Category Archive: 5) Global Macro

Can technology save the rarest creatures on the planet? | The Economist

A “Facebook for fish” is being used to try and save the critically-endangered Giant Sea Bass. This is just one of the pioneering experiments being carried out by marine biologist, Douglas McCauley, in his mission to protect ocean life. Click here to subscribe to The Economist on YouTube: https://econ.st/2xOgV2D For more from Economist Films visit: …

Read More »

Read More »

Does Anyone Else See a Giant Bear Flag in the S&P 500?

We all know the game is rigged, but strange things occasionally upset the "easy money bet." "Reality" is in the eye of the beholder, especially when it comes to technical analysis and economic tea leaves.

Read More »

Read More »

Can a cure for diabetes be found through surgery? | The Economist

Diabetes is the fastest growing health crisis of our time. Could a common surgical procedure bolster hopes of finding a cure? Click here to subscribe to The Economist on YouTube: https://econ.st/2M2143H Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: https://econ.st/2M1rxOZ Check out The Economist’s full video catalogue: http://econ.st/20IehQk …

Read More »

Read More »

Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX.

Read More »

Read More »

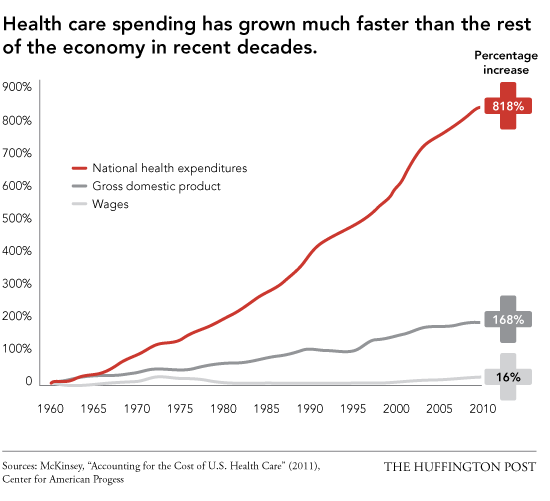

Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43 percent from 2001

Welcome to debt-serfdom, the only possible output of the soaring cost of living. Long-time readers may recall the Burrito Index, my real-world measure of inflation. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016). The Burrito Index tracks the cost of a regular burrito since 2001. Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can track the cost of a regular...

Read More »

Read More »

Sexism and the English language | The Economist

Sexism is rife in language. A woman may be described as “bossy”, while a man is more likely to be “assertive”. The Economist’s language expert Lane Greene explores the gender stereotypes used in everyday speech. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For …

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses.

Read More »

Read More »

America 2018: Dicier by the Day

Scrape all this putrid excrescence off and we're left with a non-fantasy reality: everything is getting dicier by the day. If we look beneath the cheery chatter of the financial media and the tiresomely repetitive Russian collusion narrative (that's unraveling as the Ministry of Propaganda's machinations are exposed), we find that America in 2018 is dicier by the day.

Read More »

Read More »

Should there be curbs on free speech? | The Economist

Free speech is at the heart of a healthy democracy, but in recent years it has come under attack. Controversial views are being silenced to protect vulnerable people from harm. The Economist’s Jon Fasman offers his take on how societies should react. #OpenFuture Click here to subscribe to The Economist on YouTube: https://econ.st/2J1OgIw Daily Watch: …

Read More »

Read More »

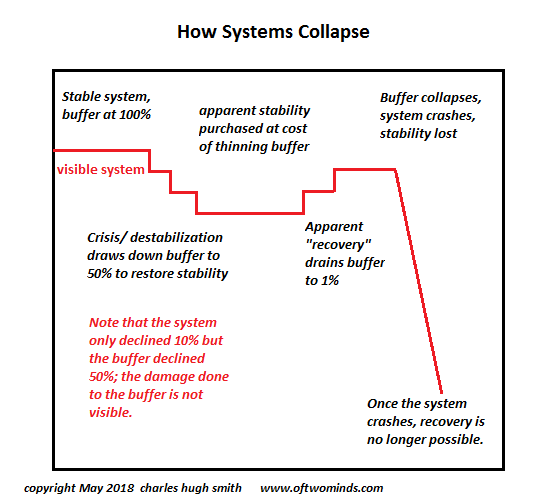

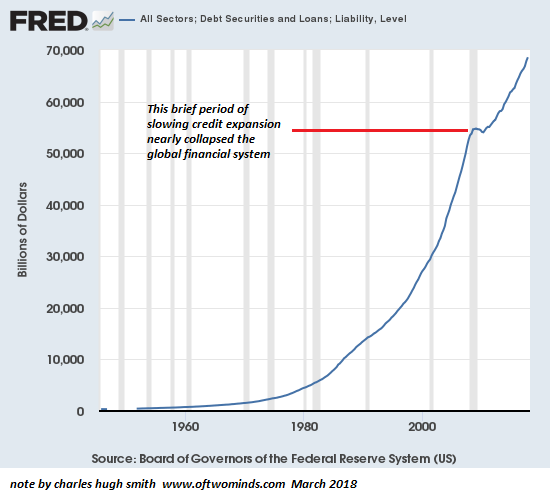

How Systems Collapse

This is how systems collapse: faith in the visible surface of abundance reigns supreme, and the fragility of the buffers goes unnoticed. I often discuss systems and systemic collapse, and I've drawn up a little diagram to illustrate a key dynamic in systemic collapse. The key concepts here are stability and buffers. Though complex systems are never static, but they can be stable: that is, they ebb and flow within relatively stable boundaries...

Read More »

Read More »

What Happened Monday?

Italian politics dominated Monday's activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections.

Read More »

Read More »

Emerging Markets: What Changed

President Trump canceled the planned summit with North Korea’s Kim Jong Un. Malaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Philippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. The United Arab Emirates opened up its economy to more foreign investment.

Read More »

Read More »

The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany.

Read More »

Read More »

Globally Synchronized Asynchronous Growth

Industrial Production in the United States rose 3.5% year-over-year in April 2018, down slightly from a revised 3.7% rise in March. Since accelerating to 3.4% growth back in November 2017, US industry has failed to experience much beyond that clear hurricane-related boost. IP for prior months, particularly February and March 2018, were revised significantly lower.

Read More »

Read More »

American trade representatives meet China’s, cartooned | The Economist

Trade representatives from America met with their Chinese counterparts this week in a bid to avoid a trade war. The negotiations did not go well, our cartoonist offers his take Click here to subscribe to The Economist on YouTube: https://econ.st/2IKOHv1 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

Sustainability Boils Down to Scale

Only small scale systems can sustainably impose "skin in the game"-- consequences, accountability and oversight. Several conversations I had at the recent Peak Prosperity conference in Sonoma, CA sparked an insight into why societies and economies thrive or fail: It All Boils Down to Scale. In a conversation with a Peak Prosperity member who goes by MemeMonkey, MemeMonkey pointed out that social / economic organizations that function well at small...

Read More »

Read More »

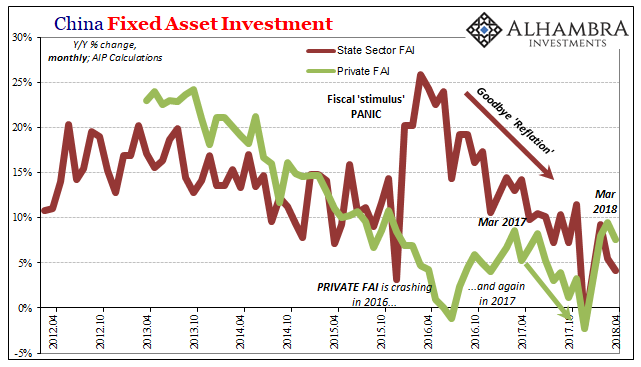

Anchoring Globally Synchronized Growth, Or We Gave Up Long Ago?

January was the last month in which China’s National Bureau of Statistics (NBS) specifically mentioned Fixed Asset Investment (FAI) of state holding enterprises (or SOE’s). For the month of December 2017, the NBS reported accumulated growth (meaning for all of 2017) in this channel of 10.1%. Through FAI of SOE’s, Chinese authorities in early 2016 had panicked themselves into unleashing considerable “stimulus.”

Read More »

Read More »

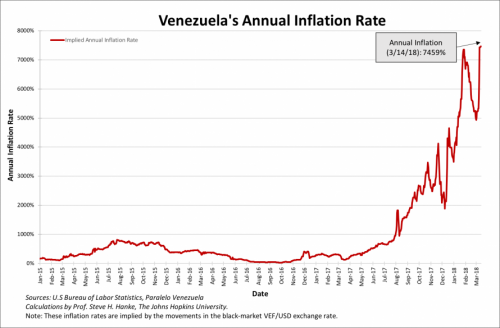

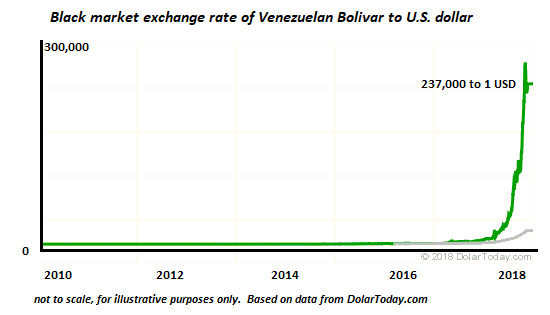

The Next Recession Will Be Devastatingly Non-Linear

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we'd expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by about 2%, lending contracts by...

Read More »

Read More »