Category Archive: 6a) Gold & Monetary Metals

Bron Suchecki – Gold & Silver Industry Simply Lacks Capacity to Handle Mass Market Coin Buying

SBTV spoke with Bron Suchecki, Precious Metals Analyst with ABC Bullion, about how the physical gold & silver markets are now exerting more pressure on the paper markets with physical bullion prices bifurcating from spot prices.

Discussed in this interview:

01:27 Gold had built a base in the past years

05:13 How Australian economy is doing amidst global recession

07:59 Physical gold and silver supply squeeze

10:56 Bifurcation of spot and...

Read More »

Read More »

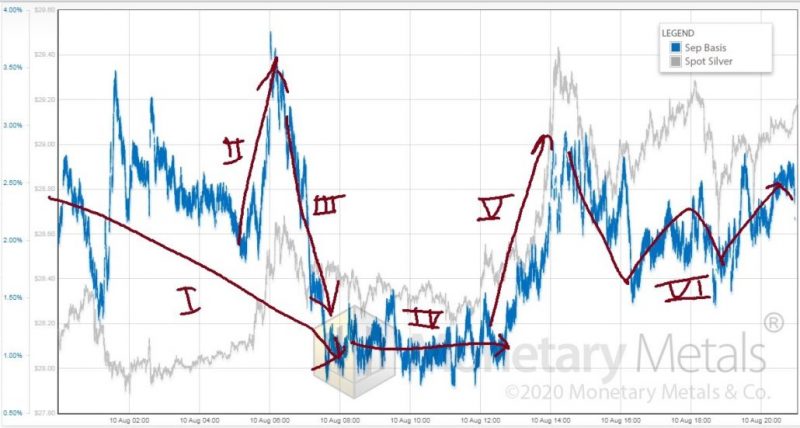

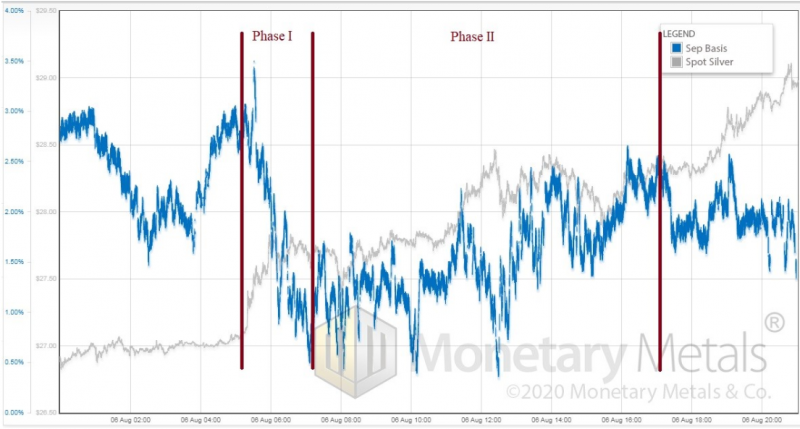

Perfect Storm for Precious Metals Leads to Price Correction

Gold fell by nearly 6% yesterday and silver by a whopping 15%, the largest one day loss in over 7 years. The futures market saw massive volumes of selling with over 1.6 bn ounces of silver contracts sold yesterday. That’s a value of over $40 billion.

Read More »

Read More »

Jay Taylor Introduces – SOS! Take cover It’s too late to turn back!

Jay introduces the guest for the show, gives updates on the sponsors and the projects they are working on and provides updates on gold and silver from Alasdair Macleod.

Read More »

Read More »

MARK O’BYRNE on the greatest ponzi scheme in mankind

An experiment, which was only supposed to buy us some time, has become the norm - and has led to massive monetary debasement. Mark O’Byrne @MarkTOByrne explains how and why we got here.

Full episode available here: https://www.youtube.com/watch?v=N_l2a3qCItY

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Renegade Inc. provides its members with the content and connections that help navigate the ‘new normal’. Finding the people who are thinking differently...

Read More »

Read More »

Silver Shorts Get Squeezed Hard… What’s Next?

Well, the extraordinary run up in precious metals markets continues as silver makes some truly epic percentage gains while gold pushes further into record territory.

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★...

Read More »

Read More »

Corona and the Digitisation of Money | Thomas Mayer

As a result of the Corona Pandemic, national debt in the euro zone is rising to dizzying heights. In order to keep interest rates low, the ECB has bought up government bonds on a large scale. Without triggering a crash in the bond market, it will no longer be able to sell these bonds. However, the public debt outstanding in the market could be reduced if the ECB issues digital central bank money to finance the government bonds it has bought....

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.7.20

Eric Sprott discusses the latest surge in the precious metals and explains why he sees even more more gains in the weeks ahead.

Visit our website https://www.sprottmoney.com/ for more news.

