Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 2.21.20

Eric Sprott discusses the global economic impact of coronavirus, the surge in gold prices and some of the recent earnings reports from the mining sector.

Read More »

Read More »

Sprott Money News Ask The Expert February 2020 – Luke Gromen

Renowned analyst and forecaster Luke Gromen joins us to answer questions about interest rates, central bank policy and the benefits of physical precious metal ownership.

Read More »

Read More »

Sprott Money News Ask The Expert February 2020 – Luke Gromen

Renowned analyst and forecaster Luke Gromen joins us to answer questions about interest rates, central bank policy and the benefits of physical precious metal ownership.

Read More »

Read More »

Silver Bullion – The Most Undervalued Asset In The World Today?

◆ Silver bullion is set to outperform gold and vastly over valued risk assets of stocks and bonds in the coming years

◆ The record nominal high of $50 in 1980 and again in 2011 will likely be

seen in the next two years

◆ Never miss breaking precious metals news and updates from GoldCore:

https://info.goldcore.com/gdpr-email-subscription-preferences

◆ In the same way you dollar, pound, euro etc cost average to acquire your silver

bullion holdings;...

Read More »

Read More »

Silver Bullion – The Most Undervalued Asset In The World Today?

◆ Silver bullion is set to outperform gold and vastly over valued risk assets of stocks and bonds in the coming years ◆ The record nominal high of $50 in 1980 and again in 2011 will likely be seen in the next two years ◆ Never miss breaking precious metals news and updates from GoldCore: https://info.goldcore.com/gdpr-email-subscription-preferences …

Read More »

Read More »

Future silver prices will shock people & they’ll kick themselves for not buying under $20…

Interview begins at 6:58 Full transcript ?: https://www.moneymetals.com/podcasts/2020/02/14/senators-bash-gold-despite-fed-failures-001963#disqus_thread Live Silver Prices ?: https://www.moneymetals.com/precious-metals-charts/silver-price ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Marc Faber | Gold, Inflation, and Emerging Markets

– Subscribe to DailyFX: https://www.youtube.com/DailyFXNews?sub_confirmation=1 – Visit DailyFX: https://www.dailyfx.com/tv?CHID=9&QPID=3047443440&QPPID=1 Swiss economist and market forecaster Dr.Marc Faber discusses his outlook on gold, inflation, and markets. Trading Global Markets Decoded Podcast: iTunes: https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971 Stitcher:...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.14.20

Eric Sprott discusses the effect of the worsening pandemic on the global economy and the impact this will have on precious metal prices.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.14.20

Eric Sprott discusses the effect of the worsening pandemic on the global economy and the impact this will have on precious metal prices.

Read More »

Read More »

Gold Coins Worth £80,000 Found In Retiree’s Drawers In Cottage: “It Was Mind-Blowing. I Felt Like a Pirate in a Grotto”

Gold coins including gold sovereigns found in drawers of deceased retiree’s cottage sell at auction for £80,000. ◆ British gold coins including gold sovereigns from the Royal Mint found in drawers and cupboards of cottage fetch £80,000; one British gold sovereign found in a sugar bowl. ◆ Auctioneer John Rolfe expected little before he entered damp, rat-infested property near Stroud.

Read More »

Read More »

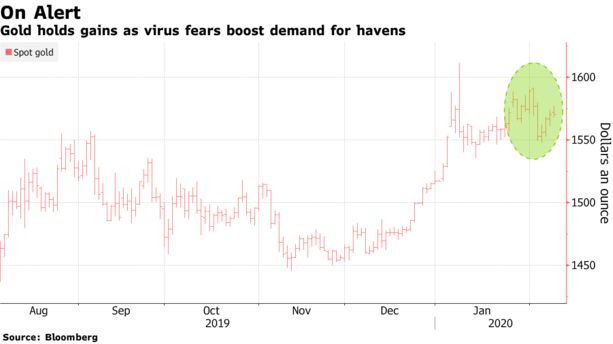

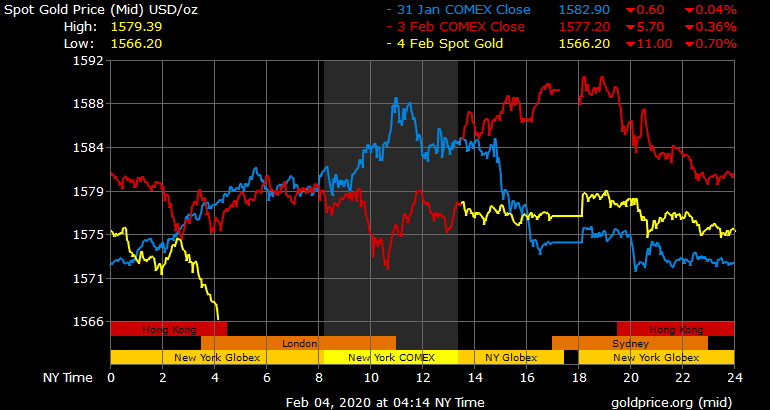

Gold Consolidates Near Six Year Record Highs At $1574/oz; WHO’s ‘Tip of the Iceberg’ Virus Warning

Gold climbed for a fourth day as investors weighed the unfolding coronavirus crisis, including a stark warning from the head of the World Health Organization about the potential for more cases beyond China and signs the disease is spreading in the key Asian trading hub of Singapore.

Read More »

Read More »

Central banks weigh up response to Libra and bitcoin

Central banks are contemplating a response to alternative money systems, such as bitcoin or Libra, with new digital versions of their own currencies. They go by the name of Central Bank Digital Currencies, or CBDCs. Libra’s stablecoin project launched in Geneva last year was a “watershed” moment that “kicked everyone in the pants”, Michael Sung, a professor at Fudan University, told the recent Crypto Finance Conferenceexternal link (CfC) in St...

Read More »

Read More »

Alabama House Considers Eliminating Income Taxes on Gold and Silver

Representative Sorrell has introduced House Bill 122, a tax-neutral measure to exclude from gross income any net capital gain and any net capital loss derived from the exchange of precious metals bullion. Policies that penalize savers in precious metals reduce the likelihood that Alabama citizens will take prudent steps to insulate themselves from the inflation and financial turmoil caused by the Federal Reserve.

Read More »

Read More »

Axel Merk: Fed to Stimulate in Any Crisis; Don’t Let Short-Term Events Bother You

Interview ?️ begins at 4:58 Full transcript ?: https://www.moneymetals.com/podcasts/2020/02/07/economic-optimism-boosting-trump-and-stocks-001960 Gold & Silver Prices ?: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.7.20

Eric Sprott discusses the impact that the spreading coronavirus will have on the global economy and, by extension, the precious metals and the mining shares.

Send your questions to [email protected]

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.7.20

Eric Sprott discusses the impact that the spreading coronavirus will have on the global economy and, by extension, the precious metals and the mining shares. Send your questions to [email protected]

Read More »

Read More »

“Smart Move” By Prudent Investors Is To Diversify Into Gold

With no opportunity cost to holding a zero-yield asset such as gold, investors increasingly are adding it to their portfolios as a hedge. ◆ Gold retains its intrinsic value, something no paper currency has managed to do over history. ◆ Gold is insurance. Insurance isn’t supposed to make you rich; it’s supposed to keep you from being poor.

Read More »

Read More »

Gold Falls 0.6percent After Having A Seven Year Weekly High Close and 4percent Gain In January

Gold falls from seven year high weekly close ◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb.

Read More »

Read More »