Category Archive: 5) Global Macro

Dollar Bleeding Stanched as Markets Search for Direction

Markets have a bit of a risk-off feel today; the dollar bleeding has been stanched for now; IMF releases its updated World Economic Outlook. A stimulus package before the election appears doomed; Fed’s Barkin and Daly speak; a big data week for the US kicks off with September CPI today.

Read More »

Read More »

Our Simulacrum Economy

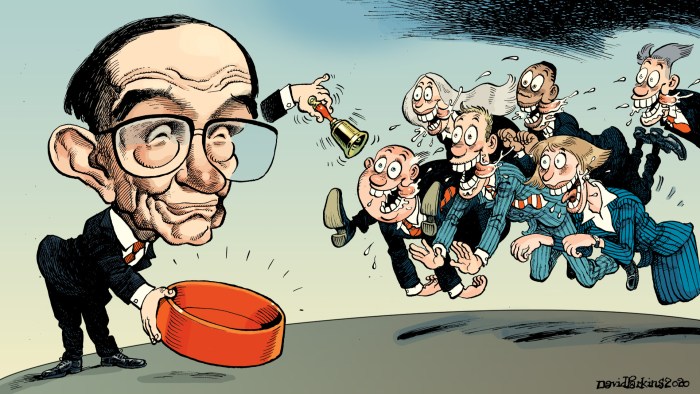

In the hyper-real casino, everyone has access to the terrors of losing, but only a few know the joys of the rigged games that guarantee a few big winners by design. Readers once routinely chastised me for over-using simulacrum to describe our economy and society.

Read More »

Read More »

Drivers for the Week Ahead

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday. A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week.

Read More »

Read More »

Dollar Slide Continues as US Fiscal Stimulus Remains Questionable

The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals. This is another quiet day in terms of US data; Canada reports September jobs data. We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield.

Read More »

Read More »

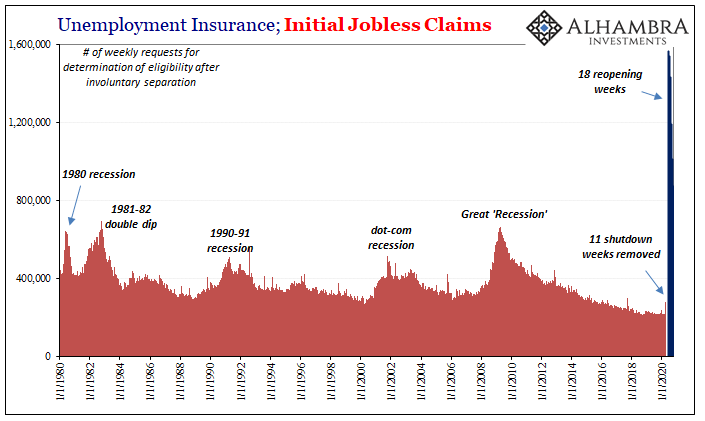

It Just Isn’t Enough

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state.

Read More »

Read More »

A Hard Rain Is Going to Fall

The status quo is about to discover that it can't stop the hard rain or protect its fragile sandcastles. You'll recognize A Hard Rain Is Going to Fall as a cleaned-up rendition of Bob Dylan's classic "A Hard Rain's a-Gonna Fall".

Read More »

Read More »

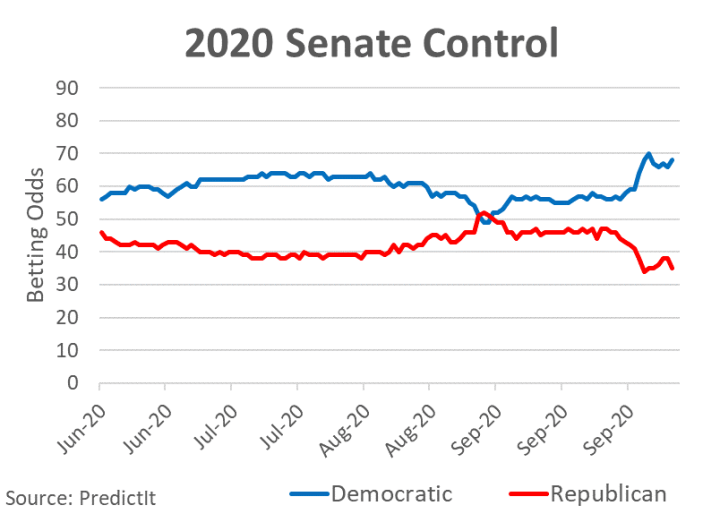

Dollar Remains Heavy as Markets Await Fresh Drivers

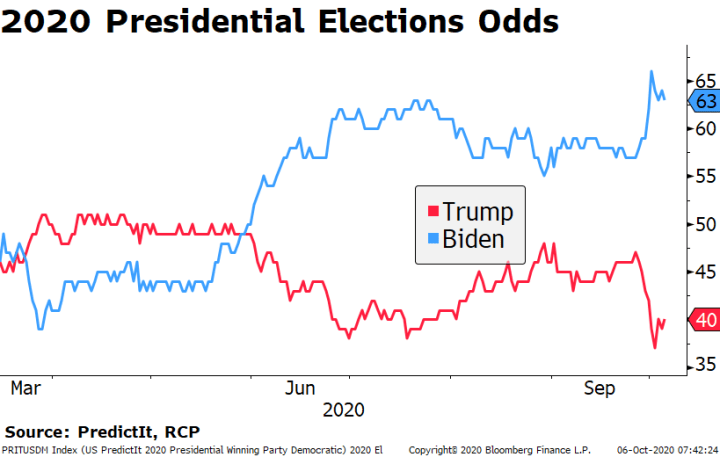

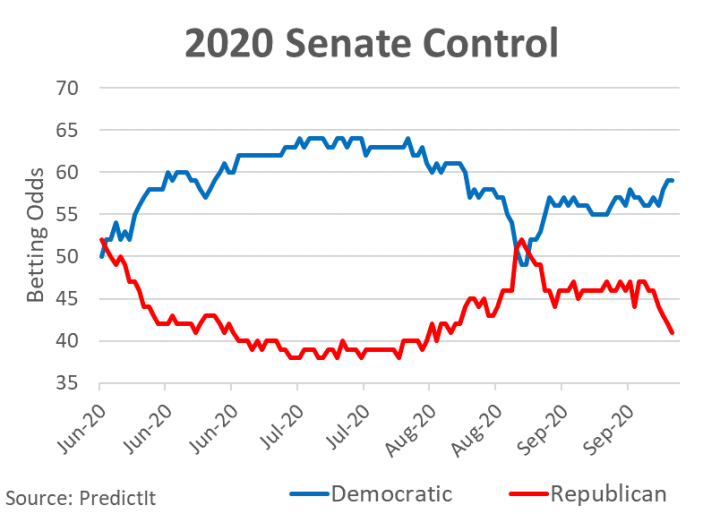

The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states. The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises.

Read More »

Read More »

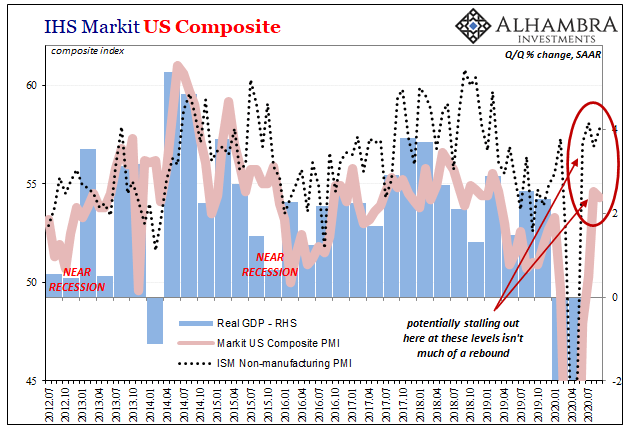

Is There Enough?

It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time.

Read More »

Read More »

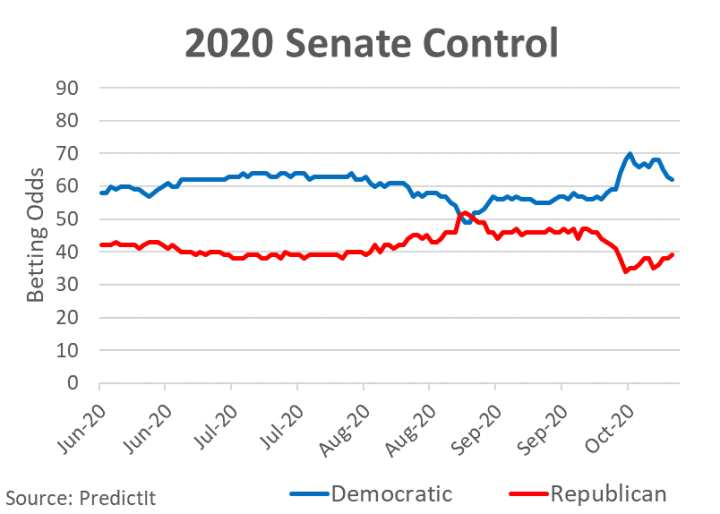

Dollar Softens and US Curve Steepens as Odds of Democratic Sweep Rise

The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data. President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4.

Read More »

Read More »

Who’s Negative? The Marginal American Worker

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments.

Read More »

Read More »

Things Change

Things change, supposedly immutable systems crumble and delusions die. That's the lay of the land in the The Empire of Uncertainty I described yesterday.

Read More »

Read More »

Drivers for the Week Ahead

The US political outlook has been upended by recent developments; lack of a significant safe haven bid for the dollar so far is telling. This is a very quiet week in terms of US data; FOMC minutes will be released Wednesday; there is a full slate of Fed speakers.

Read More »

Read More »

Dollar Remains Soft but Sterling Pounded by Brexit Risks

The dollar remains under pressure as market sentiment continue to improve; stimulus talks were extended. Two major US airlines announced significant job furloughs starting today; US data for September will continue to roll out; weekly jobless claims will be reported.

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »

The Urban Exodus and How Greatness Goes Bankrupt

The best-case scenario is those who love their "great city" will accept the daunting reality that even greatness can go bankrupt. Two recent essays pin each end of the "urban exodus" spectrum.

Read More »

Read More »

Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground.And so it was also in...

Read More »

Read More »

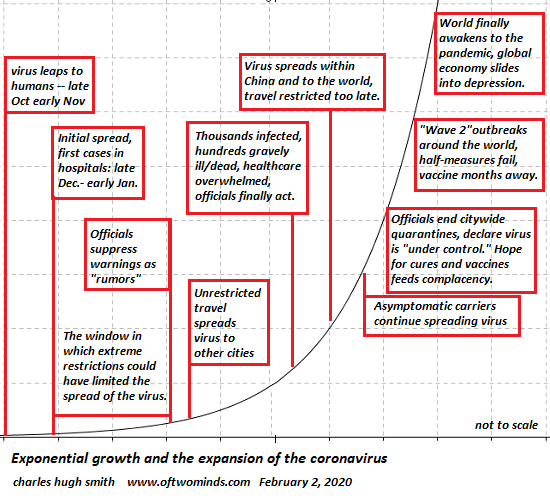

The Empire of Uncertainty

Anyone claiming they can project the trajectory of the U.S. and global economy is deluding themselves. Normalcy depends entirely on everyday life being predictable. To be predictable, life must

be stable, which means that there is a high level of certainty in every aspect of life.

Read More »

Read More »

Helicopter Money and the End of Taxes

Rather than right the ship, the "easy fix" is to distribute "free money"--not just to billionaires and corporations but to everyone.

Read More »

Read More »

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

Dollar Softens as Risk-Off Sentiment Ebbs

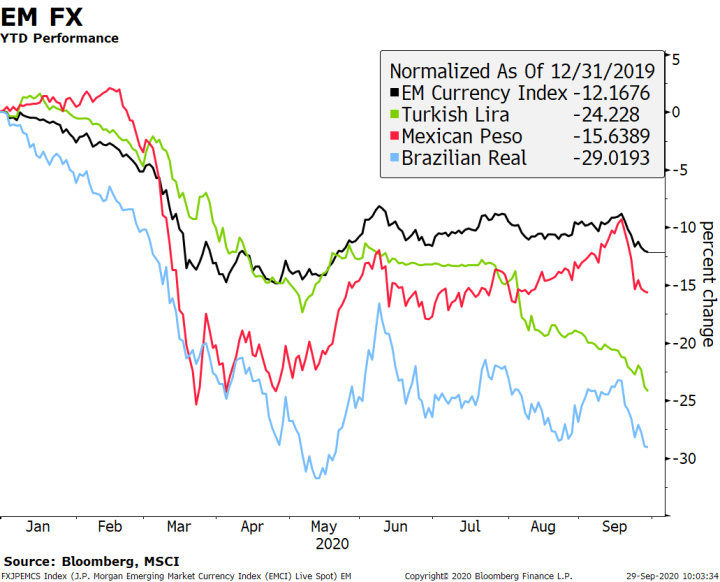

The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight. House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns.

Read More »

Read More »