Category Archive: 5) Global Macro

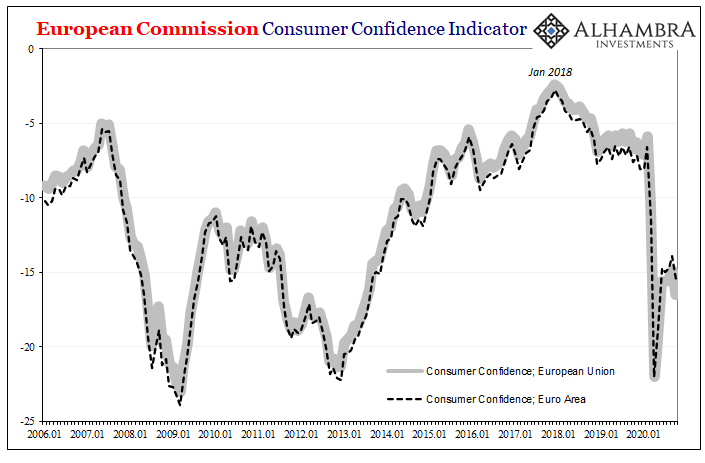

Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom.

Read More »

Read More »

Covid-19: how to fix the economy | The Economist

Governments will have to deal with the economic fallout from the pandemic for decades to come. If they get their response wrong, countries risk economic stagnation and political division. Read more here: https://econ.st/3ojORKY

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/3m212Kj

Read our special report on the economic impact of the COVID-19 pandemic: https://econ.st/37mGlos

How the pandemic is reshaping banking:...

Read More »

Read More »

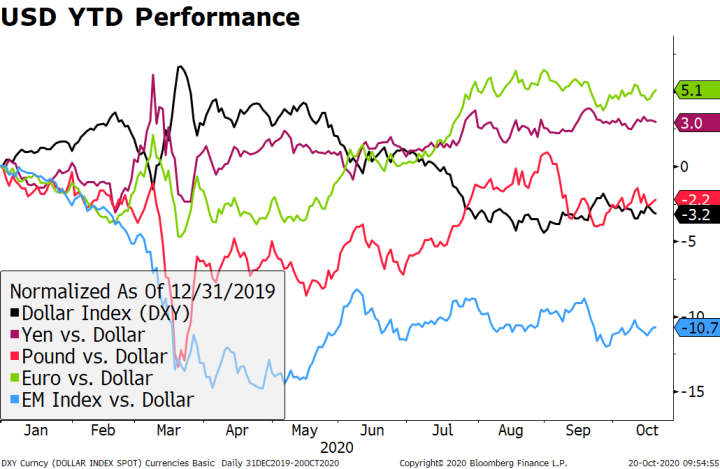

Dollar Catches Modest Bid but Weakness to Resume

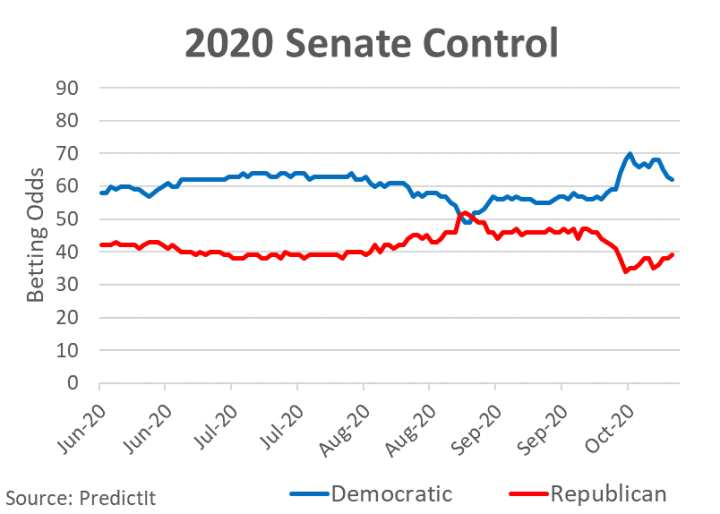

Geopolitical tensions have risen after US officials accused Russia and Iran of meddling in the elections; the dollar has caught a modest bid today. Stimulus talks continue; Pelosi warned that a deal may not come together before the November 3 election; whether Republican Senators change their minds after the elections depends on the outcome.

Read More »

Read More »

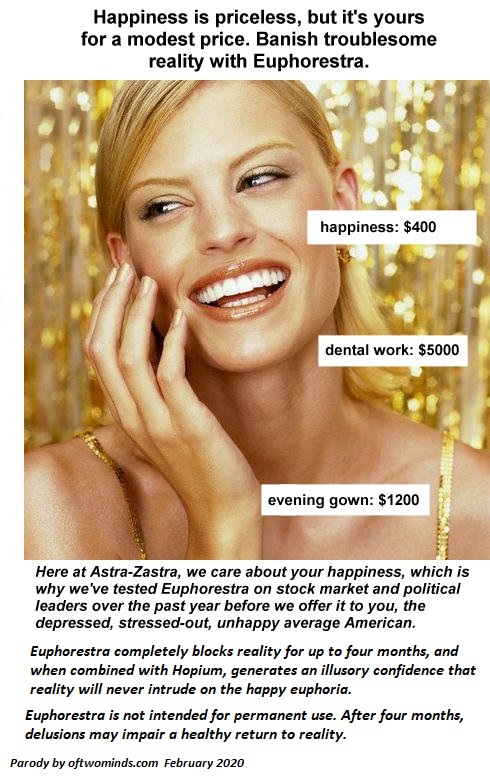

Everything is Staged

All the staging is a means to an end, and everyone in America is nothing more than a means to an end: close the sale so the few can continue exploiting the many. You know how realtors stage a house to increase its marketability: first, they remove all evidence that people actually live there.

Read More »

Read More »

The New Tyranny Few Even Recognize

Clearly, the Fed reckons the public is foolish enough to believe the Fed's money will actually be "free." It's pretty much universally recognized that authorities use crises to impose "emergency

powers" that become permanent.

Read More »

Read More »

Dollar Soft as Markets Await Fresh News and Rumours

The dollar is coming under pressure again; markets are finally waking up to the fact that a stimulus deal before 2021 is unlikely; 10-year Treasury yields have been trading in a narrow range for months.

Read More »

Read More »

Charles Hugh Smith: Entrepreneur Skills A Must for Any Job

Jason Burack of Wall St for Main St interviewed economic blogger and author Charles Hugh Smith from the popular blog Of Two Minds

Read More »

Read More »

Will the Stock Market Be Dragged to the Guillotine?

The Fed's rigged-casino stock market will be dragged to the guillotine by one route or another. The belief that the Federal Reserve and its rigged-casino stock market are permanent and forever is touchingly naive. Never mind the existential crises just ahead; the financial "industry" (heh) projects unending returns of 7% per year, or is it 14% per year?

Read More »

Read More »

Election 2020: what the data tell us

The presidential election has been transformed by data. From key swing states and early voting to voter suppression and possible election-night chaos, Elliott Morris, our data journalist and election guru, discusses his polling predictions and answers your questions about the 2020 race for the White House.

Read More »

Read More »

Drivers for the Week Ahead

Some are holding out hope but we think the stimulus package remains dead; Fed releases its Beige Book report Wednesday; there is a full slate of Fed speakers this week. Fed manufacturing surveys for October will continue to roll out; weekly jobless claims will be reported Thursday; BOC releases results of its Q3 Business Outlook Survey Monday.

Read More »

Read More »

EM Preview for the Week Ahead

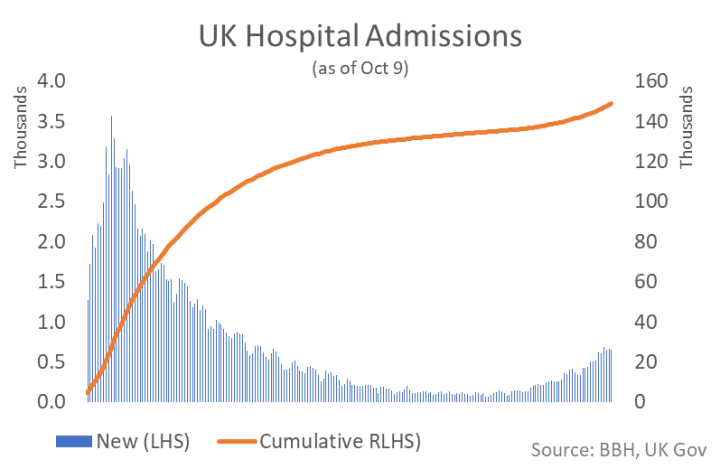

Risk assets are coming off a tough week. The dollar was bid across the board except for the yen, which outperformed slightly. The only EM currencies to gain against the dollar were KRW and CLP. The major US equity indices somehow managed to eke out very modest gains but stock markets across Europe sank as the viral spread threatens to slam economic activity again.

Read More »

Read More »

5 Estate Planning Myths That Can Derail Your Estate Plan

You spend a lifetime earning, saving, acquiring. But the old adage is true—you can’t take it with you. So, what do you do with your assets when you’re gone? How do you want them distributed? That’s where a good estate plan comes in.

Read More »

Read More »

Dollar Gains as Market Sentiment Goes South

Virus restrictions across Europe continue to sour sentiment; the dollar is benefiting from the risk-off backdrop. The stimulus package is deader than Elvis; Fed manufacturing surveys for October will start to roll out; weekly jobless claims will be reported; Chile is expected to keep rates steady at 0.5%.

Read More »

Read More »

Why We’re Doomed: Our Delusional Faith in Incremental Change

Better not to risk any radical evolution that might fail, and so failure is thus assured. When times are good, modest reforms are all that's needed to maintain the ship's course. By "good times," I mean eras of rising prosperity which generate bigger budgets, profits, tax revenues, paychecks, etc., eras characterized by high levels of stability and predictability.

Read More »

Read More »

Dollar Bounce Remains Modest as Headwinds Build

The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September. Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country.

Read More »

Read More »

Can deep-sea mining help the environment?

Mining companies and governments will soon be allowed to extract minerals from the deep-ocean floor. These rare metals are vital for a more environmentally sustainable future on land, but at what cost to the health of the ocean?

Read More »

Read More »

Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook. A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today.

Read More »

Read More »

A Deflationary Mindset That Isnt In Our Minds: Jeff Snider

The timing could not have been worse, though in the grand scheme of things it is just perfect. It was barely two weeks ago when Jay Powell was announcing what he and others were claiming was a huge, massive deal. No longer a specific inflation target, but one that would be averaged high against low.

Read More »

Read More »

Our Simulacrum Economy

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society.

Read More »

Read More »