Category Archive: 5) Global Macro

French fried: will the election lead to chaos?

Both the left and right are likely to do well in France’s upcoming parliamentary poll, with President Emmanuel Macron’s party squeezed in the middle. The snap election could leave the country in chaos (https://www.economist.com/europe/2024/06/16/france-is-being-thrown-into-uncharted-territory). In America, recreational use of weed is now commonplace, but what impact does it have on users’ wellbeing...

Read More »

Read More »

Heir tight: why boomers are so stingy

The post-war generation reaped the benefits of peace and prosperity. Yet rather than spend that bounty, retired boomers are hoarding their riches (https://www.economist.com/finance-and-economics/2024/05/26/baby-boomers-are-loaded-why-are-they-so-stingy)–and upending economists’ expectations. The science of menstruation is baffling, partly because most animals don’t do it. Now clever innovations...

Read More »

Read More »

Sudan impact: the war the world forgot

Much of Sudan has already collapsed into chaos (https://www.economist.com/graphic-detail/2024/05/24/sudan-the-war-the-world-forgot). Now a crucial city may fall, the United Nations is belatedly scrambling to avert a bloodbath. Gary Lineker (https://www.economist.com/britain/2024/05/25/footballer-broadcaster-podcast-mogul-the-career-of-gary-lineker) is a former footballer, broadcaster and podcast mogul. He also embodies Britain’s social aspirations...

Read More »

Read More »

Fight for his party to the right: Nigel Farage

Britain’s pint-sipping rabble-rouser of the right has joined the campaigning (https://www.economist.com/britain/2024/06/06/the-return-of-the-farage-ratchet?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) ahead of a general election. Win or lose, he will make an impact. America’s stadiums and arenas are often built using...

Read More »

Read More »

A real work of peace? An Israel-Hamas deal

America’s upbeat assessment of a ceasefire deal masks deep divides (https://www.economist.com/middle-east-and-africa/2024/06/12/hamas-and-israel-are-still-far-apart-over-a-ceasefire-deal?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) that may not, in fact, be bridgeable. There are nevertheless reasons for optimism. Our...

Read More »

Read More »

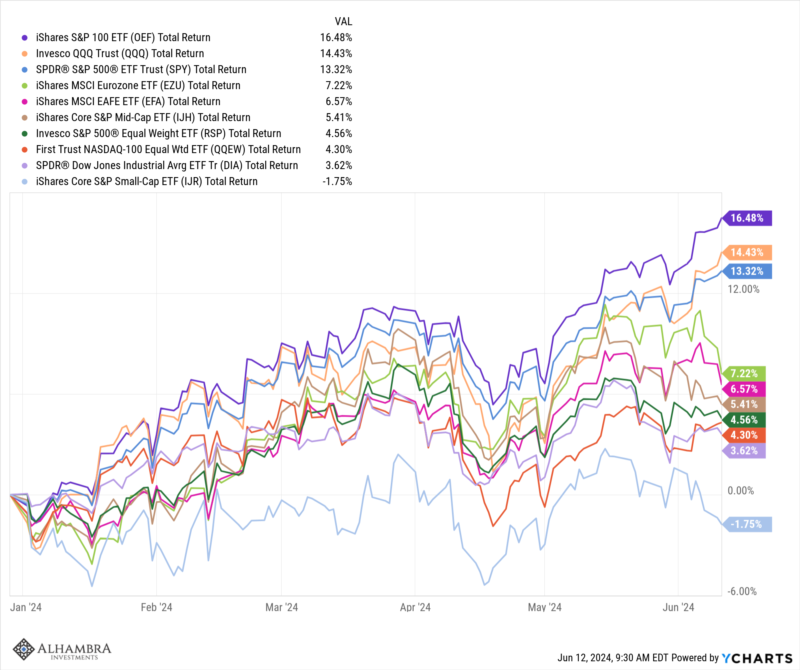

Market Morsel: How “The Market” Is Really Doing

When people talk about “the market” they are usually referring the big indexes – the S&P 500 or the NASDAQ. For more casual observers, “the market” is the Dow which is a lousy index for a lot of reasons but has the advantage of history. But are any those really representative of how “the market” is doing? Not really.

Read More »

Read More »

America’s next top-job model: our election forecast

We have dusted off and tuned up our forecast model (https://www.economist.com/interactive/us-2024-election/prediction-model/president?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) for America’s presidential race. So far it gives Donald Trump a marginally higher chance of a second term. There is at last progress on not...

Read More »

Read More »

Doing their not-own thing: “generation rent”

Across the rich world millions spend more than a third of their disposable income on rent. We ask why policymakers have such terrible ideas (https://www.economist.com/international/2024/05/29/is-your-rent-ever-going-to-fall?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) on easing the pressure. America’s bid to crimp...

Read More »

Read More »

French anti-foreign legion: an EU-election shock

Hard-right parties did well in Europe's parliamentary elections—so well in France that President Emmanuel Macron called (https://www.economist.com/europe/2024/06/09/as-the-french-hard-right-triumphs-in-eu-elections-macron-calls-snap-vote?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) a risky snap election. Elsewhere,...

Read More »

Read More »

The Modi Raj 1: The chaiwallah’s son

Narendra Modi has been chosen to lead India for the third time in a row. But after 10 years in power, he was humbled at the national election. What kind of leader will he be? Stories from his youth in the Hindu nationalist movement offer clues.

This episode draws on audio from the following publishers: Narendra Modi YouTube, ANI, Legend Global Studios, Lalit Vachani, Prasar Bharti Archives, Desh Gujarat, The New York Times, NDTV, Doordarshan and...

Read More »

Read More »

If AI Is So Great, Prove It: Eliminate All Surveillance, Spam and Robocalling

AI is for the peons, access to humans is reserved for the wealthy. Judging by the near-infinite hype spewed about AI, its power is practically limitless: it's going to do all our work better and cheaper than we can do, replacing us at work, to name one example making the rounds.

Read More »

Read More »

One dam thing after another? Ukraine and reconstruction

When Russia attacked the Kakhovka dam in Ukraine a year ago, lives were lost, families stranded and towns submerged. But from that devastation emerged discussion on post-war reconstruction (https://www.economist.com/interactive/europe/2024/06/05/russias-explosion-of-a-huge-ukrainian-dam-had-surprising-effects). Our correspondent spent months investigating Narendra Modi (https://www.economist.com/audio/podcasts/the-modi-raj), the strongman who was...

Read More »

Read More »

Labour’s pains: Britain’s growth problem

As Britain’s general-election campaign heats up, party leaders are vague on their economic plans (https://www.economist.com/britain/2024/06/03/can-britains-economy-grow-as-fast-as-it-needs-to). With growth so slow, how could the victor energise the economy? We visit the D-day beaches 80 years on, as war rages in Europe once again (10:19). And Venice’s new daytripper fee...

Read More »

Read More »

Modi’s mess: a shock election result spells uncertainty for India

Narendra Modi, the strongman of India, will have to compromise now his party has lost its majority (https://www.economist.com/asia/2024/06/04/a-shock-election-result-in-india-humbles-narendra-modi). What does the surprise result mean for the country? As some foreign investors shy away from Africa, the continent’s private sector (https://www.economist.com/business/2024/05/23/africa-inc-is-ready-to-roar) is serving domestic customers to fill that...

Read More »

Read More »

The big gag: Hong Kong’s crackdown on freedom

There has been a slow strangling of freedom (https://www.economist.com/china/2024/05/30/hong-kong-convicts-14-pro-democracy-activists?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) in the territory where pro-democracy activists have been convicted; an annual vigil for the victims of the Tiananmen Square crackdown in...

Read More »

Read More »

I, Claudia: Mexico’s new leader

Claudia Sheinbaum has been elected Mexico’s first female president (https://www.economist.com/leaders/2024/06/03/mexicos-new-president-must-do-a-high-stakes-u-turn?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). Now the real fight begins: crime is rocketing, corruption is rampant and the country is divided. Hurricane...

Read More »

Read More »

Choose this podcast: abortion and the election

In 2022 the Supreme Court gave control of abortion back to “the people and their elected representatives.” This November will be the greatest test yet of what that means. Democrats are running hard on the issue...

Read More »

Read More »

Trump found guilty: what does this verdict mean?

Donald Trump is a convicted felon. Historic, yes. Game-changer? Probably not.

Sign up to The Economist’s daily newsletter: https://econ.st/4bSCoWE

Read more about the 2024 US elections: https://econ.st/4bF3q3X

Read our leader on the verdict: https://econ.st/4dWFkDn

Listen to our US podcast, “Checks and Balance”: https://econ.st/3yIkdo8

Read More »

Read More »

Out on a ledger: Trump convicted

The former president was found guilty (https://www.economist.com/leaders/2024/05/30/the-disgrace-of-a-former-american-president?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) on all 34 charges of falsifying business records. But his convictions leave lots of room for appeals, and for supporters to cry foul. South...

Read More »

Read More »

Trailer: The Modi Raj

Narendra Modi may well be the most popular politician on the planet. India’s prime minister is eyeing a third term atop the world’s biggest democracy.

A tea-seller’s son, Mr Modi began life an outsider and the man behind the political phenomenon remains hard to fathom. India has become an economic powerhouse during his ten years in charge. But he’s also the frontman for a chauvinistic Hindu nationalist dogma.

Can Mr Modi continue to balance...

Read More »

Read More »