Category Archive: 5) Global Macro

How will covid-19 change travel? | The Economist

The covid-19 pandemic has devastated the travel industry. But as vaccines are rolled out and global travel slowly picks up, how will the industry evolve, and will holidays ever be the same again? Read more here: https://econ.st/3aA2row

Sign up to The Economist’s daily newsletter to keep up to date with our latest coverage: https://econ.st/3aor3kg

Read our special report about the future of tourism: https://econ.st/3bnP1vc

Read about why...

Read More »

Read More »

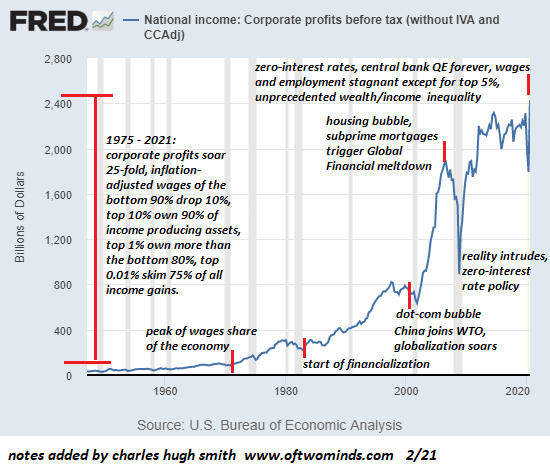

What Poisoned America?

America's financial system is nothing more than a toxic waste dump of speculation, fraud, collusion, corruption and rampant profiteering. What Poisoned America?

Read More »

Read More »

Two Seemingly Opposite Ends Of The Inflation Debate Come Together

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else.

Read More »

Read More »

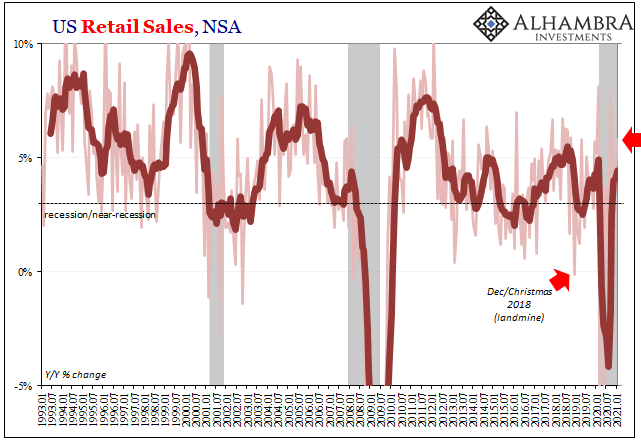

Uncle Sam Was Back Having Consumers’ Backs

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

Read More »

Read More »

Quick Takes: Not Allowing Deflation *is* the Inflation (w/Jeff Snider Criticism)

Two sides of the same coin here, where preventing deflation is the inflation. #JeffSnider #EmilKalinowski #AlhambraInvestments #InflationVsDeflation #LukeGromen #LynAlden

Read More »

Read More »

The Green Market – Episode 1: Charles Hugh Smith, Julian Morris and Martí Jiménez-Mausbach

This weeks host, Richard Bonugli, CEO of Cedargold, talks with Charles Hugh Smith (OfTwoMinds.com), Julian Morris (Senior Fellow at Reason Foundation), and Martí Jiménez-Mausbach (Head of Research at the Ostrom Institute) on the works of Hayek, Elinor Ostrom and whether local and decentralised economies can promote Market Environmentalism to the masses, who are looking to find a sustainable solution to the problems of climate change, without...

Read More »

Read More »

Christine Lagarde: How covid-19 will shape Europe | The Economist

Europe has been widely criticised for its slow response to the covid-19 pandemic. Christine Lagarde, president of the European Central Bank, discusses the long-term damage and whether things might have been different had there been more female leaders.

Chapter titles

00:00 - Covid-19 in Europe

00:52 - How covid-19 worsens inequality

03:35 - Why female leaders have performed better

05:10 - How to have more female leaders

06:38 - Europe’s stimulus...

Read More »

Read More »

Gains Are Unreal, Losses Are Real

Why would anyone sell when further gains are guaranteed? Because the gains are unreal but the losses are real. When markets are soaring and your portfolio is rocketing higher, the gains seem unreal.

Read More »

Read More »

What Collapsed the Middle Class?

The middle class has already collapsed, but thanks to debt and bubbles, this reality has been temporarily cloaked. What collapsed the middle class? In many ways the answer echoes an Agatha Christie mystery: rather than there being one guilty party, a number of suspects participated in the collapse of the middle class.

Read More »

Read More »

The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance.

Read More »

Read More »

Can flying go green? | The Economist

Covid-19 has caused the worst crisis in aviation's history. Is this the industry's moment for a green reset—and which technologies offer the best hope?

Read The Economist’s special report on business and climate change: https://econ.st/3bbckJZ

Sign up to The Economist’s fortnightly climate change newsletter: https://econ.st/3b8FQ3c

Find our most recent climate change coverage: https://econ.st/3pQLYkq

Can the aviation industry fully recover...

Read More »

Read More »

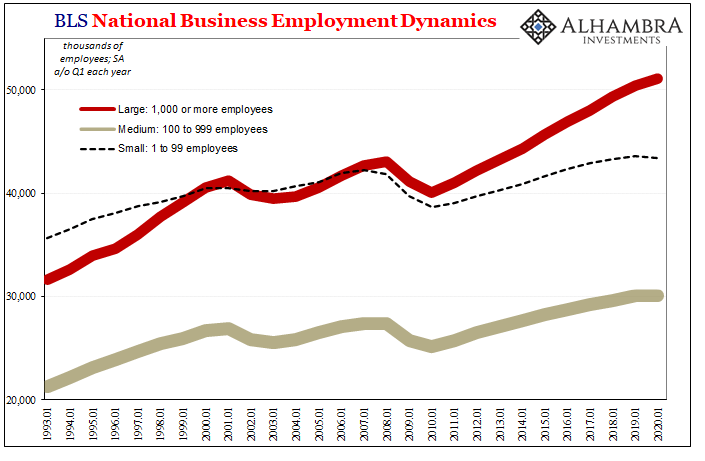

Permanent Jobs And Permanent Job Losses

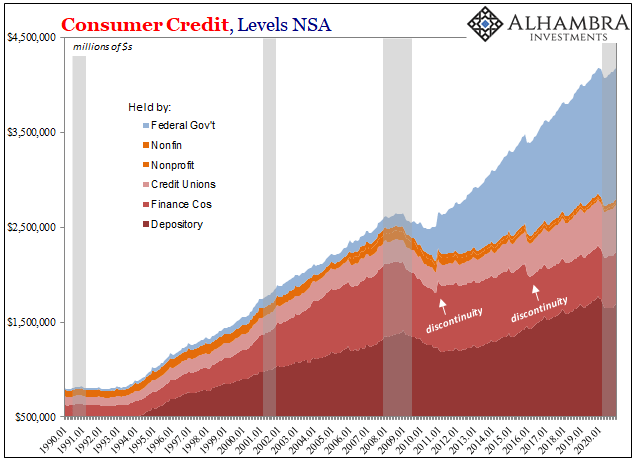

Even the feds haven’t been able to keep up. Without the government having taken over student loans in the wake of 2008-09’s Great “Recession”, there’d have been almost no additional consumer credit extended during the decade since.

Read More »

Read More »

The Insatiable Appetite to Tax Social Security Benefits

First, it was 10%, then 20%, and today more than 50% of U.S. retirees pay taxes on their Social Security benefits, and the number is expected to go even higher. The cause seems to be that one government hand doesn’t know, or care, what the other government hand is doing.

Read More »

Read More »

Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

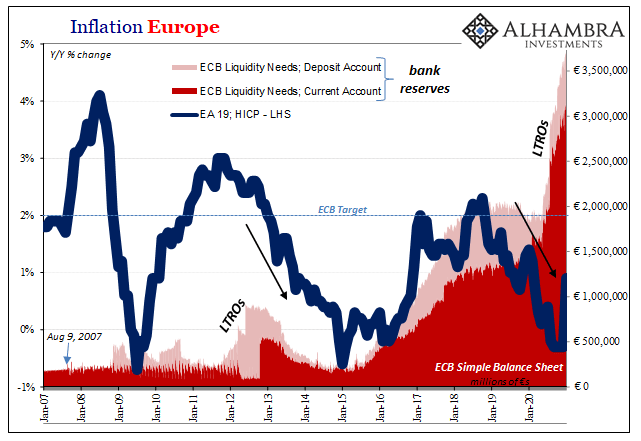

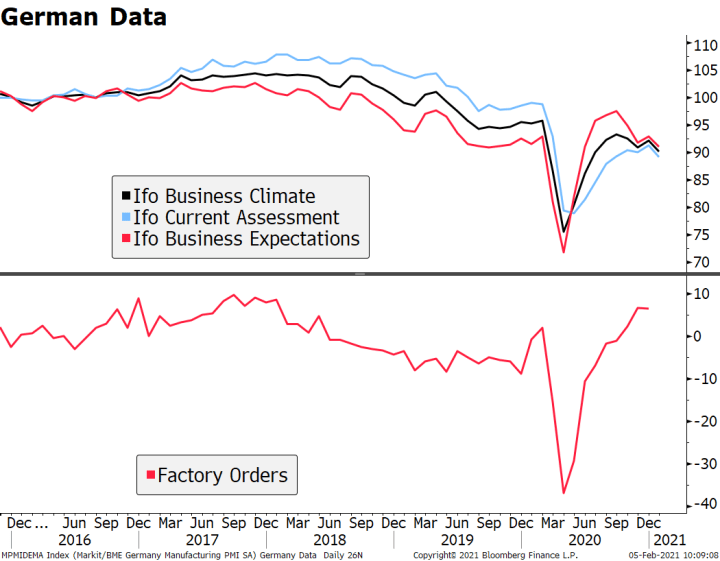

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona.Whereas Draghi spent those years howling for inflationary conditions...

Read More »

Read More »

The Top 10percent Is Doing Just Fine, The Middle Class Is Dying on the Vine

Please study these charts as a means of understanding the inevitability of economic stagnation and a revolt of the decapitalized middle class.

Read More »

Read More »

The minimum wage: does it hurt workers? | The Economist

Joe Biden has pledged to raise America's national minimum wage to $15 an hour. Economists traditionally believed that minimum wages actually hurt workers, but recent research has led to a rethink.

Sign up to The Economist’s newsletter to stay up to date: https://econ.st/3tgaHl5

Find all of our finance and economics coverage: https://econ.st/3pujLQM

Why does low unemployment no longer lift inflation? https://econ.st/3j8sWEj

Why a surge in...

Read More »

Read More »

Dollar Consolidates Its Gains Ahead of Jobs Report

Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI.

Read More »

Read More »

Covid-19 vaccines: what information can you trust? | The Economist

Factual and reliable information is vital to creating trust in vaccines and to overcoming the pandemic. Ed Carr, The Economist’s deputy editor, and Natasha Loder, our health policy editor, answer some of the big questions about the global vaccination drive.

Chapters

00:00 - Challenges in vaccinating the world

00:45 - Trust in vaccines

02:30 - mRNA vaccines

03:23 - Impact of variants on vaccination

04:29 - Time between vaccine doses

06:09 -...

Read More »

Read More »

Our Fragile, Brittle Stock Market

This heavily managed 'market structure' is far from equilibrium and extremely prone to instability.

Read More »

Read More »

Silver Swans, Maginot Lines and the Unforeseen Risks of Collapse

Our Nobility's assessment of risk and their war-gaming of vulnerabilities are fatally deficient. Many people have heard of Nassim Taleb's black swan but fewer understand how few events qualify as black swans. Per Wikipedia, a black swan is

an unpredictable or unforeseen event, typically one with extreme consequences, an event that is beyond what is normally expected of a situation and has potentially severe consequences.

Read More »

Read More »