Category Archive: 5.) Brown Brothers Harriman

Sterling Pounded by Brexit Developments

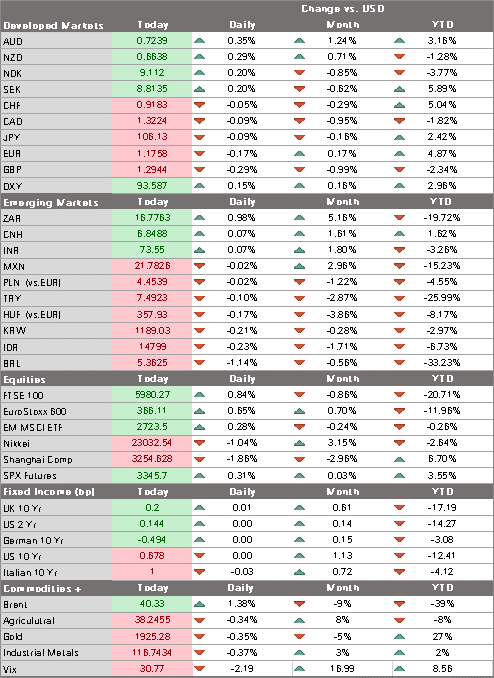

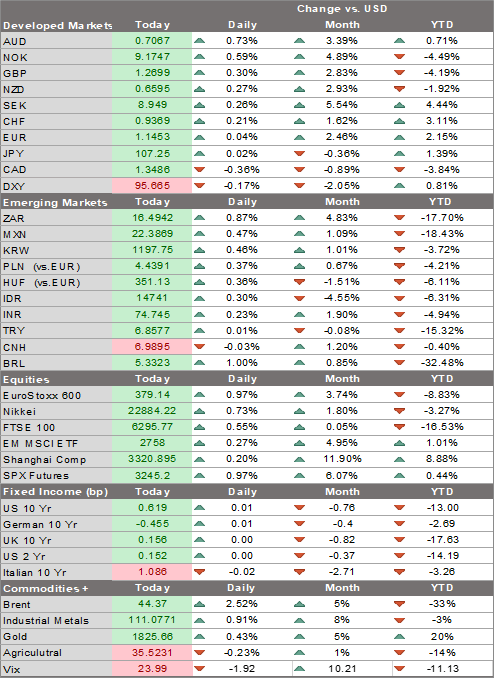

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today. Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation.

Read More »

Read More »

ECB Preview

The ECB meets tomorrow and is widely expected to stand pat. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. Looking ahead, a lot of room remains for further ECB actions.

Read More »

Read More »

EM Preview for the Week Ahead

EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities.

Read More »

Read More »

Drivers for the Week Ahead

The dollar is likely to remain under pressure after Powell’s dovish message at Jackson Hole. August jobs data Friday will be the data highlight of the week. The Fed releases its Beige Book report Wednesday; Powell will face many questions about the Framework Review that he unveiled at Jackson Hole.

Read More »

Read More »

Where Has All the Carry Gone?

