read More »

Marc Faber: Coronavirus changes society FOREVER! Plus: GOLD, stocks, interest rates, China & HK

Exclusive interview with the “congenial contrarian”, investing legend Dr. Marc Faber! Sign up for Marc Faber newsletter at: https://www.gloomboomdoom.com/ SUBSCRIBE to our channel: https://bit.ly/2x22Q1C Follow Us for Frequent Updates and Videos! 1️⃣ FB: https://www.facebook.com/WallStreetReporter1843 2️⃣ TW: https://www.Twitter.com/WallStreetRprtr 3️⃣ IN: https://www.linkedin.com/company/18917144/ ? Website:...

Read More »

Read More »

Marc Faber explains the risk-off mode | EXCLUSIVE

Oil stocks trading at depressed valuations. Developing real estate will add value to a portfolio, says Marc Faber. Tune in for the exclusive conversation on the impact of coronavirus on business, global currencies, and precious metals. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► https://goo.gl/SEjvK3 Subscribe Now To Our Network …

Read More »

Read More »

Eric Sprott, Terry Lynch: Protect Retail Investors, Let Them Make Money

At the Prospectors & Developers Association of Canada convention, the Investing News Network got an update from Terry Lynch and Eric Sprott on the Save Canadian Mining initiative. #PDAC2020 #SaveCanadianMining #Investing

Save Canadian Mining's goal is to have a securities trading rule known as the “uptick rule” or “tick test” reinstated. Lynch is its founder and Sprott is one of its backers. ...

Read More »

Read More »

Marc Faber : HOW REVOLUTIONS, WARS AND PLAGUES ARE HARBINGERS OF “GREAT CHANGES” IN ECONOMICS

Marc Faber : HOW REVOLUTIONS, WARS AND PLAGUES ARE HARBINGERS OF “GREAT CHANGES” IN SOCIETIES AND IN ECONOMICS economic collapse,rich dad poor dad,super rich,greed,rich,ww3,documentary bbc,deutsche bank,China trade war,Argentina depression,Stock Market Crash,Dr. Marc Faber,Marc Faber,asset bubble,contrarian investor,inflation,stock market capitalization,recession,marc faber this week,marc faber september 2019,marc faber interview,marc...

Read More »

Read More »

Goldman: 3 Key Reasons Why We Are Bullish On Gold

On “Bloomberg Commodities Edge”, Bloomberg’s Alix Steel and Naureen Malik talk with Jeff Currie, global head of commodities research at Goldman Sachs. They discuss Goldman’s bullish stance on gold.

Read More »

Read More »