Category Archive: 5) Global Macro

New Patterns of Disturbance

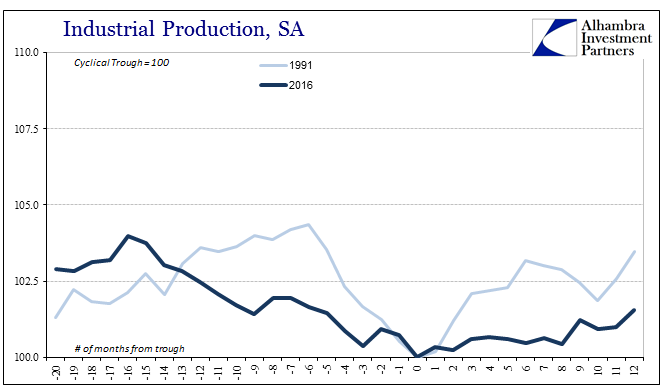

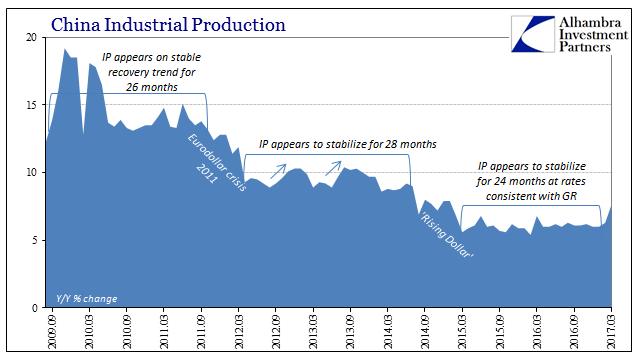

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in March 2017, the highest growth...

Read More »

Read More »

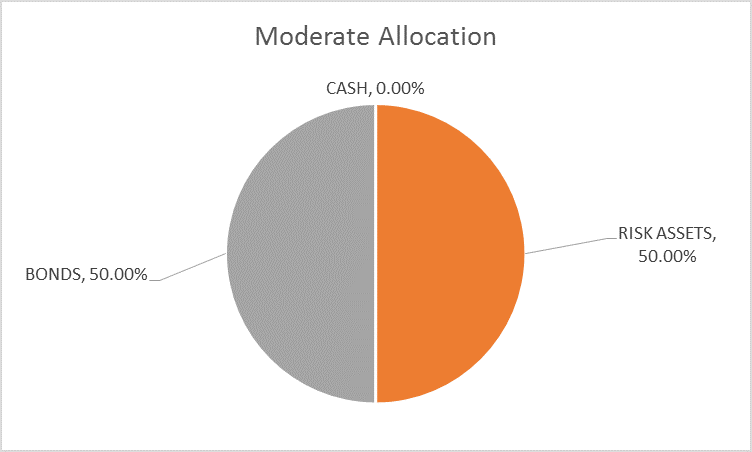

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new...

Read More »

Read More »

France’s presidential election: A populist front

French voters go to the polls on Sunday for the first round of the country’s presidential election. We go to Marine Le Pen’s heartlands to examine why this far-right, anti-immigrant and Eurosceptic candidate has gained such favour Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 France is about to elect a new president …

Read More »

Read More »

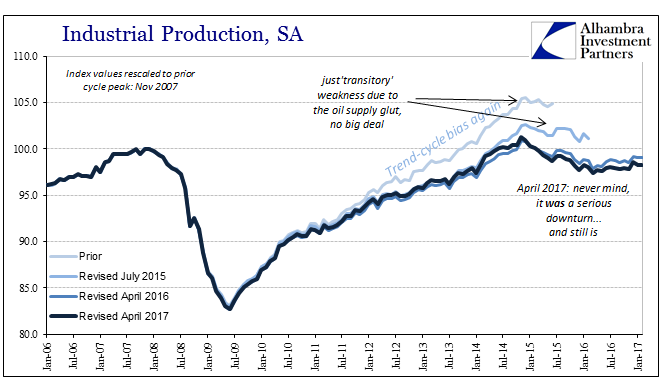

Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions.

Read More »

Read More »

The Left’s Descent to Fascism

The Left is morally and fiscally bankrupt, devoid of coherent solutions, and corrupted by its embrace of the Corporatocracy. History often surprises us with unexpected ironies. For the past century, the slide to fascism could be found on the Right (conservative, populist, nationalist political parties).

Read More »

Read More »

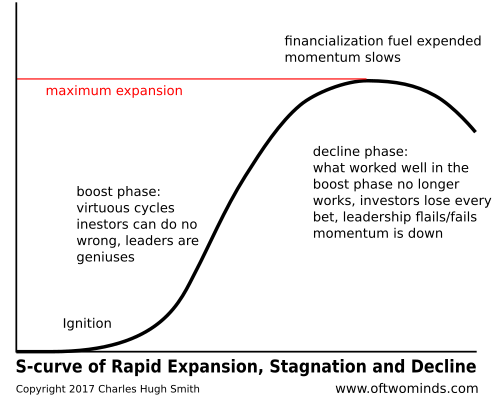

Central Banks Have Manipulated The Markets Which Will Ultimately Crash: Charles Hugh Smith

Today’s Guest: Charles Hugh Smith Websites: Of Two Minds http://www.oftwominds.com Books: Get a Job, Build a Real Career… Why Things Are Falling Apart and What We Can Do About It Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject …

Read More »

Read More »

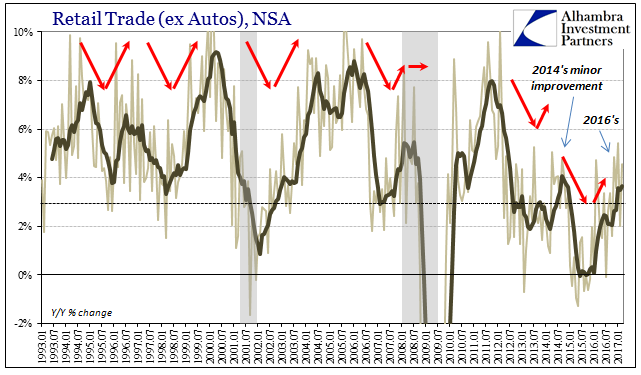

The Expanded Retail Sales Gap

Retail sales growth in February 2017 was going to be low by virtue of its comparison to February 2016 and the extra day in that month. The Census Bureau’s autoregressive models are supposed to normalize just these kinds of calendar irregularities so that we can make something close to apples to apples comparisons. The seasonally-adjusted estimate for February, however, was calculated to be less than the one for January 2017, therefore suggesting...

Read More »

Read More »

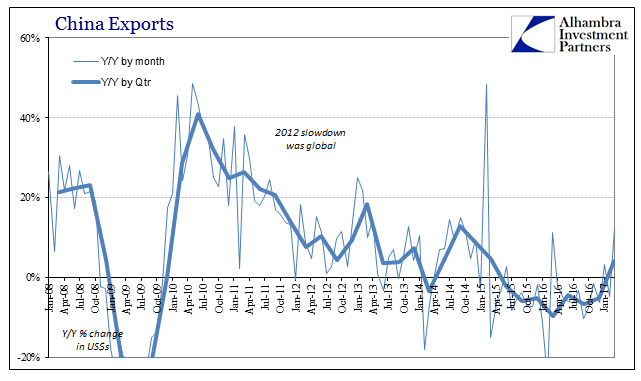

Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful.

Read More »

Read More »

Why many World Heritage sites are at risk | The Economist

UNESCO’s World Heritage site designation aims to protect the world’s most valuable natural and cultural treasures. But often, that designation is not enough. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 In 2016, the archaeological site of Philippi in Greece was listed as a World Heritage Site by UNESCO. It was one of …

Read More »

Read More »

The Palestinian Museum with no exhibits

Omar al-Qattan has dedicated 20 years to building a museum celebrating Palestinian cultural expression and heritage yet it still lies empty. Why does this museum matter so much? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films visit: …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate for EM to remain challenging this week.

Read More »

Read More »

What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency.

Read More »

Read More »

Emerging Markets: What has Changed

Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed. Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate.

Read More »

Read More »

Charles Hugh Smith On The Commercial Real Estate Bubble Caused By Financial Repression

Click here for the full transcript with slides: http://financialrepressionauthority.com/2017/04/16/the-roundtable-insight-charles-hugh-smith-on-the-commercial-real-estate-bubble-caused-by-financial-repression/

Read More »

Read More »

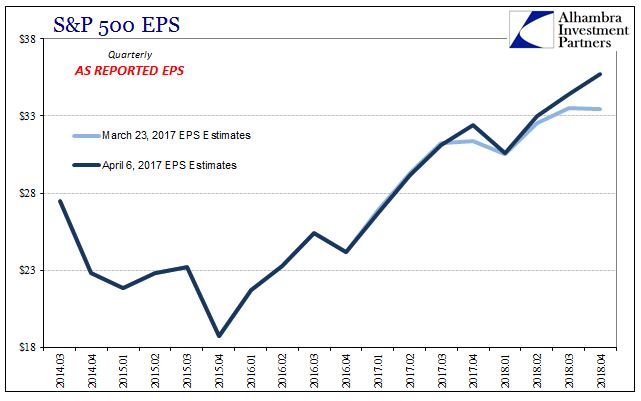

Earnings per Share: Is It Other Than Madness?

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04 to $24.16. At $26.70, that would...

Read More »

Read More »

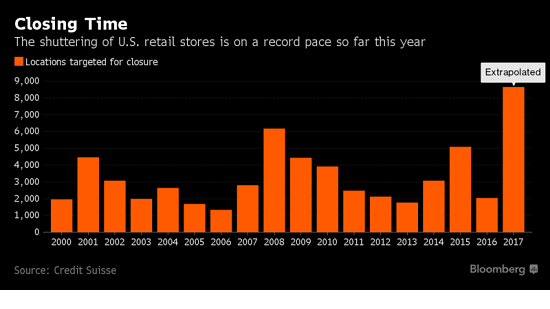

Charles Hugh Smith–Wither The Suburb? #3536

While much has been written about the massive retail decline in America, Charles sheds interesting light upon another core cause of the retail apocalypse. Namely, Millennials, due to staggering student loan debt, have lowered expectations and are staying close to urban downtowns. They have smaller homes, less need for expensive furnishings and have often shed …

Read More »

Read More »

Optimal Lunacy

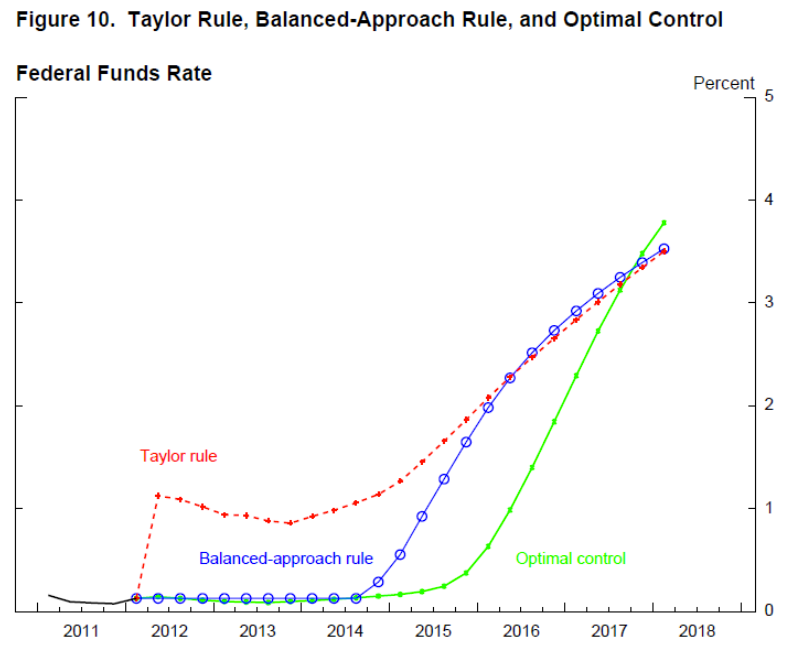

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this economic inertia.

At that...

Read More »

Read More »

Millennials Are Abandoning the Postwar Engines of Growth: Suburbs and Autos

Where's the growth going to come from as the dominant generation makes less, borrows less, spends less, saves more and turns away from long commutes, malls and suburban living and abandons the worship of private vehicles?

Read More »

Read More »

Tim Berners-Lee explains what it will take to make the internet more accessible | The Economist

The internet is inaccessible to 60% of the world’s population. Tim Berners-Lee, the web’s inventor, has decided to change this. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 60% of the world’s people are still not connected to the internet. The majority of these are women and people living in poverty. In July …

Read More »

Read More »

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »