Category Archive: 5) Global Macro

Your responses to “a minute to change the world” | The Economist

What is the one thing you would change to build a more open world—and how would you go about it? You told us your answers in a 60 second video with #OpenFuture See more from OpenFuture here: https://www.economist.com/openfuture #Openfuture playlist is here: https://goo.gl/ehUxFa Click here to subscribe to The Economist on YouTube: https://econ.st/2J1OgIw Daily Watch: …

Read More »

Read More »

The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

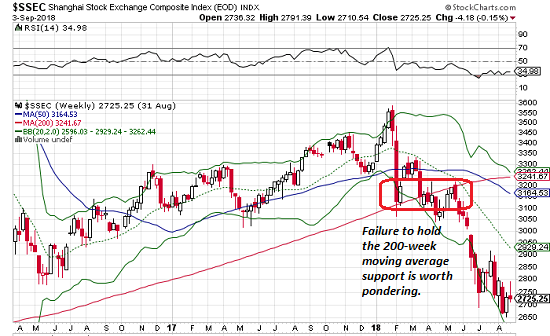

Currencies don't melt down randomly. This is only the first stage of a complete re-ordering of the global financial system. Take a look at the Shanghai Stock Market (China) and tell me what you see: A complete meltdown, right? More specifically, a four-month battle to cling to the key technical support of the 200-week moving average (the red line). Once the support finally broke, the index crashed.

Read More »

Read More »

How to tame tech giants | The Economist

Google, Facebook and Amazon are among the biggest companies in the world. Their dominance is worrying for consumers and competition. Here’s why. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Can you imagine life without Google, Facebook or Amazon? Chances are you’re actually on one of those platforms right now watching this. These …

Read More »

Read More »

Emerging Market Week Ahead Preview

EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday.

Read More »

Read More »

Emerging Markets: What Changed

China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned.

Read More »

Read More »

‘Mispriced’ Bonds Are Everywhere

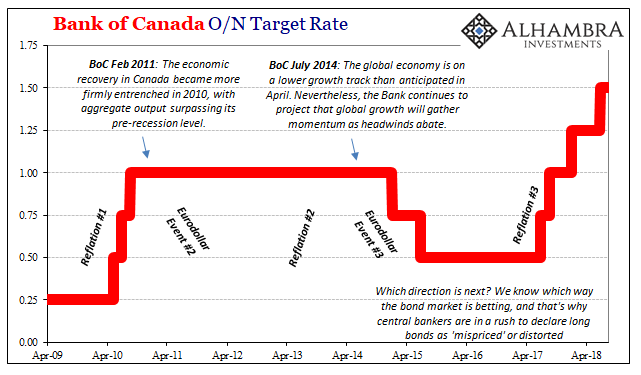

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

Why Is Productivity Dead in the Water?

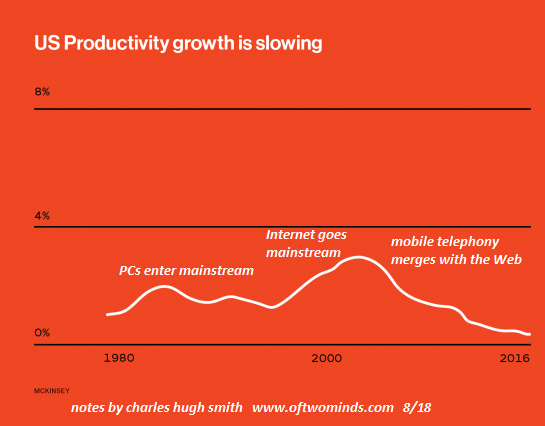

As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value.

Read More »

Read More »

Why startups are leaving Silicon Valley | The Economist

The future of Silicon Valley is The Economist’s cover story this week. Why are people leaving, and startups going elsewhere? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For decades Silicon Valley has been where you go if you want to make it big in technology but these days entrepreneurs are starting to …

Read More »

Read More »

Disease around the world: mapping the contagion | The Economist

Humanity has only ever eradicated one human disease: smallpox. Progress has been made with big killers such as malaria and AIDS but there is still a lot of work to do. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy In the 1980s Polio paralysed 1,000 children globally every 24 hours. Today it has …

Read More »

Read More »

Here’s How We Ended Up with Predatory, Parasitic Elites

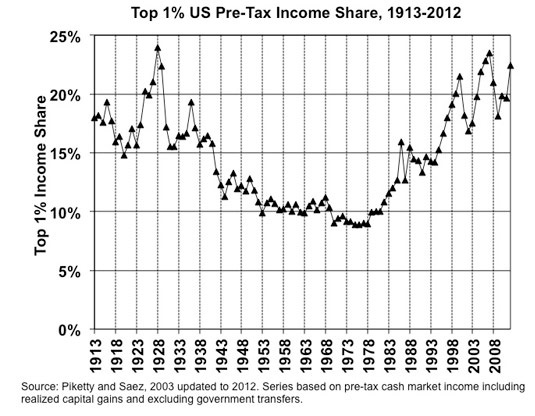

Combine financialization, neoliberalism and moral bankruptcy, and you end up with predatory, parasitic elites.

How did our financial and political elites become predatory parasites? Some will answer that elites have always been predatory parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.

