Category Archive: 5) Global Macro

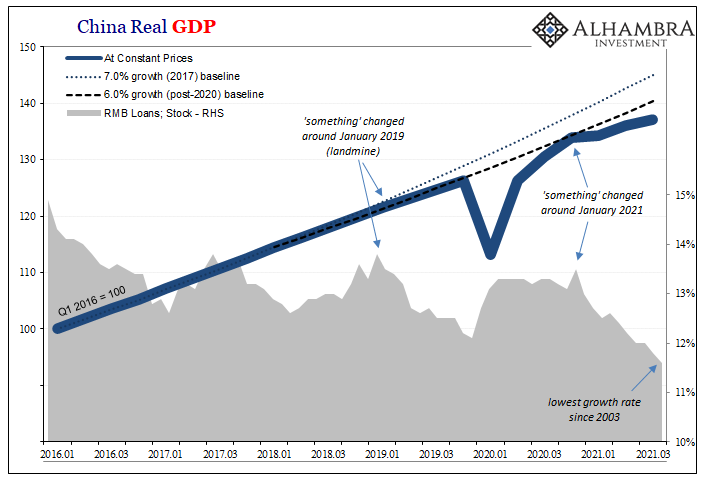

China’s Imports Outright Declined In March, And COVID Was The Reason Why But Not Really

The guy said this was going to be the future. Not just of China, for or really from the rest of the world. Way back in October 2017, at the 19th Communist Party Congress newly-made Emperor Xi Jinping blurted out his grand redesign for Socialism with Chinese Characteristics.

Read More »

Read More »

India’s software giant Infosys announces withdrawal from Russia

The Indian software giant Infosys has finally joined the corporate boycott of Russia over its invasion of Ukraine. Speaking to media at its headquarters in India's Bengaluru Infosys said it would move its business out of the country and pursue alternate options.

Read More »

Read More »

US gives Ukraine $800 million more in military aid | Latest English News | WION

US President Joe Biden announced an additional $800 million in military assistance to Ukraine, expanding the scope of the systems provided to include heavy artillery ahead of a wider Russian assault expected in eastern Ukraine.

Read More »

Read More »

Yes, It Is Different This Time

Most people would be horrified by a 40% decline in their "investments." When bubbles pop, speculative assets don't drop 40%, they drop 90% or even 98%.

Read More »

Read More »

Gravitas: Japan says Russia has “illegally occupied” disputed islands

A decades-long territorial dispute between Japan and Russia has been reignited. Tokyo claims Russia has "illegally occupied" four disputed islands. Molly Gambhir tells you more.

#Gravitas #Japan #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring...

Read More »

Read More »

French election 2022: Marine Le Pen wants France out of NATO | World News | WION

The presidential challenger and far-right candidate Marine Le Pen pitches her foreign policy agenda. Le Pen wants closer NATO-Russia ties. To get more details, we're joined by William Courtney of RAND corporation.

#France #MarineLePen #Elections

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With...

Read More »

Read More »

Brexit: What will happen to Ireland? | The Economist

The border between Northern Ireland and the Republic is one of the most contentious in the world. But what really divides Ireland? And after Brexit, is Irish unification a real possibility?

00:00 Ireland’s irregular border

00:45 Ireland’s history divided

02:31 Caught on the wrong side

04:36 The Troubles

06:30 Working towards peace

07:44 New divisions, old tensions

Sign up to The Economist’s daily newsletter to keep up to date with our latest...

Read More »

Read More »

Russian Warship ‘Seriously Damaged,’ Ukraine claims responsibility

While Ukraine and Russia continue to hold ceasefire talks the fighting on ground has only intensified. With Moscow now reporting attack on warship, a Russian flagship was reportedly damaged due to attack at the Black Sea. Russian navy's flagship sea fleet the Moskva missile cruiser was damaged heavily.

Read More »

Read More »

You Know What They Say About The Light At The End Of The Tunnel

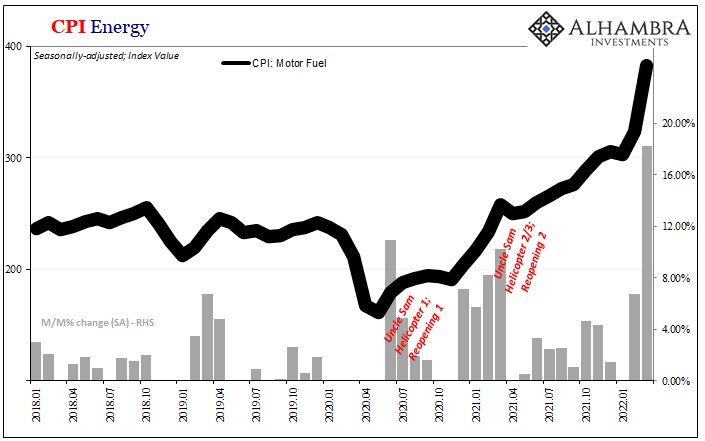

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen.

Read More »

Read More »

European leaders flock to Ukraine after US President Joe Biden calls Russian invasion a genocide

European politicians are flocking to Ukraine the latest to do so are the leaders from Poland Lithuania Latvia and Estonia. The visit comes after Biden calls invasion a genocide.

Read More »

Read More »

Russia-Ukraine Conflict: US President Joe Biden escalates rhetoric against Putin | World News

US president Joe Biden has escalated rhetoric against Russia's President Putin and termed Russian acts as 'genocide' several times. However, Emmanuel Macron has refused to term Russian acts as 'genocide'.

Read More »

Read More »

Produzentenfenster Globale Rezessionsuhr

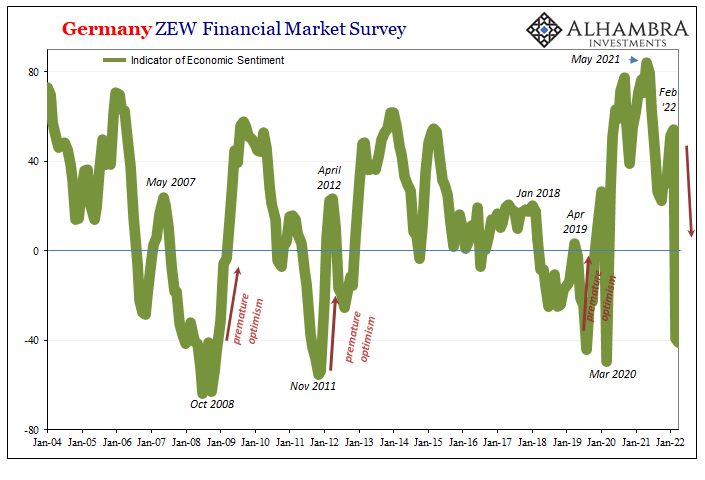

German optimism was predictably, inevitably sent crashing in March and April 2022. According to that country’s ZEW survey, an uptick in general optimism from November 2021 to February 2022 collided with the reality of Russian armored vehicles trying to snake their way down to Kiev. Whereas sentiment had rebounded from an October low of 22.3, blamed on whichever of the coronas, by February the index had moved upward to 54.3.

Read More »

Read More »

War in Ukraine: The Economist interviews Tony Blair | The Economist

Tony Blair, former British Prime Minister, talks to Zanny Minton Beddoes, The Economist’s editor-in-chief, about the war in Ukraine. He gives his opinions on how to deal with Vladimir Putin, the retreat of Western foreign policy and the future of geopolitics.

00:00 - The evolution of Vladimir Putin

01:52 - The wake up call for the West

02:20 - Consequences of Western retreat

05:09 - Is peace with Putin possible?

06:17 - What should the West’s...

Read More »

Read More »

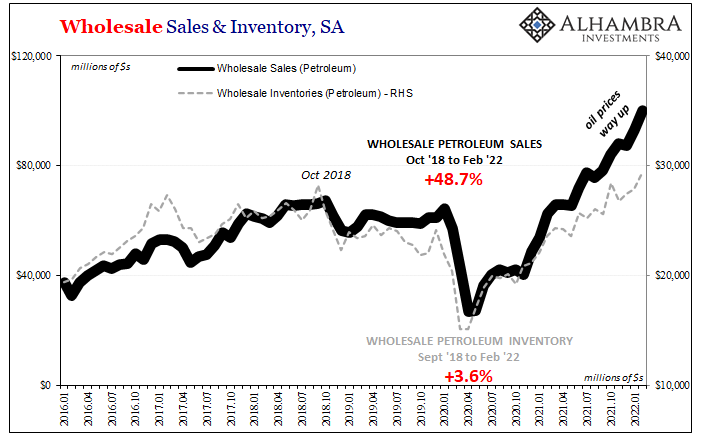

Concocting Inventory

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast.

Read More »

Read More »

Ukrainian cities: Before & after the war – Kyiv, Bucha, Mariupol & others | WION Originals

Cities in Ukraine are bearing the brunt of the Russia-Ukraine war. Cities that were once tourist attractions have turned into war zones and rubble. Cities including the capital Kyiv, have been damaged. Destruction, dead bodies, and silence occupy the streets of some of the cities including Bucha, Kharkiv, Mariupol, and Odessa. Will these cities come back to life? War in Ukraine but at what cost?

#Ukraine #UkraineCities #WIONOriginals

About...

Read More »

Read More »

War in Ukraine: the journey to interview President Zelensky | The Economist

On March 25th, Zanny Minton Beddoes, editor-in-chief of The Economist, was granted rare access to President Volodymyr Zelensky's war room in Kyiv. In this exclusive interview he reveals the inside story of his transformation into a wartime leader - and what he thinks of Ukraine's chances.

00:00 - The realities of a war zone

01:05 - Our visit with President Zelensky

01:36 - Can Ukraine win?

02:59 - What is the current military situation?

Watch...

Read More »

Read More »

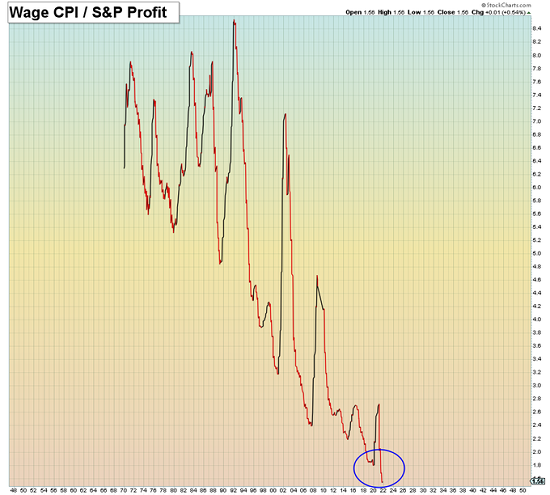

Worry Walls Don’t Explain Repeated Falls

Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over.

Read More »

Read More »

Russia-Ukraine conflict: ‘Russia faces a long descent into isolation,’ says EU Prez | World News

European Union has closed Bloc's ports to Russian vessels and will reduce dependence on Russia. On the other side, the EU has also rolled out additional funding to boost Ukraine's army.

Read More »

Read More »

Russian currency Rouble rebounds, no longer ‘in rubble’

After the Russian invasion of Ukraine, the Russian currency Rouble was at an all-time low, it shared 45 per cent of its value against the dollar. The collapse was an indication of Russia's economic isolation

#Russia #Rouble #WION

Read More »

Read More »

Why the French are fed up (and what it means for Macron) | The Economist

The French are miserable. Normally this means defeat for sitting presidents, but Macron is still just about leading in the polls. So what's going on?

00:00 - The French are fed up

01:03 - Has Macron boosted France’s economy?

02:02 - Why are the French so discontent?

02:57 - Why do voters lack confidence in Macron?

03:52 - A deeply divided France

05:32 - Why voters are flocking to political extremes

07:34 - France’s fragmented politics

View...

Read More »

Read More »