Category Archive: 6a) Gold & Monetary Metals

Marc Faber im Interview – Wie sicher ist unser Geld wirklich? Euro-Crash? Finanzausblick (2019)

Marc Faber: https://www.gloomboomdoom.com Euro-Crash-Report: https://thorstenwittmann.com/f3-eurocrashreport/ Finanztipps erhalten: https://thorstenwittmann.com/e-letter/ Interview mit Dr. Marc Faber in Thailand Vielleicht kennst du ihn als Finanzexperten aus dem Fernsehen, von seinen Publikationen oder unserer Veröffentlichung zu den treffsichersten Finanzanalysten der Welt: Dr. Marc Faber Er bei hat nachweislich bei seinem „Gloom, Boom,...

Read More »

Read More »

Cryptos/Switzerland: Mountain Pass

Facebook takes on global finance. But its proposed digital currency Libra frightens central banks and regulators. Below the radar, Switzerland launches its own skirmish. Two local crypto-finance pioneers this week became the first to win banking licences.

Read More »

Read More »

Jeff Christian Exclusive: We’re Now Forecasting Sharply Higher Gold & Silver Prices Sooner…

Read full transcript here: https://bit.ly/2NGuyaJ Gold & Silver Live Prices ?: https://bit.ly/2WUgewY Coming up we’ll hear some very interesting comments from a first-time guest, Jeffrey Christian of the CPM Group. Jeff talks about who’s been buying gold, and who hasn’t been – at least not compared to levels of a few years ago, tells us …

Read More »

Read More »

Gordon Chang: Gold to Benefit as Chinese Economy Hits the Wall

Read full transcript here: https://bit.ly/2MpU8Rr Check out gold prices ?: https://bit.ly/2TFn8Vb Coming up we dive into China with one of the foremost experts on the subject Gordon Chang. Gordon shares his thoughts on the U.S.-China trade war and why he believes it’s not likely to end anytime soon, talks about the pending economic catastrophe he …

Read More »

Read More »

Bitcoin-Friendly Banks

Over its 10 years of existence, Bitcoin adoption has been just like its price—up and down. At this point in time, it’s safe to say that the adoption of our favourite cryptocurrency has never been higher. Since adoption is so high, it has never been easier to buy bitcoin (with hundreds of payment methods available on peer-to-peer marketplaces).

Read More »

Read More »

Gold Is Overvalued in Short-Term, Says Goldcore’s O’Byrne

Aug.26 -- Mark O’Byrne, executive director at Goldcore Ltd., discusses his outlook for gold amid the global uncertainty. He speaks on “Bloomberg Markets: European Open.”

Read More »

Read More »

Switzerland’s First Crypto Banks Receive Licences

The Swiss financial regulator has awarded banking and securities dealer licences to two new “crypto banks”. SEBA and Sygnum have been cleared to operate in the new world of tokenised digital securities, a major milestone for the fledging industry.

Read More »

Read More »

Directive 10-289, Report 25 Aug

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Read More »

Read More »

Gold-gedeckte Kryptowährung als Alternative? Interview mit Prof. Thomas Mayer

Mit der Blockchain-Technologie lassen sich neben Bitcoin & Co. durchaus auch andere Kryptowährungen darstellen. Davon ist Prof. Dr. Thomas Mayer, Gründungsdirektor des Flossbach von Storch Research Institute überzeugt und nennt als Beispiel eine gold-gedeckte Kryptowährung. Diese könne eine wichtige Funktion übernehmen, sollte das bestehende Bargeldsystem zusammenbrechen oder verboten werden, so der Finanzexperte. Das komplette Gespräch aus dem...

Read More »

Read More »

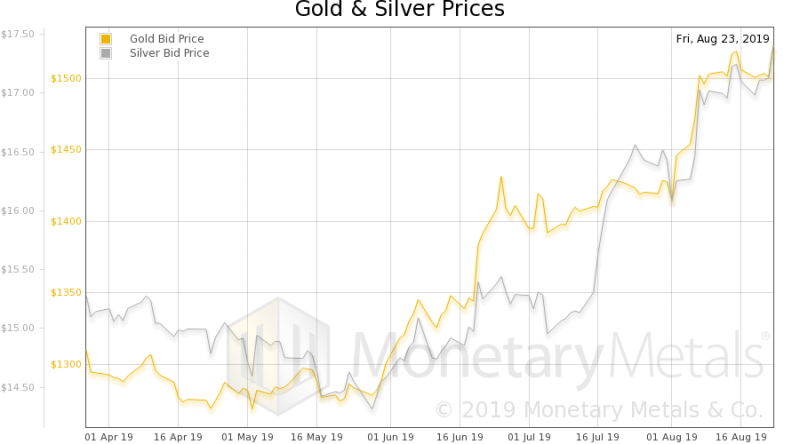

Sprott Money News Weekly Wrap-up – 8.23.19

Eric Sprott returns this week to discuss negative interest rates, the failing global economy and growing demand for physical gold and silver.

Read More »

Read More »

Sprott Money News Ask The Expert August 2019 – David Rosenberg

David Rosenberg is Chief Economist and Strategist for Gluskin Sheff in Toronto. In this episode, David answers questions regarding negative interest rates, central bank policy and the outlook for the dollar and gold.

Read More »

Read More »

Marc Faber: Negativ-Zinsen, Bargeldverbot, Orwell

Michael Mross im Gespräch mit Marc Faber. Die Minus-Zinsen werden die Banken zerstören. Diese werden dann verstaatlicht. Und dann hat der Staat Zugriff auf alle Konten. Somit leistet die Bankenkrise Vorschub zum totalen Überwachungsstaat.

Read More »

Read More »

Trade war is favourable for China in long-run: Marc Faber

Commenting on the investment opportunities available and the ongoing trade war between the US and China, Faber said investors would make more money in emerging economies than in the US over the next few years. He said the trade tension is favourable for China in the long run. ► Subscribe to The Economic Times for …

Read More »

Read More »

Outlook for emerging markets & more | Marc Faber to ET NOW | Exclusive

Marc Faber, editor and publisher of The Gloom, Boom & Doom Report speaks to Nikunj Dalmia about the prospects of a rescission, outlook for emerging markets and how to spot the next booming asset. Listen In! Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► https://goo.gl/SEjvK3 Subscribe Now To Our Network …

Read More »

Read More »

Why Do I Have to Pay a Premium for Silver Coins?

https://www.moneymetals.com/precious-metals-charts/silver-price#why-do-i-have-to-pay-a-premium-for-silver-coins Premiums vary according to market conditions. When demand is soft, premiums may fall, especially on secondary market products such as pre-1965 U.S. silver coins. Secondary market products – items that are being resold rather than sold for the first time as brand new – can often be purchased at a discount to newly minted...

Read More »

Read More »

Why Can’t I Buy Silver at the Spot Price?

https://www.moneymetals.com/precious-metals-charts/silver-price#why-cant-i-buy-silver-at-the-spot-price Retail bullion products including bars, rounds, and coins carry small premiums over spot prices. The premium includes minting costs plus the dealer’s profit. The premium also incorporates any wholesale premiums the dealer must pay to acquire the inventory. Silver Prices FAQ Playlist:...

Read More »

Read More »

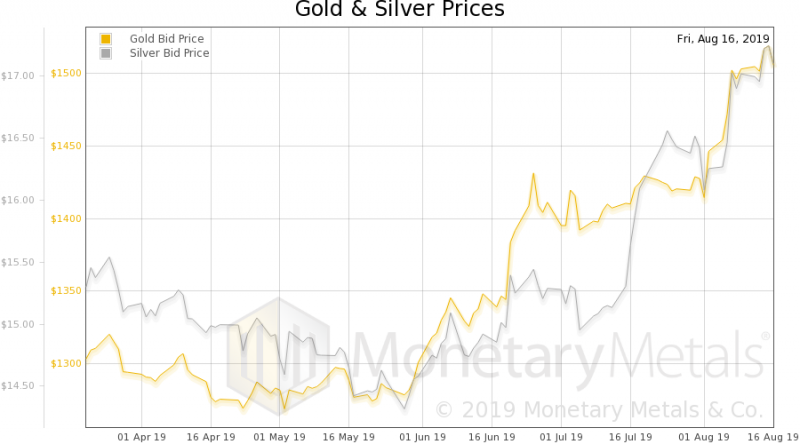

Sprott Money News Weekly Wrap-up – 8.16.19

Rick Rule of Sprott USA joins us this week to discuss the precious metals, the mining shares and his investment strategies for the remainder of 2019 and beyond.

Read More »

Read More »

How is the Silver Spot Price Determined?

https://www.moneymetals.com/precious-metals-charts/silver-price#how-is-the-silver-spot-price-determined Traders determine silver and gold spot prices on futures exchanges. Metals contracts can change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price. Silver …...

Read More »

Read More »