Category Archive: 5) Global Macro

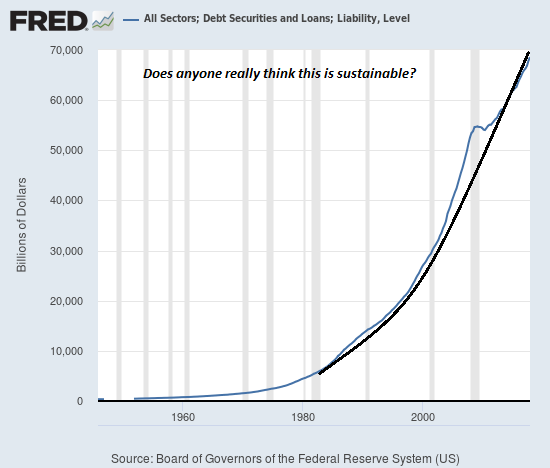

Our Time/Labor Is Finite, But Money Is Infinite

Once we understand this mechanism, we understand that labor can never get ahead. I've been pondering a comment longtime correspondent Drew P. emailed me in response to my post, What's Holding Up the Market?: Our time/labor is finite, but money is infinite. Drew explained that creating new fiat currency and injecting it into a closed system (our financial system) controls and restrains the value of our time and labor, past, present and future.

Read More »

Read More »

From JOLTS Series Shift To Series of Rate Cuts

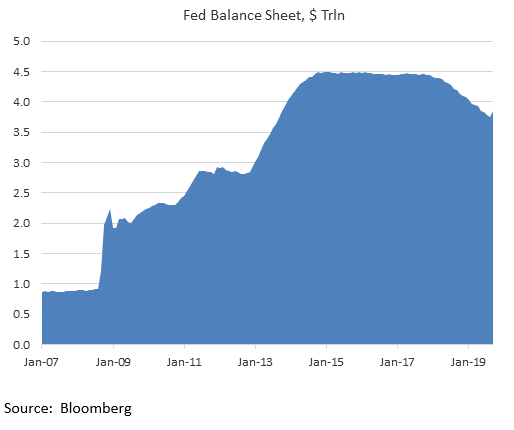

I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it.

Read More »

Read More »

South Africa: rugby’s race problem | The Economist

South Africa’s national rugby squad has ‘‘quotas’’ to ensure more black players are selected. 25 years after the end of apartheid, can the controversial practice redress the race imbalance in the sport? And at what cost? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy It was a win that unified a divided country. …

Read More »

Read More »

Dollar Soft Despite Heightened Geopolitical Risks

The dollar staged a stunning comeback yesterday as risk-off took hold on rising geopolitical risk; those risks remain high. US-China tensions have risen ahead of trade talks that begin Thursday. The US abruptly announced that it would withdraw its troops from northeast Syria. US reports September PPI; German IP came in better than expected.

Read More »

Read More »

All-Stars #67 Jeff Snider: Reconciling extreme treasury demand with declining bid-to-cover ratios

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »

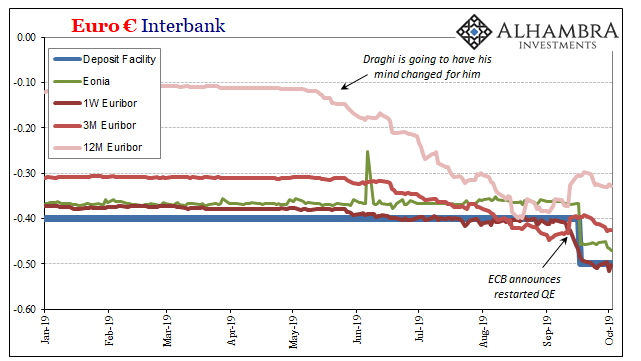

The Consequences Of ‘Transitory’

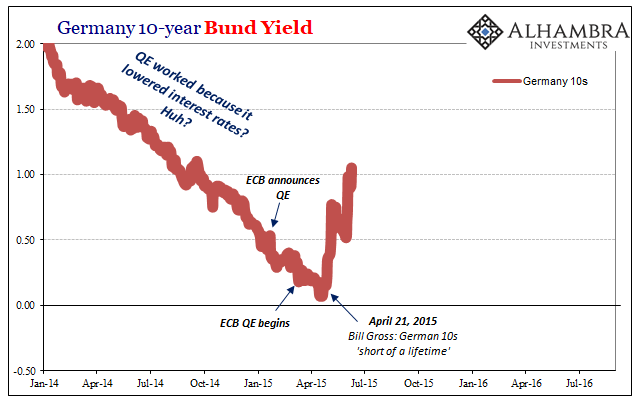

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Read More »

Read More »

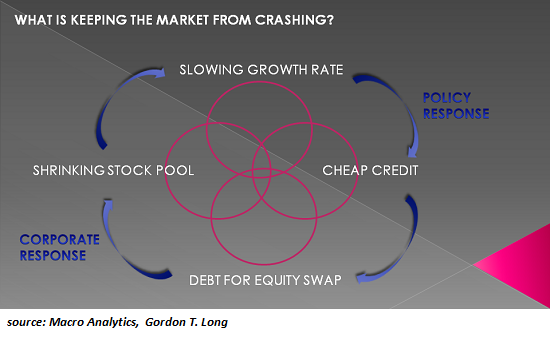

What’s Holding Up the Market?

The Fed's nearly free money for financiers policies in support of the Super-Rich do not exist in a vacuum--the disastrous consequences are already baked in. What's holding up the U.S. stock market? The facile answer is the Federal Reserve but this doesn't actually describe the mechanisms in play or the consequences of a market that levitates ever higher on the promise of more Fed money-for-nothing injected into the diseased veins of the financial...

Read More »

Read More »

Drivers for the Week Ahead

The dollar rally has been derailed by weak US data and rising recession fears. The September jobs data was not a game-changer and so we are left waiting for more clues. Believe it or not, the US economy remains solid; however, the US repo market has not fully normalized yet. The Chinese trade delegation arrives in Washington Thursday for two days of trade talks.

Read More »

Read More »

Big Trouble In QE Paradise

Maybe it was a sign of things to come, a warning how it wasn’t going to go as planned. Then again, when it comes to something like quantitative easing there really is no plan. Other than to make it sound like there is one, that’s really the whole idea. Not what it really is and what it actually does, to make it appear like there’s substance to it.

Read More »

Read More »

MACRO ANALYTICS – 10-03-19 – What’s Holding The Market Up? w/ Charles Hugh Smith

NOTE: THIS IS NOT AN INTERVIEW BUT RATHER AN ONGOING MONTHLY EXCHANGE BETWEEN CHARLES AND GORDON WHICH IS MADE AVAILABLE TO THE PUBLIC AS A PUBLIC SERVICE. VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: http://charleshughsmith.blogspot.com/2019/10/whats-holding-up-market.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, …

Read More »

Read More »

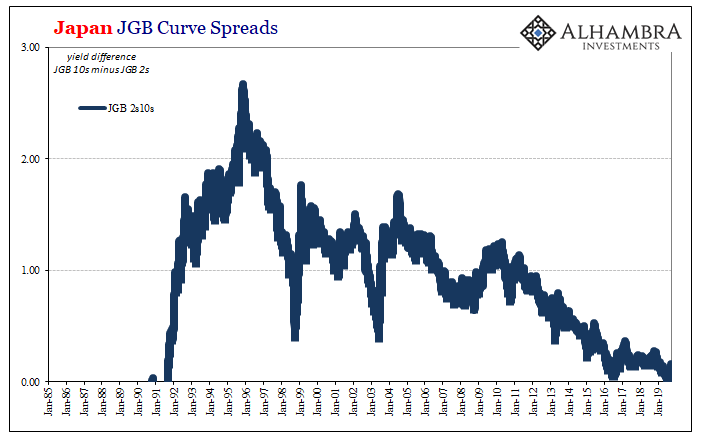

Why The Japanese Are Suddenly Messing With YCC

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more.

Read More »

Read More »

Chimamanda Ngozi Adichie: identity, feminism and honest conversations

Chimamanda Ngozi Adichie, an award-winning Nigerian author whose work deals with race, identity and gender, speaks to The Economist’s public policy editor Sacha Nauta about some of the most pressing issues facing society today This was held at The Economist’s the second annual Open Future Festival. Watch the full livestream here: https://econ.st/2Vf5p8Q

Read More »

Read More »

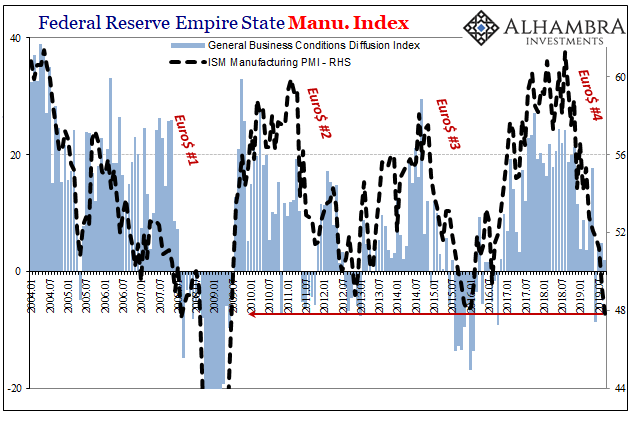

ISM Spoils The Bond Rout!!! Again

For the second time this week, the ISM managed to burst the bond bear bubble about there being a bond bubble. Who in their right mind would buy especially UST’s at such low yields when the fiscal situation is already a nightmare and becoming more so? Some will even reference falling bid-to-cover ratios which supposedly suggests an increasing dearth of buyers.

Read More »

Read More »

The Big Picture Doesn’t Include ‘Trade Wars’

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors.

Read More »

Read More »

ISM Spoils The Bond Rout!!!

With China closed for its National Day Golden Week holiday, the stage was set for Japan to steal the market spotlight. If only briefly. The Bank of Japan announced last night that it had had enough of the JGB curve. The 2s10s very nearly inverted last month and BoJ officials released preliminary plans to steepen it back out.

Read More »

Read More »

How to help America’s poor | The Economist

The nature of poverty in America is changing, challenging stereotypes. What is the best way to help families living in poverty today? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow The …

Read More »

Read More »

Musings on the Repo Market, Fed Policy, and the US Economy

The US repo market appears to finally be normalizing. The low pace of normalization is concerning and so a more permanent solution may be needed to head off similar problems at year-end. We do not think this issue has any implications for the economic outlook, which we continue to view as solid.

Read More »

Read More »

Why is there still poverty in America? | The Economist

In America almost 40m people—one eighth of its population—live in poverty. Why does the richest big country in the world still have so many people living in profound need? Find out more here: https://econ.st/2ofmd33 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s …

Read More »

Read More »

Could Pricey Urban Meccas become Crime-Ridden Ghost Towns?

As the exodus gathers momentum, all the reasons people clung so rabidly to urban meccas decay. If there is any trend that's viewed as permanent, it's the enduring attraction of coastal urban meccas: despite the insane rents and housing costs, that's where the jobs, the opportunities and the desirable urban culture are.

Read More »

Read More »

Drivers for the Week Ahead

We continue to think that the US economy is in better shape than most appreciate, and that underpins our strong dollar call. Tensions are likely to remain high after reports emerged last week that the US will look into limiting capital flows into China. US September jobs data Friday will be the data highlight of the week; there is a heavy slate of Fed speakers this week.

Read More »

Read More »