Category Archive: 5) Global Macro

See what three degrees of global warming looks like | The Economist

If global temperatures rise three degrees Celsius above pre-industrial levels, the results would be catastrophic. It’s an entirely plausible scenario, and this film shows you what it would look like.

00:00 - What will a 3°C world look like?

00:57 - Climate change is already having devastating effects

02:58 - How climate modelling works

04:06 - Nowhere is safe from global warming

05:20 - The impact of prolonged droughts

08:24 - Rising sea levels,...

Read More »

Read More »

Santa’s Revenge: Everyone Front-Running My Rally, You Get Nothing

Santa is generally a jolly fellow, but that doesn't mean he doesn't take pleasure in meting our well-deserved punishment to the greedy.

Read More »

Read More »

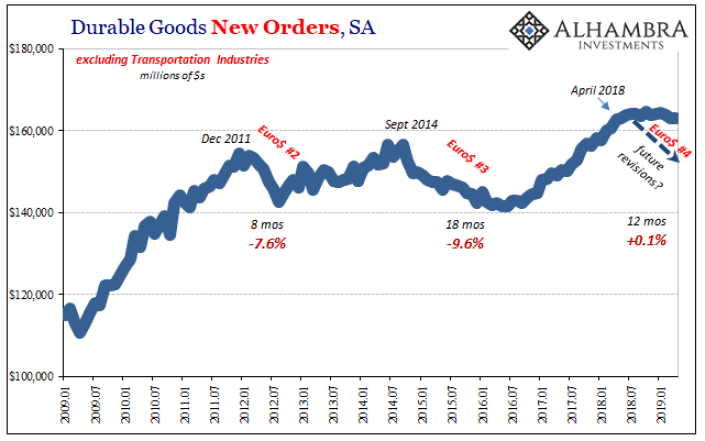

The Enormously Important Reasons To Revisit The Revisions Already Several Times Revisited

Extraordinary times call for extraordinary commitment. I never set out nor imagined that a quarter century after embarking on what I thought would be a career managing portfolios, researching markets, and picking investments, I’d instead have to spend a good amount of my time in the future taking apart how raw economic data is collected, tabulated, and then disseminated.

Read More »

Read More »

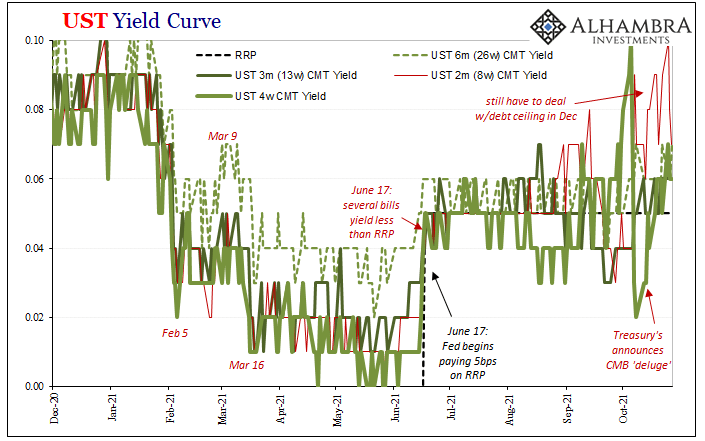

Short Run TIPS, LT Flat, Basically Awful Real(ity)

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

What’s the future of food? | The Economist

Over one-third of greenhouse-gas emissions come from food production. For a greener future, this urgently needs to change. What’s the future of food in a more sustainable world? Our experts answer your questions.

This film is supported by @Infosys - https://impact.economist.com/sustainability

00:00 - Food’s environmental impact

00:44 - Why it’s important to make food sustainable

01:34 - Will everyone have to give up meat?

02:13 - Can...

Read More »

Read More »

What *Seems* Inflation Now Is Something Else Entirely

This is yet another one of those crucial recent developments which should contribute much clarity about the economic situation, yet is exploited in other ways (political) adding only more to the general state of economic confusion. The shelves may be empty in a lot of places around the country, leaving anyone with the impression there just aren’t enough goods.

Read More »

Read More »

1970s Inflation vs. 2020s Price Increases [Ep. 130, Macropiece Theater]

Time travel to the early 1970s where we hear the Nixon Tapes, read memorandums, and study Congressional testimony to understand what the Federal Reserve knew, and when they knew it. Turns out they didn't know "money" then and they still don't today. A reading, by Emil Kalinowski.

Read More »

Read More »

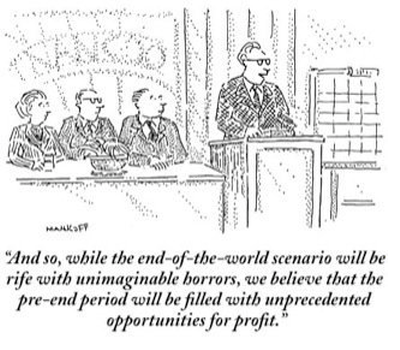

Doing 90 MPH on Deadman’s Curve: A Few Thoughts on Risk

When the wreck is recovered, witnesses will wonder why they took such heedless, foolish risks. You're in the back seat wedged between tipsy revelers, the driver is drunk and heading into Deadman's Curve at 90 miles per hour. Nobody's worried because the driver has never crashed.

Read More »

Read More »

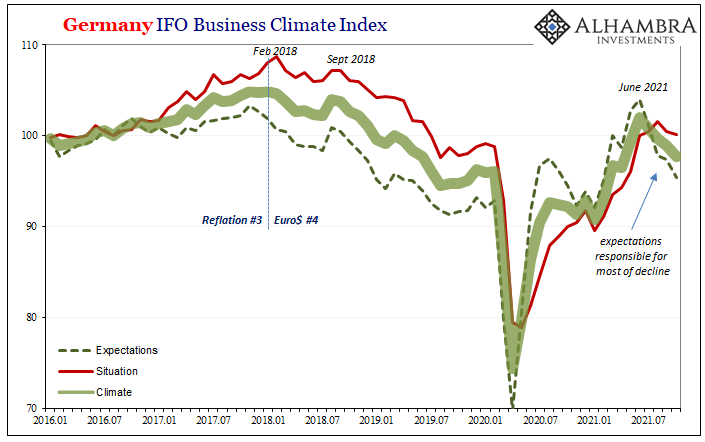

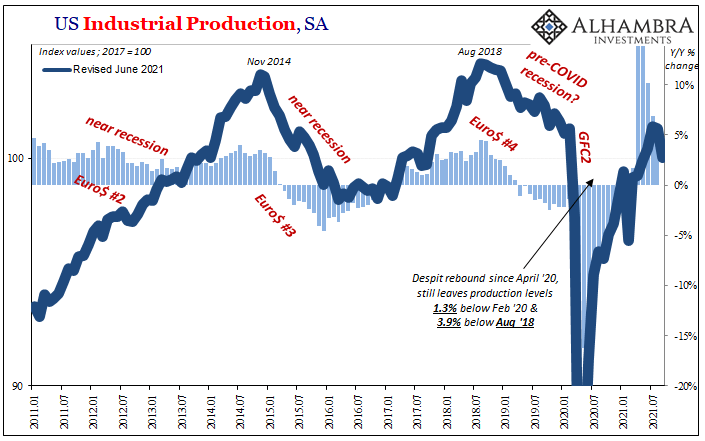

An Anti-Inflation Trio From Three Years Ago

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential.

Read More »

Read More »

Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

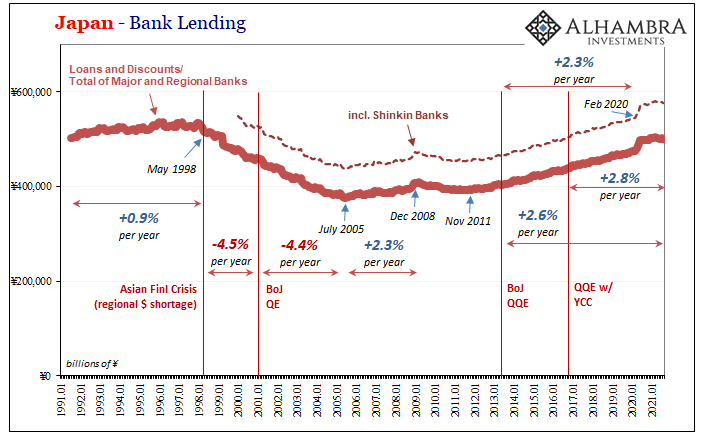

You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s.

Read More »

Read More »

The hidden cost of black hair | The Economist

Hair is an important part of black women’s identity, but throughout history it has also been a target of oppression. What is the true cost of having black hair?

00:00 - What does your hair mean to you?

01:17 - Current attitudes towards textured hair

02:37 - How has black hair been viewed historically?

05:12 - Adhering to white expectations

06:14 - Why is black hair so expensive?

07:30 - The economics of the black hair care industry

09:16 - The...

Read More »

Read More »

America Is Now a Kleptocrapocracy

I hope everyone here is hungry because the banquet of consequences is being served. I've coined a new portmanteau word to describe America's descent: kleptocrapocracy, a union of kleptocracy (a nation ruled by kleptocrats) and crapocracy, a nation drowning in a moral sewer of rampant self-interest in which the focus is cloaking all the skims, scams, rackets and bezzles in some virtuous-sounding garb, a nation choking on low-quality junk ceaselessly...

Read More »

Read More »

Business: go woke or go broke? | The Economist

Today consumers want to buy more sustainable products, employees want to work for firms that share their values, and in the investment world, ESG funds are all the rage. How are companies responding to these shifting demands and can businesses really do well by doing good?

00:00 - Can companies do well by doing good?

00:50 - Environment and climate change

06:50 - Employee wellbeing

09:51 - Workforce diversity

15:50 - Ethical supply chains

19:26 -...

Read More »

Read More »

Ask Bob – What Do I Do If I Choose The Wrong Medicare Plan?

Alhambra’s Bob Williams answers the question, “What do I do if I choose the wrong Medicare Plan?”.

Read More »

Read More »

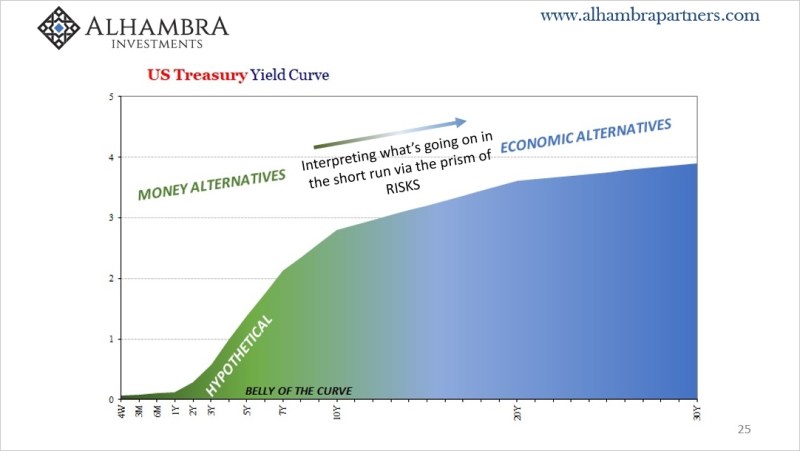

The Curve Is Missing Something Big

What would it look like if the Treasury market was forced into a cross between 2013 and 2018? I think it might be something like late 2021. Before getting to that, however, we have to get through the business of decoding the yield curve since Economics and the financial media have done such a thorough job of getting it entirely wrong (see: Greenspan below).

Read More »

Read More »

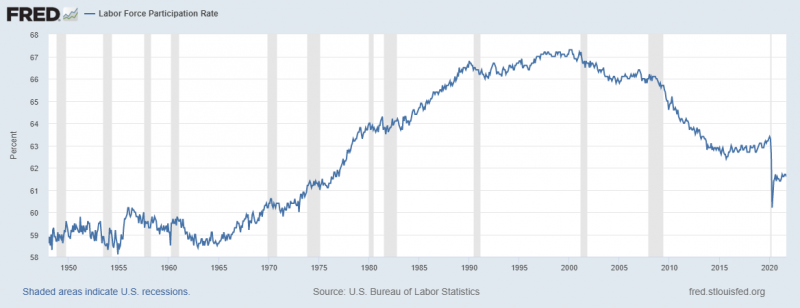

Far Longer And Deeper Than Just The Past Few Months

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States.

Read More »

Read More »

Software Ate the World and Now Has Indigestion

As for all those automated systems we have to navigate--do any of them work so well that those profiting from them actually use them? Of course not.

Read More »

Read More »

Reading Jeff Snider: US Bank Loans Shrinking in 2021 [Ep. 128, Macropiece Theater]

Bank balance sheets are expanding in 2021, which is great news if you believe credit is modern money. But a closer look reveals banks are PILING into the SAFEST assets while beating a RETREAT from loans (real economy money).

Read More »

Read More »

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »