Category Archive: 5) Global Macro

WION Live Broadcast: Did Israeli gunfire kill journalist Abu Akleh? | Russia captures Luhansk region

WION Live Broadcast: Did Israeli gunfire kill journalist Abu Akleh? | Russia captures Luhansk region

- Did Israeli gunfire kill journalist Abu Akleh?

- Russia captures Luhansk region

#WIONLiveBroadcast #EnglishNews #WION

Read More »

Read More »

Boris Johnson resigns: what happens next?

After weeks of clinging on, Boris Johnson has agreed to resign as British prime minister. What happens now, and what challenges will his successor face?

00:00 - Boris Johnson’s resignation

00:29 - Will the Tory party persist with populism?

01:14 - Britain’s economy

02:21 - War in Ukraine

03:09 - Brexit

04:00 - Britain’s reputation

Why Boris Johnson should go immediately: https://econ.st/3ykyjby

The toxicity of Boris Johnson and how it...

Read More »

Read More »

Wasting Money on Medicare

How would you like to waste a lot of the money you spend on Medicare coverage and miss a bunch of the benefits Medicare provides? Crazy question. But that’s exactly what’s happening to millions of Medicare beneficiaries. In October 2021, the insurance website MedicareAdvantage.com published the results of its most recent survey of Medicare beneficiaries.

Read More »

Read More »

Russian shelling continues in Kharkiv, Putin declares victory in Luhansk | World News

Moscow made its biggest territorial gains this week as it claimed full control of the Luhansk region by capturing the last Ukrainian stronghold Lysychansk on Sunday despite this the war seemed to be far from over as new reports of artillery shelling are now emerging from Ukraine.

Read More »

Read More »

Norwegian oil and gas workers start strike, cutting output | World Business Watch

Norwegian offshore workers began a strike on Tuesday that will reduce oil and gas output. Workers are demanding wage hikes to compensate for rising inflation.

Read More »

Read More »

The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or "global markets," maximizing greed / corporate profits.Sorry about the clickbait title.

Read More »

Read More »

Pakistan: Trade deficit hits highest levels | Record jump due to increase in oil price

Pakistan's trade deficit has hit the highest levels. There is a record jump due to the increase in oil prices in the international market.

Read More »

Read More »

Weekly Market Pulse: Things That Need To Happen

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Read More »

Read More »

Ukraine hits Russian base in South, blasts kill 3 in Russian city of Belgorod | World News

As per the reports, at least 3 people were killed and dozens of buildings damaged in the Russian city of Belgorod. Russia claimed that Ukraine has targeted citizens in Belgorod.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 4 juillet 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

Russia claims ‘full control’ over Luhansk region | Latest International News

In a latest update on Russia-Ukraine conflict, Russia has claimed that it has taken control of Ukraine's eastern Luhansk region. However, Ukraine did not confirm Russia's control over Luhansk.

Read More »

Read More »

The Most Valuable Form of Money Nobody’s Seen–Yet

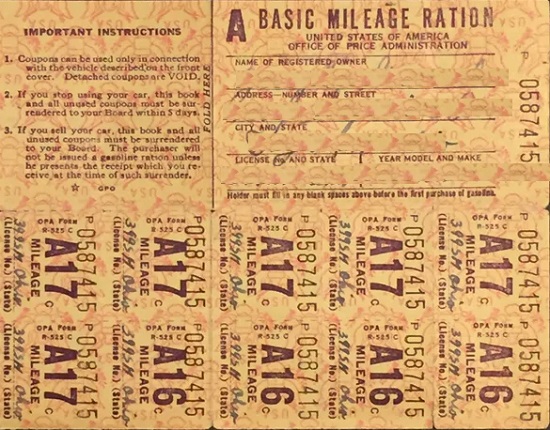

What is "money"? "Money" is a claim on the essentials of life. Ration cards are claims on essentials.Many people expect "money" will soon be tied to commodities. Agreed. It's called a ration cardthat grants the holder the right to buy a specific quantity of essential goods at a specified price.

Read More »

Read More »

Global Leadership Series: ‘Russia & Ukraine must negotiate and not fight,’ says Ugandan Prez

In an exclusive conversation with Ugandan President Yoweri Museveni with Eric Njoka on WION's Global Leadership, he said, we did not support motions against Russia at United Nations. He added, Russia & Ukraine must negotiate and not fight.

Read More »

Read More »

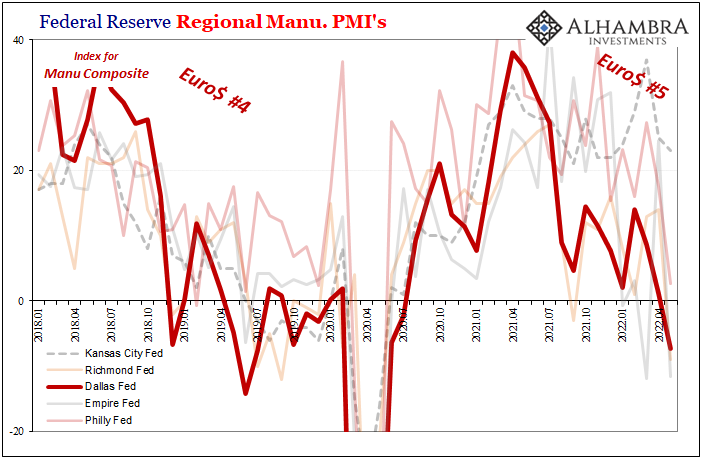

Demand Down, Supply Down, Ugly Up

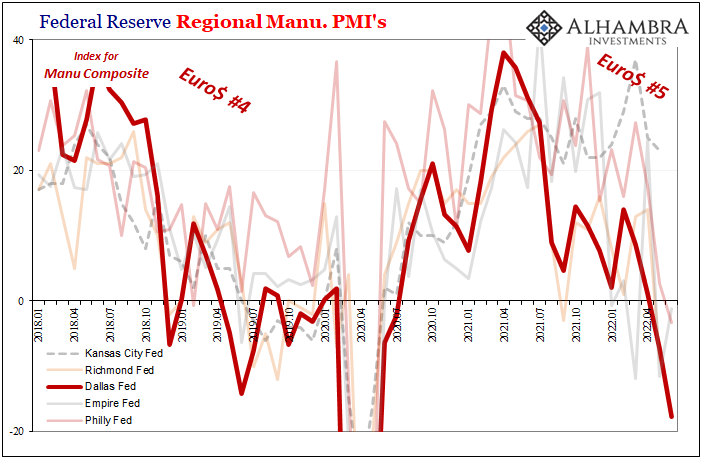

Well, that was a mess. The Richmond Fed’s Manufacturing Survey was at first released before being taken back. Initially reported as a plunge in the headline number, it was quickly scrapped once the statisticians remembered they had just discontinued their average workweek component – but had kept a zero in its place when tallying the overall PMI.

Read More »

Read More »

Getting Whipped Will Really Hurt

The Federal Reserve’s various branches don’t just do manufacturing surveys anymore. This is a modern economy, after all, meaning industry isn’t the same top dog as what it used to be. While still important, and still able to tear down even the global-iest synchronized of growth-y, services are the big macro enchilada.

Read More »

Read More »

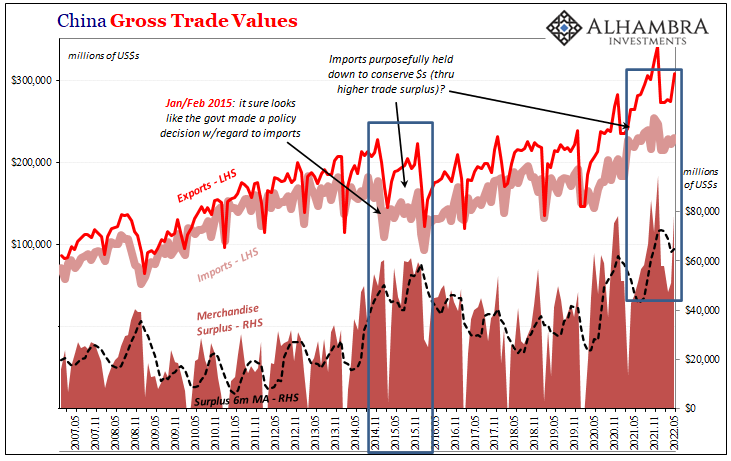

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

Why the Housing Bubble Bust Is Baked In

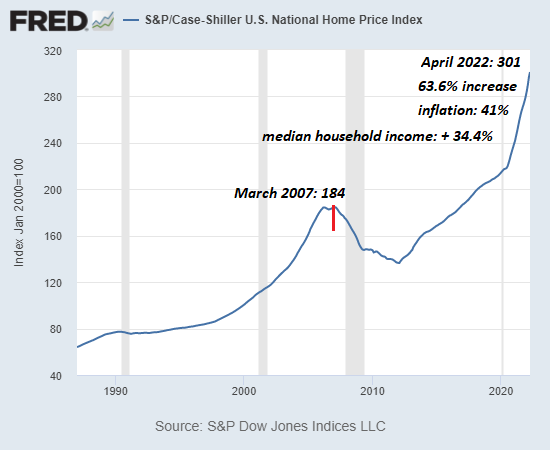

Putting this all together, it's clear that the source of the current housing bubble is the explosion of financial speculation fueled by central bank policies. Those benefiting from speculative bubbles have powerful incentives to deny the bubble can bust.

Read More »

Read More »

Eurodollar Futures Interpretation Is Everywhere

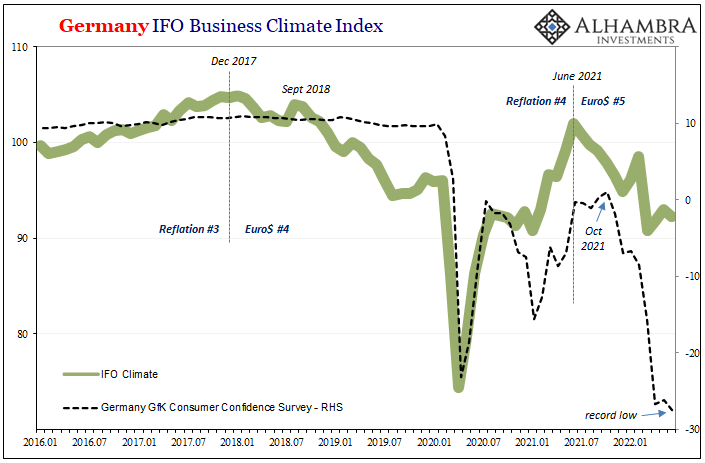

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation.

Read More »

Read More »

How China crushed Hong Kong

In 1997 China promised to protect Hong Kong's freedoms for the next five decades—but just 25 years after the handover, Hong Kong is now a police state. So how did China crush Hong Kong?

00:00 - How China crushed Hong Kong

00:44 - Tiananmen square massacre vigil banned

02:37 - China’s ambition since 1842: reclaim Hong Kong

04:16 - How China needed Hong Kong’s booming business

05:30 - President Xi’s aim to crush Hong Kong

07:30 - How China...

Read More »

Read More »

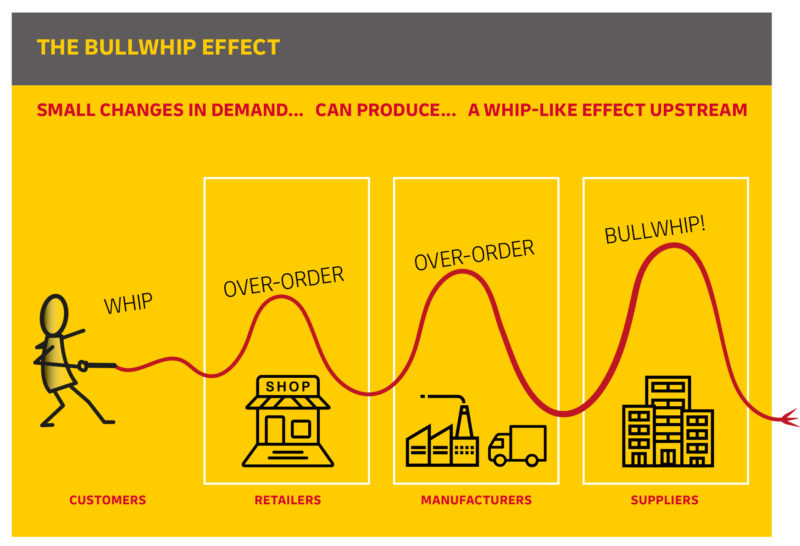

It’s Inventory PLUS Demand

It’s not just the flood of never-ending inventory. That’s a huge and growing problem, sure, as the chickens of last year’s short-termism overordering finally come home to their retailer roost. Being stuck with too many goods isn’t necessarily fatal to the global and domestic manufacturing sectors.

Read More »

Read More »