Category Archive: 5) Global Macro

5 Estate Planning Myths That Can Derail Your Estate Plan

You spend a lifetime earning, saving, acquiring. But the old adage is true—you can’t take it with you. So, what do you do with your assets when you’re gone? How do you want them distributed? That’s where a good estate plan comes in.

Read More »

Read More »

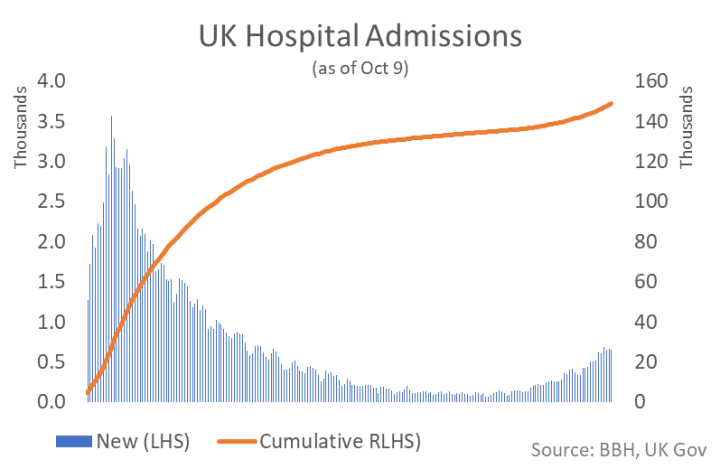

Dollar Gains as Market Sentiment Goes South

Virus restrictions across Europe continue to sour sentiment; the dollar is benefiting from the risk-off backdrop. The stimulus package is deader than Elvis; Fed manufacturing surveys for October will start to roll out; weekly jobless claims will be reported; Chile is expected to keep rates steady at 0.5%.

Read More »

Read More »

Why We’re Doomed: Our Delusional Faith in Incremental Change

Better not to risk any radical evolution that might fail, and so failure is thus assured. When times are good, modest reforms are all that's needed to maintain the ship's course. By "good times," I mean eras of rising prosperity which generate bigger budgets, profits, tax revenues, paychecks, etc., eras characterized by high levels of stability and predictability.

Read More »

Read More »

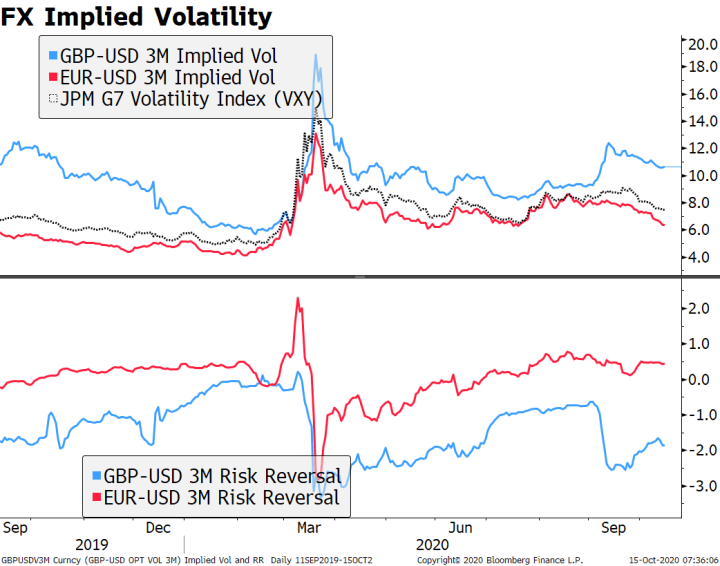

Dollar Bounce Remains Modest as Headwinds Build

The dollar is making a modest comeback; stimulus talks have hit a dead end; we get more US inflation readings for September. Brexit talks continue ahead of the EU summit Thursday and Friday; a new bill by the UK government could change the investment landscape in the country.

Read More »

Read More »

Can deep-sea mining help the environment?

Mining companies and governments will soon be allowed to extract minerals from the deep-ocean floor. These rare metals are vital for a more environmentally sustainable future on land, but at what cost to the health of the ocean?

