Category Archive: 5) Global Macro

AxisOfEasy Salon #1: Hypernormalisation, Legitimacy and Simulacrum

The first episode in the AxisOfEasy Salon and Interviews series with the AoE Contributors: Charles Hugh Smith, Jesse Hirsh and Mark E. Jeftovic.

Read More »

Read More »

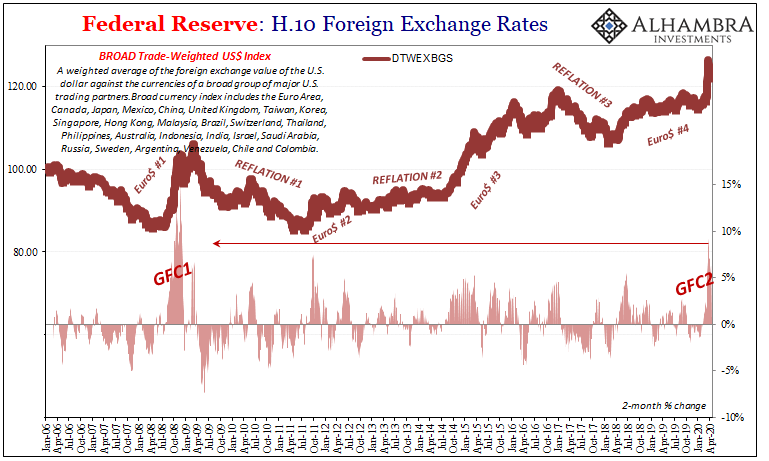

The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel.

Read More »

Read More »

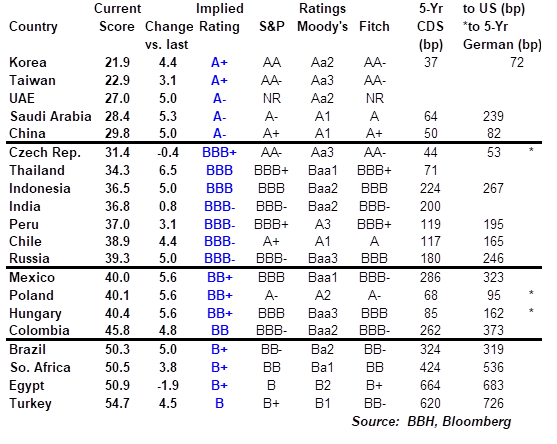

EM Sovereign Rating Model For Q2 2020

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come.

We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs.

Read More »

Read More »

Jeff Snider: the world banking EuroDollar system Jedi

Shadow Banking. Go look up Jeff Snider. This is not an advertisement. He's just the best resource for learning about the world banking system, called the EuroDollar system. He has Twitter, and EuroDollar University videos on YouTube.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

Dollar Stalls as Market Sentiment Improves

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln. Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

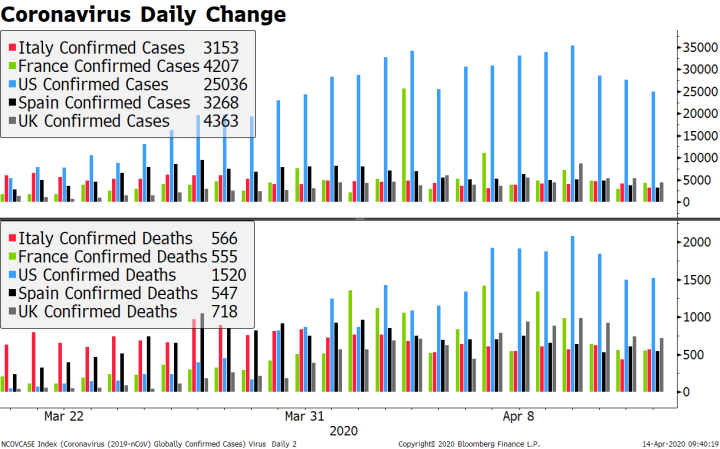

Covid-19: Why is America’s death toll so high? | The Economist

America's covid-19 death toll is higher than anywhere else in the world—and is continuing to mount. What’s behind the country’s coronavirus pandemic failings? Read more here: https://econ.st/2zl0BaX

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Sign up to The...

Read More »

Read More »

Covid-19: Why is America’s death toll so high? | The Economist

America’s covid-19 death toll is higher than anywhere else in the world—and is continuing to mount. What’s behind the country’s coronavirus pandemic failings? Read more here: https://econ.st/2zl0BaX Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ Sign …...

Read More »

Read More »

Dollar Firm as Equities and Oil Start the Week Under Pressure

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains. Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US.

