Category Archive: 5.) Charles Hugh Smith

America Needs a New National Strategy

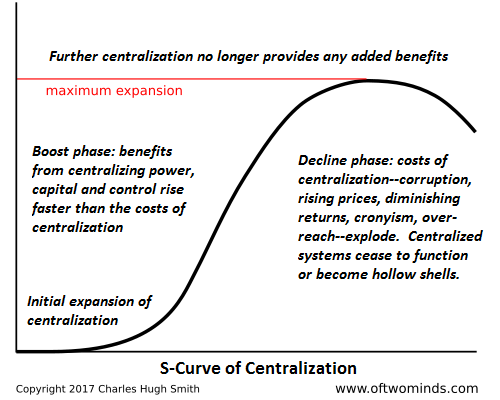

A productive national Strategy would systemically decentralize power and capital rather than concentrate both in the hands of a self-serving elite. If you ask America's well-paid punditry to define America's National Strategy, you'll most likely get the UNESCO version: America's national strategy is to support a Liberal Global Order (LGO) of global cooperation on the environment, trade, etc. and the encouragement of democracy, a liberal order that...

Read More »

Read More »

Does the Market Need a Heimlich Maneuver?

For all we know, the panic selling is Wall Street's way of forcing the Fed's hand: stop with the rates increases already or Mr. Market expires. Markets everywhere are gagging on something: they're sagging, crashing, imploding, blowing up, dropping and generally exhibiting signs of distress.

Read More »

Read More »

Does Any of This Make Sense?

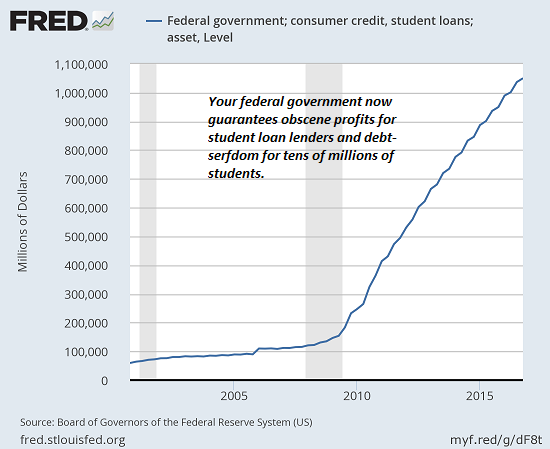

Does any of this make sense? No. But it's so darn profitable to the oligarchy, it's difficult to escape debt-serfdom and tax-donkey servitude. We rarely ask "does this make any sense?" of things that are widely accepted as beneficial-- or if not beneficial, "the way it is," i.e. it can't be changed by non-elite (i.e. the bottom 99.5%) efforts.

Read More »

Read More »

The Implicit Desperation of China’s “Social Credit” System

Other governments are keenly interested in following China's lead. I've been pondering the excellent 1964 history of the Southern Song Dynasty's capital of Hangzhou, Daily Life in China on the Eve of the Mongol Invasion, 1250-1276 by Jacques Gernet, in light of the Chinese government's unprecedented "Social Credit Score" system, which I addressed in Kafka's Nightmare Emerges: China's "Social Credit Score".

Read More »

Read More »

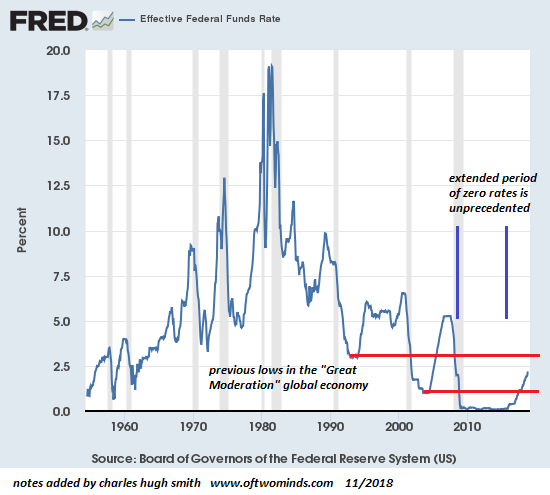

Understanding the Global Recession of 2019

Isn't it obvious that repeating the policies of 2009 won't be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of dollars of bonds and iffy assets...

Read More »

Read More »

Why Are so Few Americans Able to Get Ahead?

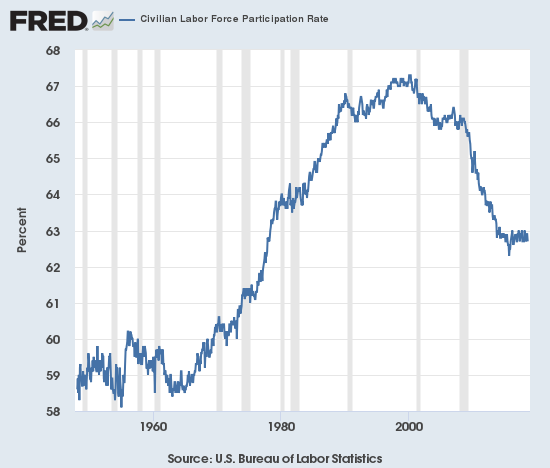

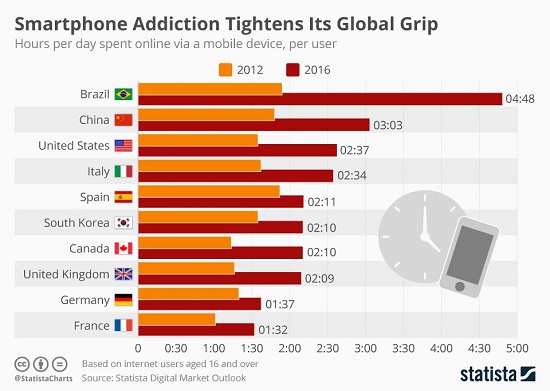

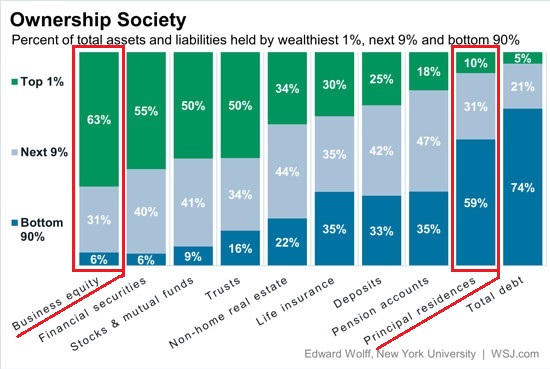

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the "ownership society" and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children.

Read More »

Read More »

Is This “The Most Important Election of our Lives” or Just Another Distraction?

The problem isn't polarization; the problem is neither flavor of the status quo is actually solving any of the nation's most pressing system problems. As I write this at 5 pm (Left Coast) November 6, the election results are unknown. While various media are trumpeting this as "the most important election of our lives," the less eyeball-catching, emotion-triggering reality is this election is nothing but another distraction.

Read More »

Read More »

Turn Off, Tune Out, Drop Out

An unknown but likely staggeringly large percentage of small business owners in the U.S. are an inch away from calling it quits and closing shop. Timothy Leary famously coined the definitive 60s counterculture phrase, "Turn on, tune in, drop out" in 1966. (According to Wikipedia, In a 1988 interview with Neil Strauss, Leary said the slogan was "given to him" by Marshall McLuhan during a lunch in New York City.)

Read More »

Read More »

What’s Behind the Erosion of Civil Society?

Rebuilding social capital and social connectedness is not something that can be done by governments or corporations. As the mid-term elections are widely viewed as a referendum of sorts, let's set aside politics and ask, what's behind the erosion of our civil society? That civil society in the U.S. and elsewhere is fraying is self-evident.