Submit your questions to [email protected]

Read More »

Read More »

* David Brady: JP Morgan Positioned For Gold, Silver To Soar

David Brady: #JPMorgan Positioned For #Gold, #Silver To Soar

With the #FederalReserve buying #ETFs and corporate #bonds, it's becoming more and more clear to the world that they’re never going to stop printing money. Which has placed a lot of pressure on the paper gold and silver markets.

Of course one of the factors that many in the market follow closely is what mega-bank JP Morgan is doing. And #DavidBrady of #SprottMoney joined me on the show...

Read More »

Read More »

Part 7 – Antal Fekete – GSU V – Nathan Narusis Intervews Bron Suchecki Perth Mint

Professor Antal Fekete

Antal E. Fekete, Professor, Memorial University of Newfoundland, was born in Budapest, Hungary, in

1932. He graduated from the Loránt Eötvös University of Budapest in mathematics in 1955. He left

Hungary in the wake of the 1956 anti-Communist uprising that was brutally put down by the

occupying Soviet troops. He immigrated to Canada in the following year and was appointed Assistant

Professor at the Memorial University of...

Read More »

Read More »

Next Phase of The SILVER SQUEEZE | Alasdair Macleod

Banking Crisis? Currency Crisis? Silver Short Squeeze on the COMEX?

Alasdair Macleod, Head of Research at GoldMoney.com returns to Liberty and Finance / Reluctant Preppers to give us an update! His recent analysis foresaw a banking crisis as soon as the end of July 2020, and a currency crisis yet this year.

What is the latest from this engaging and respected analyst, so we can be ready for what comes next? ...

Read More »

Read More »

Marc Faber says “Real Estate in the Countryside is a Very Important Consideration”.

#investment #diversification #inflation #papermoney #dollar #gold #silver #tangibles #commodities #stock #bonds #fiatcurrency Today I had a conversation with Marc Faber, the editor and publisher of the Gloom, Boom and Doom Report, about the markets, the economy and investments. Dr Marc Faber’s website: https://www.gloomboomdoom.com/ SUPPORT MANECO64: Use promo code maneco64 to get a 0.5% discount on …

Read More »

Read More »

Part 7 – Bron Suchecki – GSI I – Components of COMEX Gold

_________________________________________________________________

Professor Antal Fekete

Antal E. Fekete, Professor, Memorial University of Newfoundland, was born in Budapest, Hungary, in

1932. He graduated from the Loránt Eötvös University of Budapest in mathematics in 1955. He left

Hungary in the wake of the 1956 anti-Communist uprising that was brutally put down by the

occupying Soviet troops. He immigrated to Canada in the following year and...

Read More »

Read More »

S02E13: Alasdair Macleod | Tunes in the Hoose

Are you a musician? To get involved, join our private members group for Musicians and Contributors here: https://www.facebook.com/groups/Tunes...

For daily episodes, tune details and live performances, follow our Facebook page at https://www.facebook.com/TunesInTheHoose

For all news, events, our upcoming documentary series and business enquiries, visit https://www.TunesInTheHoose.com

Supported by the National Lottery through Creative...

Read More »

Read More »

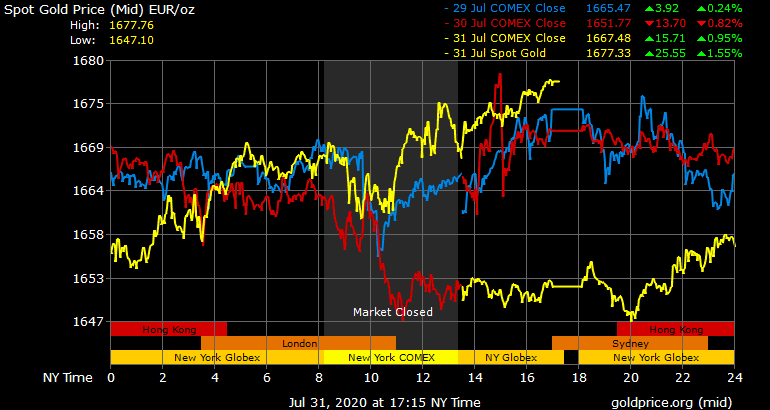

Short Term Weakness Likely Prior To A “Massive Short Squeeze Propels” Gold and Silver “To Much Higher Levels” – GoldCore

Gold and silver are set for a 5% and 6% gain this week and a significant 11% and 30% gain in the month of July.

Read More »

Read More »

A blueprint for a European superstate

After intense negotiations, long days and nights of clashes and a distinctly sour note underlying the entire summit, European Union leaders finally agreed on an unprecedented 1.82 trillion-euro ($2.1 trillion) budget and COVID recovery package.

Read More »

Read More »

Gold Rallying to All-Time Highs on $1+ Trillion in New Handouts

Another big week for precious metals markets as gold prices catapulted to new record highs. Gold’s record-setting rise has been driven by Federal Reserve stimulus, dollar weakness, and strong safe-haven investment demand.

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 7.31.20

Eric Sprott recaps a great month for the precious metals and looks ahead to earnings season for the mining companies.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »