Category Archive: 5) Global Macro

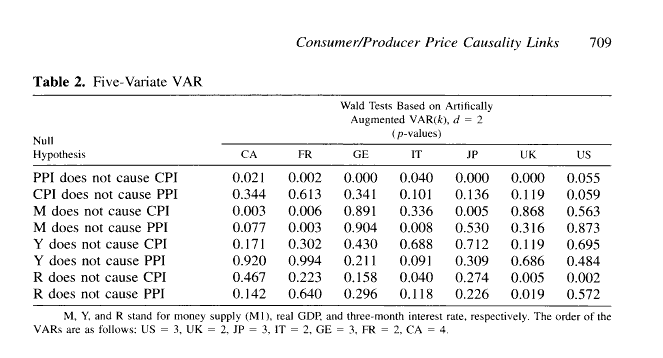

Testing The Supply Chain Inflation Hypothesis The Real Money Way

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

The FOMC Chases The US Unemployment Rate Regardless of China’s Huge Mess

In certain quarters, “scientific” quarters, the Chinese haven’t just done a fantastic job managing their own outbreak of COVID-19, the Communist government has produced a pandemic response model for the entire world to envy.

Read More »

Read More »

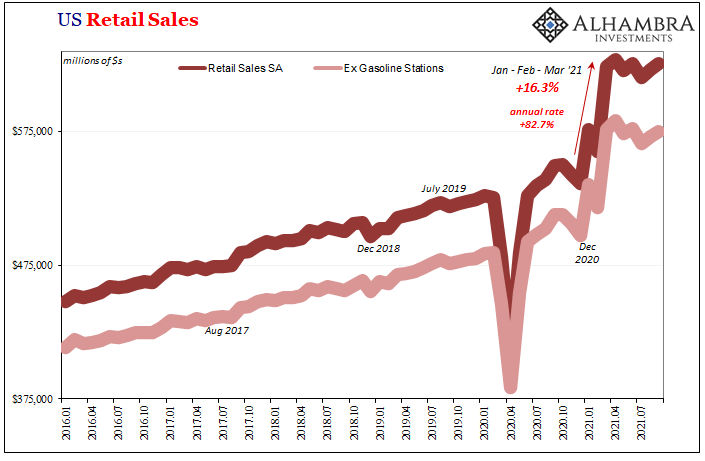

Trying To Project The Goods Trade Cycle

One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure.

Read More »

Read More »

Can science help poor kids earn more? | The Economist

The wide gap in development between rich and poor children could be closed with the help of neuroscience. Might a controversial focus on genetics also help? Film supported by @Mishcon de Reya LLP

00:00- The achievement gap between rich and poor kids

00:55 - Words matter in childhood development

03:16 - Conversation can combat childhood inequality

05:09 - Can genetics help close the achievement gap?

07:30 - Genetics can be controversial

Sign up...

Read More »

Read More »

Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

Get in Crash Positions

When the market goes bidless, it's too late to preserve capital, never mind all those life-changing gains. Everyone with some gray in their ponytails knows the stock market has ticked every box for a bubble top, so everybody get in crash positions: Let's run through the requirements for a bubble top: 1. Retail investors (i.e. dumb money) are all in and buying the dip with absolute confidence.

Read More »

Read More »

Xi’s Gambit: China at the Crossroads

If Xi's gambit succeeds, China could become a magnet for global capital. If success is only partial or temporary, China may well struggle with the structural excesses that are piling up not just in China but in the entire global economy.

Read More »

Read More »

2022: a preview of the year’s biggest themes | The Economist

What will some of 2022’s top themes and stories be? Tom Standage, editor of The Economist’s future-gazing annual, “The World Ahead 2022”, gives his prediction

00:00 What to expect in 2022

00:35 Pandemic to endemic

01:35 Inequality in hybrid working

02:34 Taming cryptocurrencies

03:43 The race to dominate space

04:34 The need for corporate climate solutions

Read our latest coverage on The World Ahead: https://econ.st/3HtLmuQ

Sign up to The...

Read More »

Read More »

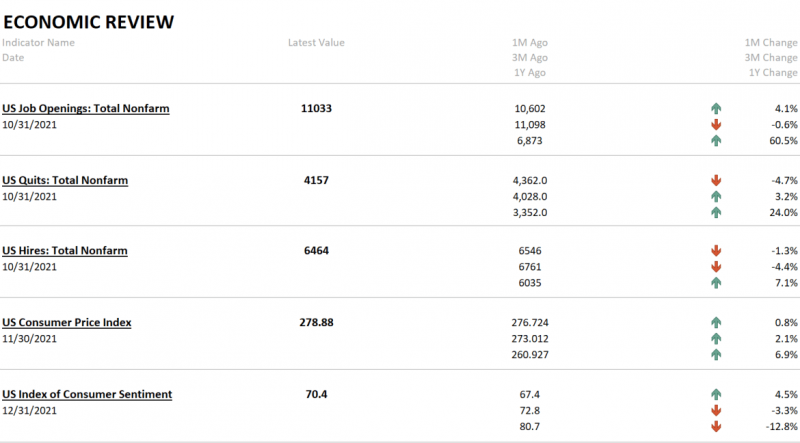

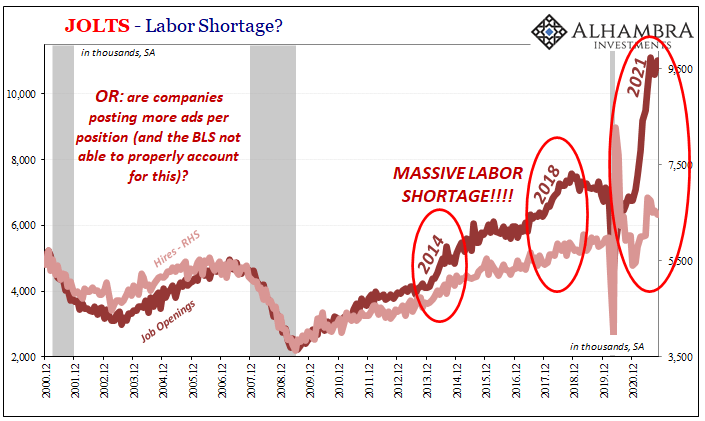

A Global JOLT(s) In July

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million.

Read More »

Read More »

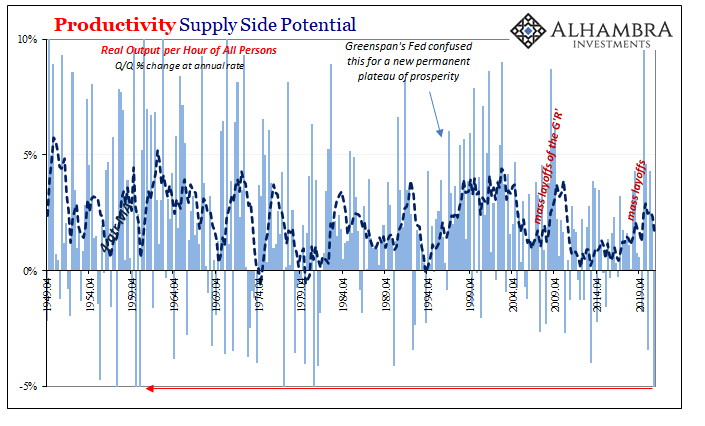

The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market.

Read More »

Read More »

Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs.

Read More »

Read More »

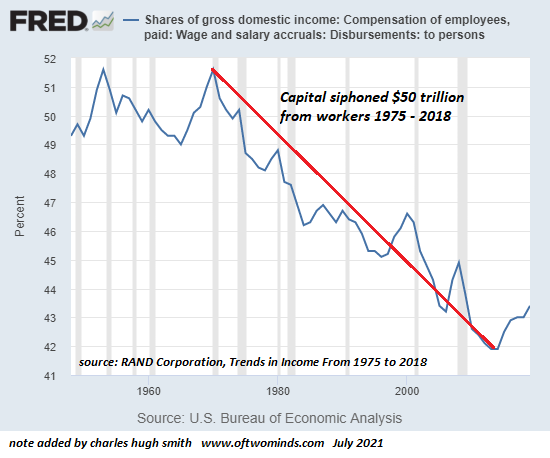

The Long Cycles Have All Turned: Look Out Below

But alas, humans do not possess god-like powers, they only possess hubris, and so all bubbles pop: the more extreme the bubble, the more devastating the pop. Long cycles operate at such a glacial pace they're easily dismissed as either figments of fevered imagination or this time it's different.

Read More »

Read More »

How vegan burgers can help save the planet | The Economist

When people cook steak, they’re also cooking the planet. As meat consumption continues to rise, what role can meat alternatives play in a more sustainable food system? Read more: https://econ.st/3rvlWHC

Film supported by @Infosys

00:00 - What you put on your plate impacts the planet

01:03 - Britain’s meat-eating habits

03:06 - The environmental impact of meat and dairy

05:43 - Plant-based food is better for the environment

07:03 - The rise of...

Read More »

Read More »

This Is A Big One (no, it’s not clickbait)

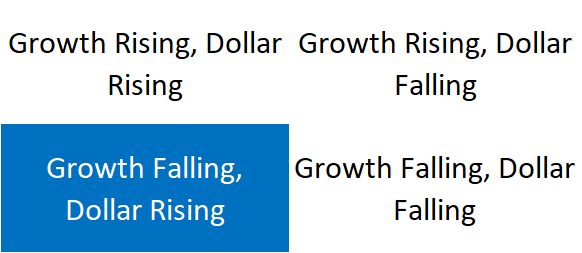

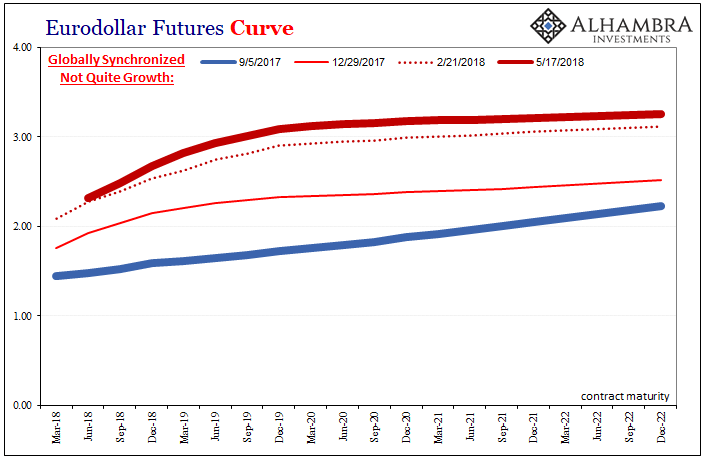

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two.

Read More »

Read More »

Covid-19: How dangerous is Omicron? | The Economist

The new variant of covid-19, Omicron, is spreading around the world. Just how infectious is the strain, and will current vaccines prove effective against it? Our experts answer your questions.

00:00 What is Omicron?

01:30 How dangerous is Omicron?

02:39 Will new vaccines be needed?

03:15 What are governments doing?

04:17 Is this new variant a setback in the fight against covid-10?

Keep up to date with The Economist’s coverage of the...

Read More »

Read More »

Medicare Eats Up Most of the 2022 Social Security Raise

There was dancing in the streets when Social Security announced that 2022 checks will go up by 5.9%, the biggest Cost of Living Adjustment (COLA) in 40 years. But now, the streets are empty and the cheering is gone. Most of that Social Security COLA will be eaten up by increases in Medicare.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 29 novembre 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Why Inflation Is a Runaway Freight Train

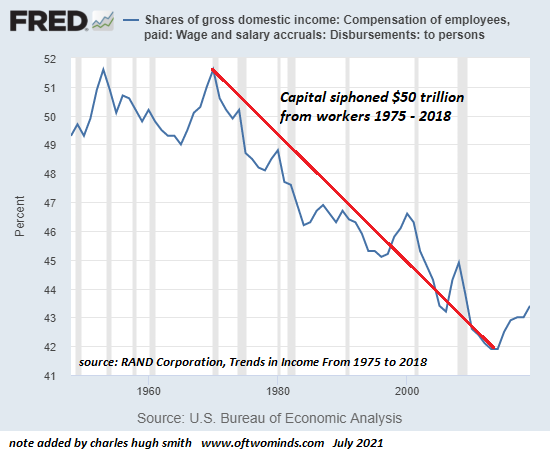

The value of these super-abundant follies will trend rapidly to zero once margin calls and other bits of reality drastically reduce demand. Inflation, deflation, stagflation--they've all got proponents. But who's going to be right?

Read More »

Read More »

Economic Growth Scare: Are Markets Rightly Scared? [Eurodollar University, Ep. 168c]

The nominal value of Chinese imports of iron ore, German exports and Japanese exports all look pretty, pretty good. But the unit volume is pretty, pretty awful.

Read More »

Read More »

The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID.

Read More »

Read More »