Category Archive: 6a) Gold & Monetary Metals

Go for Gold – Win a beautiful Gold Sovereign coin

The Irish Times has teamed up with GoldCore, Ireland’s first and leading gold broker, to offer you the chance to win a beautiful, freshly minted Gold Sovereign coin (2017) which contains nearly one quarter of an ounce of gold and is ‘investment grade’ 22 carat pure gold.

Read More »

Read More »

Only Gold Lasts Forever

his current state of play won’t last forever. Only Gold lasts forever. Some days it can feel a little rough being a gold investor. In today’s article Dominic Frisby is certainly feeling that way. Sometimes it can be all too easy to get caught up in the day to day chat around prices. Some forget that the reasons why they invested are still strong, even if it feels like the price isn’t.

Read More »

Read More »

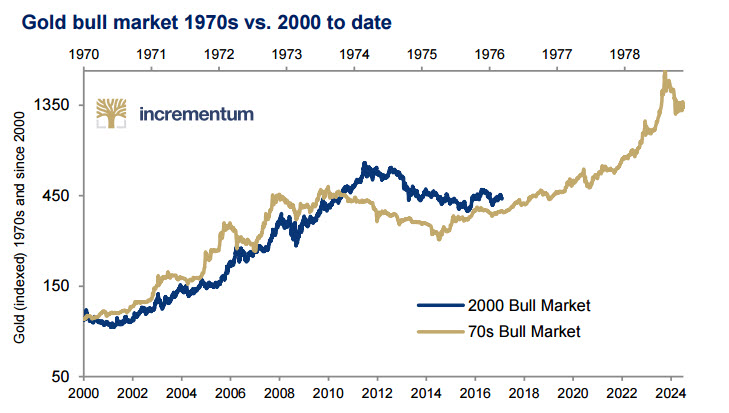

In Gold we Trust Report: Must See Gold Charts and Research

The 11th edition of the annual “In Gold we Trust” is another must read synopsis of the fundamentals of the gold market, replete with excellent charts by our friend Ronald-Peter Stoeferle and his colleague Mark Valek of Incrementum AG.

Read More »

Read More »

MARC FABER | Amerigeddon Economic Collapse Will be on June 21 2017

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / AGENDA 21 / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2017

Read More »

Read More »

Liberty Silvers ädelmetallseminarium i Göteborg – Ronan Manly

Info will follow in english. I februari anordnade Liberty Silver ett ädelmetallseminarium i Göteborg. Kvällen började med en företagspresentation av Liberty Silvers VD Mikael From följt av en föreläsning av Liberty Silvers grundare Torgny Persson. Torgny berättade om prismanipulation på ädelmetallmarknaden och bullionbanker. Därefter intog den irländske ädelmetallanalytikern Ronan Manly scenen och föreläste om centralbanker …

Read More »

Read More »

David Morgan Interview: Gold & Silver At Breakout Point From 6 Year Downtrend

Read the full transcript here ? https://goo.gl/jNPn3c David Morgan of The Morgan Report joins Mike Gleason of Money Metals Exchange for a terrific interview on counterparty risk and other dangers in today’s markets and also shares his thoughts on when he expects the metals to turn and what the smart money is already doing. Don’t …

Read More »

Read More »

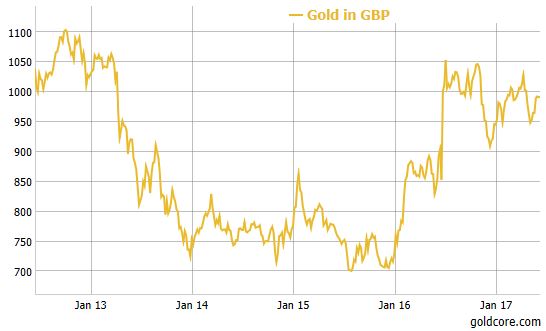

Gold Prices Steady On UK Election Risk; ECB Meeting and Geopolitical Risk

Gold held steady on Thursday as investors awaited cues on market direction amid a number of geopolitical events later in the day that could boost the safe-haven demand for the metal.

Read More »

Read More »

Gold Prices Break 6-Year-Long Downtrend On Safe Haven and 50percent Surge In Chinese Demand

Gold prices break 6 year down trend on safe haven demand (see charts). Chinese gold demand set to surge 50% to 1,000 metric tonnes. Chinese demand for gold bars on track to surge more than 60 percent in 2017. Geopolitical risk internationally leading to safe haven demand. UK election, terrorism and rising tensions in Middle East supporting gold after attacks in London and attacks in Iran today.

Read More »

Read More »

Deposit Bail In Risk as Spanish Bank’s Stocks and Bonds Crash

Deposit bail in risk as stocks and bonds of Spanish bank – Banco Popular – crash. Banco Popular stock crashes most on record – down 63% this year to 34 euro cents. Spanish bank tells employees – “Don’t panic”. Risk of Spanish banking crisis as Banco Popular credit curve inverts. Banco Popular needs to find at least €4 billion more capital – analysts.

Read More »

Read More »