Category Archive: 5.) Brown Brothers Harriman

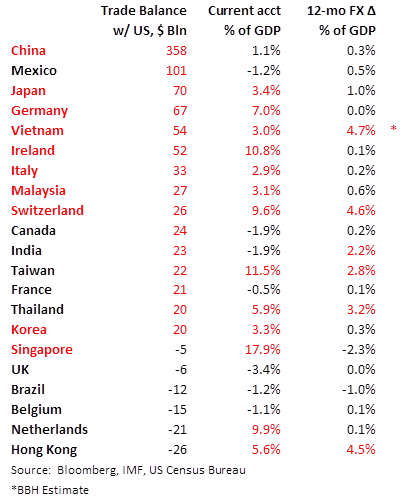

Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report no longer considers China a currency manipulator. The underlying message is that the Trump administration will continue to use an ad hoc “carrot and stick” approach to improve US access to the domestic markets of its major trading partners.

Read More »

Read More »

EM Preview for the Week Ahead

EM has been able to get some traction as markets basically shrugged off the risk-off sentiment after the Iran attacks. This week’s planned signing of the Phase One trade deal should help boost EM further, but we remain cautious. The Iran situation is by no means solved, and we see periodic bouts of risk-off sentiment coming from smaller skirmishes.

Read More »

Read More »

Dollar Builds on Gains as Iran Tensions Ease

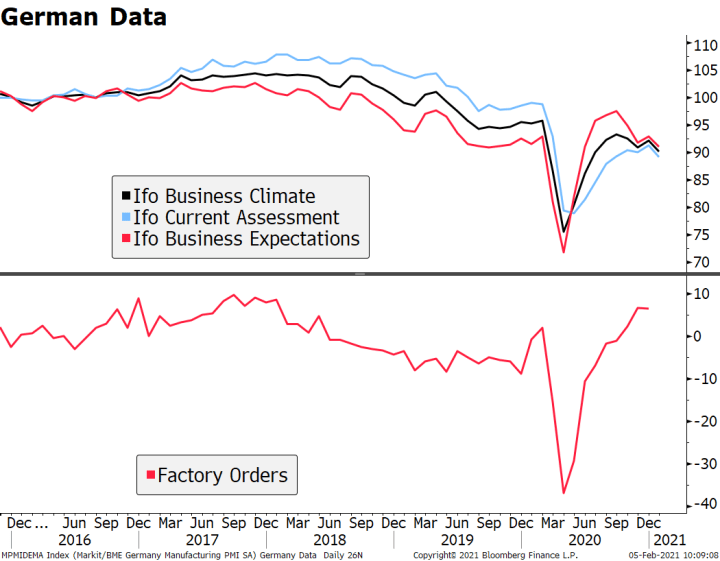

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction. The North American session is quiet in terms of US data. Mexico reports December CPI; Peru is expected to keep rates steady at 2.25%. German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney.

Read More »

Read More »

EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mostly firmer last week. ZAR, PEN, and CLP outperformed while TRY, HUF, and CNY underperformed. MSCI EM traded at new highs for the cycle but ran out of steam near the 1110 area, while MSCI EM FX lagged a bit and has yet to surpass its July high. Overall, the backdrop for EM remains constructive but investors must be prepared to differentiate amongst credits in 2020.

Read More »

Read More »

Hard Brexit Redux?

The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled.

Read More »

Read More »

Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off. During the North American session, US November retail sales will be reported. Russia central bank cut rates 25 bp to 6.25%, as expected.

Read More »

Read More »

EM Preview for the Week Ahead

EM has had a good month so far as market optimism on a Phase One trade deal remains high. Yet November trade data due out this week should show that until that deal is finalized, the outlook for EM remains weak. Deadline for the next round of US tariffs is December 15 and so talks this week are crucial.

Read More »

Read More »

Dollar Soft on Weak Data and the Return of Tariff Man

The dollar has taken a hit from the weaker than expected data Monday. Tariff man is back. The US economy remains solid in Q4 but there are some worrying signs for the November jobs data Friday. The political pressure on Turkey from the US could increase soon; South Africa’s Q3 GDP came in well below expectations at -0.6% q/q and 0.1% y/y.

Read More »

Read More »

EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress.

Read More »

Read More »

Dollar Builds on Recent Gains

The dollar remains resilient; optimism towards a Phase One deal continues to support risk appetite. There was also optimism from Fed Chairman Powell yesterday; the US economy is not out of the woods yet. Turkish President Erdogan started deploying Russia’s S-400 missile system, raising the specter of sanctions. Hong Kong reported weak October trade data; Philippine central bank Governor Diokno said a December cut was possible.

Read More »

Read More »

Drivers for the Week Ahead

The dollar was surprisingly resilient last week; we look for further dollar gains ahead. It is a holiday shortened week in the US, but there are still some major data releases. There is a fair amount of eurozone data this week; UK Prime Minister Johnson unveiled his Tory manifesto. Hong Kong held local elections this weekend; tensions between Japan and Korea appear to have eased, but questions remain.

Read More »

Read More »

Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions. FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue. South Africa is expected to cut rates by 25 bp to 6.25%. Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected.

Read More »

Read More »

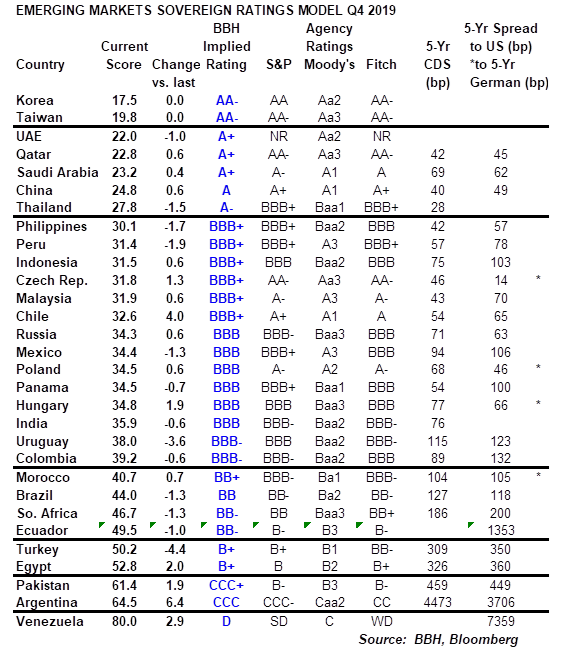

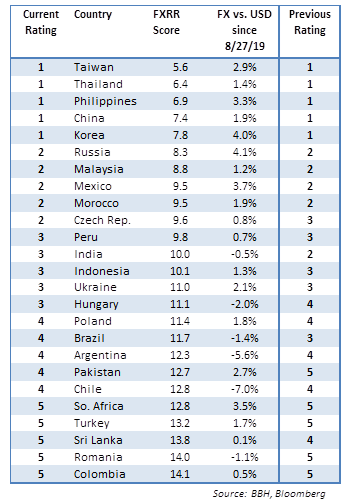

EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

Read More »

Read More »

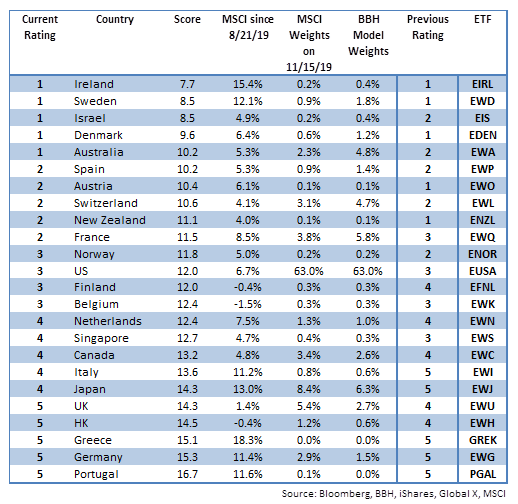

DM Equity Allocation Model For Q4 2019

Global equity markets continue to power higher US-China trade tensions have eased. MSCI World made a new all-time high today near 2290 and is up 23% YTD. Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia. Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal.

Read More »

Read More »

EM FX Model for Q4 2019

EM FX has rallied sharply in recent weeks, helped by growing optimism that we’ve seen the worst of the US-China trade war. Given our more constructive outlook on EM, we believe MSCI EM FX should eventually test the 1657.50 high from July. We see continued divergences within the asset class. Our 1-rated (strongest fundamentals) grouping for Q4 2019 consists of TWD, THB, PHP, CNY, and KRW.

Read More »

Read More »

Dollar Stabilizes as Markets Await Fresh Drivers

Press reports suggest that the mood in Beijing is pessimistic after President Trump pushed back against tariff rollbacks. Fed Chair Powell met with President Trump and Treasury Secretary Mnuchin yesterday. Hungary is expected to keep rates steady; the deadline to form a government in Israel is fast approaching. RBA released dovish minutes from its November policy meeting.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mostly weaker last week due to doubts about a Phase One trade deal between the US and China. Those talks continue this week and while we expect a deal to be struck, there is likely to be a lot of last minute posturing that will likely keep markets volatile over the short-run. In the meantime, investors need to beware of idiosyncratic country risk within EM.

Read More »

Read More »