Category Archive: 5.) Charles Hugh Smith

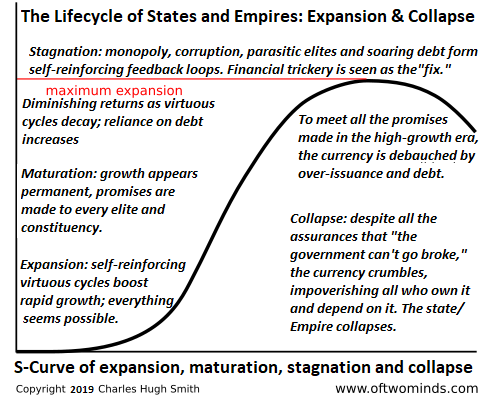

How States/Empires Collapse in Four Easy Steps

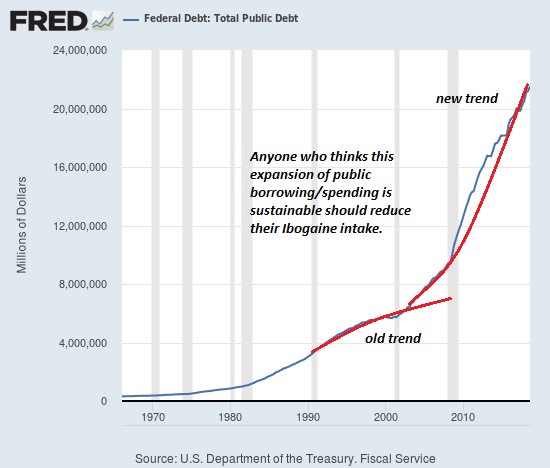

There is a grand, majestic tragedy in the inevitable collapse of once-thriving states and empires: it all seemed so permanent at its peak, so godlike in its power, and then slowly but surely, too many grandiose, unrealistic promises were made to too many elites and constituencies, and then as growth decays to stagnation, the only way to maintain the status quo is to appear to meet all the promises by creating money out of thin air, i.e. debauching...

Read More »

Read More »

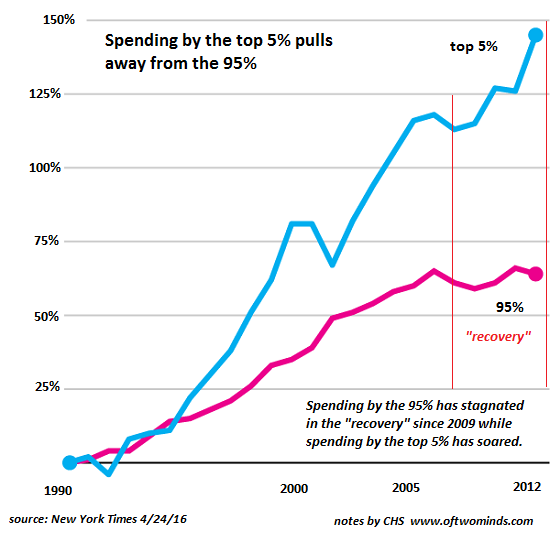

Here’s The Problem: The Pie Is Shrinking

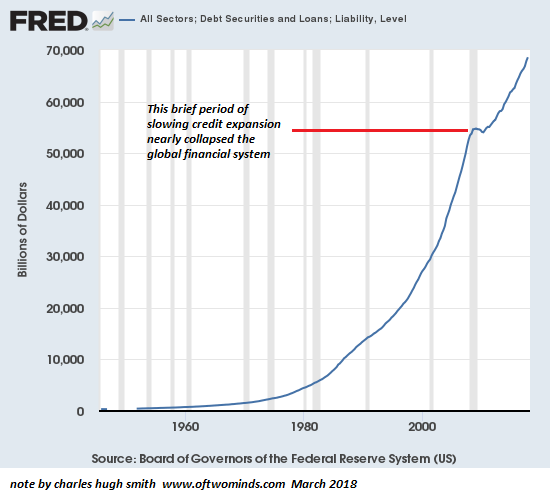

Scrape away the churn and distraction and the problem is simple: the pie of prosperity is shrinking, and the "fixes" are failing. The status quo arrangement is based on the endless expansion of "growth" and debt, which is the monetary fuel of more, more, more of everything: money, energy, resources, goods, services, jobs, wealth and income, all of which make up the elixir of prosperity.

Read More »

Read More »

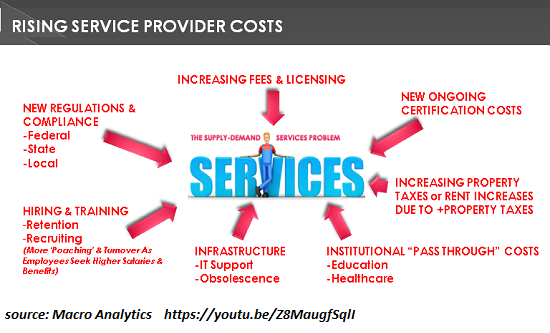

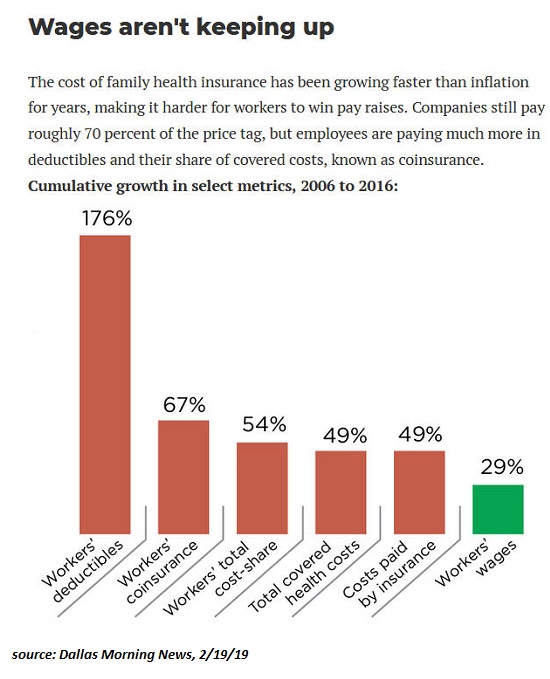

The Source of Killer Inflation: Services

The soaring cost of services is driven by a number of factors. What will the future bring: fire (inflation) or ice (deflation)? The short answer: both, but in very different doses. Goods that are tradeable and exposed to technologically driven commodification will decline in price (deflation) while untradeable services that are difficult to commoditize will increase in price (inflation), generating a self-reinforcing feedback loop of wage-price...

Read More »

Read More »

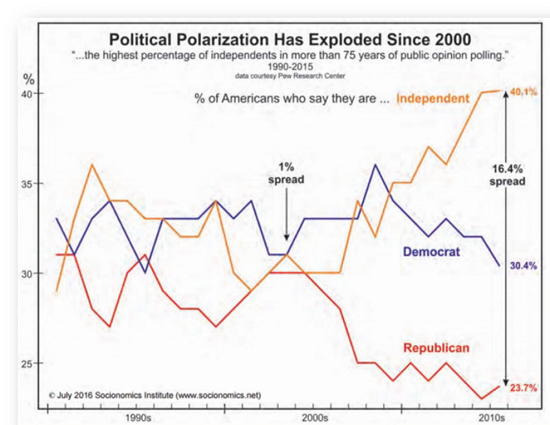

What If Politics Can’t Fix What’s Broken?

This is the politics of decline and collapse. The unspoken assumption of the modern era is that politics can fix whatever is broken: whatever is broken in society or the economy can be fixed by some political policy or political process-- becoming more inclusionary, seeking non-partisan middle ground, etc.

Read More »

Read More »

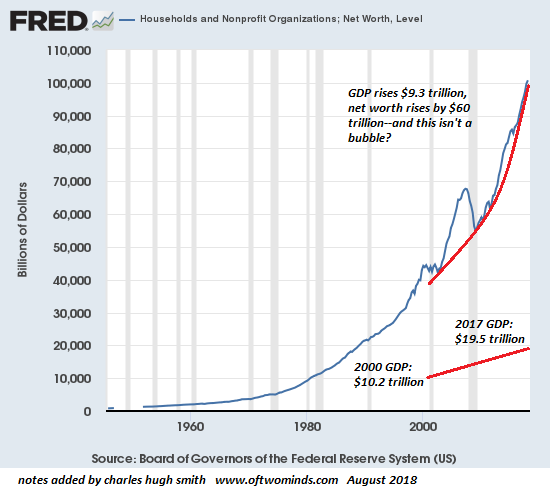

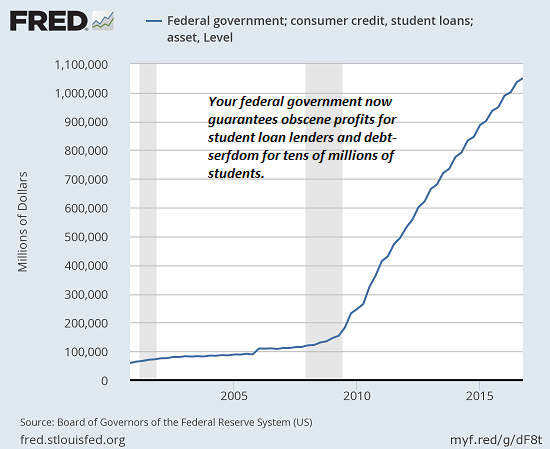

The Fed’s “Wealth Effect” Has Enriched the Haves at the Expense of the Young

The Fed is the mortal enemy of the young generations, and thus of the nation itself. The wealth effect" generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn't Target The Market, Eh?

Read More »

Read More »

What Killed the Middle Class?

Rounding up the usual suspects won't restore a vibrant middle class. What killed the middle class? The answer may well echo an Agatha Christie mystery: rather than there being one guilty party, it may be that each of the suspects participated in the demise of the middle class.

Read More »

Read More »

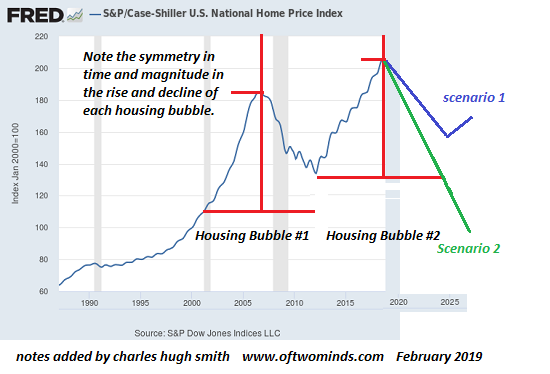

The Doomsday Scenario for the Stock and Housing Bubbles

It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy. The Doomsday Scenario for the stock and housing bubbles is simple: the Fed's magic fails. When dropping interest rates to zero and flooding the financial sector with loose money fail to ignite the economy and reflate the deflating bubbles, punters will realize the Fed's magic only worked the first three times: three bubbles...

Read More »

Read More »

Now that Housing Bubble #2 Is Bursting…How Low Will It Go?

There are two generalities that can be applied to all asset bubbles: 1. Bubbles inflate for longer and reach higher levels than most pre-bubble analysts expected. 2. All bubbles burst, despite mantra-like claims that "this time it's different".

Read More »

Read More »

Homeless Encampments and Luxury Apartments: Our Long Strange Boom

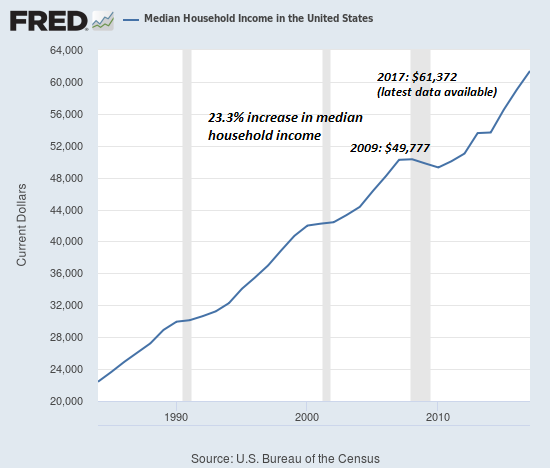

It's been a long, strange economic boom since the nadir of the Global Financial Meltdown in 2009. A 10-year long boom that saw the S&P 500 rise from 666 in early 2009 to 2,780 and GDP rise by 43% has been slightly more uneven for most participants.

Read More »

Read More »

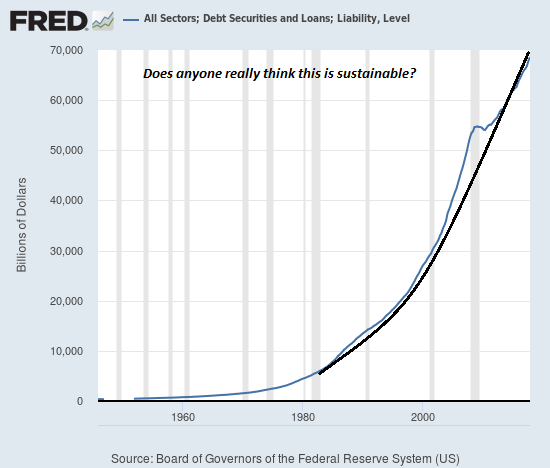

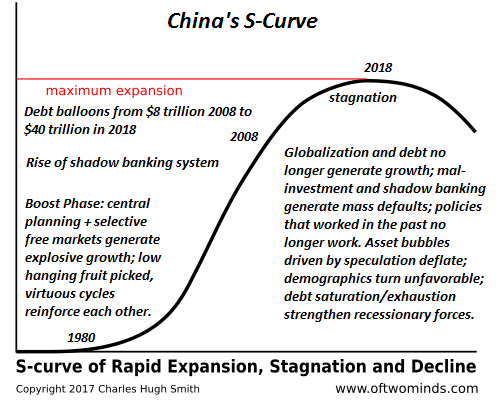

Credit Exhaustion Is Global

Europe is awash in credit exhaustion, and so is China. The signs are everywhere: credit exhaustion is global, and that means the global growth story is over: revenues and profits are all sliding as lending dries up and defaults pile up.

Read More »

Read More »

What Happens When More QE Fails to Reverse the Recession?

The smart money is liquidating assets, paying off debt and moving capital into collateral that isn't impaired by debt or speculative valuations. The Federal Reserve's sudden return to "accommodative" dovishness in response to the stock market's swoon telegraphs its intent to fire up QE once the recession kicks into gear.

Read More »

Read More »

What Caused the Recession of 2019-2021?

As I discussed in We're Overdue for a Sell-Everything/No-Fed-Rescue Recession, recessions have a proximate cause and a structural cause. The proximate cause is often a spike in energy costs (1973, 1990) or a financial crisis triggered by excesses of speculation and debt (2000 and 2008) or inflation (1980).

Read More »

Read More »

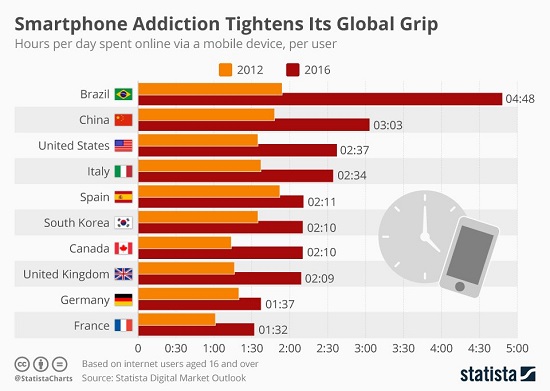

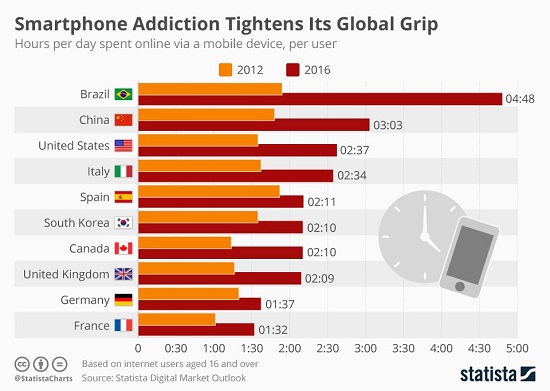

The Corporate Lemmings Who Rushed into Mobile/Social Media Ads Are Running off the Cliff

Given that corporations are run by people, and people are social animals that run in herds, it shouldn't surprise us that corporations follow the herd, too. Take the herd move to forming conglomerates in the go-go late 1960s: corporations suddenly started buying companies in completely different sectors in businesses they knew nothing about, because the herd was forming conglomerates--not because it made any business sense but because it was the...

Read More »

Read More »

We’re Overdue for a Sell-Everything/No-Fed-Rescue Recession

We're way overdue for a sell-everything recession, one that the Fed will only make worse by pursuing its usual policies of lowering interest rates and goosing easy money. As I noted last week, central banks, like generals, always fight the last war--until the war is lost.

Read More »

Read More »

2019: The Three Trends That Matter

Look no further than Brexit in Britain, the yellow vests in France and the Deplorables in the U.S. for manifestations of a broken social contract and decaying social order. Among the many trends currently in play, Gordon Long and I discuss three that will matter as 2019 progresses: 2019 Themes (56 minutes).

Read More »

Read More »

Brace for Impact

As credit-asset bubbles pop, the dominoes start falling. The economy is far more precarious than the surface boom/bubble suggests. A great many households, enterprises and municipalities are in overloaded boats whose gunwales are just a few inches above the water; the slightest wave will swamp and sink them.

Read More »

Read More »

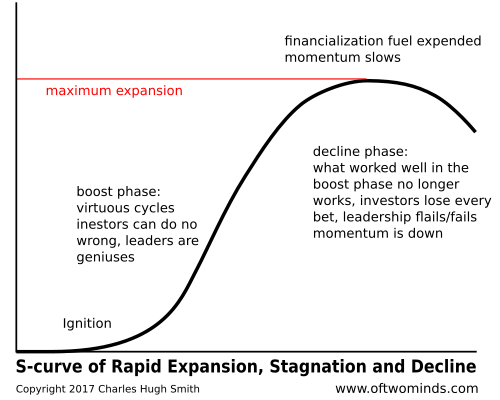

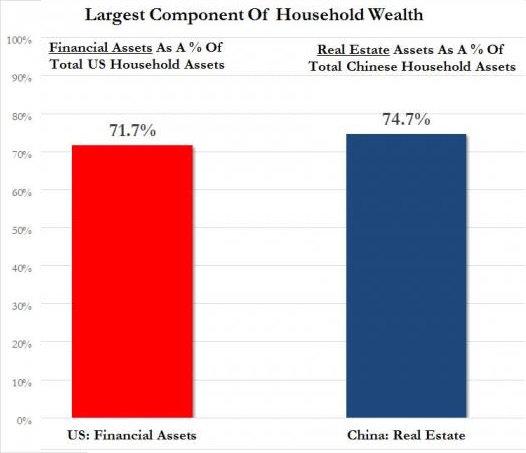

China’s S-Curve of Expansion, Stagnation and Decline

All the policies that worked in the Boost Phase no longer work. Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what's known as the S-Curve. The dynamic isn't difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc.

Read More »

Read More »

The Coming Global Financial Crisis: Debt Exhaustion

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.) via liar loans and...

Read More »

Read More »

So If Half of Facebook Accounts Are Fake… What Is Facebook Worth?

The social media space is absolutely ripe for a new entrant who demands arduous verification and constantly monitors its user base to eliminate cloned and fake accounts. How many accounts on Facebook are fake? Recent estimates of half could be low. Here's an experiment: open a Facebook account with a name that cannot possibly be anyone else's real name, for example, Johns XQR Citizenry.

Read More »

Read More »

So You Want to Get Rich: Focus on Human Capital

Wealth is flowing to those who earn money from their human capital and enterprise. So you want to get rich: OK, what's the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs.

Read More »

Read More »