Category Archive: 5) Global Macro

The Fed’s Grand Bargain Has Finally Imploded

The Fed has backed itself not into a corner but to the edge of a precipice. Though the Federal Reserve never stated its Grand Bargain explicitly, their actions have spoken louder than their predictably self-serving, obfuscatory public pronouncements. Here's the Grand Bargain they offered institutional investors and speculators alike.

Read More »

Read More »

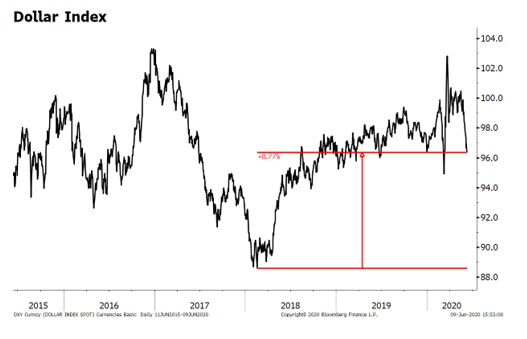

Dollar Suffers as Stimulus Efforts Boost Market Sentiment

Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered. The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today. The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight.

Read More »

Read More »

Fed Balance Sheet: Swap Me Update

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not.Meaning, there is purpose.

Read More »

Read More »

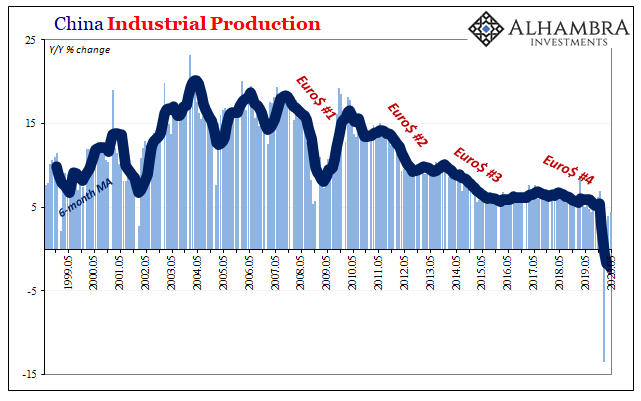

A Chinese Outbreak (of Li v. Xi, Round 2)

Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics? Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi...

Read More »

Read More »

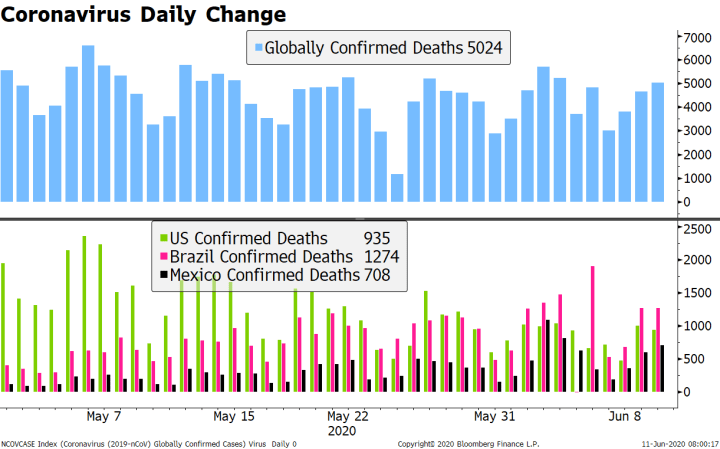

Is the Pandemic Over and a V-Shaped Recovery Baked In?

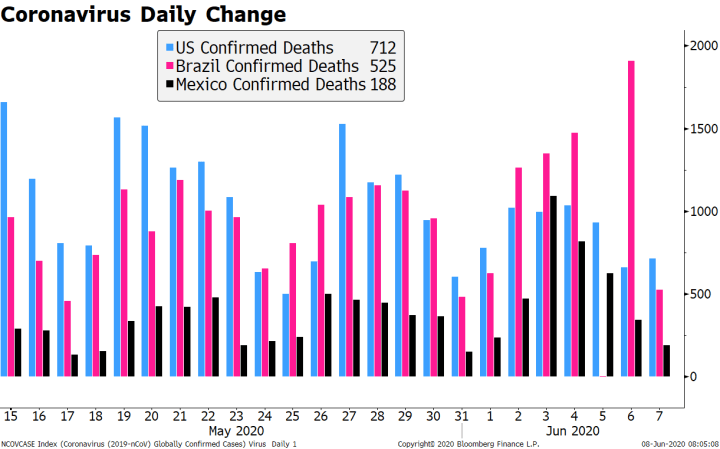

So what do we know with any sort of certainty about the claim that "the pandemic is over"? Very little. Is the pandemic over in China, Europe, Japan and the U.S./Canada? Is the much-anticipated V-Shaped economic recovery already baked in, i.e. already gathering momentum? The consensus, as reflected by the stock market (soaring), the corporate media and governmental easings of restrictions seems to be "yes" to both questions.

Read More »

Read More »

EM Preview for the Week Ahead

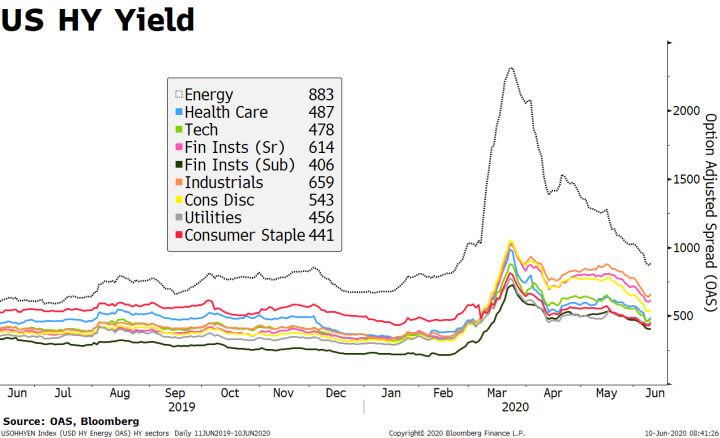

EM and other risk assets stabilized to end the week after Thursday’s selloff, but remain vulnerable. The risks ahead are the same as before, which include a second wave of infections as well as a longer and shallower than expected recovery in global growth. The Fed’s message of low rates as far as the eye can see was balanced by Powell’s grim outlook for unemployment.

Read More »

Read More »

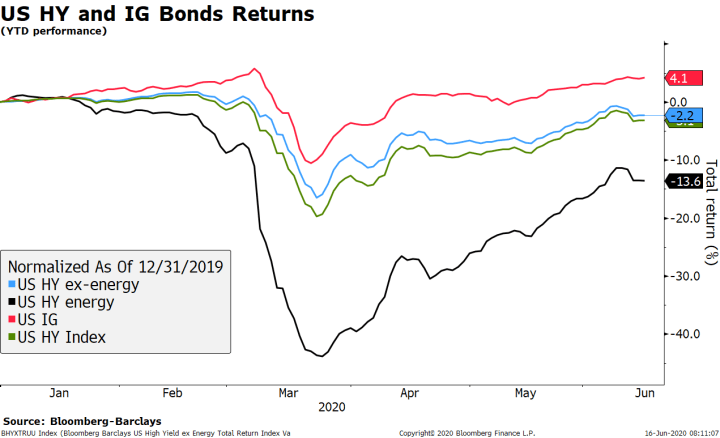

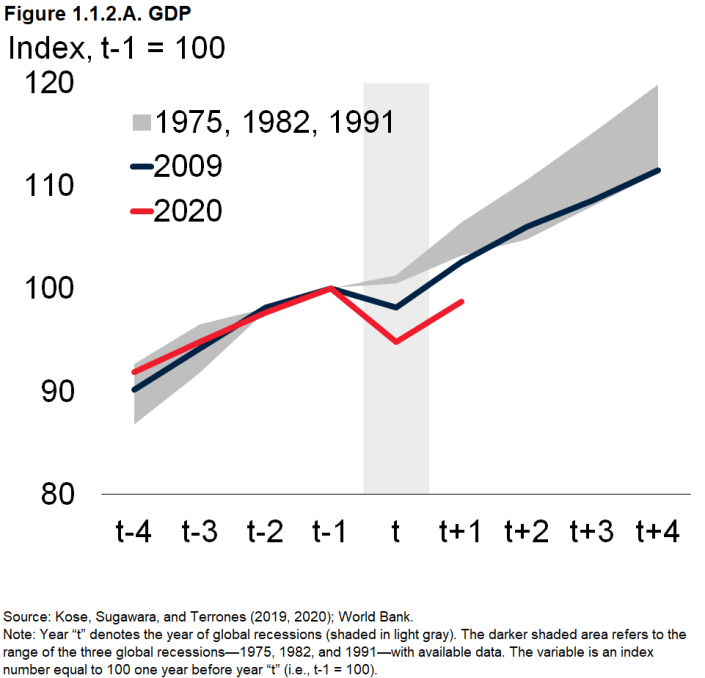

This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The Right

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations...

Read More »

Read More »

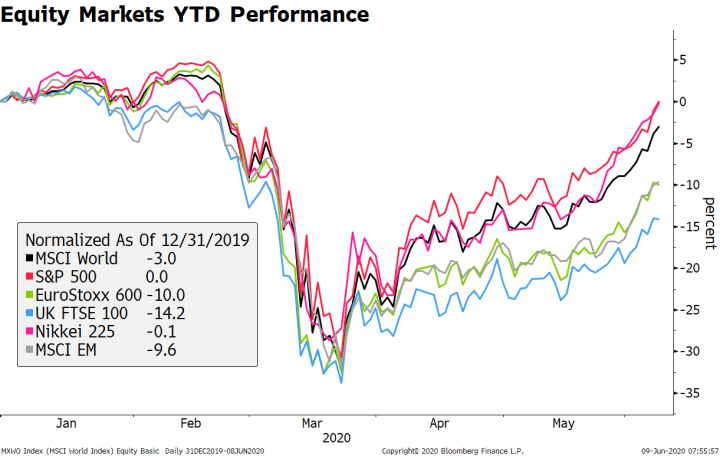

Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t).

Read More »

Read More »

How to fix America’s police | The Economist

George Floyd's killing has reignited #BlackLivesMatter and sparked calls for America to defund its police forces, with some arguing that this is the only way to overcome systemic racism. But defunding is not the only option. Read more here: https://econ.st/3cTUit7

Read our obituary for George Floyd here: https://econ.st/3dTWeTK

The killing of George Floyd has sparked protests around the world: https://econ.st/3dWSh0n

How history is repeated in...

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Intensifies After FOMC Decision

Concerns about still rising infection numbers and a second wave ofCovid-19 have contributed to today’s downdraft in risk assets; for now, the weak dollar trend is hard to fight. Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal; stocks have not reacted well to the Fed; weekly jobless claims and May PPI will be reported.

Read More »

Read More »

Deep State to Powell: Stop Goosing Stocks Higher Or You’ll Re-Elect Trump

Come on, Jay, you can always goose stocks back to new highs after the election. Indulge me for a moment in some backroom speculation. It's absurdly obvious that the unelected, permanent, ever-expanding National Security State, a.k.a the Deep State, and its Democratic Party allies have been attempting to torpedo Donald Trump since the 2016 election took them by surprise. (Imagine doing everything that worked so well in the past and failing at the...

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Takes Hold

Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction. The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus.

Read More »

Read More »

We Have Reached The Silly Phase of the Bull Market

Have we entered a new bull market? Was the 35% pullback in the S&P 500 in March the fastest bear market in history? Or is this just a continuation of the bull market that started in 2009, interrupted by a rather large correction? Bull markets and bear markets are about behavior, about the human emotions of fear and greed. While we got a brief bout of fear in March, greed has since overwhelmed all sense, common and otherwise.

Read More »

Read More »

Dollar Broadly Weaker Ahead of FOMC Decision

The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar. Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation. We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m.

Read More »

Read More »

Dollar Stabilizes as the New Week Begins

The dollar has stabilized a bit; Friday’s US jobs data could be a game changer. The US bond market selloff continues; for now, the weak dollar trend is hard to fight. The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics.

Read More »

Read More »

Jeff Snider! Huge Money Printing Speaks For Itself

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Our Latest Thoughts on the Dollar

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows.

Read More »

Read More »

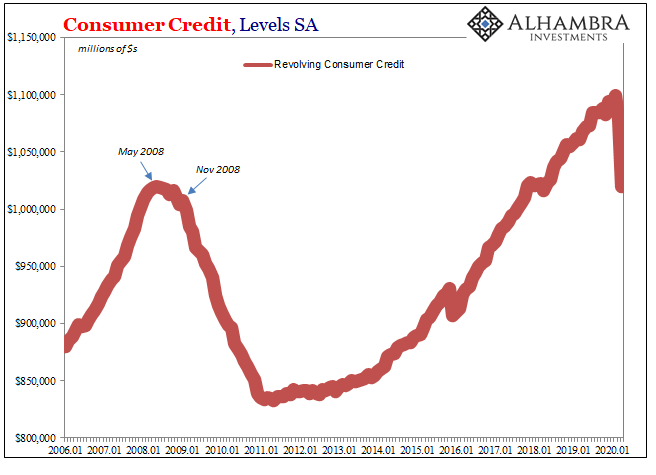

A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail.

Read More »

Read More »

Charles Hugh Smith: This Event Has Revealed The Failures Of Government & Central Banks

https://rebrand.ly/gunstorage Charles Hugh Smith: This Event Has Revealed The Failures Of Government & Central Banks Mac SlavoJune 1st, 2020SHTFplan. com Central banking and centralized planning has failed. This “event,” also well-known as a scamdemic, or plandemic, has proven that the government always fails, and to give them another chance is simply ludicrous. Charles Hugh …

Read More »

Read More »

Global Crisis: the Convergence of Marx, Kafka, Orwell and Huxley

The global crisis is not merely economic; it is the result of profound financial, sociological and political trends described by Marx, Kafka, Orwell and Huxley. The unfolding global crisis is best understood as the convergence of the dynamics described by Marx, Kafka, Orwell and Huxley.

Read More »

Read More »