Category Archive: 5) Global Macro

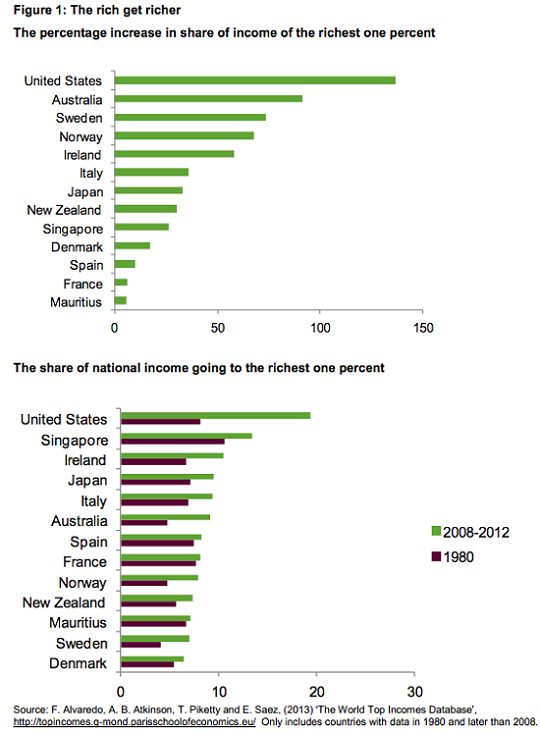

No Wonder the Super-Rich Love Inflation

Asset inflation benefits the super-rich more than anyone else because they own the vast majority of these assets. With the reflation euphoria running full blast, maybe central banks will finally get all that inflation they've been pining for. So let's ask cui bono--who will benefit from inflation?

Read More »

Read More »

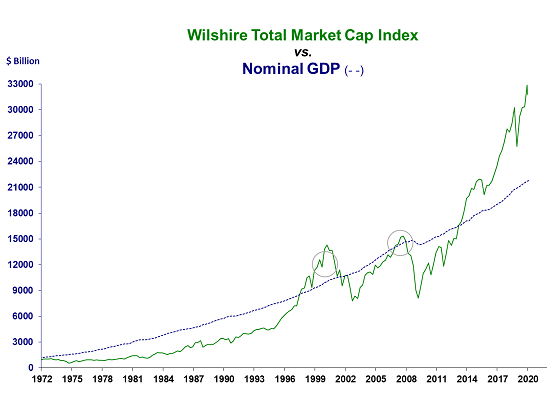

Forget GOAT, Look at GBOAT: The Greatest Bubble Of All Time

So enjoy the GBOAT (greatest bubble of all time) but watch the clock. Sports fans debate who qualifies as GOAT--the greatest of all time: in hoops, Kobe, Jordan, Kareem, Magic; in boxing, Ali, and so forth. What we have today is GBOAT--the greatest bubble of all time That it's GOAT is beyond doubt, as the charts below reveal.

Read More »

Read More »

Good Payrolls Still Say Slowdown

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month.

Read More »

Read More »

Joe Biden wins: what next for America? | The Economist

Joe Biden has won the race to become America’s next president. Our experts answer your questions on potential court battles, a divided country and the future of America.

00:00 Can Biden reunite America?

01:27 Is Biden’s path to the White House assured?

02:13 Does Trump have grounds for legal challenges?

05:15 Were the polls right?

06:54 Why are Trump's supporters so hard to poll?

07:25 How did Trump manage to widen his base this election?

09:27...

Read More »

Read More »

Could ELECTION SHENANIGANS Investigation UNCOVER Something DEEPER??

CHARLES HUGH SMITH Joins Michelle To Discuss The Presidential Elections, Which Are About The American People's TRUST In Their Right To Chose Their Own President. Or Will America's President Be Selected For Us?

Read More »

Read More »

Here’s Our Historical Analogy Menu: Rome, the USSR or Revolutionary France

The core dynamic is ultimately the loss of social cohesion within the ruling elites and in the social order at large. There's a definite end of days feeling to the euphoria that the world didn't end on November 3. And what better way to celebrate the victory of what passes for normalcy with a manic stock market rally?

Read More »

Read More »

Could ELECTION SHENANIGANS Investigation UNCOVER Something DEEPER?

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser.

Read More »

Read More »

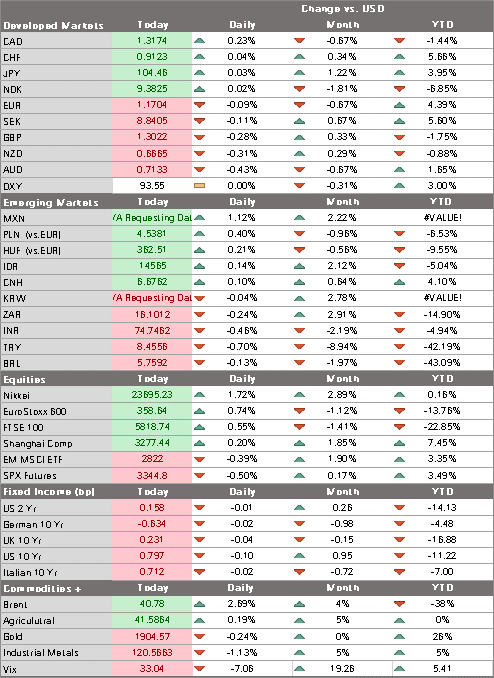

Markets Gyrate Ahead of Protracted Period of Uncertainty

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs. Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities.

Read More »

Read More »

Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider...

Read More »

Read More »

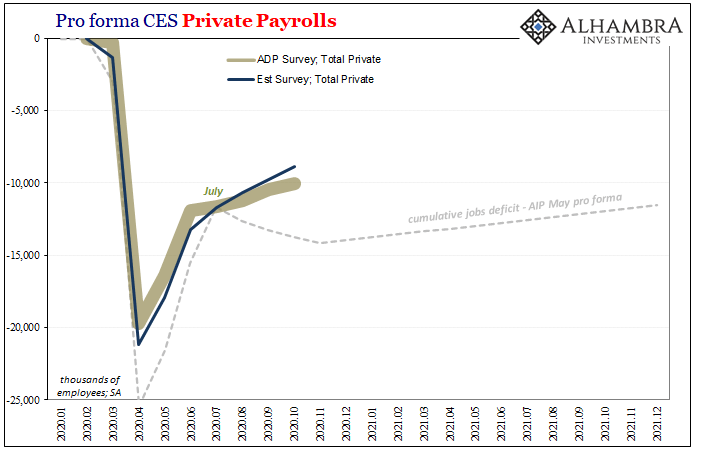

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »

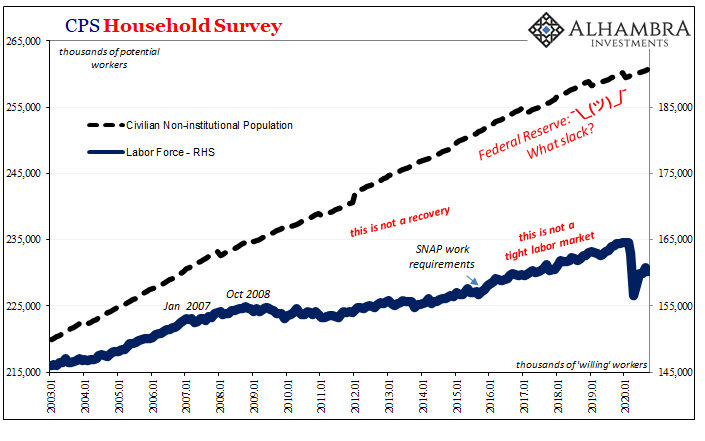

What We Don’t Elect Matters Most: Central Banking and the Permanent Government

We're Number One in wealth, income and power inequality, yea for the Fed and the Empire! If we avert our eyes from the electoral battle on the blood-soaked sand of the Coliseum and look behind the screen, we find the powers that matter are not elected: our owned by a few big banks Federal Reserve, run by a handful of technocrats, and the immense National Security State, a.k.a. the Permanent Government.

Read More »

Read More »

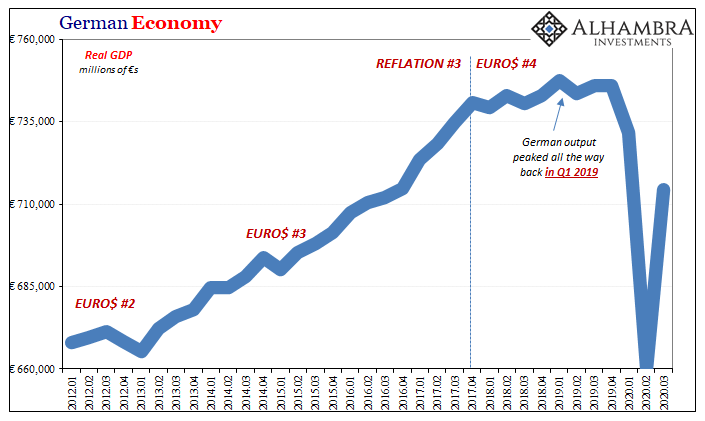

Meanwhile, Outside Today’s DC

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

Our Imperial Presidency

Regardless of who holds the office, America's Imperial Project and its Imperial Presidency are due for a grand reckoning. While elections and party politics generate the emotions and headlines, the truly consequential change in American governance has been the ascendancy of the Imperial Presidency over the past 75 years, since the end of World War II.

Read More »

Read More »

FOMC Preview: Coronavirus Daily Change

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4.

