Category Archive: 5) Global Macro

Charles Hugh Smith on the Emerging Repo Crisis

Charles Hugh Smith on the Emerging Repo Crisis http://financialrepressionauthority.com/2020/01/27/the-roundtable-insight-charles-hugh-smith-on-the-emerging-repo-crisis/

Read More »

Read More »

Sharp Sell-Off on Virus Concerns

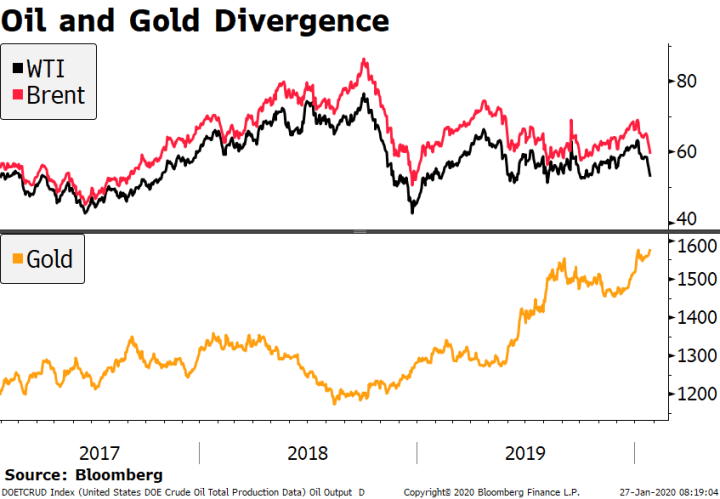

Global stocks lower on virus fears, yen appreciates, and yield curves flatten. Oil prices continue to fall while gold rises. Italian assets outperform on favorable election results for ruling coalition. German IFO survey disappoints, trimming nascent green shoots.

Read More »

Read More »

EM Preview for the Week Ahead

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus.

Read More »

Read More »

The Future of What’s Called “Capitalism”

The psychotic instability will resolve itself when the illusory officially sanctioned "capitalism" implodes. Whatever definition of capitalism you use, the current system isn't it so let's call it "capitalism" in quotes to indicate it's called "capitalism" but isn't actually classical capitalism.

Read More »

Read More »

Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus. US steps up trade rhetoric against EU and pushes back against UK digital tax plan. AUD stronger on solid Australian jobs report and pricing out of RBA easing. CAD weaker on dovish BOC communication yesterday.

Read More »

Read More »

The Big And Small of Leading Japan

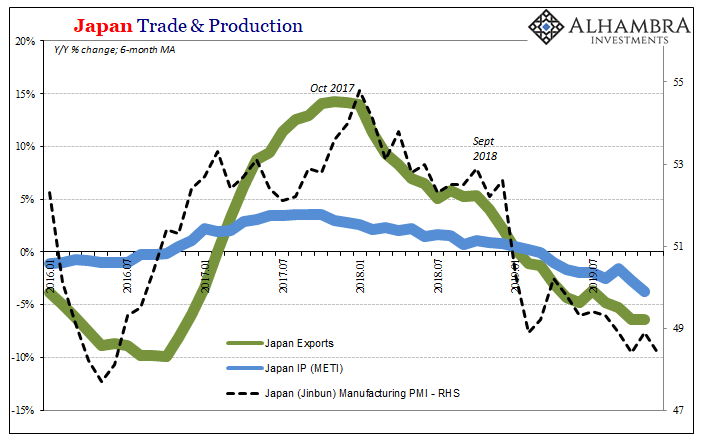

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.”

Read More »

Read More »

How an obsession with home ownership can ruin the economy | The Economist

Many dream of owning their own home, and thanks to huge financial incentives in the rich world many have been able to so. But government policies to encourage home ownership were a huge mistake. Read more here: https://econ.st/2v6sHo6 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

Calling Things by Their Real Names

One does not need money to convey one's thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week's explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.:

Read More »

Read More »

Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight. US President Trump and French president Macron agreed to take a step back from the digital tax dispute. The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light. The UK reported firm jobs data for November; BOJ kept policy steady, as expected.

Read More »

Read More »

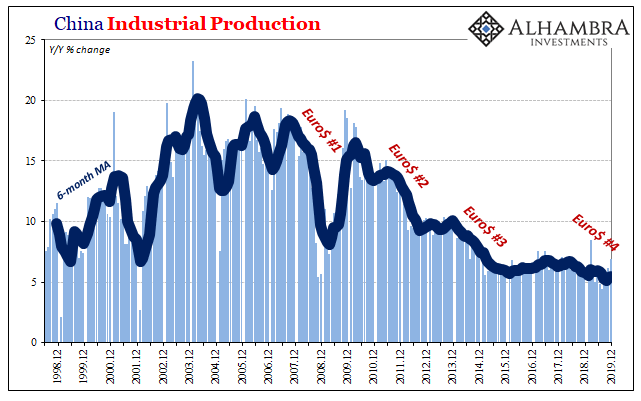

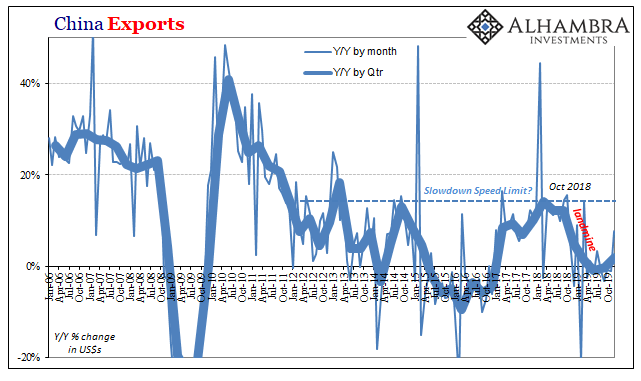

China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »

EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week.

