Category Archive: 5) Global Macro

Covid-19: why the economy could fare worse than you think | The Economist

Three months after lockdown was relaxed in China, its economy is now running at around 90% of normal levels. Although 90% may sound fine, for many it could be catastrophic. Read more here: https://econ.st/2AeZ86k Further reading: Sign up to The Economist’s daily newsletter to keep up to date with our latest covid-19 coverage: https://econ.trib.al/YD53WI6 Find …

Read More »

Read More »

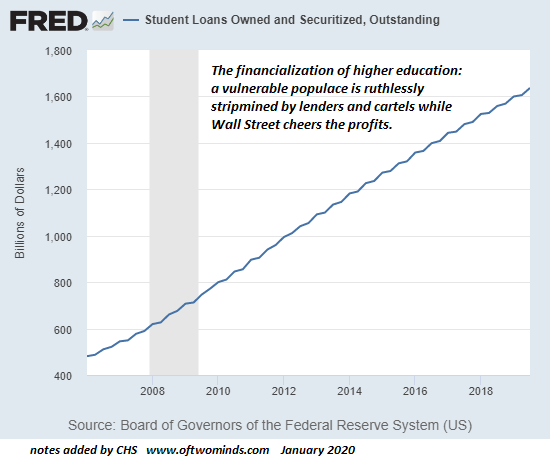

Re-Opening the Economy Won’t Fix What’s Broken

Re-opening a fragile, brittle, bankrupt, hopelessly perverse and corrupt "normal" won't fix what's broken. The stock market is in a frenzy of euphoria at the re-opening of the economy. Too bad the re-opening won't fix what's broken. As I've been noting recently, the real problem is the systemic fragility of the U.S. economy, which has lurched from one new extreme to the next to maintain a thin, brittle veneer of normalcy.

Read More »

Read More »

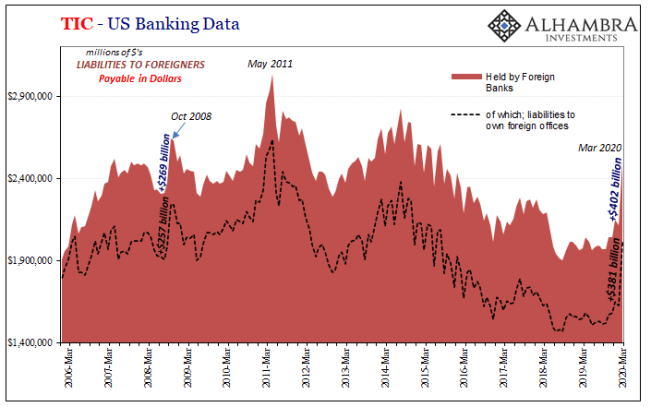

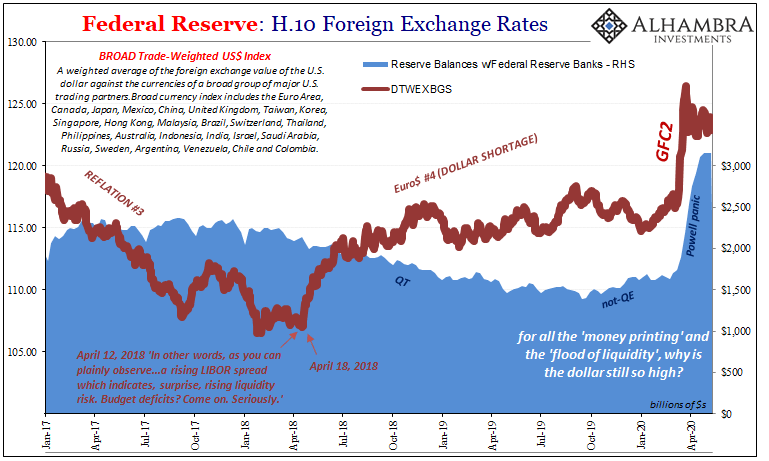

So Much Dollar Bull

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered.In second place (now third)...

Read More »

Read More »

Crypto Soundbites 3 – Jeff Snider, Defiance and Lyn Alden

3 clips this week, Defiance takes a big look at how you money gets diluted. Jeff Snider takes on the Fed and Nathaniel Whitmore talks to Lyn Alden about how the potential for Inflation vs Deflation. Links to the episodes below.

What the Fed with Jeff Snider https://youtu.be/E2gCKaejiso

Lyn Alden https://www.youtube.com/watch?v=fEhDdWJZ3HI

Defiance https://www.defiance.news/podcast/the-money-game-cheaters-edition

Read More »

Read More »

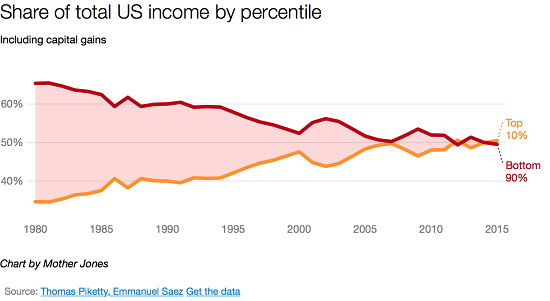

The Pandemic Gives Us Permission To Get What We Always Wanted

Dear Corporate America: maybe you remember the old Johnny Paycheck tune? Let me refresh your memory: take this job and shove it. Put yourself in the shoes of a single parent waiting tables in a working-class cafe with lousy tips, a worker stuck with high rent and a soul-deadening commute--one of the tens of millions of America's working poor who have seen their wages stagnate and their income becoming increasingly precarious / uncertain while the...

Read More »

Read More »

Dollar Firm as China’s Hong Kong Gambit Triggers Risk-Off Trading

Legislation was introduced that allows Beijing to directly impose a national security law on Hong Kong; US-China tensions are still rising; the dollar is bid as risk-off sentiment takes hold. There are no US data reports or Fed speakers today; Canada reports March retail sales; Mexico reports mid-May CPI.

Read More »

Read More »

Why politicians have failed to tackle climate change | The Economist

Global warming is the defining threat facing the planet. So why has so little been done to curb it? Read more here: https://econ.st/3gevRJu

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

Sign up to receive The Economist’s fortnightly newsletter to keep up to date with our latest coverage on climate change: https://econ.st/3dZrKz6

Find our school briefings series here, including our recent climate explainers:...

Read More »

Read More »

Why politicians have failed to tackle climate change | The Economist

Global warning is the defining threat facing the planet. So why has so little been done to curb it? Read more here: https://econ.st/3gevRJu Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Sign up to receive The Economist’s fortnightly newsletter to keep up to date with our latest coverage on climate change: https://econ.st/3dZrKz6 Find …

Read More »

Read More »

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

Dollar Firm as US-China Tensions Flare

The virus news stream is mixed; the dollar has stabilized; US-China tensions continue to ratchet up. We will get some more US economic data for May; weekly jobless claims are expected at 2.4 mln. Eurozone and UK reported firm preliminary May PMI readings; BOE officials continue to take a very dovish tone.

Read More »

Read More »

What the Fed. w/ Jeff Snider & Emil Kalinowski; Crypto Liquidity, Inflation… and he hints at XRP

We have the honor of Hosting Alhambra Investments Chief Researcher, Jeff Snider and Eurodollar University's own Emil Kalinowski and we're going to peel back the layers or "perceived" layers of the Federal Reserve and Broader Financial Markets and ask the question... what would REAL US STIMULUS look like?

It's going to be an incredible Show!

Check out Eurodollar University - Alhambra Investments...

Read More »

Read More »

The Claims Podcast – Episode #1 – Jeff Snider

In the inaugural episode of The Claims Podcast, LSG COO Matthew Markham sits down with Jeff Snider of Gradient AI to discuss the future of predictive analytics in insurtech, legaltech and regtech. Both LSG and Gradient AI offer machine-learning-enabled software for insurance companies, TPAs and enterprises in order to bring down the cost of their legal spend, as part of a broader litigation spend management strategy.

***

ABOUT LSG

Website:...

Read More »

Read More »

Dollar Treads Water Ahead of FOMC Minutes

The virus news stream is mixed; the dollar has stabilized a bit. FOMC minutes will be released; Canada reports April CPI and March wholesale trade sales; the news from Brazil keeps getting worse. Another group of EU nations will release their own plan in a rebuttal of France and Germany; UK reported April CPI data.

Read More »

Read More »

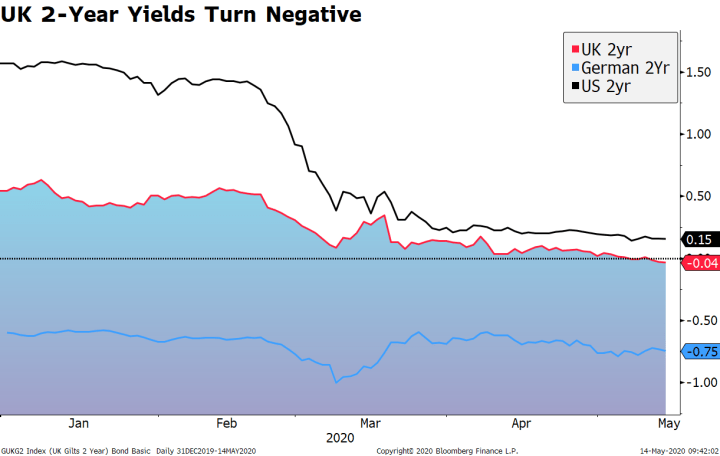

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

Consumer Spending Will Not Rebound–Here’s Why

Any economy that concentrates its wealth and income in the top tier is a fragile economy. There are two structural reasons why consumer spending will not rebound, no matter how open the economy may be. Virtually everyone who glances at headlines knows the global economy is lurching into either a deep recession or a full-blown depression, depending on the definitions one is using. Everyone also knows the stock market has roared back as if nothing...

Read More »

Read More »

Covid-19: Britain’s chief of the defence staff talks about the military challenges | The Economist

Armed forces around the world have mobilised to fight covid-19. General Sir Nick Carter, the most senior uniformed military adviser to the British government, talks to Anne McElvoy about the challenges—and dangers—posed by the pandemic. See all of The Economist’s podcasts here: https://econ.st/3g58fak China’s opacity has allowed conspiracy theories around covid-19’s origins to flourish. Where …

Read More »

Read More »

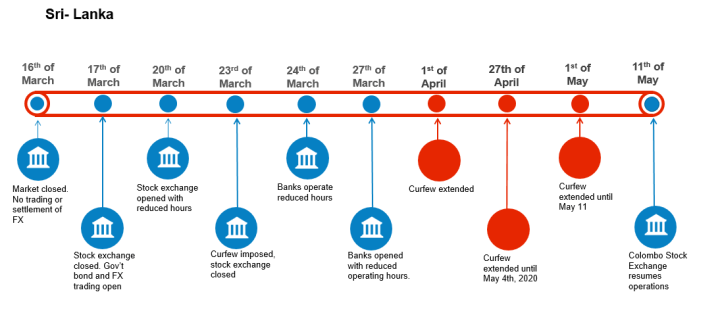

Restricted Market Trading Comments

Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below

Read More »

Read More »

There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

The Collapse of Main Street and Local Tax Revenues Cannot Be Reversed

The core problem is the U.S. economy has been fully financialized, and so costs are unaffordable. To understand the long-term consequences of the pandemic on Main Street and local tax revenues, we need to consider first and second order effects. The immediate consequences of lockdowns and changes in consumer behavior are first-order effects: closures of Main Street, job losses, massive Federal Reserve bailouts of the top 0.1%, loan programs for...

Read More »

Read More »

Dollar Firm as Risk-off Sentiment Intensifies

Risk-off sentiment has intensified; as a result, the dollar is getting some more traction. Fed Chair Powell pushed back against the notion of negative rates in the US; US Treasury completed its quarterly refunding. Weekly jobless claims are expected at 2.5 mln vs. 3.169 mln last week; Mexico is expected to cut rates 50 bp to 5.5%

Read More »

Read More »