Read More »

Read More »

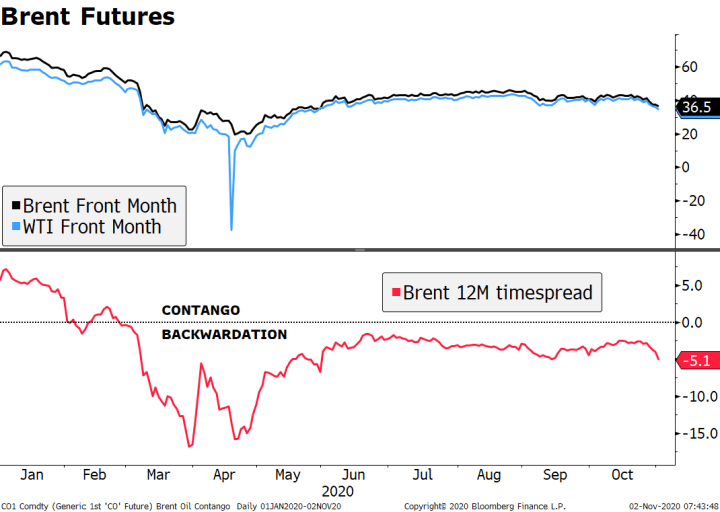

Dollar Firm at Start of Very Eventful Week

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges. This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week.

Read More »

Read More »

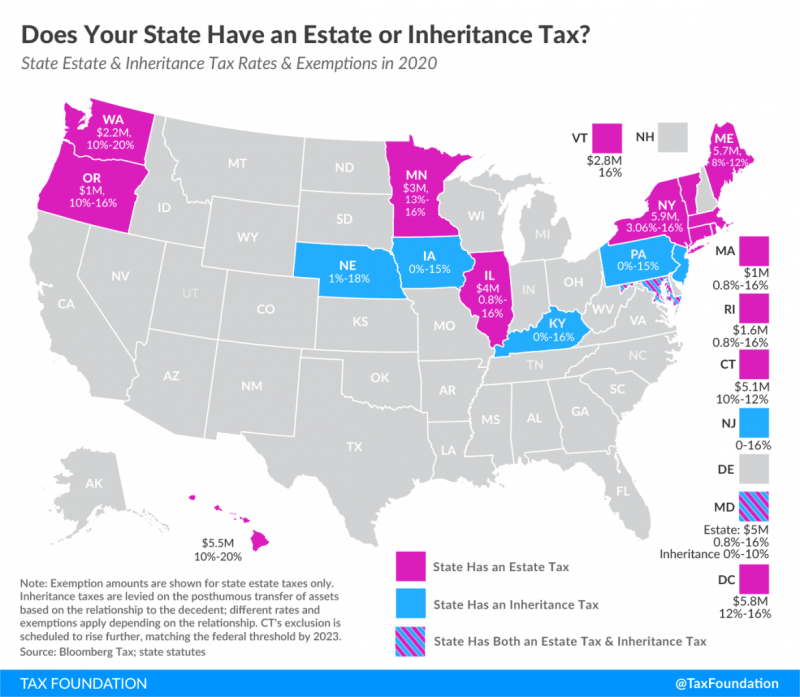

17 States that Charge Estate or Inheritance Taxes

Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise.

Read More »

Read More »

Election 2020: What has President Trump done to America? | The Economist

In the 2020 election, President Donald Trump will be judged on his handling of the covid-19 pandemic. But what else will be his legacy if he loses?

Further content:

Find The Economist’s coverage of the US elections: https://econ.st/3mwsMa4

Sign up to The Economist’s weekly “Checks and Balance” newsletter on American politics: https://econ.st/3l5C4dl

See The Economist’s 2020 presidential election forecast: https://econ.st/35JCkI2

Listen to...

Read More »

Read More »

Dollar Bid as Markets Steady Ahead of ECB Decision

Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors. The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported.

Read More »

Read More »

ALICE Doesn’t Work Here Anymore

What the political class and the Financial Nobility don't yet grasp is that ALICE will never go back to her insecure, low-wage job, ever.

Read More »

Read More »

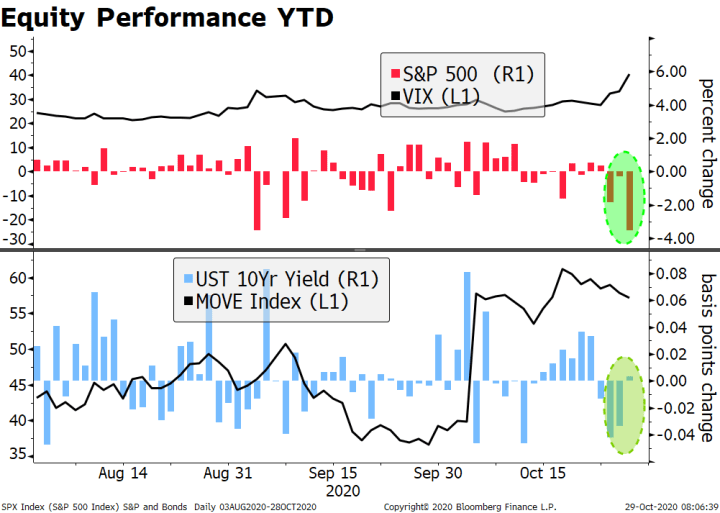

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »