Category Archive: 6a) Gold & Monetary Metals

Gold doing what it does best – Part II

While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time.

Read More »

Read More »

* Silver Price Analysis June 2020 – Silver Acceleration | Uranium Market, Marc Faber Is Silver $15

Full Document transcript go to:https://www.financialanalysis.tv Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Skype: akira10k Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

The Debt-Inflation Spiral Is Driving up the Demand for Gold: Alasdair Macleod

Https://rebrand.ly/rawealthpartners6

Join Now

The Debt-Inflation Spiral Is Driving up the Demand for Gold: Alasdair Macleod , Keyword

Measured in dollars, the current bull market for gold started in December 2015, since which its price in dollars has almost doubled. Other than the odd headline when gold exceeded its previous September 2011 high of $1,920, only gold bugs seem to be excited. But in our modern macroeconomic world of...

Read More »

Read More »

Keiser Report | Free Money Drives Hard Money Higher | Summer Solutions | E1581

In this episode of Keiser Report’s annual Summer Solutions series, Max and Stacy chat to hard money advocate, Alasdair Macleod of GoldMoney.com, about the headline-grabbing moves in gold prices. Goldman Sachs says that soaring gold prices are, indeed, signalling that the US dollar’s days as world reserve currency may be coming to an end. And, while they spoke before it was announced that Warren Buffett has gone long gold miner, Barrick Gold, they...

Read More »

Read More »

Gold, Silver Jump After Swings Amid Weak Dollar and Economic Woe

Spot gold headed for back-to-back gains as investors weighed the outlook for the metal’s record-setting rally after this week’s dramatic price swings. Silver climbed the most in more than five years.

Read More »

Read More »

Alasdair Macleod Warns? Monetary Reset After the COVID-19 Crisis -NEW WORLD ORDER

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Value of gold stored by Irish metals broker GoldCore surges past €100m

Investment in gold has risen during pandemic. The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

Gold prices last week topped the $2,000-per-ounce level for the first time as investors seek havens...

Read More »

Read More »

ALASDAIR MACLEOD – Government Doing Everything To Resist To Collapse Of Paper Currencies

The US Dollar and all paper currencies are collapsing, but we watch it without doing anything. Our assets are constantly losing value. The government should do something about it, the Central Bank should do something about it.

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy...

Read More »

Read More »

Physical Gold & Silver Demand Rising to Unprecedented Levels

As Joe Biden announced his VP pick, Wall Street’s hopes for a V-shaped economic recovery were revived by falling jobless claims and the S&P 500 inching closer to an all-time high. Precious metals markets, meanwhile, were hit with a big V for Volatility.

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.14.20

Eric Sprott recaps a volatile week in the precious metals and discusses some specific mining companies that have caught his eye.

Visit our website https://www.sprottmoney.com/ for more news.

You can submit your questions to [email protected]

Read More »

Read More »

* Dr. Marc Faber: The Fed Started QE to Infinity in 2008

#Dr.MarcFaber: #TheFed Started QE to Infinity in 2008 While the Federal Reserve still has yet to admit that it’s running another quantitative easing campaign, Dr. #MarcFaber of the #GloomBoomandDoomReport explained how in reality, when the Fed started QE in 2008, that was the beginning of #QEtoinfinity. Dr. Faber talked about how the Federal Reserve has …

Read More »

Read More »

TỶ PHÚ MARC FABER HUYỀN THOẠI ĐẦU TƯ TOP 10 THẾ GIỚI

Trước những biến động của thị trường đầu tư, chúng tôi quyết định tổ chức 2 ngày học TRỰC TUYẾN cùng tỷ phú Marc Faber và các chuyên gia hàng đầu giúp anh chị có những thông tin, kiến thức hữu ích và cơ hội phù hợp. ? FINANCIAL SUMMIT 2020 – 2 NGÀY CHUYÊN … Continue reading...

Read More »

Read More »

Credit Crisis LOOMING: Central Banks Committed to Printing! – Alasdair Macleod

Subscribe to our Free Financial Newsletter:

http://crushthestreet.com

To get more from Alasdair visit: www.GoldMoney.com

TOPICS IN THIS INTERVIEW:

Metals vulnerable to corrections due vs. evidence of the COT reports.

Silver has one ETF.

Non reportable are going long.

Fed has to finance the government deficits.

Major banks at the greatest risk of failures.

The mainstream Keynesians are inflation believers.

Food price inflation is...

Read More »

Read More »

Marc Faber: The Economy Will Not Return for Years

Marc feels, “The economy is currently in a dead-cat bounce and that peak economic levels seen in 2018-2019 will not come back for a long-time… and by a long-time… years.” To subscribe to our newsletter and get notified of new shows, please visit http://palisaderadio.com Tom welcomes an always popular guest back to the program, Marc …

Read More »

Read More »

? Alasdair Macleod: Financial Wars on Gold – The Gold Bullion Bank Will Collapse

Alasdair Macleod: Financial Wars on Gold - The Gold Bullion Bank Will Collapse

#Gold

#economic

#AlasdairMecleod

#WW3

Read More »

Read More »

Bron Suchecki – Gold & Silver Industry Simply Lacks Capacity to Handle Mass Market Coin Buying

SBTV spoke with Bron Suchecki, Precious Metals Analyst with ABC Bullion, about how the physical gold & silver markets are now exerting more pressure on the paper markets with physical bullion prices bifurcating from spot prices.

Discussed in this interview:

01:27 Gold had built a base in the past years

05:13 How Australian economy is doing amidst global recession

07:59 Physical gold and silver supply squeeze

10:56 Bifurcation of spot and...

Read More »

Read More »

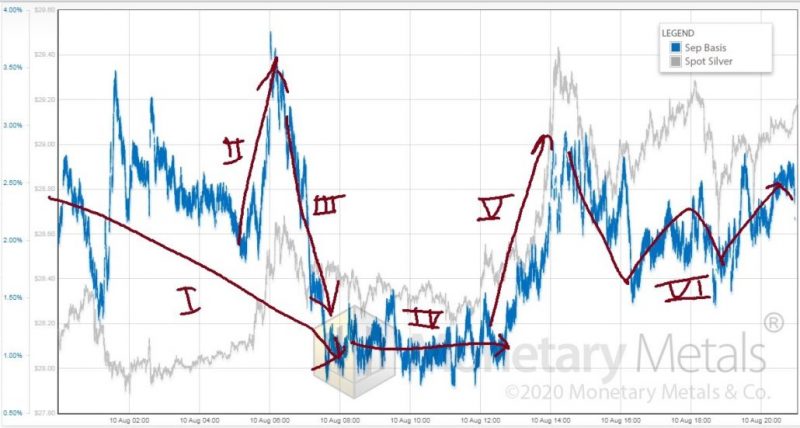

Perfect Storm for Precious Metals Leads to Price Correction

Gold fell by nearly 6% yesterday and silver by a whopping 15%, the largest one day loss in over 7 years. The futures market saw massive volumes of selling with over 1.6 bn ounces of silver contracts sold yesterday. That’s a value of over $40 billion.

Read More »

Read More »

Jay Taylor Introduces – SOS! Take cover It’s too late to turn back!

Jay introduces the guest for the show, gives updates on the sponsors and the projects they are working on and provides updates on gold and silver from Alasdair Macleod.

Read More »

Read More »