Category Archive: 5) Global Macro

Fama 2: No Inflation For Old Central Banks

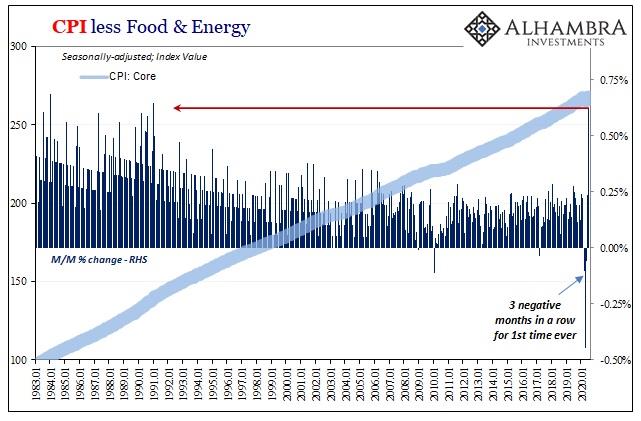

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level.

Read More »

Read More »

Charles Hugh Smith – In The World Change Process

The world is in the process of change. Especially in terms of health and economy, the world has experienced the biggest chaos of recent times. We are seeing signs of transition to the new economic order. What are the plans?

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy

#silverprice...

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

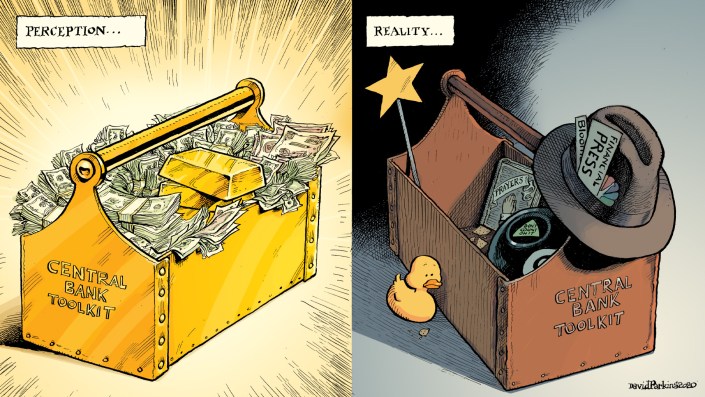

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

Dollar Softens, Equities Rise as Markets Ignore the Negatives

Markets seem to be increasingly desensitized to the usual negative drivers; the dollar is under pressure again. Stimulus talks remain stalled; reports suggest Trump is mulling a capital gains tax cut of some sort. US data highlight today will be July PPI; US Treasury begins its record $112 bln quarterly refunding.

Read More »

Read More »

Science of Sentiment: Zooming Expectations Wonder

It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them. What would a “united” European system do to try and fill in this massive hole?The...

Read More »

Read More »

Shrinkflation, Hidden Inflation, and Jeff Snider

A certain faction (e.g. Jeff Snider, Jerome Powell, Paul Krugman) continues to beat home the idea that there is no inflation. If you remove everything that rises from the CPI and then fail to count substitutions or shrinkflation, you can come to that conclusion. But if you live in the real world, you know this is not reality. In this episode we cover hidden inflation and shrinkflation.

Read More »

Read More »

* Jeff Snider! Huge Money Printing Speaks For Itself

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

SPECIAL REPORT: Follow The Money – Volume 5

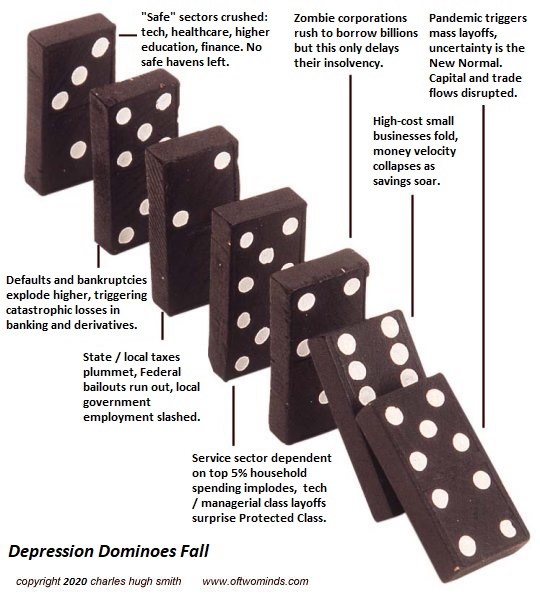

If the recession was the first “shoe to drop”, what’s the second…or third? The shock of the self-inflicted COVID recession is behind us. What we’re all wondering now is what comes next? Will the economy recover to its previous state? Something better? Something worse? That will be determined by the second and third-order effects and they are already starting.

Read More »

Read More »

A Second JOLTS

What happens when we are stunned and dazed? We filter out the noise to focus on the bare basics by getting back to our instincts, acting reflexively based upon our deeply held beliefs and especially training. When faced with a crisis and there’s no time to really think, shorthand will have to suffice.

Read More »

Read More »

The Economy Is Mortally Wounded

A fully financialized, totally debt and speculation-dependent economy is terminal once leverage and debt stop expanding exponentially. We all know the movie scene in which the character is wounded but dismisses it as no big deal, and then lurches into the closing sequence where we discover the wound was not inconsequential, it was mortal, and the character expires.

Read More »

Read More »

EM Preview for the Week Ahead

The dollar got some traction against the majors towards the end of last week. This weighed on EM FX, with the high best currencies TRY, BRL, CLP, and ZAR leading the losers. We downplay risk of contagion from Turkey, but we acknowledge it will keep investors wary of the countries with poor fundamentals.

Read More »

Read More »

If the “Market” Never Goes Down, The System Is Doomed

"Markets" that never go down aren't markets, they're signaling mechanisms of the Powers That Be. Markets are fundamentally clearing houses of information on price, demand, sentiment, expectations and so on--factual data on supply and demand, shipping costs, cost of credit, etc.--and reflections of trader and consumer emotions and psychology.

Read More »

Read More »

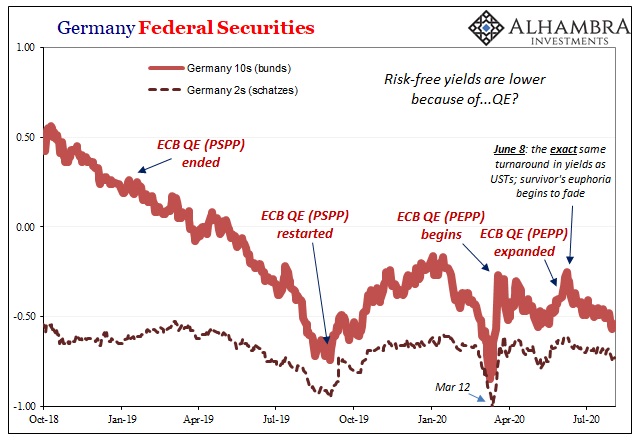

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »

Election 2020: what a Biden victory could mean for America | The Economist

Joe Biden currently stands a good chance of winning the presidency. He is a lifelong centrist, but could turn out to be the most ambitious Democratic president in generations. Read more here: https://econ.st/31Ammy6

Find The Economist’s most recent coverage of the 2020 US election here: https://econ.st/3a2ptCN

Sign up to “Checks and Balance”, our weekly newsletter on American politics: https://econ.st/3grrESz

Listen to the “Checks and Balance”...

Read More »

Read More »

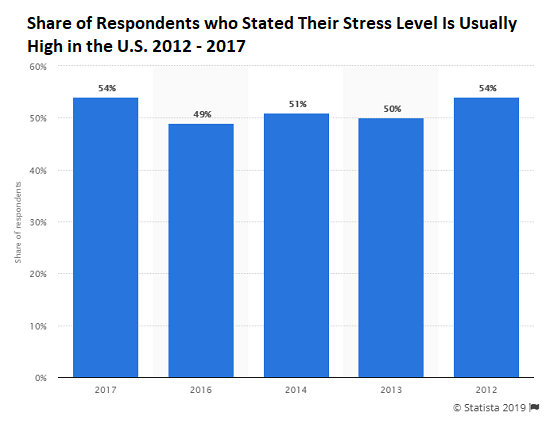

The Bogus “Recovery,” Stress and Burnout

We have three basic ways to counter the destructive consequences of stress.We have all experienced the disorientation and "brain freeze" that stress triggers. The pandemic and the responses to the pandemic have been continuous sources of stress, i.e. chronic stress, which is the pathway to burnout, the collapse of our ability to cope with the burdens pressing on us.

Read More »

Read More »

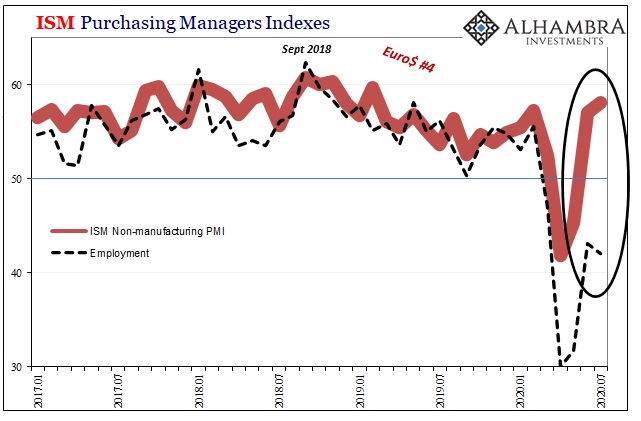

Purchasing Managers Indigestion

There’s already doubt given how the two major series supposedly measuring the same thing seemingly can’t agree. If the rebound was truly robust, it would show up unambiguously everywhere. But IHS Markit’s purchasing managers indices struggled to get back above 50 in July, barely getting there, suggesting the economy might be slowing or even stalling way too close to the bottom.

Read More »

Read More »

5 Tax Strategies to Help you Hold on to Your Money in Retirement

What is retirement, really? We think we know. So, we do our best to prepare for both current circumstances and as many surprises as we can conjure up. After all, with people living longer than ever before your money has to last longer than ever before.

Read More »

Read More »

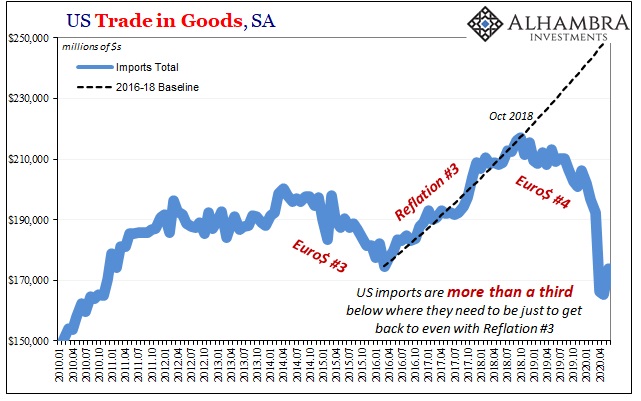

Summer Special – Deep Dive into U.S. Dollar with Jeff Snider

MacroVoices Erik Townsend and Patrick Ceresna welcome Jeff Snider to the show to discuss the U.S. Dollar system, structurally how it works and why it’s leading systemically to a dollar shortage.

Read More »

Read More »

Accusing the Accused of Excusing the Mountain of Evidence

Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

Read More »

Read More »

EM Preview for the Week Ahead

EM currencies took advantage of broad dollar weakness against the majors last week, with most gaining against the greenback. Yet the week ended on a bit of a risk-off note as concerns intensified about the resurgent virus and the impact on the still-weak global economy.

Read More »

Read More »