Category Archive: 5) Global Macro

Rape in the British military: women speak out | The Economist

Almost two-thirds of women in the British armed forces have experienced sexual harassment, bullying or discrimination, yet few report their experience because of a culture of fear and impunity. What creates this culture, and how can it be addressed?

00:00 - Sexual harrassment in the British armed forces

01:17 - A culture of sexual harrassment

05:03 - Harassment can lead to serious assault

06:59 - Why women are often silenced by the military

10:30...

Read More »

Read More »

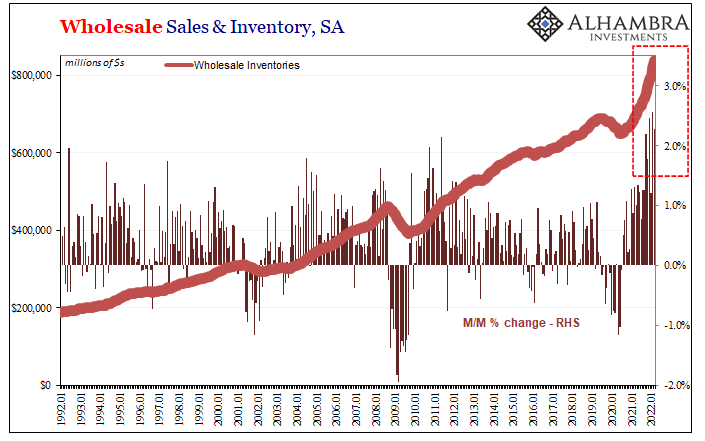

Historic Inventory Continued In March, But Is It All Price Illusion, Too?

The Census Bureau today released its advanced estimates for March trade. These include, among other accounts like imports and exports, preliminary results reported by retailers and wholesalers. That means, for our purposes, inventories. Oh my, was there ever more inventory. It was, apparently, widely expected that following an avalanche of goods building up over the previous five months the situation might calm down a touch.

Read More »

Read More »

Euro$ #5 in Goods

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one?

Read More »

Read More »

Dr Fauci: follow the science | The Economist

Death threats, misinformation and dedication to public service: Dr Anthony Fauci discusses his personal experiences of the covid–19 pandemic with The Economist’s deputy editor, Edward Carr.

00:00 - Who is Dr Anthony Fauci?

00:38 - Should scientists be apolitical?

01:30 - The importance of political neutrality

03:55 - Being a scientist in public service

05:30 - Has science become politicised?

Watch the full discussion here:...

Read More »

Read More »

Russian troops to unilaterally stop all hostilities to allow civilian evacuation in Mariupol

Russia has announced that it will allow civilians to evacuate from Azovstal steel plant amid the ongoing Russian invasion of Ukraine.

Read More »

Read More »

Crash Is King

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You've heard the expression "cash is king." Very true. But it's equally true that "crash is king:" when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 25 avril 2022, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Russia’s Sarmat intercontinental ballistic missile test is not a threat: United States | World News

Russia has test launched its Sarmat intercontinental ballistic missile, it's a new addition to the country's nuclear arsenal and Vladimir Putin has said that the missile will give Moscow's enemies something serious to ponder about.

Read More »

Read More »

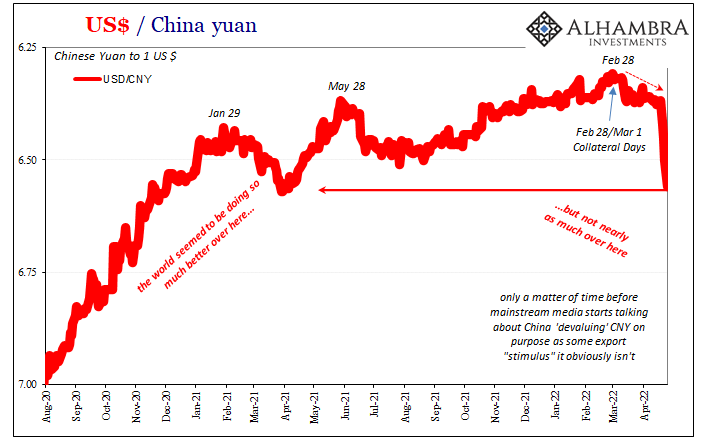

CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss.

Read More »

Read More »

The (less) Dollars Behind Xi’s Shanghai of Shanghai

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth.

Read More »

Read More »

France sends heavy artillery to Ukraine to help boost their defence

France announced that it will be sending heavy artillery to Ukraine as it continues to fight off Russian offensive. French President Emmanuel Macron said that the country is now delivering some significant equipment from Milan which includes anti-tank missiles to caesar self propelled howitzers

Read More »

Read More »

Gravitas: Is the West trying to hide Russian oil imports?

Recently, U.S. lectured India to not increase the purchase of Russian oil.

Turns out, the West itself is secretly buying Russian oil. Russian tankers have begun disappearing from radar. Are these tankers carrying oil to European ports?

#Gravitas #US #RussianOil

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore...

Read More »

Read More »

Global protest rage against Russian invasion of Ukraine | World Latest English News | WION

Around 200 Russians living in Germany took to the streets holding placards which read 'Russians against the War'. Similar protests were also held in Paris where Ukrainians living in the country called the ongoing war a 'Genocide'

#Russia-UkraineWar #Globalprotest #WION

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to...

Read More »

Read More »

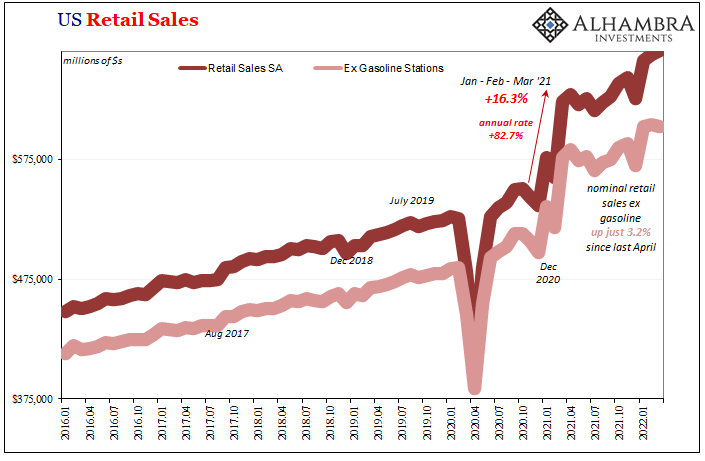

Not Good Goods

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go.

Read More »

Read More »

Putin claims taking control of Mariupol, ‘block off Azovstal plant so not even a fly can escape’

According to reports, the city of Mariupol, the key port city for which the battle been raging on in Ukraine for almost about eight weeks, Russia has now claimed that it has managed to secure control over the whole of Mariupol except for the Azovstal steel plant.

Read More »

Read More »

Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing.

Read More »

Read More »

Russia ups its offensive against Ukraine, Kyiv says ‘battle for Donbas has begun’ | Latest News

It is week nine of the Russian invasion of Ukraine and Kyiv says that the second phase of the war has begun. Russia has launched its much anticipated offensive in eastern Ukraine with explosions reported all along the eastern front along with attacks in other regions.

Read More »

Read More »

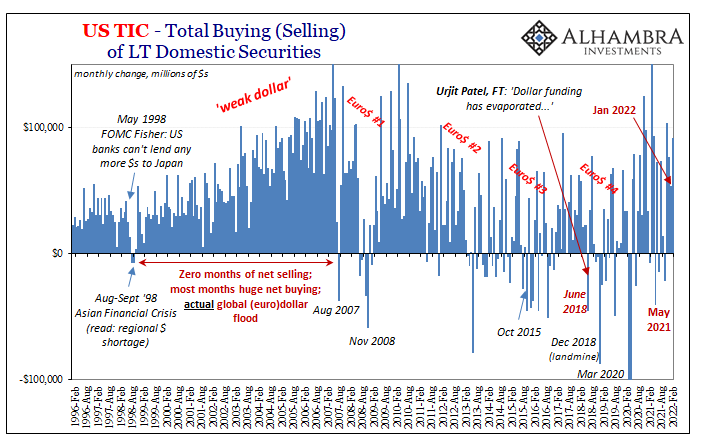

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

First Images of damaged Russian Cruiser Moskva emerges | Russia-Ukraine Crisis

New photos and videos have emerged online of the sinking Russian Moskva ship, the leading Russian warship sank in the Black Sea. Video circulating online shows that it was probably struck by anti-ship missiles, the ship was abandoned before the ship sank in the Black Sea.

Read More »

Read More »

What’s Your Plan A, B and C?

Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever.

Here's the default Bullish case for stocks and the economy: let's call it Plan Zero.

1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy)

Read More »

Read More »