Following in Ancient Rome's Footsteps: Moral Decay,...

Read More »

Read More »

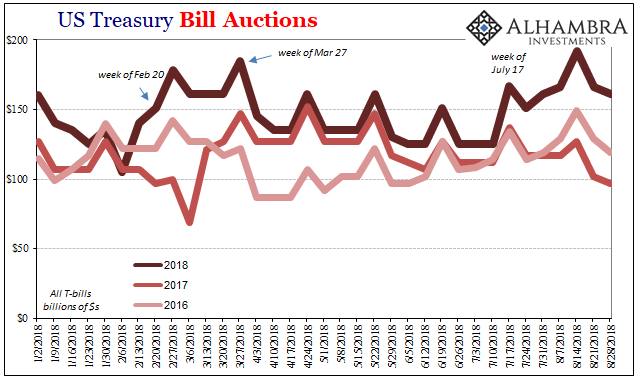

Anticipating How Welcome This Second Deluge Will Be

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

Read More »

Read More »

EuroDollar University, Season 2, Part 1

Erik Townsend and Patrick Ceresna welcome Jeffrey Snider back to MacroVoices for Part 1 of Season 2 of the new Eurodollar University series. During this episode, Erik and Jeff discuss the lost dollar decade and put into context the global dollar markets. They further dive into the shadow of the great financial crisis and liquidity …

Read More »

Read More »

YouTube’s battle for free speech | The Economist

Over one billion hours of YouTube videos are viewed every day. A new generation of content creators are harnessing the power of the social-media platform, but they’re also grappling with issues surrounding censorship and free speech. #creatorsforchange Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Some of YouTube’s most popular clips have been …

Read More »

Read More »

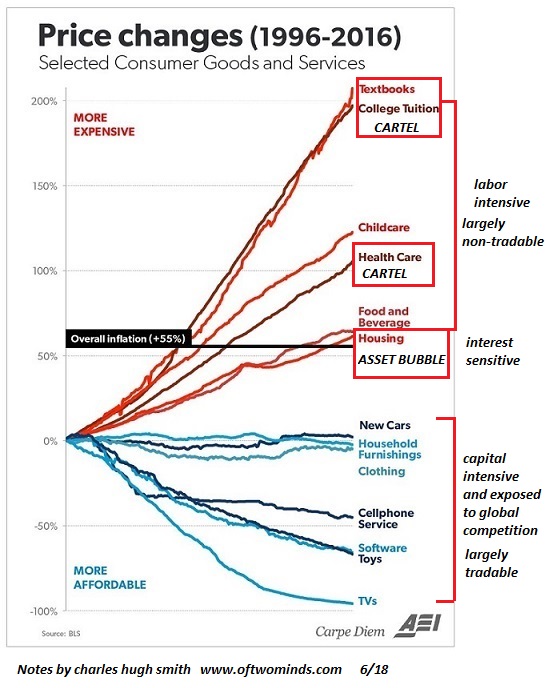

To Understand America’s Neofeudal Economy, Start with Extortion

Let's spin the time machine back to the late Middle Ages, at the height of feudalism, and imagine we're trying to get a boatload of goods to the nearest city to sell. As we drift down the river, we're constantly being stopped and charged a fee for transiting one small fiefdom after another. When we finally reach the city, there's an entry fee for bringing our goods to market.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM.

Read More »

Read More »

Global PMI’s Hang In There And That’s The Bad News

At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

Read More »

Read More »

Trump corruption: the creatures that live in the Washington swamp | The Economist

President Trump has been caught up in a corruption scandal involving two of his associates, Michael Cohen and Paul Manafort. The White House is sinking further into the Washington swamp. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

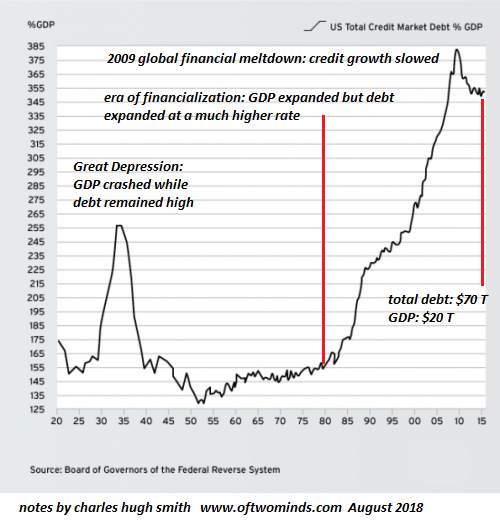

How “Wealthy” Would We Be If We Stopped Borrowing Trillions Every Year?

These charts reflect a linear system that is wobbling into the first stages of non-linear destabilization.

The widespread presumption is the U.S. is wealthy beyond words, and will remain so as far as the eye can see: wealthy enough to fund trillion-dollar weapons systems, trillion-dollar endless wars, multi-trillion dollar Medicare for all, multi-trillion dollar Universal Basic Income, and so on, in an endless profusion of endless trillions....

Read More »

Read More »

Cocaine: why the cartels are winning | The Economist

America spends $40bn a year on the war on drugs. But its “zero tolerance” approach has done little to curb addiction or overdose rates, which are the highest in the world. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »