Category Archive: 6a.) Monetary Metals

How Is Negative Interest Possible? Report 8 Sep

Germany has recently joined Switzerland in the dubious All Negative Club. The interest rate on every government bond, from short to 30 years, is now negative. Many would say “congratulations”, in the belief that this proves their credit risk is … well … umm … negative(?) And anyways, it will let them borrow more to spend on consumption which will stimulate … umm… well… all of the wasteful consumption for which governments are rightly...

Read More »

Read More »

Asset Inflation vs. Consumer Goods Inflation, Report 1 Sep

A paradigm is a mental framework. It has a both a positive pressure and a negative filter. It structures one’s thoughts, orients them in a certain direction, and rules out certain ideas. Paradigms can be very useful, for example the scientific method directs one to begin with facts, explain them in a consistent way, and to ignore peyote dreams from the smoke lodge and claims of mental spoon-bending.

Read More »

Read More »

Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins

Read More »

Read More »

Keith Weiner, ObLEFTivists, et al.

2019-08-16

by Keith Weiner

LANGUAGE ADVISORY – if you are an ObLEFTivist, I’m going to swear at and insult you. Gratuitously. ENJOY!!! Support this channel: https://www.patreon.com/MrCropper ADVChina’s video: https://www.youtube.com/watch?v=aW9YL81oICo&t=5s

Read More »

Read More »

The Economic Singularity, Report 11 Aug

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

Read More »

Read More »

I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term…

Read More »

Read More »

Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day.

Read More »

Read More »

The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

Read More »

Read More »

How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Read More »

Keith Weiner, PhD, CEO & Founder of Monetary Metals

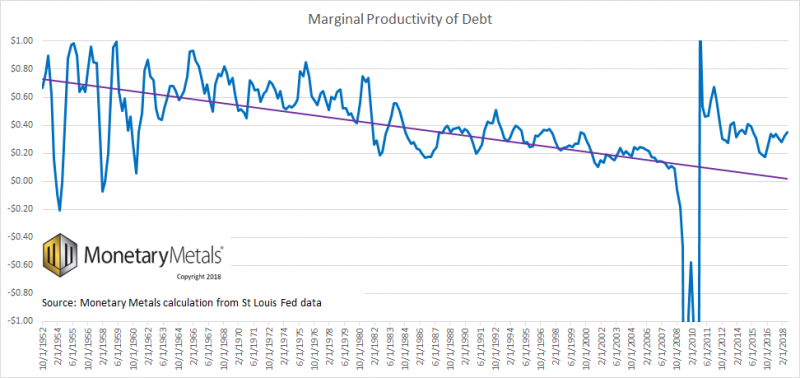

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

Read More »

Read More »

More Squeeze, Less Juice, Report 7 Jul

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

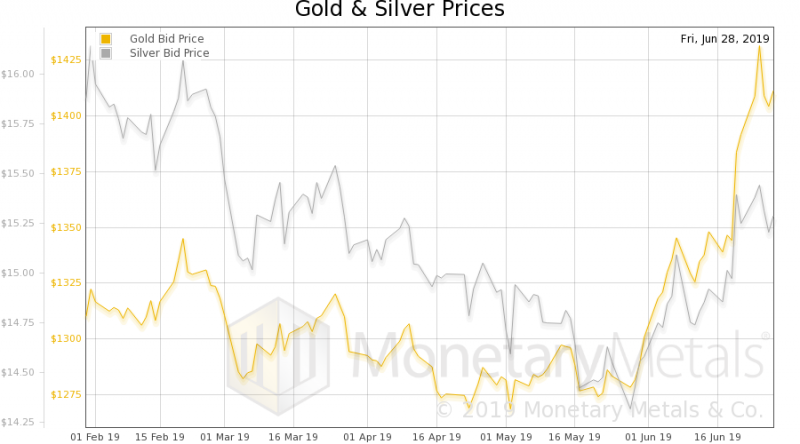

All this borrowing to consume is unsustainable and the bill is overdue

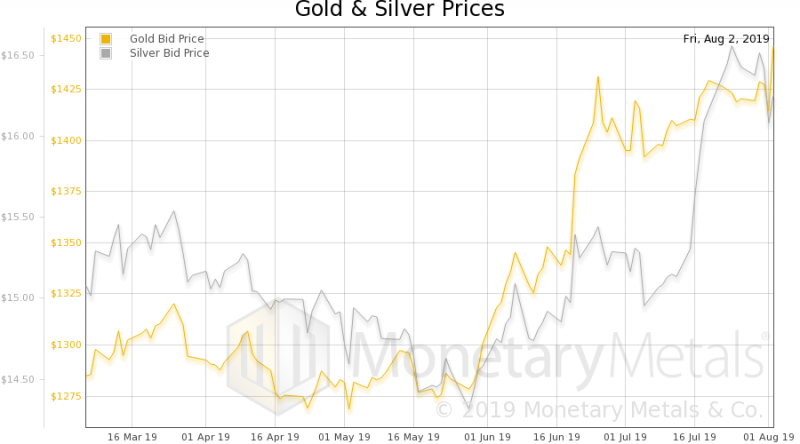

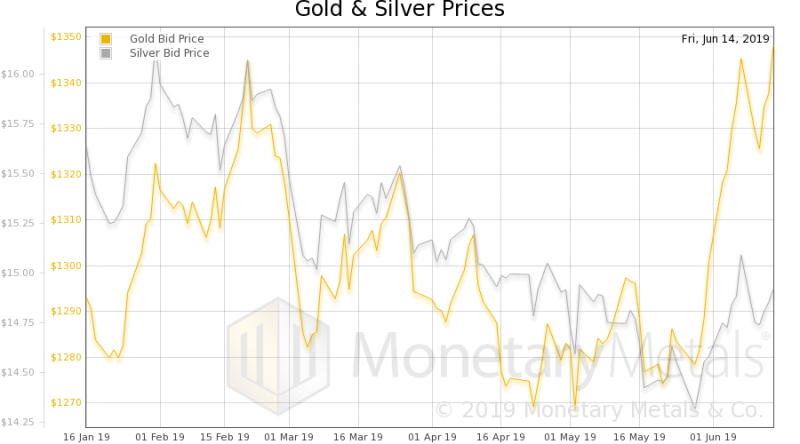

June has been an interesting month for gold, as geopolitical events, market fluctuations and developments on the monetary policy front fueled an exciting ride for the precious metal. As long-term investors with a strict focus on the big picture, short-term moves and speculative angles are largely irrelevant in and of themselves, but they do provide important signals that, without fail, confirm the strategic superiority of precious metals holdings...

Read More »

Read More »

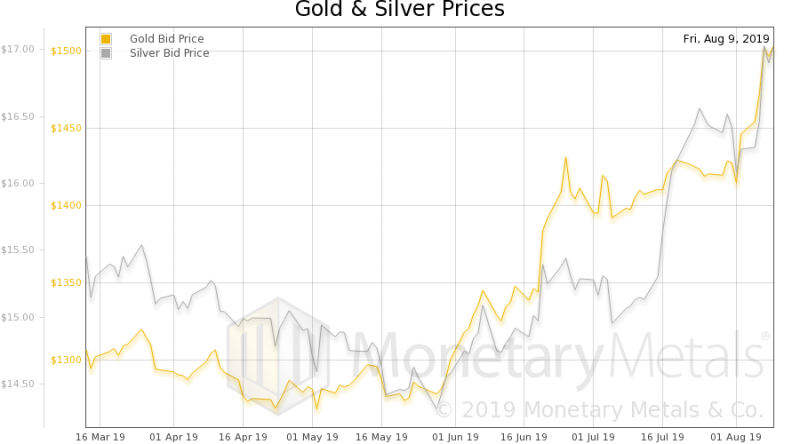

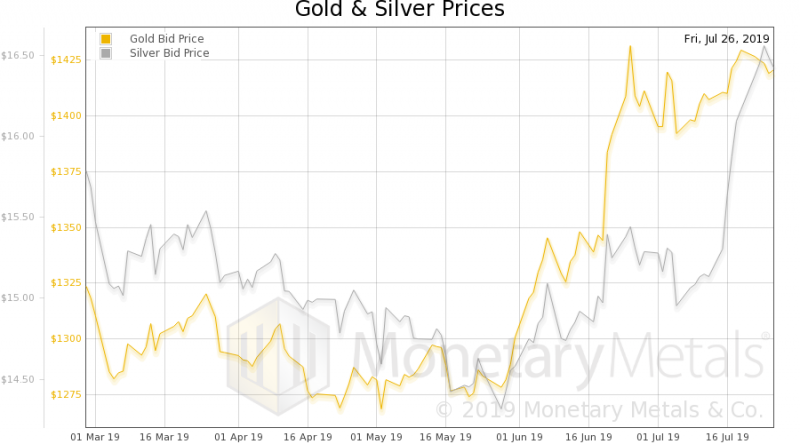

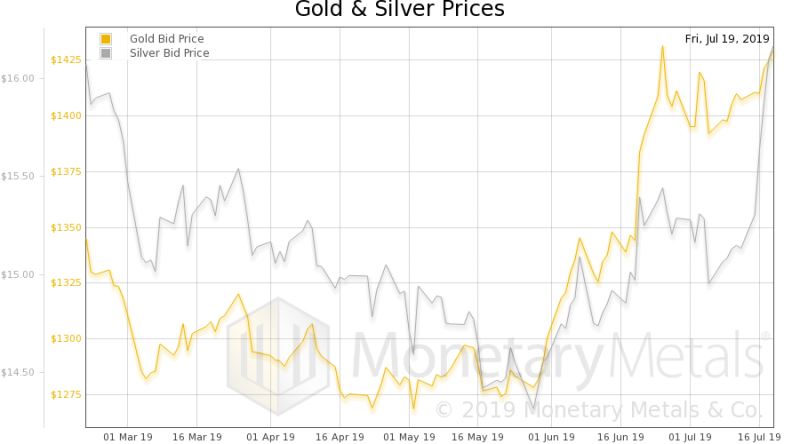

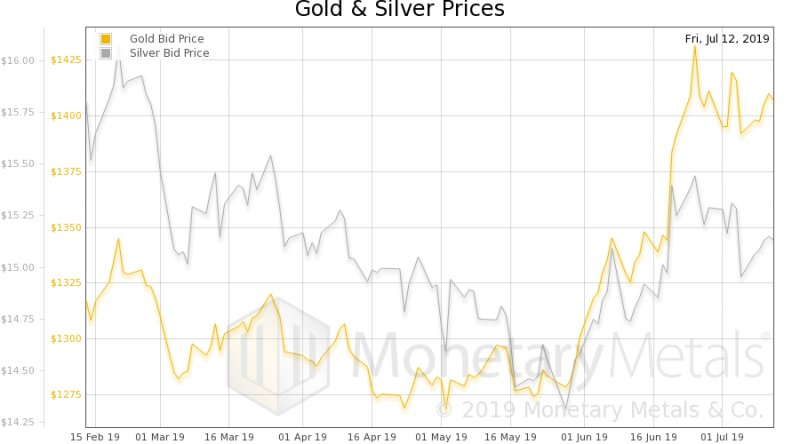

Keith Weiner – This Golden Bull is for Real #4402

2019-07-03

by Keith Weiner

As time goes by, Keith Weiner and others are more and more convinced that the long awaited bull market in gold has finally arrived. Both from a technical and fundamental point of view, there is agreement among most that this bull is the real deal. Of course anything can happen, and probably will, but things … Continue...

Read More »

Read More »

Keith Weiner Gets Interviewed

Our economic views and unique product are generating buzz. There have been a number of interviews recently (more will be posted soon). Lobo Tiggre interviewed Keith Weiner (video) about the unique Monetary Metals business model to pay interest on gold.

Read More »

Read More »

GDP Begets More GDP (Positive Feedback), Report 30 June

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth.

Read More »

Read More »

Keith Weiner – Basel III Is Not Good For Gold!

2019-06-27

by Keith Weiner

SBTV speaks with Keith Weiner, CEO of Monetary Metals, at The Safe House gold & silver vault in Singapore about the real impact of the Basel III reclassification of gold as a Tier 1 asset. Find out why it is not good for gold. Discussed in this interview: 02:58 Is gold an outdated asset for … Continue reading »

Read More »

Read More »

In The Pit: Keith Weiner, Founder and CEO, Monetary Metals (June 2019)

2019-06-26

by Keith Weiner

Monetary Metals is one of the most interesting companies I’ve come across in a long time. The idea is to fix the long-standing objection to gold as a financial asset in that it “doesn’t pay interest.” I’m not ready to invest yet, but if they can consistently deliver on what they’ve started, it could be …

Read More »

Read More »

What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”).

Read More »

Read More »

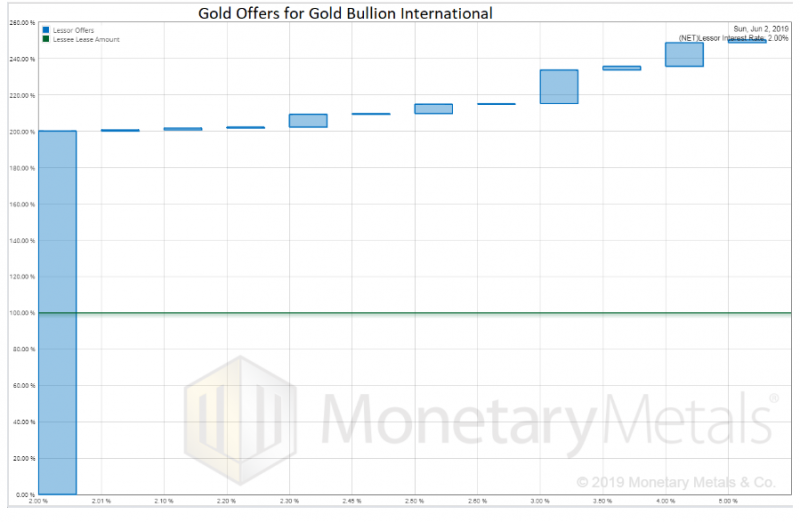

Gold Bullion International Lease #1 (gold)

Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository.

Read More »

Read More »

The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy!

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

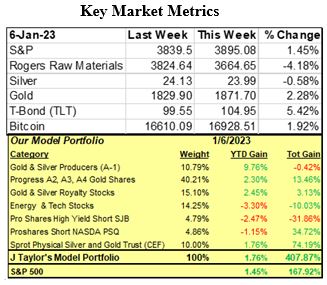

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

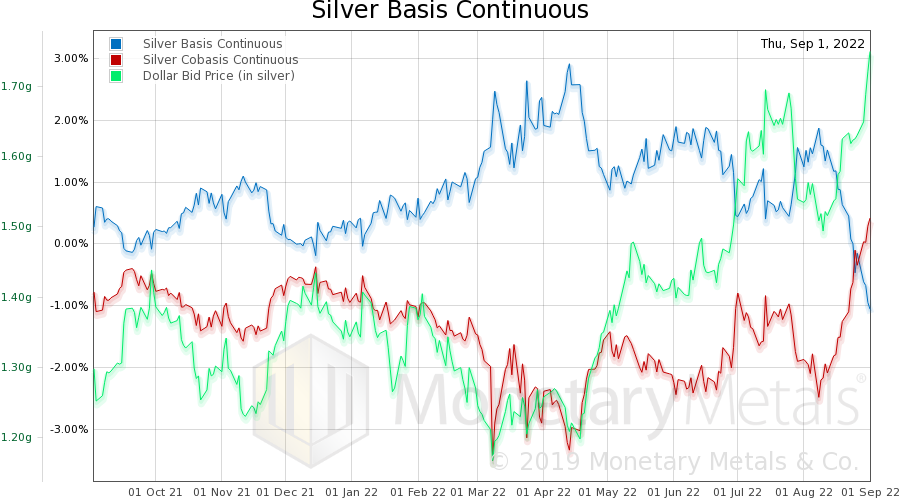

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022