Category Archive: 5.) Brown Brothers Harriman

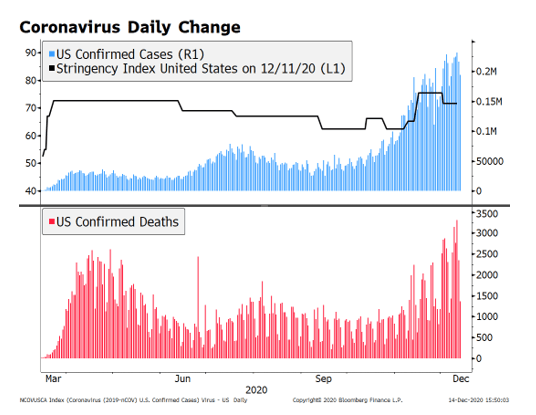

Dollar Mixed as Coronavirus News Stream Deteriorates

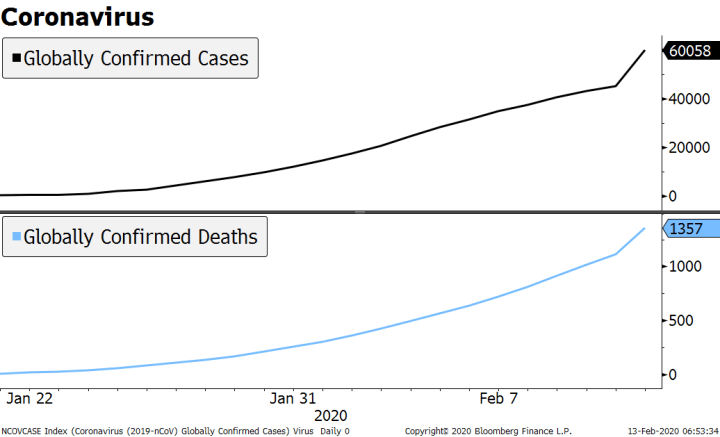

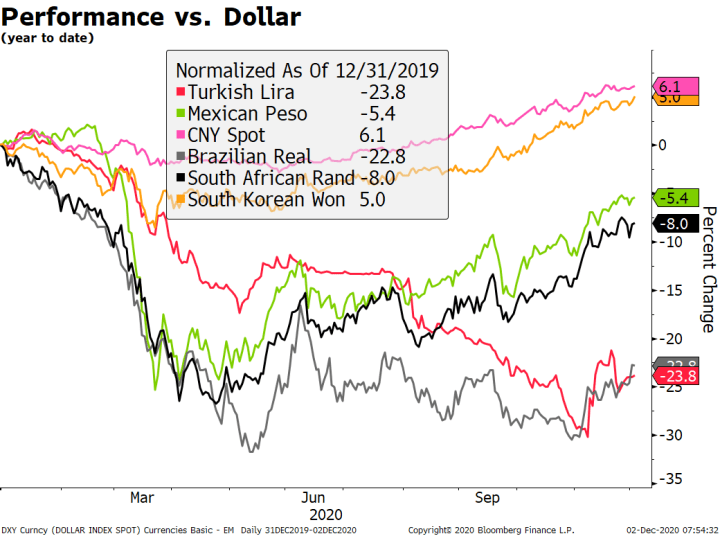

The virus news stream continues to deteriorate. Lower US yields and growing concerns about the spread of the coronavirus in the US are taking a toll on the greenback. OPEC officials are trying to work out another supply cut; The outlook for Turkey is going from bad to worse. Simply put, there is nothing the Fed can do to address the economic impact of supply chain disruptions and social distancing.

Read More »

Read More »

Seven Big-Picture Considerations for Covid-19

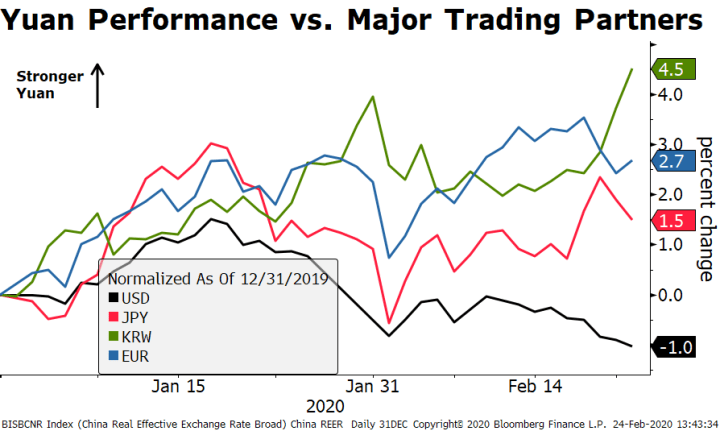

Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy.

Read More »

Read More »

EM Preview for the Week Ahead

The still-growing impact of the coronavirus should keep EM and risk sentiment under pressure this week. The weekend G20 meeting in Saudi Arabia acknowledged the risks to the global economy and said participants agreed on a “menu of policy options.” However, the G20 offered little specific in terms of a coordinated policy response.

Read More »

Read More »

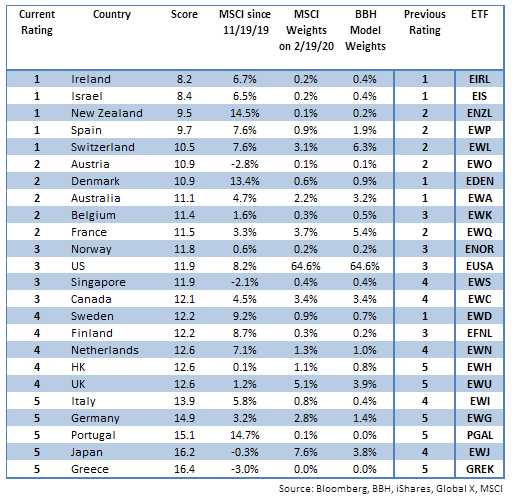

DM Equity Allocation Model For Q1 2020

Developed equity markets remain near the highs despite mounting concerns about the impact of the coronavirus. MSCI World made a new all-time high last week near 2435 and is up 2.5% YTD. Our 1-rated grouping (outperformers) for Q1 2020 consists of Ireland, Israel, New Zealand, Spain, and Switzerland.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Picks Up Again

Negative news on the coronavirus has kept risk appetite subdued across the board; the dollar rally continues. During the North American session, we will get some more clues to the state of the US economy; FOMC minutes were largely as expected. UK January retail sales came in firm; ECB releases the account of its January 23 meeting.

Read More »

Read More »

Drivers for the Week Ahead

We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday. Canada reports some key data this week. Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week.

Read More »

Read More »

Virus Concerns Resurface

Markets are reacting badly to upward revisions to coronavirus cases in China. The euro fell to the weakest level since mid-2017 against the dollar. UK housing data adds to relatively upbeat figures since the December elections. Malaysia’s government is joining in the counter-cyclical fiscal effort.

Read More »

Read More »

Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb. This is another big data week for the US; the US economy remains strong. Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday.

Read More »

Read More »

Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb. The January jobs data is the highlight for the week; Canada also reports jobs data. The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data.

Read More »

Read More »

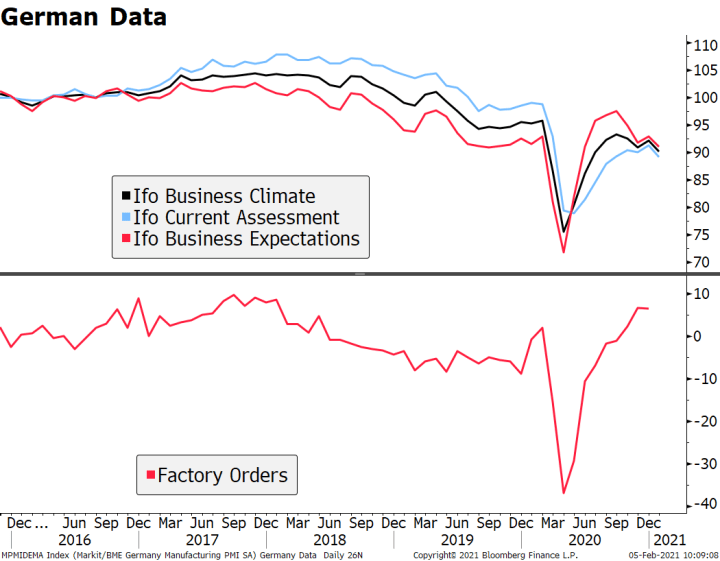

Dollar Firm as Markets Await Fresh Drivers

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way. The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp. Germany reported very weak December factory orders; all is not well in the German state of Thuringia.

Read More »

Read More »

Dollar Mixed as Some Risk Appetite Returns

The dollar continues to climb; one of side-effects of the virus has been a swelling of the amount of negative yielding debt globally. The US primary season got off to a rocky start for the Democrats. During the North American session, December factory orders will be reported; the US economy remains strong.

Read More »

Read More »

EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty.

Read More »

Read More »

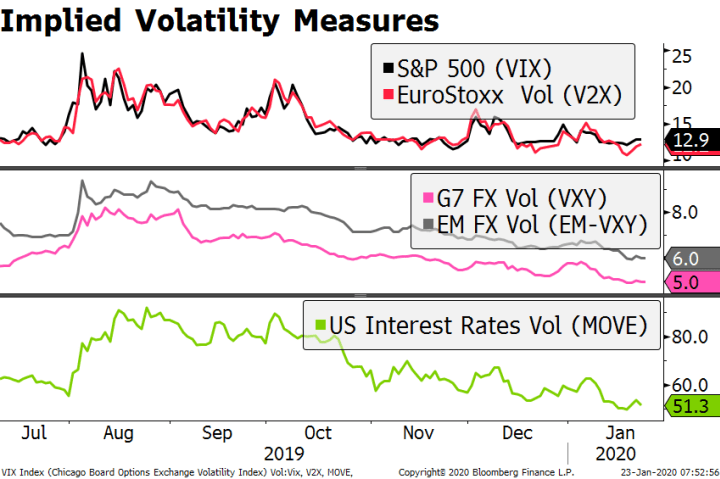

Dollar Firm Ahead of BOE Decision

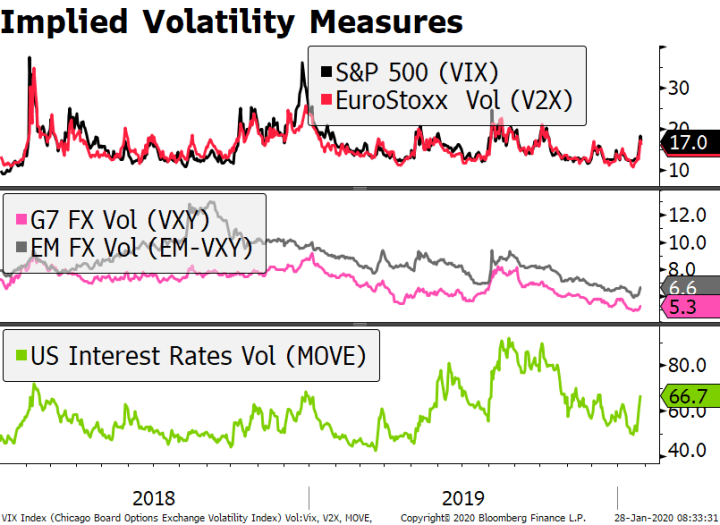

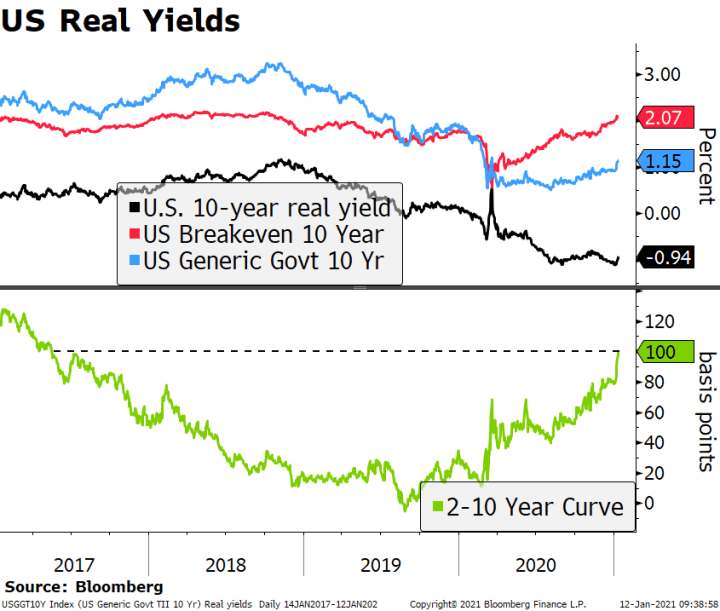

The World Health Organization called an emergency meeting today; the dollar continues to climb. The FOMC meeting was a non-event; US advance Q4 GDP will be reported. Risk-off sentiment has derailed curve steepening trades. Implied rates still suggest that today’s BOE meeting is a coin toss.

Read More »

Read More »

Tentative Stabilization

Risk-off continues in Asia, but moves have been less dramatic. European market jittery but stable. Implied rates now pricing in a full Fed cut by September. The UK will announce its decision on Huawei’s access to the country’s 5G network.

Read More »

Read More »

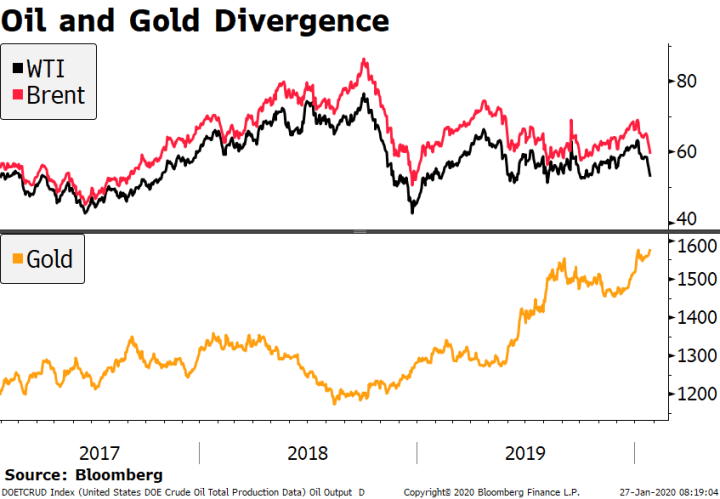

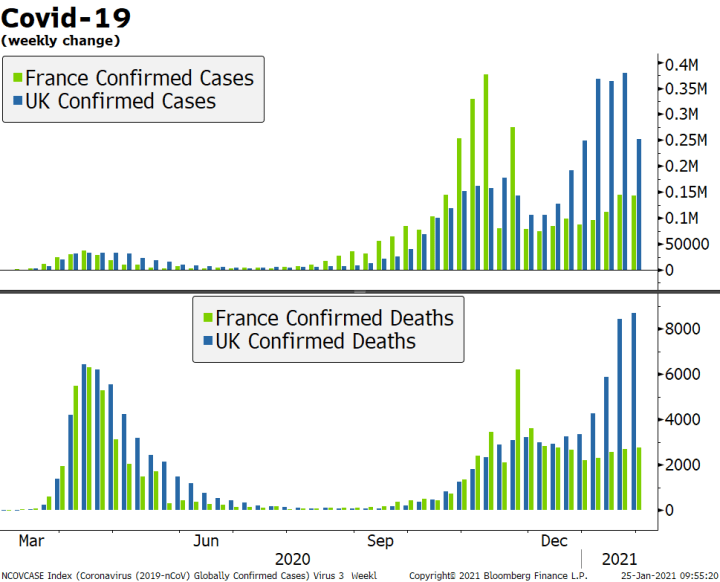

Sharp Sell-Off on Virus Concerns

Global stocks lower on virus fears, yen appreciates, and yield curves flatten. Oil prices continue to fall while gold rises. Italian assets outperform on favorable election results for ruling coalition. German IFO survey disappoints, trimming nascent green shoots.

Read More »

Read More »

EM Preview for the Week Ahead

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus.

Read More »

Read More »

Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus. US steps up trade rhetoric against EU and pushes back against UK digital tax plan. AUD stronger on solid Australian jobs report and pricing out of RBA easing. CAD weaker on dovish BOC communication yesterday.

Read More »

Read More »

Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight. US President Trump and French president Macron agreed to take a step back from the digital tax dispute. The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light. The UK reported firm jobs data for November; BOJ kept policy steady, as expected.

Read More »

Read More »

EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week.

Read More »

Read More »

Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal. The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today. Bank of England credit survey showed demand for loans fell in Q4. Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5%.

Read More »

Read More »