Category Archive: 5) Global Macro

Monthly Macro Monitor – September 2020

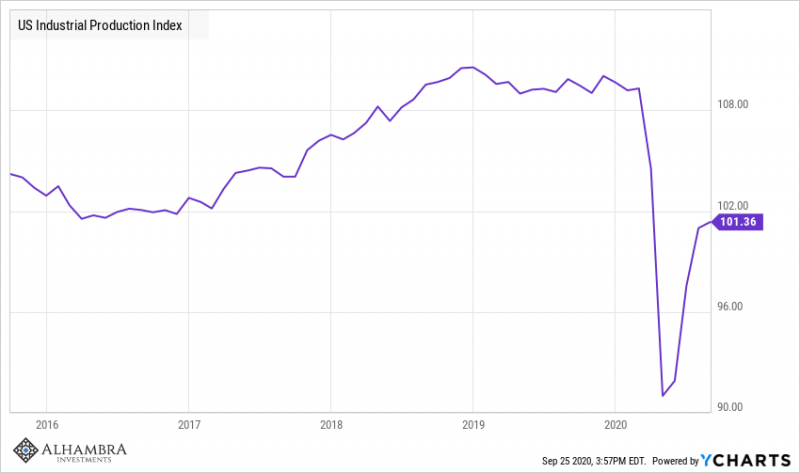

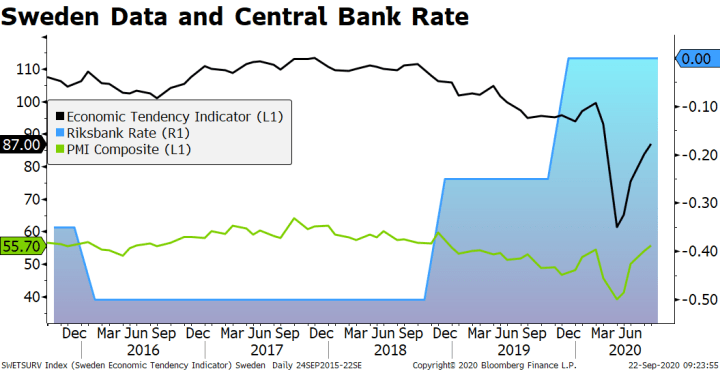

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

Dollar Soft as Markets Ignore Virus Numbers and Switch to Risk-On Mode

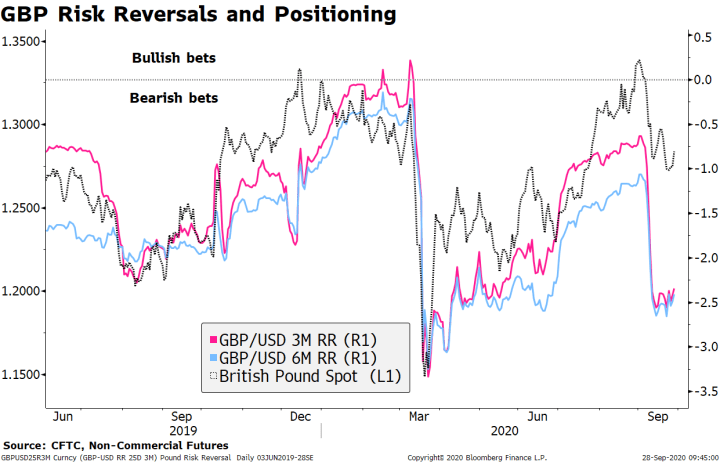

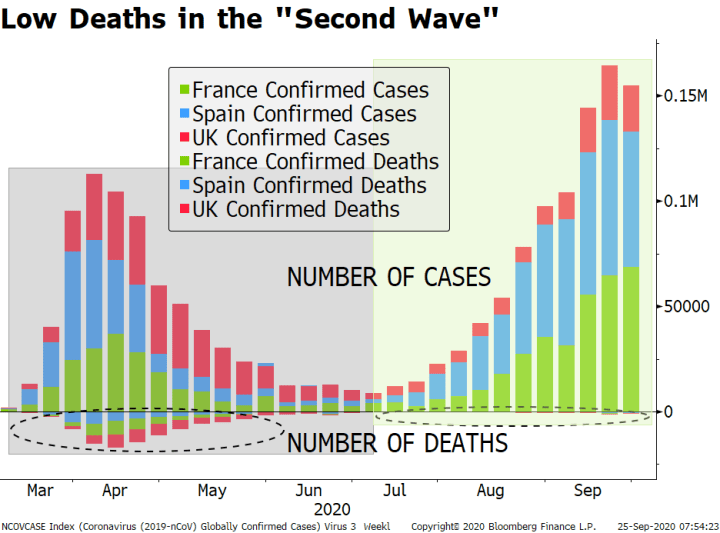

Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs. It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed.

Read More »

Read More »

EM Preview for the Week Ahead

Persistent risk-off impulses weighed on EM last week and that may continue this week. The Asian currencies outperformed last week while MXN, ZAR, and COP underperformed, and we expect these divergences to continue. Despite optimism about a stimulus package in the US, we think it remains a long shot. Meanwhile, virus numbers are rising in Europe and the US, with data from both regions likely to continue weakening.

Read More »

Read More »

Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside. Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations.

Read More »

Read More »

The Silent Exodus Nobody Sees: Leaving Work Forever

The "take this job and shove it" exodus is silently gathering momentum. The exodus out of cities is getting a lot of attention, but the exodus that will unravel our economic and social orders is getting zero attention: the exodus from work. Like the exodus from troubled urban cores, the exodus from work has long-term, complex causes that the pandemic has accelerated.

Read More »

Read More »

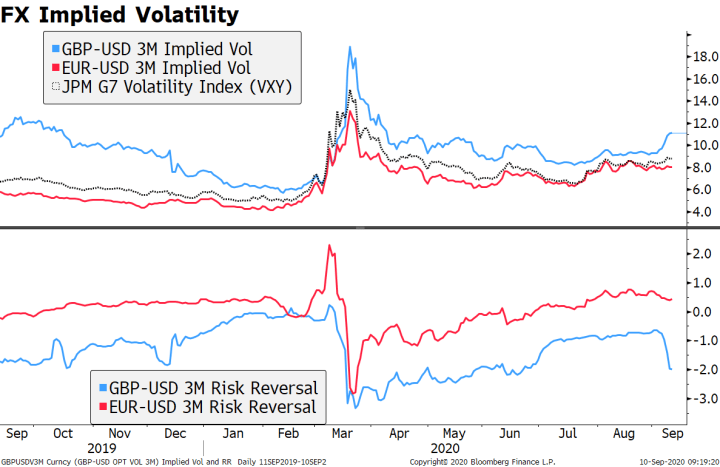

Uh Oh, The Dollar Has Caught A Bid

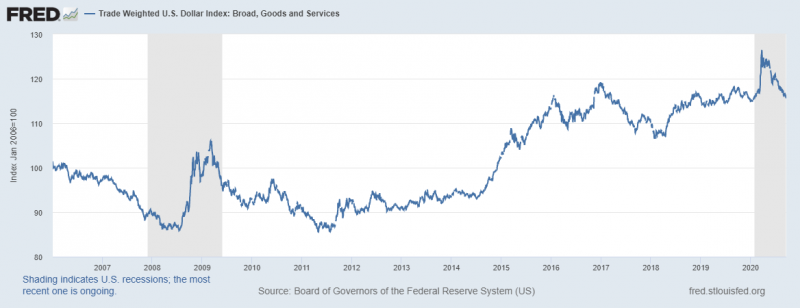

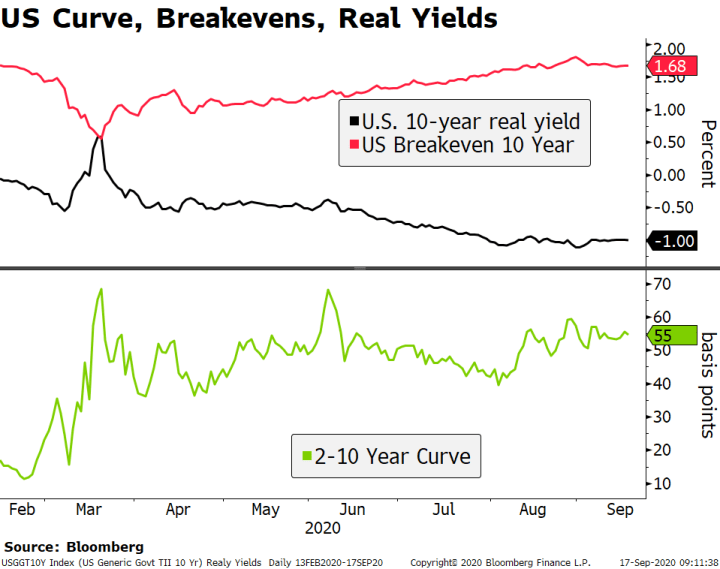

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008.

Read More »

Read More »

Dollar Remains Firm Ahead of Powell Testimony

The dollar remains firm on continued safe haven flows but we still view this situation as temporary. Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin; the text of Powell’s testimony was released already.

Read More »

Read More »

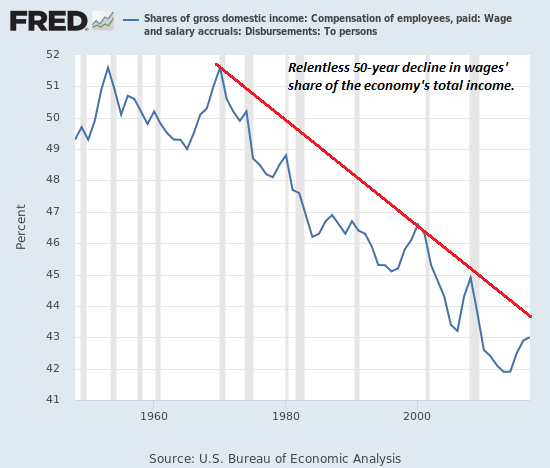

Inflation and “Socialism-Lite” Are Just What the Billionaires Want

After a bout of inflation and "socialism-light", we could end up with even more extreme inequality when the whole rotten structure collapses.

Read More »

Read More »

Dollar Gains from Risk-Off Trading Unlikely to Persist

Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary. US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done.

Read More »

Read More »

“Inflation” and America’s Accelerating Class War

Those who don't see the fragmentation, the scarcities and the battlelines being drawn will be surprised by the acceleration of the unraveling. I recently came across the idea that inflation is a two-factor optimization problem.

Read More »

Read More »

If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

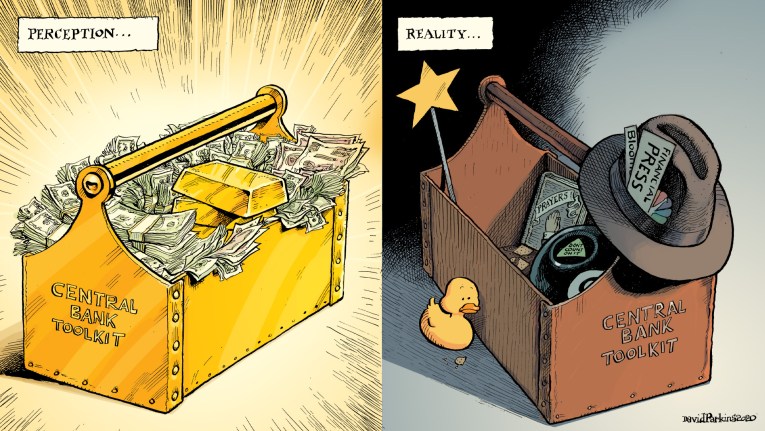

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

Risk Appetite Ebbs Ahead of BOE Decision

The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises. We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday.

Read More »

Read More »

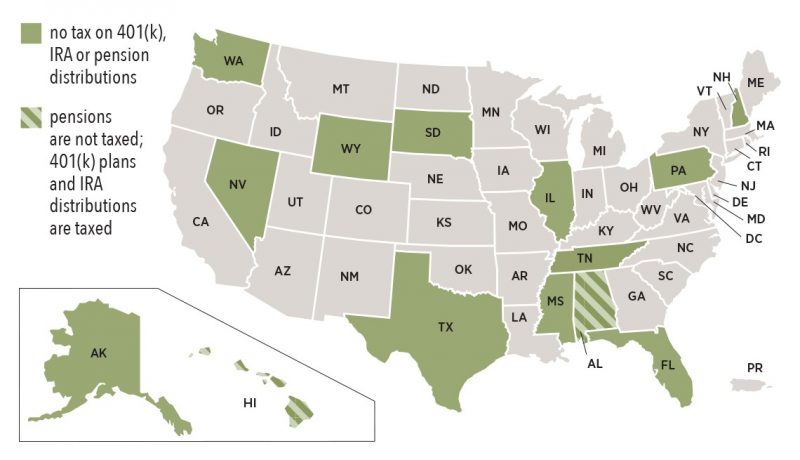

12 States That Keep Retirement Dollars in Your Pocket

“Will I outlive my money?” That’s one of the biggest concerns for most retirees. There’s the high cost of medical care, which gets more expensive all the time. There’s inflation, which raises the cost of goods and services, eating into your retirement budget.

Read More »

Read More »

Sacrifice for Thee But None For Me

The banquet of consequences for the Fed, the elites and their armies of parasitic flunkies and factotums is being laid out, and there won't be much choice in the seating. Words can be debased just like currencies. Take the word sacrifice.

Read More »

Read More »

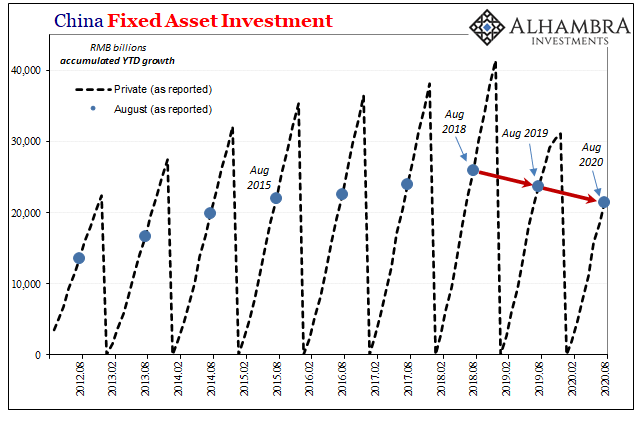

China’s Hole Puzzle

One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost...

Read More »

Read More »

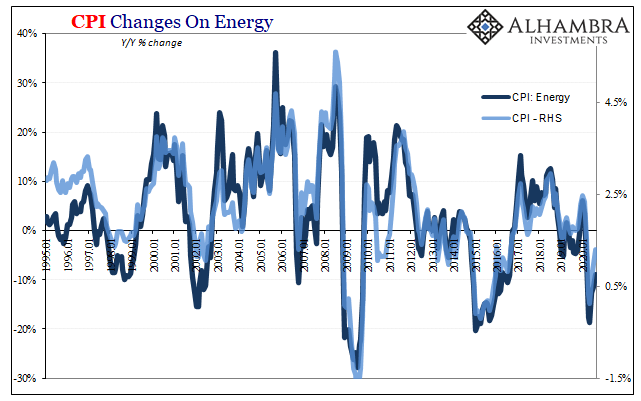

Inflation Karma

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements.

Read More »

Read More »

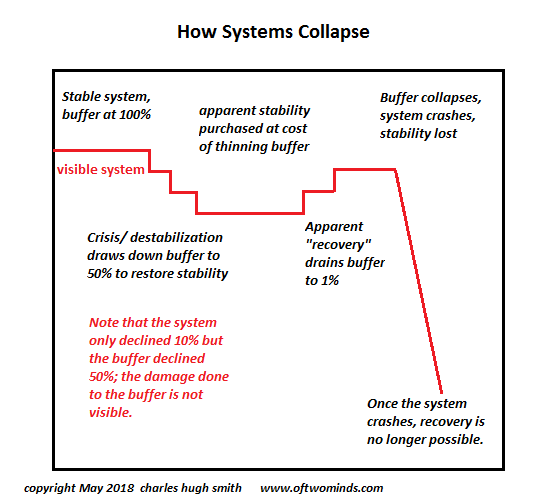

The Four D’s That Define the Future

When the money runs out or loses its purchasing power, all sorts of complexity that were previously viewed as an essential crumble to dust. Four D's will define 2020-2025: derealization, denormalization, decomplexification and decoherence. That's a lot of D's. Let's take them one at a time.

Read More »

Read More »

Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill. US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday

BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25%.

Read More »

Read More »