Category Archive: 6a) Gold & Monetary Metals

Alasdair Macleod: Gold / Silver Supply Chain Will Be Broken For Months

Subscribe, Re-Subscribe, Share and Like - thanks for watching and listening.

Over the past few days the entire the precious metals markets has completed changed. These changes are not likely to revert in any short order. We have three of the top gold refineries in the world completely shuttered, there is a fourth gold refinery, Rand, while not shut down it has cut production by close to half. This means instead of the world processing gold...

Read More »

Read More »

Corona-Krise – Eine machbare, vertretbare Lösung

Nachdem ich mich systematisch mit den verschiedenen Teilproblemen beschäftigt habe, bin ich nun überzeugt, eine machbare, vertretbare und rasche Lösung für das Corona-Problem gefunden zu haben.

Read More »

Read More »

Missed Payments In Production Chains Will Collapse System: Alasdair Macleod

Subscribe, Re-Subscribe, Share, Like. Thanks for watching / listening.

I sat down with Alasdair Macleod, Head of Research for Gold Money - https://wealth.goldmoney.com - to get an update on the FMQ (Fiat Money Quantity) since there has been about a dozen cargo ships filled with digital dollars spewed all around the world. Well, it turns out that not only is this a massive problem that we've all known is a problem, but there is another, even...

Read More »

Read More »

Gold & Silver Prices Rise as Senate Passes $2.2 Trillion Bailout

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤ https://instagram.com/moneymetals/

LINKEDIN ➤ https://www.linkedin.com/company/mone...

SOUNDCLOUD ➤ https://soundcloud.com/moneymetals

TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »

Gold & Silver Prices Rise as Senate Passes $2.2 Trillion Bailout

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤ https://instagram.com/moneymetals/ LINKEDIN ➤ https://www.linkedin.com/company/mone… SOUNDCLOUD ➤ https://soundcloud.com/moneymetals TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.27.20

Eric Sprott discusses the economic impact of the coronavirus how this is affecting the precious metals.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.27.20

Eric Sprott discusses the economic impact of the coronavirus how this is affecting the precious metals.

Read More »

Read More »

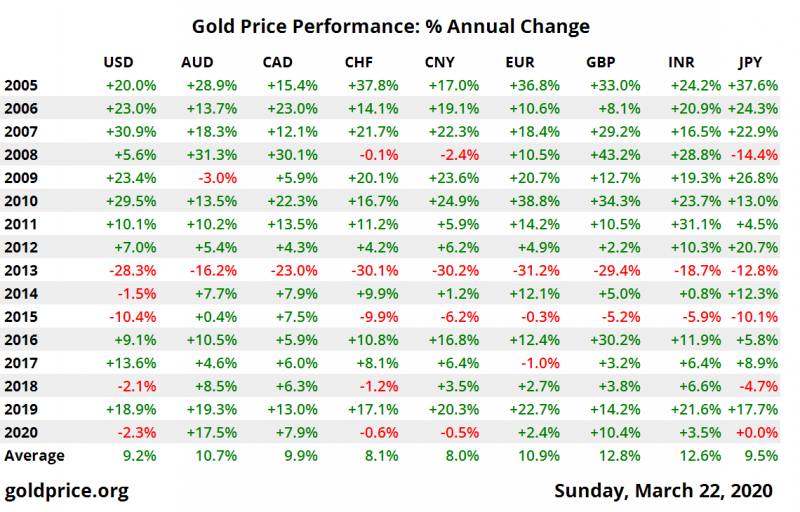

Is gold still a safe haven?

There have been moments in recent months when many gold owners, myself included, have asked themselves whether gold might have lost its safe haven status, at least in the western world. Was it enough for two generations, who grew up in a paper money system, to forget the history and the 5000-year-old status of gold as real money?

Read More »

Read More »

Alasdair Macleod⚠️RESET THE WORLD -Global Great Depression Dead Ahead?

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Alasdair Macleod? why a Dollar Collapse is Inevitable? Digital Money replaces Cash !!

For the full transcript go to: https://www.financialanalysis.tv

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver

#Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse...

Read More »

Read More »

Alasdair Macleod-Will Financial Cancer Plus COVID 19 End Fiat Currencies?

Alasdair Macleod believes the dollar-based global fiat monetary system is doomed to fail given the cancerous growth of debt from the fiat monetary system.

Read More »

Read More »

Global Supply of Gold and Silver Coins and Bars Evaporated In Safe Haven Rush

◆ GoldCore remain open for business unlike many dealers, mints and refineries (see News below) and we continue to buy bullion coins and bars and sell gold bars (1 kilo). The supply situation changes hour to hour. ◆ We, like the entire industry have experienced record demand in recent days and the global supply of gold and silver bullion coins (legal tender 1 oz) and gold bars (in 1 oz and 10 oz formats) has quickly evaporated. We continue to have...

Read More »

Read More »

Keiser Report | Money Printing Go Brrrr | E1518

Check Keiser Report website for more: http://www.maxkeiser.com/

In this episode of the Keiser Report, Max and Stacy discuss the all out money printing from the US central bank failing to stop markets from continuing to tumble. They explore the deflationary bust driven by the soaring dollar against which most other currencies are tumbling. In the second half, Max interviews Alasdair Macleod of GoldMoney.com about gold in the age of pandemic. They...

Read More »

Read More »

MARC FABER 2020 The Economic Crash

Credit Suisse, Deutsche Bank, Petro-Dollar, Interest Rate Swaps, Gold price, Euro-Swissy, Consider JPMorgue, REPO market, subprime bond crisis, Chinese bitch coulee, Gold in their reserves, major banks, Global Economic RESET, golden crypto-currencies, Gold Trade, Chinese cryptos, The Dollar Crisis, Causes, Consequences, Cures, Revised Global recession, Silver, Stocks, Dollar Crash-Gold, Stock Market, real economy, global financial …...

Read More »

Read More »

GLOBAL GREAT DEPRESSION DEAD AHEAD? — Dr. Marc Faber

Get Your Back Up Solar Bank Now and Be Prepared! Click Here! http://www.backupsolarbank.com Get 15% OFF W/ Promo Code “SGT15” Dr. Marc Faber joins me to discuss coronavirus and its devastating impact on the global economy. Check out SGT Report’s THE PROPAGANDA ANTIDOTE podcast now on iTunes: https://podcasts.apple.com/us/podcast/the-propaganda-antidote/id1502568407 Please consider supporting SGT Report on Patron …

Read More »

Read More »

Marc Faber Monthly Market Commentary

Marc Faber Monthly Market Commentary: The other day, I came across an essay that aroused my interest because of its title: Universal Basic Income: A Dream Come True for Despots by Antony Sammeroff (he is the author of Universal Basic Income – For and Against. According to Sammeroff, although there are “heated disagreements between economists …

Read More »

Read More »