Category Archive: 6a) Gold & Monetary Metals

UNLIMITED QE & NIRP FUTURES IGNITE GOLD & SILVER | Alasdair Macleod

(CORRECTED AUDIO UPDATE)

As we’re being deluged with currency expansion at multiple times what was done during the Lehman crisis, and the futures market is predicting negative nominal interest rates ahead, what will the impact be on our real economy, on gold & silver, and on the lives of ordinary people?

Alasdair Macleod, head of Research at GoldMoney.com, returns to Liberty and Finance / Reluctant Preppers to answer viewers’ questions on...

Read More »

Read More »

Global Currency Reset: Will COVID 19 Lead to a Gold Standard? (Alasdair Macleod )

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Get Ready for Some SERIOUS Sticker Shock as Inflation Heats Up

Full transcript ? : https://www.moneymetals.com/podcasts/2020/05/15/sticker-shock-inflation-002032

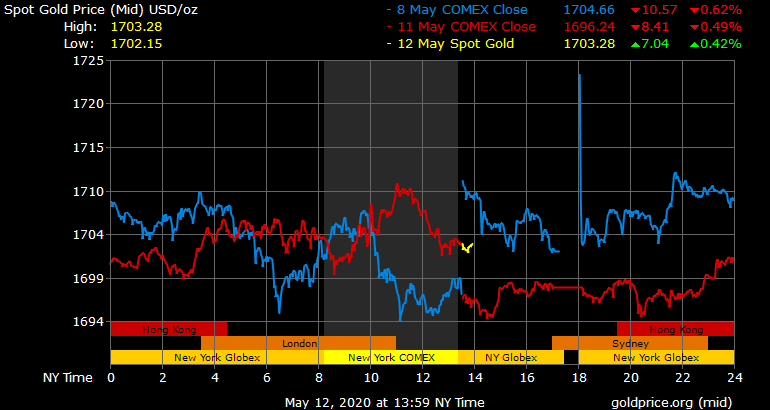

Gold & Silver Prices ??:

https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

Get Ready for Some SERIOUS Sticker Shock as Inflation Heats Up

Full transcript ? : https://www.moneymetals.com/podcasts/2020/05/15/sticker-shock-inflation-002032 Gold & Silver Prices ??: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.15.20

Eric Sprott discusses the global economy and the rationale for owning precious metals and the mining shares.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.15.20

Eric Sprott discusses the global economy and the rationale for owning precious metals and the mining shares. Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Alasdair Macleod Issue Warnings about the Fall of US Dollar !! And New Standard of Gold

For the full transcript go to: https://www.financialanalysis.tv

#Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver

#Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill Holter #Bo Polny # economic collapse...

Read More »

Read More »

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

Alasdair Macleod-Will COVID 19 Lead to a Gold Standard?

Alasdair Macleod, has a background as a stockbroker, banker and economist, heightens his warning of an impending collapse of the existing dollar-centric fiat currency system.

Read More »

Read More »

Pandemic, Lockdowns, Fake and Manipulated Markets – Gold and Silver Outlook

◆ The massive global debt driven “Everything Bubble” is bursting due to the pandemic and more specifically the governments draconian economic lockdowns. ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion

Read More »

Read More »

Pandemics, Lockdowns, Fake and Manipulated Markets – Gold & Silver Outlook

◆ The massive global debt driven "Everything Bubble" has been burst by the pandemic and more specifically the governments draconian economic lockdowns

◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion

◆ Wall Street has just been bailed out at the expense of Main Street and families and businesses in the U.S. and throughout most of the industrial...

Read More »

Read More »

Pandemics, Lockdowns, Fake and Manipulated Markets – Gold & Silver Outlook

◆ The massive global debt driven “Everything Bubble” has been burst by the pandemic and more specifically the governments draconian economic lockdowns ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion ◆ Wall Street has just been bailed …

Read More »

Read More »

Silver price, Gold Price Update – IR Eye Negative Territory Capital Prepares for Slow Death

Full transcript: https://www.moneymetals.com/podcasts/2020/05/08/gold-to-soar-rates-eye-negative-territory-002027

1:02 - Market update: Gold price, Silver price, Platinum price, Palladium price

Gold & Silver prices: https://www.moneymetals.com/precious-metals-charts/

#Goldprice #Silverprice #MoneyMetalsWeeklyMarketWrap #MoneyMetalsExchange

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Silver price, Gold Price Update – IR Eye Negative Territory Capital Prepares for Slow Death

Full transcript: https://www.moneymetals.com/podcasts/2020/05/08/gold-to-soar-rates-eye-negative-territory-002027 1:02 – Market update: Gold price, Silver price, Platinum price, Palladium price Gold & Silver prices: https://www.moneymetals.com/precious-metals-charts/ #Goldprice #Silverprice #MoneyMetalsWeeklyMarketWrap #MoneyMetalsExchange ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Dr. Marc Faber: Central Bankers Very Desperate For Higher Asset Prices While Real Economy Worsens

Jason Burack of Wall St for Main St interviewed returning guest, editor & publisher of the Gloom, Boom & Doom Report https://www.gloomboomdoom.com/, Dr. Marc Faber. During this 40+ minute interview, Jason asks Marc if the bear market in US stocks is over? Marc talks about how the Fed’s official balance sheet, in his opinion, will …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.8.20

Eric Sprott discusses factors driving precious metal prices higher and assesses the terrific performance of the mining shares.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.8.20

Eric Sprott discusses factors driving precious metal prices higher and assesses the terrific performance of the mining shares.

Read More »

Read More »

Mark O’Byrne: Silver to Go to $150 and Beyond!

To subscribe to our newsletter and get notified of new shows, please visit http://palisaderadio.com

Tom welcomes a new guest to the show Mark O'Byrne who is Research Director and founder of GoldCore, a Bullion dealer based out of Ireland. They provide services and bullion sales around the world, with vaults in Singapore and Switzerland.

Mark discusses his outlook for the precious metals markets and what lead him to start a bullion business. He...

Read More »

Read More »