Read More »

Read More »

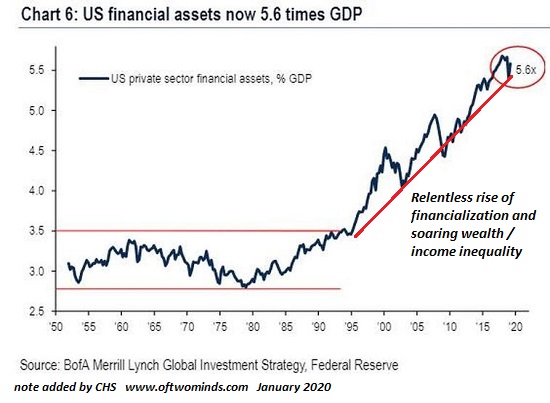

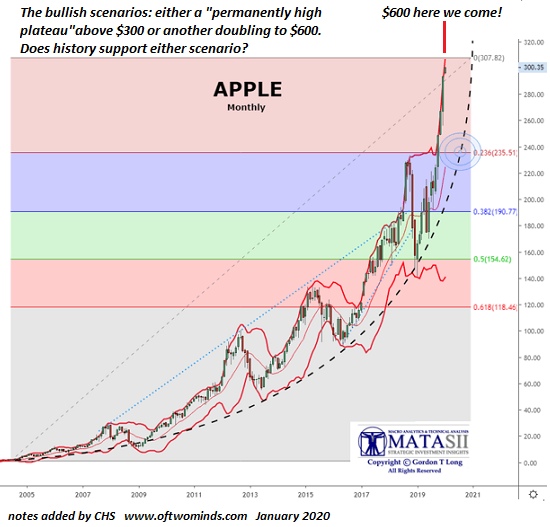

Overcapacity / Oversupply Everywhere: Massive Deflation Ahead

The price of a great many assets will crash, out of proportion to the decline in demand. Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy.

Read More »

Read More »

Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to "open for business." The two demands are inherently incompatible, and so neither one can be fulfilled.

Read More »

Read More »

How Cape Town became a murder capital | The Economist

Cape Town is one of the most murderous cities in the world. How did it become the gangland-shooting capital of Africa? Read more here: https://econ.st/2VC9LY3 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading: Read our 2019 special report on South Africa: https://econ.st/2RKaJAv Read our interview with Cyril Ramaphosa: https://econ.st/2VGjQU1 For more …

Read More »

Read More »

All About The Repo Markets with Jeff Snider – April 15, 2020

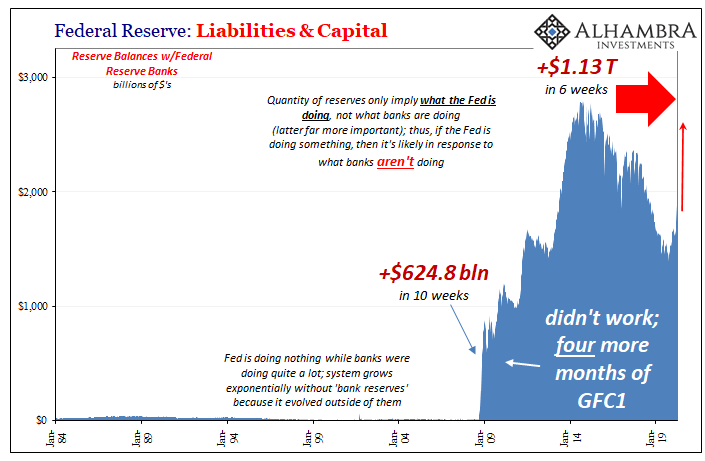

Jeff Snider, Head of Global Research at Alhambra Investment Partners, takes the time with us to discuss what the Repo market is, how this market is used and why the Repo market can cause large moves in equities markets and across many assets.

Join our list to be informed of future high-quality events such as this one: http://eepurl.com/drE6vH

Read More »

Read More »

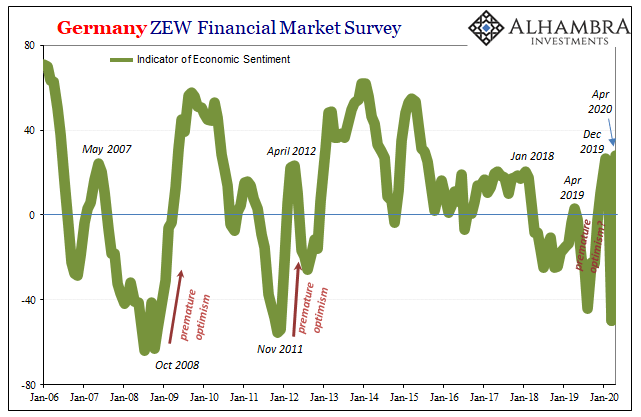

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure. The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating. With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend.

Read More »

Read More »

Dollar Under Modest Pressure as Europe Returns from Holiday

The tug of war between extending vs. softening lockdowns continues. The dollar remains under modest pressure but we think it will eventually recover; Bernie Sanders has endorsed Joe Biden. Europe reopens from holiday today but the news stream remains light; South Africa surprised with an emergency 100 bp rate cut.

Read More »

Read More »

There’s No Going Back, We Can Only Go Forward

What I see is a global collapse of intangible capital that is invisible to most people. It's only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it's three months or six months or 18 months, "the good old days" will return just as if we turned back the clock.

Read More »

Read More »

Buy The Tumor, Sell the News

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news (tm) is not a typo: the stock market is a lethal tumor in our economy and society.

Read More »

Read More »

The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work.

Read More »

Read More »