Read More »

Read More »

Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook. A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today.

Read More »

Read More »

A Deflationary Mindset That Isnt In Our Minds: Jeff Snider

The timing could not have been worse, though in the grand scheme of things it is just perfect. It was barely two weeks ago when Jay Powell was announcing what he and others were claiming was a huge, massive deal. No longer a specific inflation target, but one that would be averaged high against low.

Read More »

Read More »

Our Simulacrum Economy

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society.

Read More »

Read More »

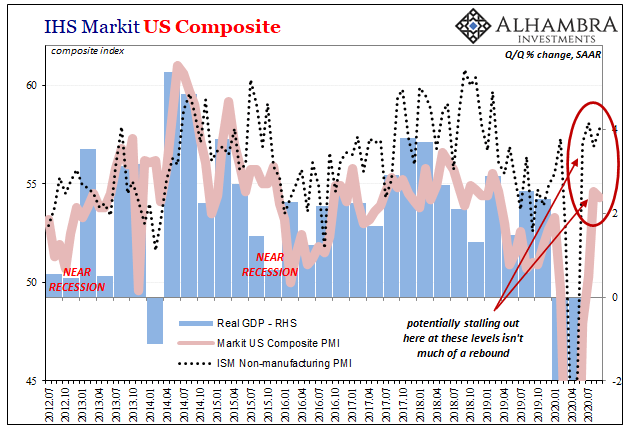

Inflation Conditions Absent, Someone Call Jay

Wednesday, October 7, 2020 5:45 AM EDT Not just payroll data, either. The JOLTS data also keeps backing up this idea of a slowdown forming in the trajectory of both the CES and CPS series. More and more it looks like the economy is running out of momentum well short of the finish line.

Read More »

Read More »

Drivers for the Week Ahead

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday. A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week.

Read More »

Read More »

Dollar Slide Continues as US Fiscal Stimulus Remains Questionable

The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals. This is another quiet day in terms of US data; Canada reports September jobs data. We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield.

Read More »

Read More »

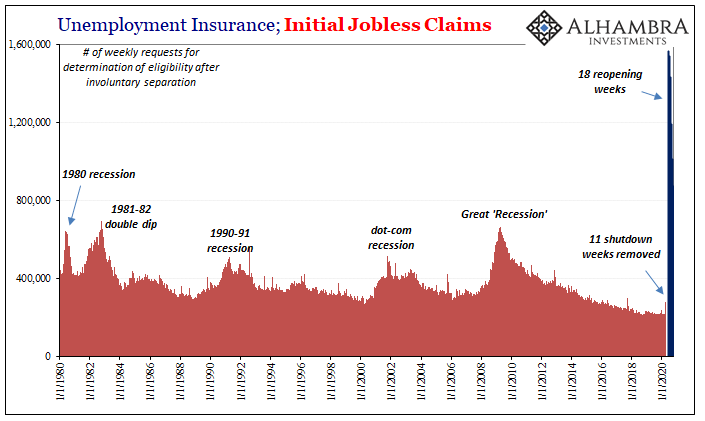

It Just Isn’t Enough

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state.

Read More »

Read More »

