Category Archive: 5) Global Macro

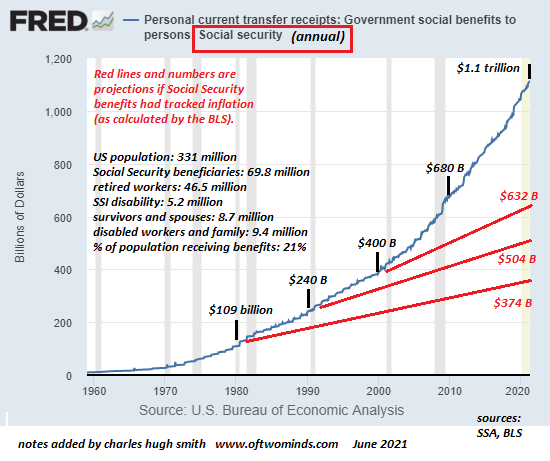

(Not) Living Large on Social Security

How many retired workers are getting less than $1,000 per month in Social Security benefits? The question came up and I was curious enough to find the answer, and download the data into an Excel spreadsheet which I saved as a

Read More »

Read More »

Increasingly Chaotic Volatility Ahead–The New Normal Few Think Possible

The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping? The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate.

Read More »

Read More »

Why hunting animals could be good for conservation | The Economist

Trophy hunting sparks outrage around the world. But the highly controversial sport can actually help to protect some of Africa's most endangered big animals. Here's how.

Find The Economist’s latest coverage of Africa: https://econ.st/3bTxaNw

Sign up to The Economist’s daily newsletter to keep up to date with our latest coverage: https://econ.st/3l79OHi

Read more about airlines banning trophy hunting: https://econ.st/3bVs6by

Does conservation...

Read More »

Read More »

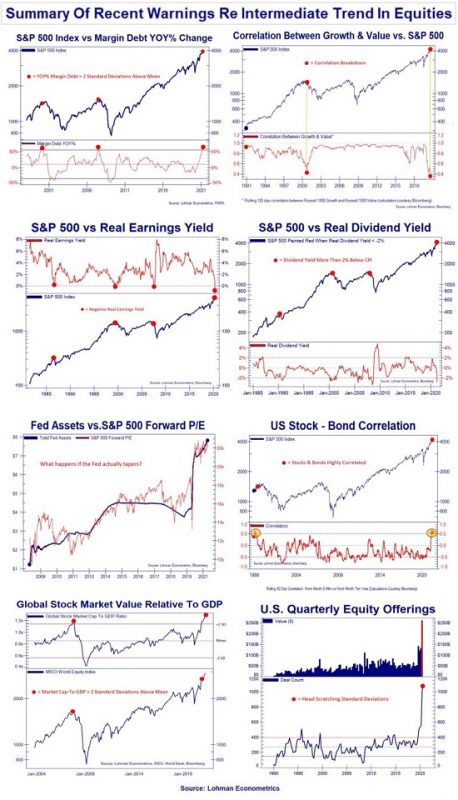

Systemic Risks Abound

For the past 22 years, every time the stock market whimpered, wheezed or whined, the Federal Reserve rushed to soothe the spoiled crybaby. There are two consequential results of the Fed as savior: The Fed has perfected moral hazard. Organic (i.e. non-manipulated) market forces have been extinguished.

Read More »

Read More »

FOMO Is Loco

We can also posit a general rule that those who inherit wealth and succumb to FOMO are eventually less wealthy while those who are wealthy and take a pass on FOMO / hoarding at the top of the manic frenzy increase their wealth.

Read More »

Read More »

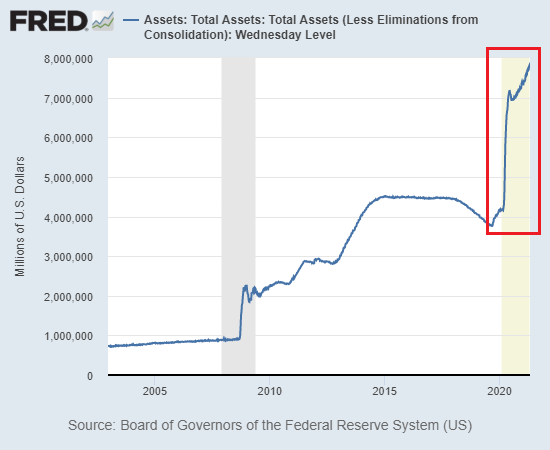

Fed to Treasury Dealers and Congress: We Can’t Count On You, We’re Taking Charge

The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient "saves" of a system that is unraveling due to its fragility and brittleness.

Read More »

Read More »

How covid-19 exposes systemic racism in America | The Economist

Black people in America are twice as likely to die from covid-19 as white people. This highlights the country’s ongoing struggle with structural racism, as our experts explain

Sign up to our weekly American politics newsletter “Checks and Balance,” to keep up to date: https://econ.st/3vlemOX

Read our special report on race in America: https://econ.st/2QOtjKs

George Floyd’s legacy, a year since his murder: https://econ.st/3oKjx8A

How...

Read More »

Read More »

Charles Hugh Smith on the Era of Accelerating Expropriations

Http://financialrepressionauthority.com/2021/05/20/the-roundtable-insight-charles-hugh-smith-on-the-era-of-accelerating-expropriations/

Read More »

Read More »

How to deal with big tech | The Economist

Senator Amy Klobuchar is leading a crusade against big-tech giants such as Apple, Amazon, Microsoft, Facebook and Google. These companies dominate the S&P 500 and wield a huge amount of influence. Should they be broken up? Read more here: https://econ.st/3bK8w1U

00:00 - Problems with big tech

01:07 - The effect of business monopolies

02:28 - How to rein in big tech firms

04:45 - Could regulation harm consumers?

06:45 - Epic Games v Apple...

Read More »

Read More »

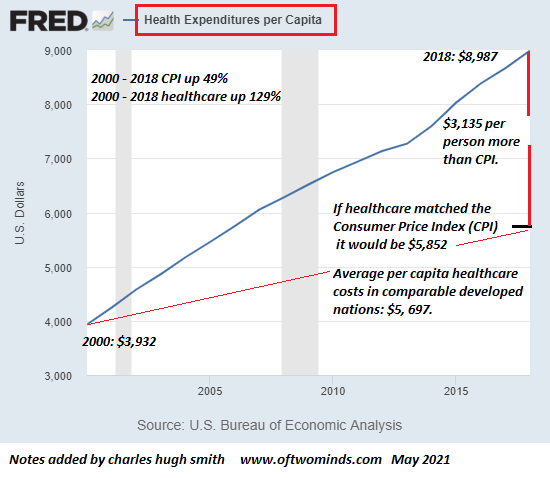

Sickcare is the Knife in the Heart of Employment–and the Economy

We need to change the incentives of the

entire system, not just healthcare, but if we don't start with healthcare, that financial

cancer will drag us into national insolvency all by itself.

American Healthcare is a growth industry in the same way cancer is a growth industry:

both keep growing until they kill the host, which in the case of healthcare is the U.S. economy.

While a great many individuals in the system care about improving the...

Read More »

Read More »

Fortnite to far right: the rise of digital extremism | The Economist

In America, far-right extremism is now considered a greater domestic threat than Islamist terrorism. The pandemic has exacerbated the spread of white supremacism and neo-nazism, which are a plague to global security.

Read More »

Read More »

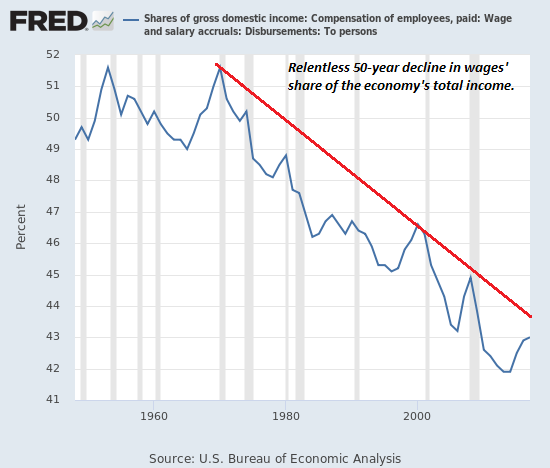

Why Wage Inflation Will Accelerate

The Fed has created trillions out of thin air to boost the speculative wealth of Wall Street, but it can't print experienced workers willing to work for low wages. The Federal Reserve is reassuring us daily that inflation is temporary, but allow me to assure you that wage inflation is just getting started and will accelerate rapidly.

Read More »

Read More »

Covid-19: how many people have died? | The Economist

Officially, covid-19 has killed 3m people around the world. But statistical modelling from The Economist suggests the number could be as much as four times higher.

Chapters

00:00 - How accurate is the official death toll?

01:25 - How to calculate the real death toll

02:10 - How to calculate India’s death toll?

03:25 - Where has the death toll been underreported?

04:14 - Where are excess deaths lower than expected?

05:06 - India’s second wave...

Read More »

Read More »

The ‘Take This Job and Shove It’ Recession

So hey there Corporate America, the Fed and your neofeudal cronies: take this job and shove it. This time it really is different, but not in the way the Wall Street shucksters are claiming.

Read More »

Read More »

Is Myanmar a failed state? | The Economist

Myanmar is on the brink of collapse. Its armed forces are continuing a brutal crackdown—arresting, torturing and killing protesters—as Aung San Suu Kyi, Myanmar’s de-facto leader, is detained. Our experts answer your questions.

Chapters

00:00 - What will happen to Aung San Suu Kyi?

02:15 - What are India and China doing?

03:37 - Should the West intervene?

05:25 - What’s happening to the Rohingya refugees?

07:16 - How will Myanmar’s neighbours be...

Read More »

Read More »

Here’s How ‘Everything Bubbles’ Pop

At long last, the moment you've been hoping for has arrived: you're pitching your screenplay to a producer. Your agent is cautious but you're confident nobody else has concocted a story as outlandish as yours. Your agent gives you the nod and you're off and running:

Read More »

Read More »

Could digital currencies put banks out of business? | The Economist

Cryptocurrencies like Bitcoin have been billed as a major disruptor to finance. But digital currencies issued by governments might be even more radical—they may even threaten the future of traditional banking.

Read our special report, “The Future of Banking” : https://econ.st/3tuTT8y

Sign up to our newsletter to keep up to date: https://econ.st/3a6aZmv

Read more of our coverage on Finance & Economics: https://econ.st/3b0g3cs

Listen to...

Read More »

Read More »