Read More »

Read More »

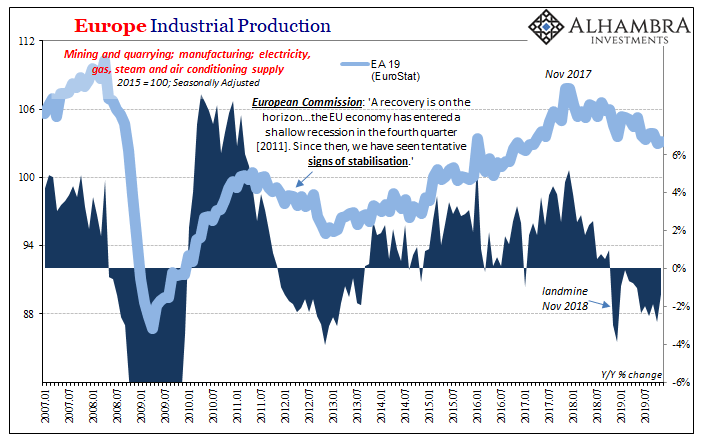

Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global...

Read More »

Read More »

Inside Iran: what’s next? | The Economist

When Iran’s military forces mistakenly shot down a Ukrainian passenger jet it sparked widespread protests around the country. Iran’s leaders face being overwhelmed by a crisis they created—how will they respond? Read more here: https://econ.st/30whzMT Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Iran’s leaders are facing unprecedented pressure from abroad and at …

Read More »

Read More »

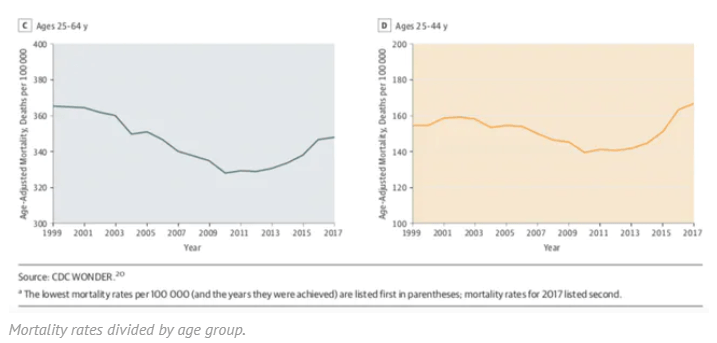

Inflation, But Only At The Morgue

Why is everyone so angry? How can socialism possibly be on such a rise, particularly among younger people around the world? Why are Americans suddenly dying off? According to one study, two-thirds of millennials are convinced they are doing worse when compared to their parents’ generation. Sixty-two percent say they are living paycheck to paycheck, with no savings and no way to get any (though they also tend to “overspend” when compared to other...

Read More »

Read More »

De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part.

Read More »

Read More »

Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal. The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today. Bank of England credit survey showed demand for loans fell in Q4. Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5%.

Read More »

Read More »

WTF: What The Fed?! Mike Maloney, Chris Martenson, Grant Williams & Charles Hugh Smith

Get the bonus video here: https://www.peakprosperity.com/wtf-what-the-fed-insights-from-advisers-sign-up “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free …

Read More »

Read More »

Instability Rising: Why 2020 Will Be Different

In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it. Economically, the 11 years since the Global Financial Crisis of 2008-09 have been one relatively coherent era of modest growth, rising wealth/income inequality and coordinated central bank stimulus every time a crisis threatened to disrupt the domestic or global economy.

Read More »

Read More »

Clarida Picks Up Some Data

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again).

Read More »

Read More »

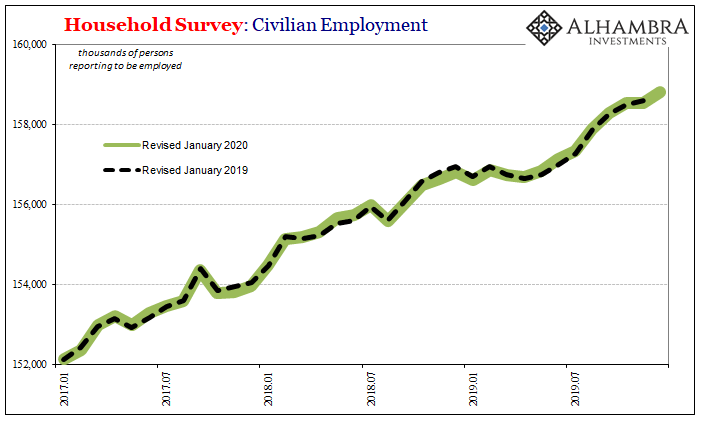

Very Rough Shape, And That’s With The Payroll Data We Have Now

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized...

Read More »

Read More »