Category Archive: 6a.) Monetary Metals

The Federal Counterfeiter

Suppose you wanted to run an enterprise the right way (we know, we know, this is pretty far-out fiction, but bear with us). And, your enterprise has a $1 million dollar piece of equipment that wears out after 10 years. You must set aside $100,000 a year, so that you have $1 million at the end of 10 years when the equipment needs replacing. There’s a word, now archaic, to describe the account in which you set aside this money.

Read More »

Read More »

Open Letter to Crispin Odey

I am writing in response to the comments you made in a letter to investors yesterday, which were widely reported. You have set the gold community afire, with claims that are not new and not true. So I shall attempt to douse the flames.

As everyone knows, President Roosevelt outlawed the ownership of gold in 1933. Although gold was legalized in 1975, fears linger today that the governments may repeat this heinous act.

Read More »

Read More »

Keith Weiner: The Central Bankers I Know Have No Interest in Gold

2020-05-11

by Keith Weiner

Keith Weiner is the CEO & Founder of Monetary Metals. He is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith currently serves as President of the Gold Standard Institute USA. He earned his …

Read More »

Read More »

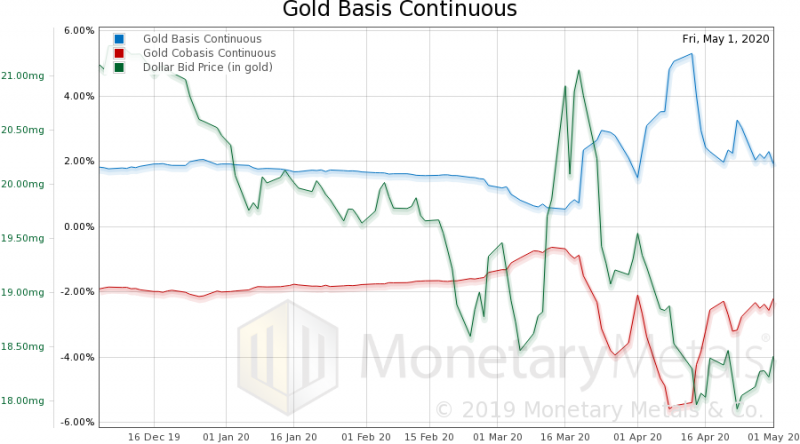

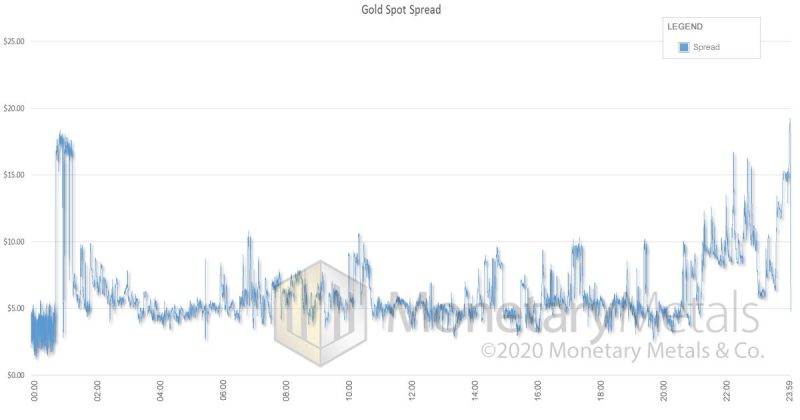

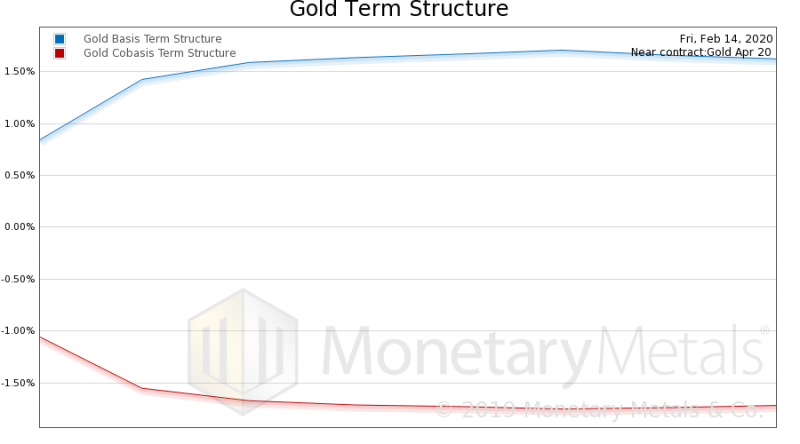

Gold and Silver Markets Start to Normalize, Report 4 May

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit. In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis.

Read More »

Read More »

It’s Only Paper, Market Report 27 Apr

The response to the virus has added a new mechanism of capital consumption to the many we have documented over the years. Businesses are shut down, yet they continue to incur expenses. There is a popular misconception out there that this is merely a paper loss. One can almost picture a neutron bomb that somehow wipes out only paper, leaving all the physical assets and plant unscathed.

Read More »

Read More »

#SocialSaturday with Keith Weiner and Therapist Laura Brown

2020-04-21

by Keith Weiner

Join the APN Lodge Social Media Specialist, Keith Weiner, on an early morning weekend live! Keith is joined by APN Therapist Laura Brown, who also happens to teach yoga! We encourage everyone to take these ten minutes and get a quick stretch into loosen up all those muscles that have just been sitting around the …

Read More »

Read More »

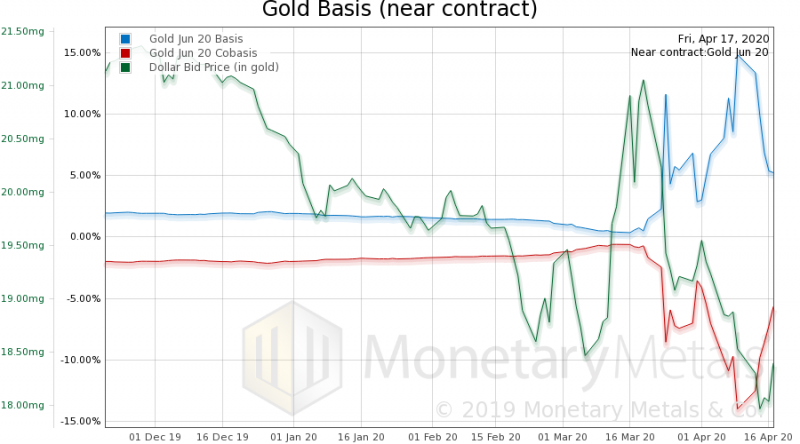

Crouching Silver, Hidden Oil Market Report 20 Apr

The price of gold has been up steadily for the last 30 days (with a few zigs and zags), now re-attaining the high it achieved prior to the big drop in March. Gold ended the week at $1,662. Alas, it’s not quite the same story in silver, whose price drop was bigger. Now its price blip is smaller. Silver ended the week at $15.19.

Read More »

Read More »

Monetary Metals Leases Gold to Brite Metals

Scottsdale, Ariz, April 7, 2020—Monetary Metals® announced today that it has leased gold to UK-based Brite Metals. The lease enables Brite Metals to buy gold from Latin American gold miners, and sell it to European refiners.

Read More »

Read More »

The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot).

Read More »

Read More »

Alchemy Rediscovered by Research Scientist, Report 1 April

“The Medievals were smarter than most people think,” says Dr. Michael Mus. “I mean, sure, they tortured people for believing that the sun was the center of our solar system, and they burned witches at the stake. But they knew a thing or two about gold.”

Read More »

Read More »

Cash is Toilet Paper, Market Report 23 March

The price of gold dropped $31, and that of silver fell even more by proportion, $2.14. The gold-silver ratio hit a hit of over 126 before closing the week around 119. This exceeds the high in the ratio last hit in the George H.W. Bush recession.

Last week, we were warming up to silver, if not recommending it.

Read More »

Read More »

Aplanando la economía «por el virus»

Escribo esto el 18 de marzo, después de haber visto un cambio de 180 grados en la forma de pensar sobre las enfermedades contagiosas. Anteriormente, poníamos a los enfermos en cuarentena y respetamos el derecho de los sanos a seguir con sus vidas. Ahora estamos al borde de la ley marcial. En nuestro afán por combatir el coronavirus, estamos cerrando los viajes, las reuniones públicas, los restaurantes, etc.

Read More »

Read More »

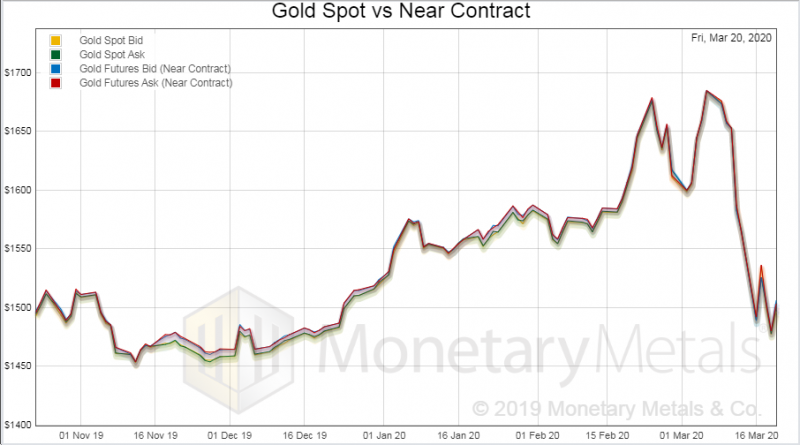

Is Now a Good Time to Buy Gold? Market Report 16 March

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high.

Read More »

Read More »

Socialism and Gold

Most people assume that the central bank prints money when it buys bonds. They further assume that this increase in the quantity of money causes an increase in the general price level. And, this leads them to assume that the value of the money is 1 / P (P is the general price level). Therefore, when the central bank prints money to buy bonds, it is diluting the value of the money held by everyone—in proportion to the amount printed divided by the...

Read More »

Read More »

Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data.

Read More »

Read More »

Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February

The price of gold rose $14 and the price of silver fell $0.07. The gold-silver ratio rose further with this price action. Welcome to our new Gold and Silver Market Report, or “Market Report” for short. We are separating this from the economics essay, which was attached for many years. As they used to say in many toy commercials of yore, “batteries sold separately”—or in this case essays.

Read More »

Read More »

“None of the Above” with Amy Peikoff and James Valliant

2020-02-14

by Keith Weiner

James and I interview Keith Weiner of the Gold Standard Institute and Monetary Metals about the consequences of fiat monetary policy, bitcoin, operating a business that operates on the gold standard, implications for this year’s election, and more!

Read More »

Read More »

Monetary Metals Gold Brief 2020

We apologize for not posting articles during January. We have been busy, and going forward will publish a separate Market Report every Monday morning plus macroeconomics essays later in the week, as time permits.

Read More »

Read More »

Keith Weiner ALERT! New Bank Bailouts REQIURE Fed’s Financial Games!!

2019-12-25

by Keith Weiner

For the full transcript go to: https://www.financialanalysis.tv #Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill …

Read More »

Read More »

They Myth of Paul Volker – Keith Weiner #4612

2019-12-24

by Keith Weiner

Is Paul Volker a legend or a myth? He’s largely credited as the man who broke the back of inflation. While he vigorously attacked inflation through double digit interest rates, but that was after the Fed had dramatically raised the money supply and caused the inflationary wave we were suffering through. History will be the …

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

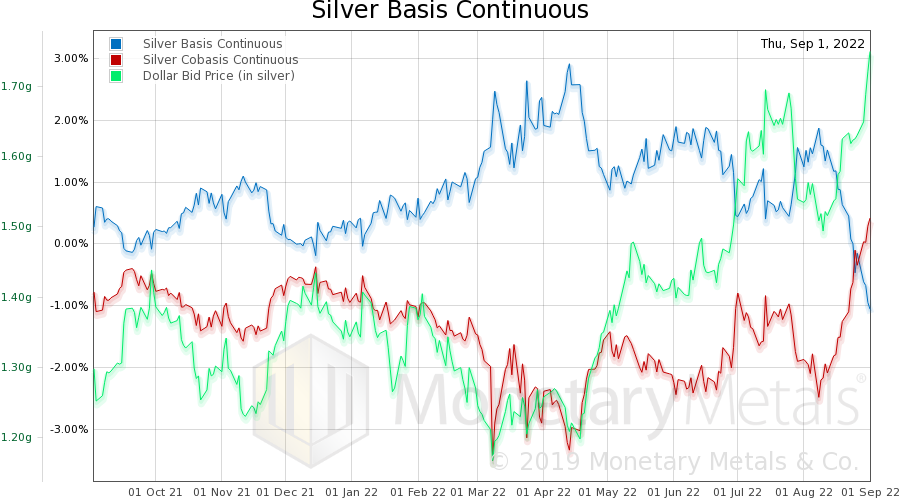

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022