Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Weekly Wrap-up – 8.23.19

Eric Sprott returns this week to discuss negative interest rates, the failing global economy and growing demand for physical gold and silver.

Read More »

Read More »

Sprott Money News Ask The Expert August 2019 – David Rosenberg

David Rosenberg is Chief Economist and Strategist for Gluskin Sheff in Toronto. In this episode, David answers questions regarding negative interest rates, central bank policy and the outlook for the dollar and gold.

Read More »

Read More »

Marc Faber: Negativ-Zinsen, Bargeldverbot, Orwell

Michael Mross im Gespräch mit Marc Faber. Die Minus-Zinsen werden die Banken zerstören. Diese werden dann verstaatlicht. Und dann hat der Staat Zugriff auf alle Konten. Somit leistet die Bankenkrise Vorschub zum totalen Überwachungsstaat.

Read More »

Read More »

Trade war is favourable for China in long-run: Marc Faber

Commenting on the investment opportunities available and the ongoing trade war between the US and China, Faber said investors would make more money in emerging economies than in the US over the next few years. He said the trade tension is favourable for China in the long run. ► Subscribe to The Economic Times for …

Read More »

Read More »

Outlook for emerging markets & more | Marc Faber to ET NOW | Exclusive

Marc Faber, editor and publisher of The Gloom, Boom & Doom Report speaks to Nikunj Dalmia about the prospects of a rescission, outlook for emerging markets and how to spot the next booming asset. Listen In! Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► https://goo.gl/SEjvK3 Subscribe Now To Our Network …

Read More »

Read More »

Why Do I Have to Pay a Premium for Silver Coins?

https://www.moneymetals.com/precious-metals-charts/silver-price#why-do-i-have-to-pay-a-premium-for-silver-coins Premiums vary according to market conditions. When demand is soft, premiums may fall, especially on secondary market products such as pre-1965 U.S. silver coins. Secondary market products – items that are being resold rather than sold for the first time as brand new – can often be purchased at a discount to newly minted...

Read More »

Read More »

Why Can’t I Buy Silver at the Spot Price?

https://www.moneymetals.com/precious-metals-charts/silver-price#why-cant-i-buy-silver-at-the-spot-price Retail bullion products including bars, rounds, and coins carry small premiums over spot prices. The premium includes minting costs plus the dealer’s profit. The premium also incorporates any wholesale premiums the dealer must pay to acquire the inventory. Silver Prices FAQ Playlist:...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.16.19

Rick Rule of Sprott USA joins us this week to discuss the precious metals, the mining shares and his investment strategies for the remainder of 2019 and beyond.

Read More »

Read More »

How is the Silver Spot Price Determined?

https://www.moneymetals.com/precious-metals-charts/silver-price#how-is-the-silver-spot-price-determined Traders determine silver and gold spot prices on futures exchanges. Metals contracts can change hands in London and Shanghai when U.S. markets are closed. But the largest and most influential market for metals prices is the U.S. COMEX exchange. The quote for immediate settlement at any given time is effectively the spot price. Silver …...

Read More »

Read More »

What is Ag on the Periodic Table?

https://www.moneymetals.com/precious-metals-charts/silver-price#what-is-ag-on-the-periodic-table The symbol Ag on the periodic table stands for silver. Silver’s atomic number is 47. Its density is 10.5 g/cm3, making silver denser than copper and most base metals but not as dense as platinum or gold. Silver Prices FAQ Playlist: https://www.youtube.com/playlist?list=PLOab6eOwix8pR1KbQpSTPS5iREEggYk_Q ? SUBSCRIBE TO MONEY METALS EXCHANGE ON...

Read More »

Read More »

What is Silver?

What is Silver? A form of nuclear fusion produces silver. A supernova explosion is a key factor in the existence of this precious metal. Silver is slightly less malleable than gold. It has an appealing metallic luster that takes a high degree of polish. https://www.moneymetals.com/precious-metals-charts/silver-price#what-is-silver Silver Prices FAQ Playlist: https://www.youtube.com/playlist?list=PLOab6eOwix8pR1KbQpSTPS5iREEggYk_Q ? SUBSCRIBE TO...

Read More »

Read More »

David Morgan: “This is the real move in gold and silver… it’s going to be multiyear.”

Read the full transcript here: https://www.moneymetals.com/podcasts/2019/08/09/gold-and-silver-multiyear-move-001838 Check the Price of Silver Here ? https://www.moneymetals.com/precious-metals-charts/silver-price Coming up David Morgan of The Morgan Report joins me to break down the recent move in the metals, explains why he believes the move is a result of something no one is talking about – and he also gives us …

Read More »

Read More »

Marc Faber: USA zündeln in Hongkong

Tausende Demonstranten legen eine Stadt lahm. Was steckt hinter der Hongkong-Krise? Die Lage eskaliert. Michael Mross im Gespräch mit Marc Faber: Hintergründe zur Ex-GB-Kronkolonie. “Die USA wollen China schwächen und stacheln die Proteste an.”

Read More »

Read More »

Marc Faber: Financial Turmoil Ahead, Gold is My Largest Single Holding

To subscribe to our newsletter and get notified of new shows, please visit http://palisaderadio.com Marc discusses how various modern economic theories are already being tested as the world now has 15 trillion in negative-yielding bonds. He feels that Modern Monetary Theory would result in an overall loss of freedoms as people would become increasingly dependent …

Read More »

Read More »

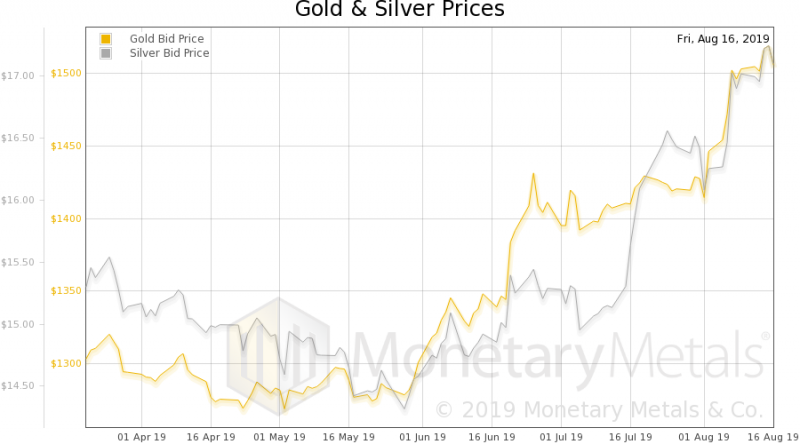

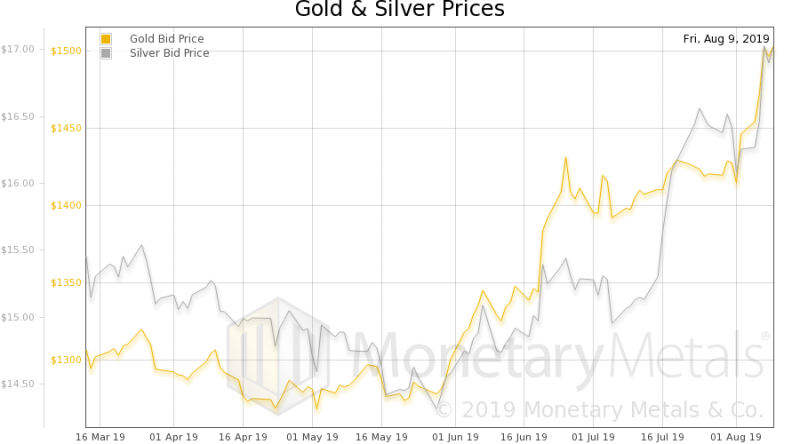

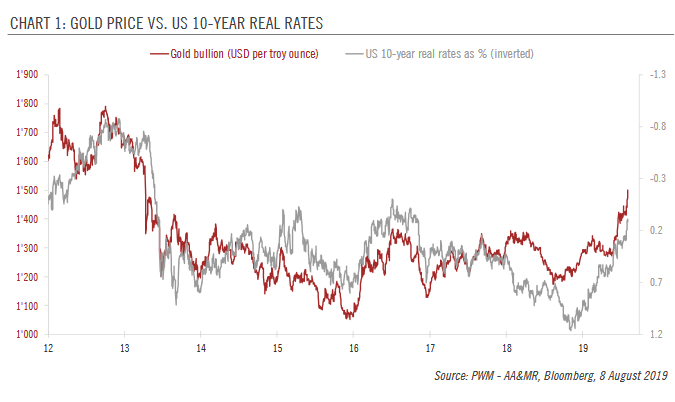

Update on gold – bad news is good news

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.9.19

Eric Sprott discusses the latest events impacting gold and silver prices and also answers listener questions regarding some specific mining companies.

Read More »

Read More »

Jim Rogers: Buy Gold Coins and Silver Coins as Global Crisis Is Coming

◆ “Get knowledgeable and get prepared as this crisis is going to be the worst in my life time”

◆ “I own physical gold and silver coins … everyone should own them”

◆ "I own Chinese, Russian, American, Australian, Austrian silver coins" and "I own UK gold coins and I own a lot of gold coins from various places"

◆ "Singapore has been and is a very safe location for storage, Switzerland is too, Austria is too, Liechtenstein is...

Read More »

Read More »