Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 3.20.20

Eric Sprott discusses the impact of the coronavirus pandemic on the precious metals and the mining shares.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.20.20

Eric Sprott discusses the impact of the coronavirus pandemic on the precious metals and the mining shares.

Read More »

Read More »

Don’t Panic – Prepare

◆ Markets have collapsed around the world as we predicted as the ‘Giant Ponzi Everything Bubble’ meets the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and bond markets and banks may be next … “bank holidays”, bail-ins and currency resets are likely

Read More »

Read More »

Ökonom Thomas Mayer: „Noch eine Finanzkrise bis zum Systemwechsel“

Unser Geldsystem ist wie ein Atomreaktor: Latent instabil und potentiell anfällig für Großkatastrophen – das glaubt der Ökonom Thomas Mayer, früher Chefvolkswirt der Deutschen Bank und heute Leiter des Research-Instituts des Asset-Managers Flossbach von Storch. „Wir sind nur noch eine Finanzkrise vom Systemwechsel entfernt“, prognostiziert Mayer im Gespräch mit FINANCE-TV. Wie sein „Vollgeldsystem“ die Unternehmensfinanzierung verändern würde und...

Read More »

Read More »

David Morgan: “Gold is doing its job… Silver market will come back as a safe-haven asset”

Interview ?️begins at 7:50

Full transcript ?: https://www.moneymetals.com/podcasts/2020/03/13/stock-market-shut-down-risk-martial-law-001984

Gold & Silver Live Spot Prices ??:

https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤...

Read More »

Read More »

David Morgan: “Gold is doing its job… Silver market will come back as a safe-haven asset”

Interview ?️begins at 7:50 Full transcript ?: https://www.moneymetals.com/podcasts/2020/03/13/stock-market-shut-down-risk-martial-law-001984 Gold & Silver Live Spot Prices ??: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

“Let’s Deal With The Facts Now & Stop the Lies & Nonsense”

◆ NOTE: We continue to do daily updates on https://news.goldcore.com/ and will do another video update very soon.

◆ Markets have collapsed around the world as we predicted. The 'Giant Ponzi Everything Bubble’ has been pricked by the massive pin that is the coronavirus' impact on already vulnerable indebted economies.

◆ Stocks have crashed and bond markets and banks may be next ... "bank holidays", bail-ins and currency resets are likely...

Read More »

Read More »

“Let’s Deal With The Facts Now & Stop the Lies & Nonsense”

◆ NOTE: We continue to do daily updates on https://news.goldcore.com/ and will do another video update very soon. ◆ Markets have collapsed around the world as we predicted. The ‘Giant Ponzi Everything Bubble’ has been pricked by the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and …

Read More »

Read More »

The Whole of Europe Shutting Down – US is Next | Alasdair Macleod

With the global economy shutting down, stock markets and oil and precious metals are all crashing, despite the Fed and POTUS rushing in unprecedented crisis measures. But the real tectonic disruption about to rock our lives could be the failure of fiat currency itself, and the black hole of the debt derivatives which underpin all else in the financial world.

Alasdair Macleod, head of research at GoldMoney.com, issues an urgent update to help us...

Read More »

Read More »

2020-03-15 Retirement Lifestyle Advocates Radio w/ Alasdair Macleod

Source:

https://www.spreaker.com/user/11090942/2020-03-15-retirement-lifestyle-advocate

The last week in the markets was in a word – DREADFUL. If you’ve been a long-time listener of the Retirement Lifestyle Advocates Show, you know that we have been forecasting a major stock decline. Obviously, predicting what the catalyst for such a decline might be is impossible, but inflated stock valuations have been there for all to see. On this week’s...

Read More »

Read More »

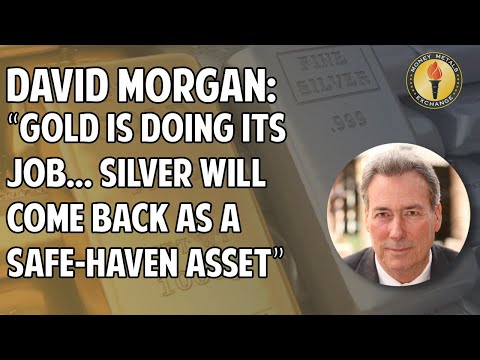

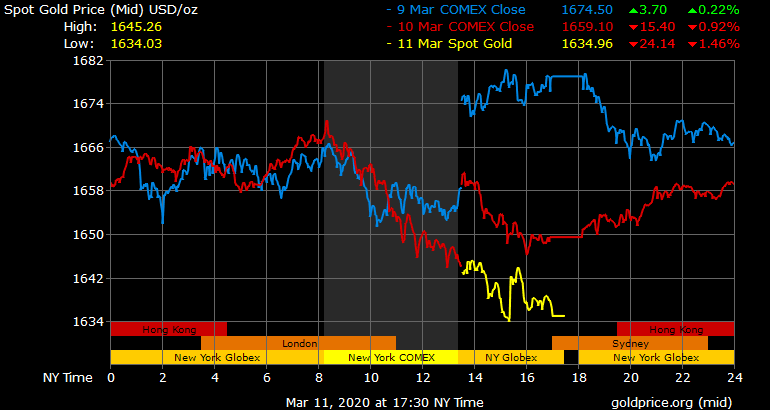

Gold Hedging Stock Market Crash: Euro Stoxx -6 percent, FTSE -5.7 percent and DAX -5.6 percent

◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised.◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.13.20

Eric Sprott discusses the collapsing global markets and the impact this having on gold, silver, and the mining shares.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.13.20

Eric Sprott discusses the collapsing global markets and the impact this having on gold, silver, and the mining shares.

Read More »

Read More »

Marc Faber and Mre – The Economic COLLAPSE 2020

Credit Suisse, Deutsche Bank, Petro-Dollar, Interest Rate Swaps, Gold price, Euro-Swissy, Consider JPMorgue, REPO market, subprime bond crisis, Chinese bitch coulee, Gold in their reserves, major banks, Global Economic RESET, golden crypto-currencies, Gold Trade, Chinese cryptos, The Dollar Crisis, Causes, Consequences, Cures, Revised Global recession, Silver, Stocks, Dollar Crash-Gold, Stock Market, real economy, global financial crisis, currency...

Read More »

Read More »

Gold Gains As Bank of England Slashes to Emergency Rate of 0.25percent and ECB Warns Of 2008 Style “Great Financial Crisis”

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy.

Read More »

Read More »

Marc Faber (Investment Legend) Rebel Capitalist Show Ep. 22!

Marc Faber reveals insights ? YOU CAN’T AFFORD TO MISS! ? Especially in these tumultuous times Marc Faber offers a voice of sanity. His analysis is always backed up by data and extensive research. He has seen it all in the world of finance, investing and economics. I have been following Marc Faber since the …

Read More »

Read More »

Marc Faber: Die Blase platzt jetzt

Stehen wir am Beginn einer neuen Finanzkrise? Ist der Kurssturz an den Börsen erst der Anfang? Müssen Banken verstaatlicht werden? Bewegen wir uns in Richtung Sozialismus? Investor-Legende Marc Farber im Gespräch mit Michael Mross. Der Faber Report: www.gloomboomdoom.com

Read More »

Read More »

Goldmoney 2020 Outlook Roundtable

As it has become tradition, Goldmoney’s leadership team – Roy Sebag, James Turk, Alasdair Macleod and Stefan Wieler – was joined by a special guest, former Member of the European Parliament Godfrey Bloom, to discuss the state of global economy, financial and systemic risks, and outlook for gold and financial markets. This video was filmed on February 29, 2020.

Learn more, visit: www.goldmoney.com.

Read More »

Read More »