Read More »

Read More »

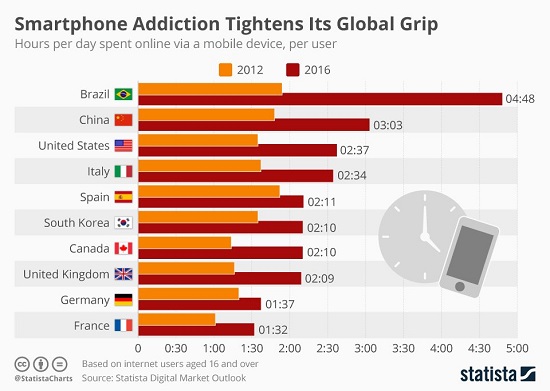

Why Is Social Media So Toxic?

The desire to improve our social standing is natural. What's unnatural is the toxicity of doing so through social media. It seems self-evident that the divisiveness that characterizes this juncture of American history is manifesting profound social and economic disorders that have little to do with politics. In this context, social media isn't the source of the fire, it's more like the gasoline that's being tossed on top of the dry timber.

Read More »

Read More »

Globalization Has Hollowed Out Rural America

What do we make of an economy in which a handful of bubblicious urban areas are magnets for jobs and capital while rural communities have been hollowed out? The short answer is that this progression of urbanization has been one of the core dynamics of civilization for thousands of years: opportunities are greater in cities, and so people move from rural areas with few opportunities to cities with greater opportunities.

Read More »

Read More »

What’s the Real Meaning of the Stock Market Swoon?

Economy has reached peak earnings so there's no fundamentals-driven upside left. Bond yields are now high enough to dampen enthusiasm for inherently risky stocks. Central banks curtailing / ending their quantitative easing programs have reduced liquidity in the financial system. US markets are catching up to the rest of the world's market slump.

Read More »

Read More »

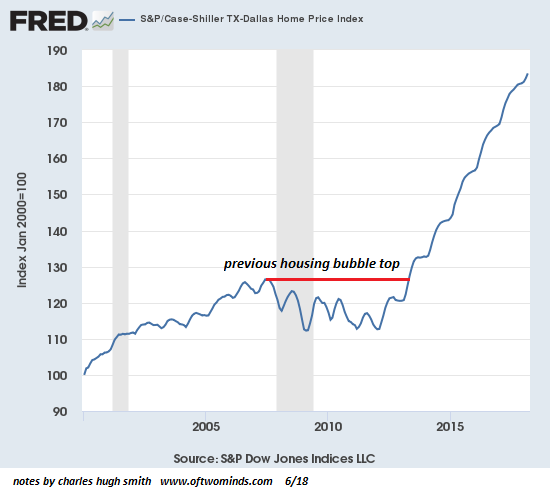

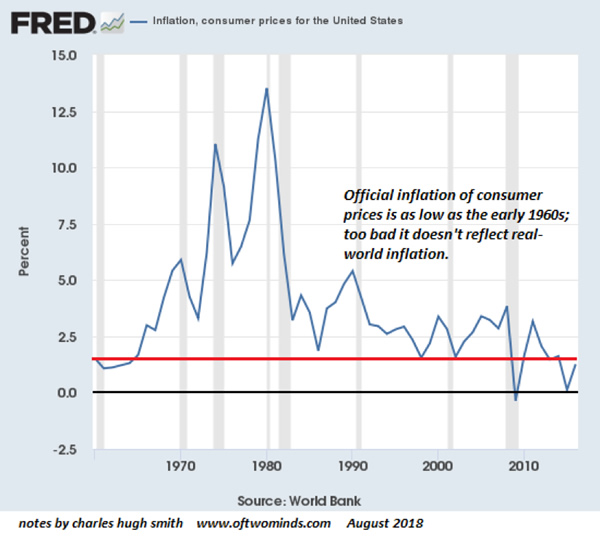

The Coming Inflation Threat

Falling asset inflation plus rising cost inflation equals stagflation. Inflation is a funny thing: we feel it virtually every day, but we’re told it doesn’t exist—the official inflation rate is around 2.5% over the past few years, a little higher when energy prices are going up and a little lower when energy prices are going down.

Read More »

Read More »

Mutiny, Class, Authority and Respect

Humiliation and fear of a catastrophic decline in status foment mutiny and rebellion. I recently finished The Bounty: The True Story of the Mutiny on the Bounty, a painstakingly researched history of the mutiny, but with a focus on how the story was shaped by influential families after the fact to save the life of one mutineer, Peter Haywood, and salvage the reputation of the leader, Fletcher Christian, via a carefully orchestrated character...

Read More »

Read More »

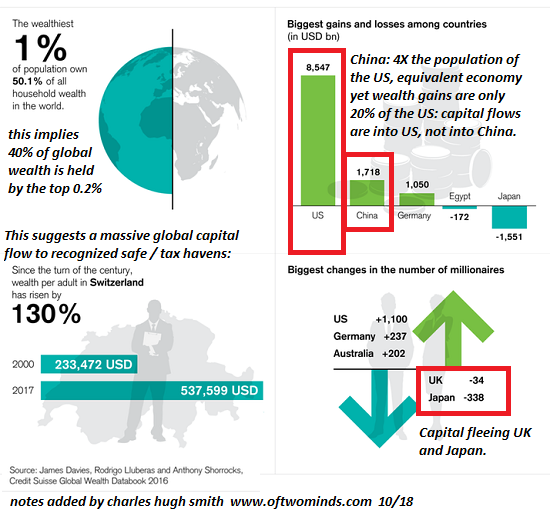

Is the Greatest Bull Market Ever Finally Ending? (Hint: Follow the Money)

The key here is the gains generated by owning US-denominated assets as the USD appreciates. Is the Greatest Bull Market Ever finally ending? One straightforward approach to is to follow the money, i.e. global capital flows: assets that attract positive global capital flows will continue rising if demand for the assets exceeds supply, and assets that are being liquidated as capital flees the asset class (i.e. negative capital flows) will decline in...

Read More »

Read More »

Here’s Why the Next Recession Will Spiral Into a Depression

Here's the difference between a recession and a depression: you can't get blood from a stone, or make an insolvent entity solvent with more debt. There are two basic differences between a recession and a depression: 1. Duration: a recession typically lasts between 6 and 18 months, while a depression drags on for years or even decades, often masked by official propaganda as "slow growth" or "stagnation."

Read More »

Read More »

How Many Households Qualify as Middle Class?

By the standards of previous generations, the middle class has been stripmined of income, assets and purchasing power. What does it take to be middle class nowadays? Defining the middle class is a parlor game, with most of the punditry referring to income brackets as the defining factor.

Read More »

Read More »

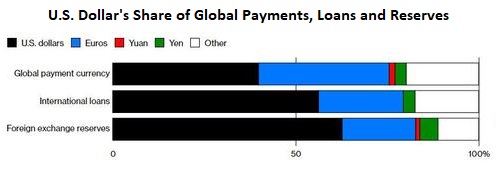

The Distortions of Doom Part 2: The Fatal Flaws of Reserve Currencies

The way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies. Over the years, I've endeavored to illuminate the arcane dynamics of global currencies by discussing Triffin's Paradox, which explains the conflicting dual roles of national currencies that also act as global reserve currencies, i.e. currencies that other nations use for global payments, loans and foreign exchange...

Read More »

Read More »

The Global Distortions of Doom Part 1: Hyper-Indebted Zombie Corporations

The defaults and currency crises in the periphery will then move into the core. It's funny how unintended consequences so rarely turn out to be good. The intended consequences of central banks' unprecedented tsunami of stimulus (quantitative easing, super-low interest rates and easy credit / abundant liquidity) over the past decade were: 1.

Read More »

Read More »

Pensions Now Depend on Bubbles Never Popping (But All Bubbles Pop)

We're living in a fantasy, folks. Bubbles pop, period. The nice thing about the "wealth" generated by bubbles is it's so easy: no need to earn wealth the hard way, by scrimping and saving capital and investing it wisely. Just sit back and let central bank stimulus push assets higher.

Read More »

Read More »