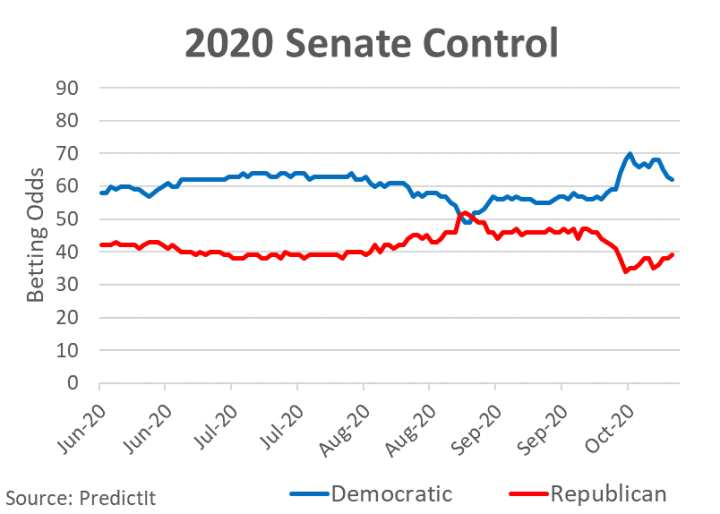

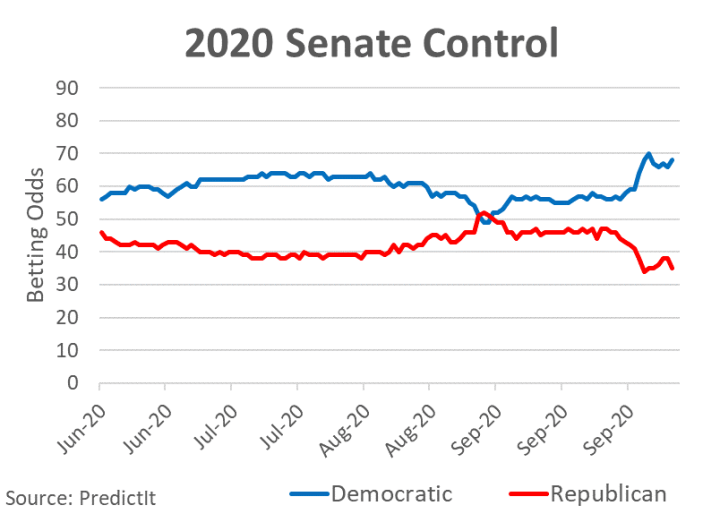

Election 2020: can the Democrats win the Senate? | The Economist

In the US 2020 election the battle to control of the Senate is almost as important as the race for the White House, because control of Congress can make or break a presidency. The Economist has created a new statistical model to predict who will win.

Read More »

Read More »

A Hard Rain Is Going to Fall

The status quo is about to discover that it can't stop the hard rain or protect its fragile sandcastles. You'll recognize A Hard Rain Is Going to Fall as a cleaned-up rendition of Bob Dylan's classic "A Hard Rain's a-Gonna Fall".

Read More »

Read More »

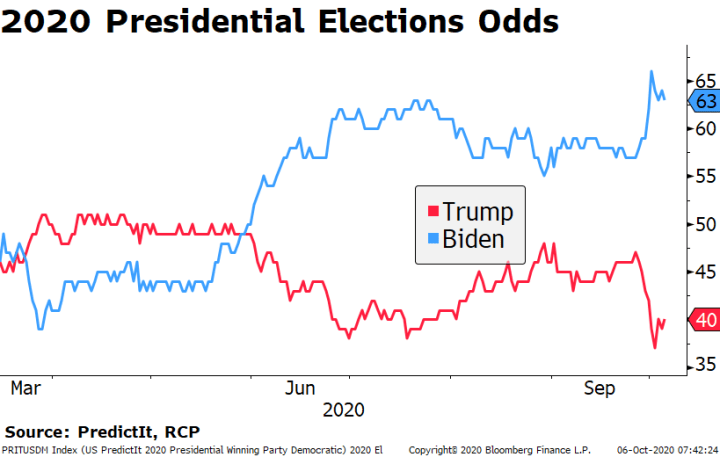

Dollar Remains Heavy as Markets Await Fresh Drivers

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states. The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises.

Read More »

Read More »

Is There Enough?

It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time.

Read More »

Read More »

Dollar Softens and US Curve Steepens as Odds of Democratic Sweep Rise

The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data. President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4.

Read More »

Read More »

Who’s Negative? The Marginal American Worker

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments.

Read More »

Read More »

The secret to tackling corruption | The Economist

Corruption costs the world nearly $3trn a year. Here are some of the innovative ways in which communities, companies and countries are tackling it.

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Check out The Economist’s full video catalogue: http://econ.st/20IehQk

Like The Economist on Facebook: https://www.facebook.com/TheEconomist/

Follow The...

Read More »

Read More »