Category Archive: 5) Global Macro

The Awakening Is Now Going World Wide, The Movement Has Started:Charles Hugh Smith

Today’s Guest: Charles Hugh Smith Website: Of Two Minds http://oftwominds.com Blog https://www.oftwominds.com/blog.html Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject matter. The representative artwork included with these videos shall not be construed as the actual events that are …

Read More »

Read More »

Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin. Shaky China: Chinese landing could be harder than expected. Brexit and EU Breakage: “I have long thought the EU will eventually fall apart”. Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold. We may see “yellow vests” spread globally: Economics is about to get interesting …

Read More »

Read More »

Congo: the race to beat Ebola | The Economist

Congo is in the grip of another Ebola outbreak, which has killed up to 400 people. There is no effective treatment for the deadly virus, but pioneering drug trials are under way Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

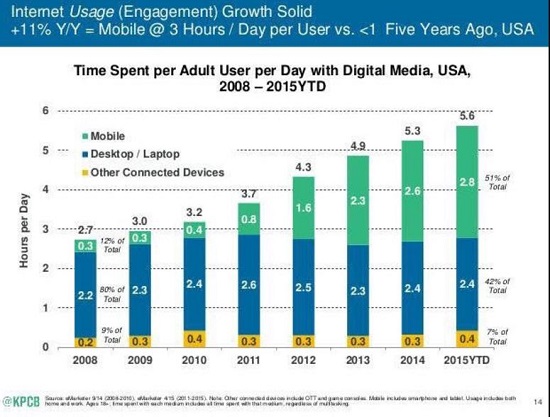

Want to Heal the Internet? Ban All Collection of User Data

The social media/search giants have mastered the dark arts of obfuscating how they're reaping billions of dollars in profits from monetizing user data, and lobbying technologically naive politicos to leave their vast skimming operations untouched.

Read More »

Read More »

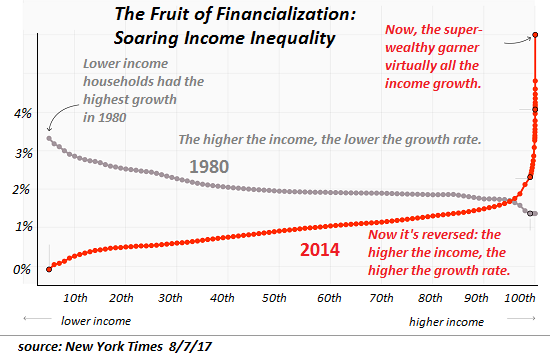

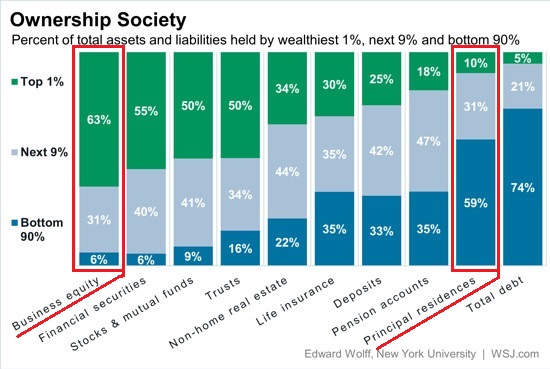

Two Ways the System Is Rigged: HFT and Oligarchic Inheritance

We often hear how the system (i.e. our economy) is rigged to benefit the few at the expense of the many, but exactly how is it rigged? Longtime correspondent Zeus Y. recently highlighted two specific mechanisms that favor the top 0.01%: high frequency trading (HFT) and oligarchic inheritance, the generational transfer of immense wealth and the power it buys.

Read More »

Read More »

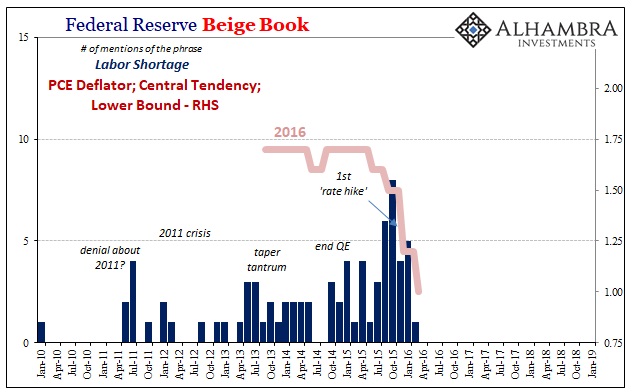

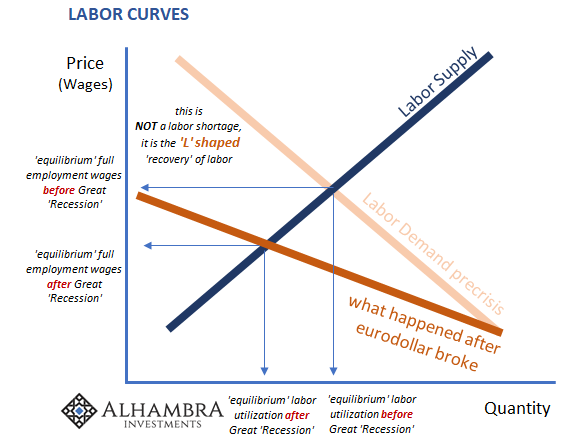

Hall of Mirrors, Where’d The Labor Shortage Go?

Today was supposed to see the release of the Census Bureau’s retail trade report, a key data set pertaining to the (alarming) state of American consumers, therefore workers by extension (income). With the federal government in partial shutdown, those numbers will be delayed until further notice. In their place we will have to manage with something like the Federal Reserves’ Beige Book.

Read More »

Read More »

How can Britain fix Brexit? | The Economist

Parliament’s rejection of Theresa May’s Brexit plan has created a democratic mess. The Economist’s Britain editor, Tom Wainwright, explains how the country got into this muddle, and the solution for getting out. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

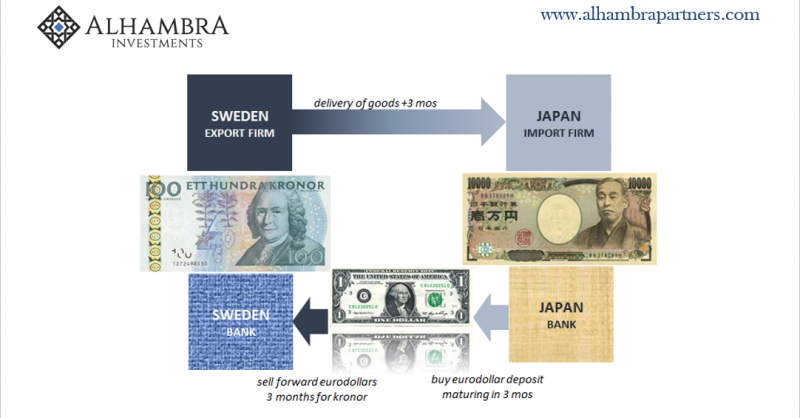

That’s A Big Minus

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention.

Read More »

Read More »

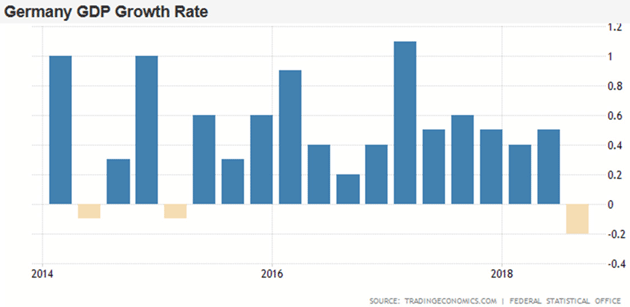

Spreading Sour Not Soar

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve.

Read More »

Read More »

As Germany and France Come Apart, So Too Will the EU

If we follow the logic and evidence presented in these seven points, we are forced to conclude that the fractures in France, Germany and the EU are widening by the day. When is a nation-state no longer a functional state? It's an interesting question to ask of the European nation-states trapped in the devolving European Union.

Read More »

Read More »

The future of work: is your job safe? | The Economist

The world of work will be radically different in the future. From hyper-surveillance of staff to digital nomadism to robots taking jobs—how, where and why we work is changing beyond all recognition. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy This is the workforce of the future. Technology is transforming the world of …

Read More »

Read More »

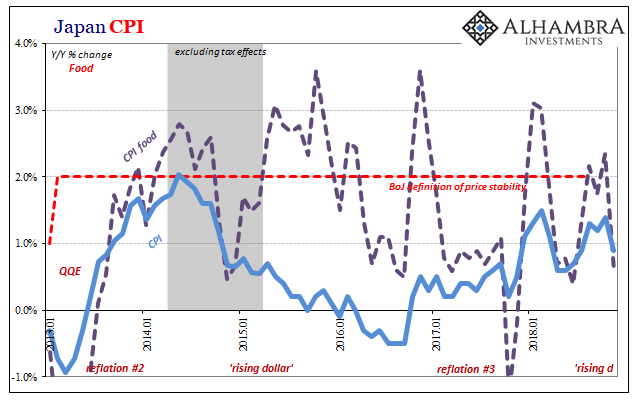

Insight Japan

As I wrote yesterday, “In the West, consumer prices overall are pushed around by oil. In the East, by food.” In neither case is inflation buoyed by “money printing.” Central banks both West and East are doing things, of course, but none of them amount to increasing the effective supply of money. Failure of inflation, more so economy, the predictable cost.

Read More »

Read More »

What makes elite athletes thrive or dive under pressure? | The Economist

Psychology is an increasingly important part of elite sport. Winning at the highest levels can depend as much on peak-fitness of the mind as the body. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Sponsored by DXC Technology. for top-level sports people it’s not just skill and athleticism they count. So often, it’s …

Read More »

Read More »

The Decline and Fall of the European Union

This exhaustion of the neocolonial-neofeudal model was inevitable, and as a result, so too is the decline and fall of the European integration/exploitation project. That a single currency, the euro, would fracture rather than unite Europe was understood long before the euro's introduction as legal tender on January 1, 2002.

Read More »

Read More »

Where Will You Be Seated at the Banquet of Consequences?

To get a good seat at the banquet of consequences, the owner of capital has to shift his/her capital into scarce forms for which there is demand. The Banquet of Consequences is being laid out, and so the question is: where will you be seated? The answer depends on two dynamics I've mentioned many times: what types of capital you own and the asymmetries of our economy.

Read More »

Read More »

Rate of Change

We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way.

Read More »

Read More »