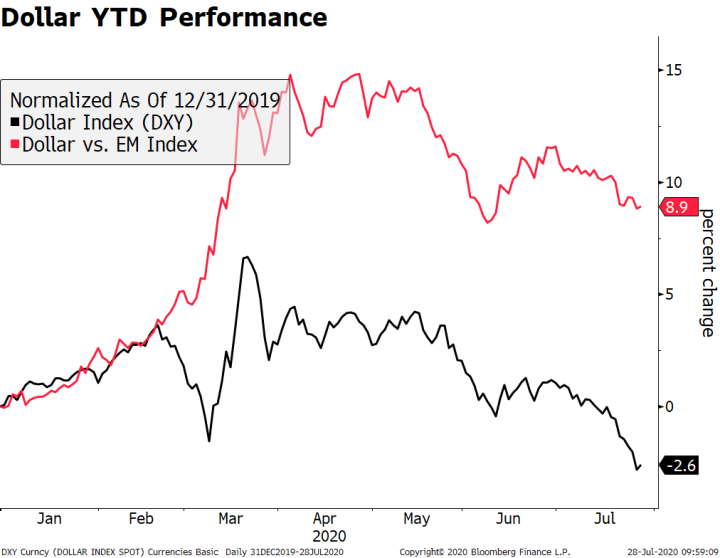

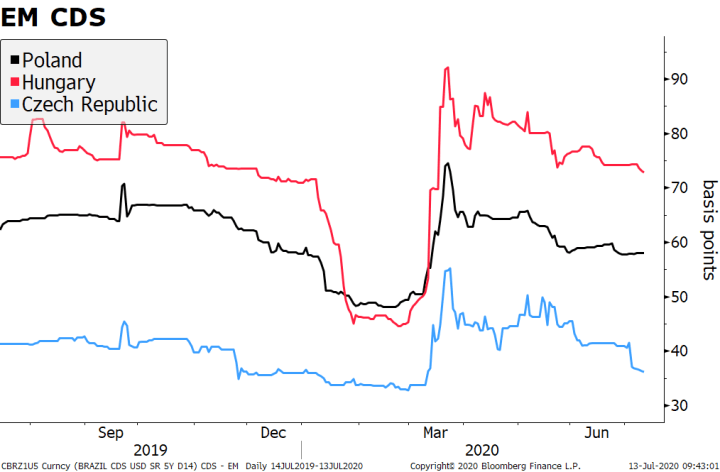

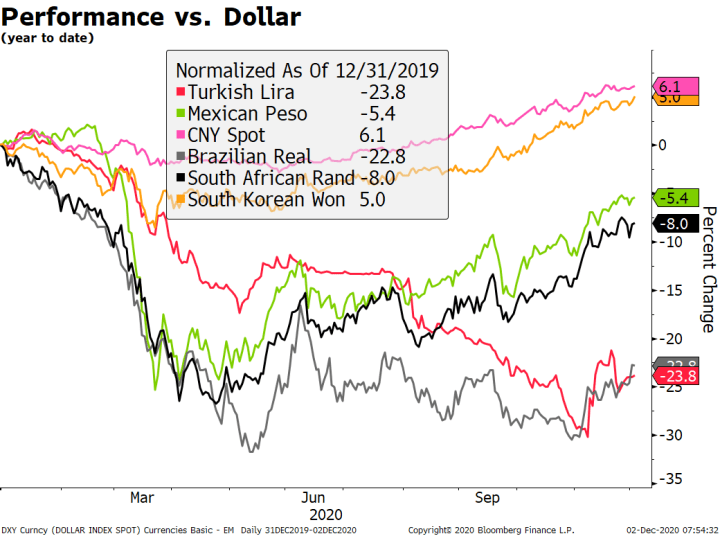

Despite broad-based dollar weakness, EM currencies have not fully participated in the risk on environment that’s now in place. The good news is that fundamentals matter again. The bad news is that there are a lot of EM countries with bad fundamentals, and the secular decline in carry no longer gives these weaklings any cover.

Read More »

Read More »

Dollar Softens, Equities Rise as Markets Ignore the Negatives

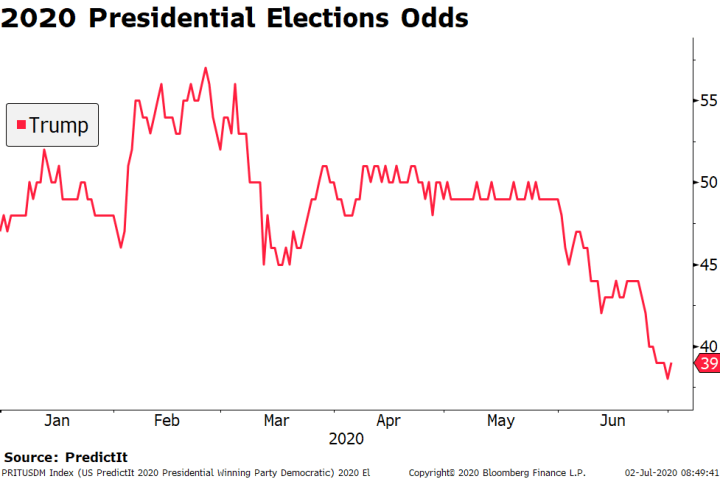

Markets seem to be increasingly desensitized to the usual negative drivers; the dollar is under pressure again. Stimulus talks remain stalled; reports suggest Trump is mulling a capital gains tax cut of some sort. US data highlight today will be July PPI; US Treasury begins its record $112 bln quarterly refunding.

Read More »

Read More »

EM Preview for the Week Ahead

The dollar got some traction against the majors towards the end of last week. This weighed on EM FX, with the high best currencies TRY, BRL, CLP, and ZAR leading the losers. We downplay risk of contagion from Turkey, but we acknowledge it will keep investors wary of the countries with poor fundamentals.

Read More »

Read More »

EM Preview for the Week Ahead

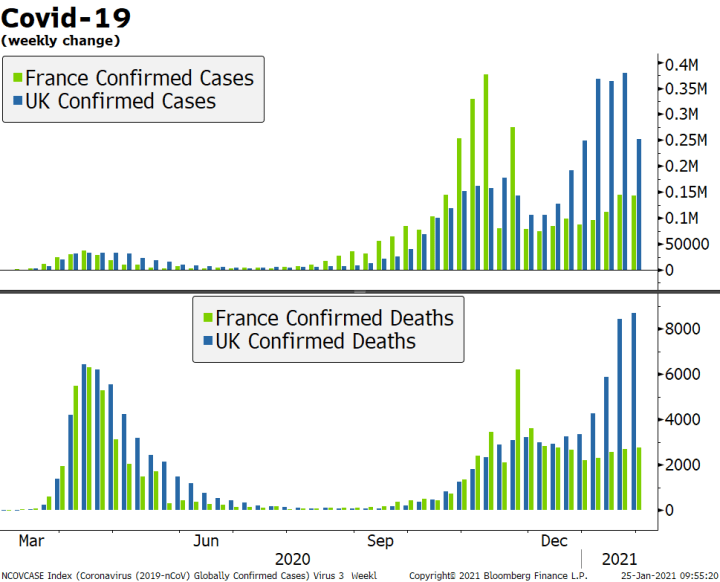

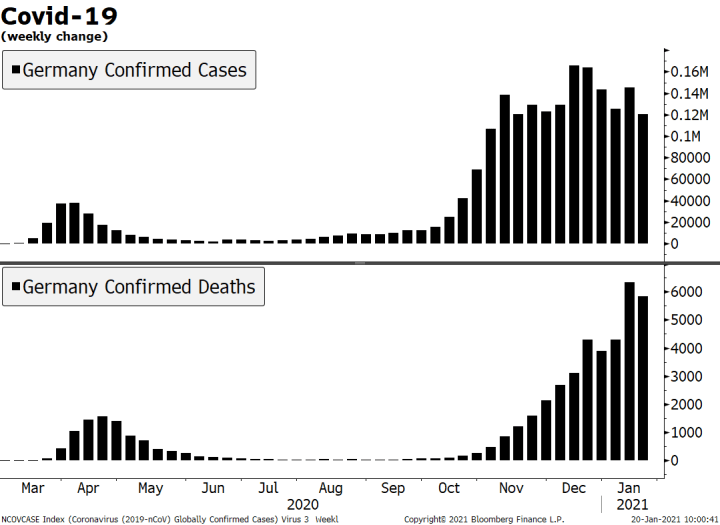

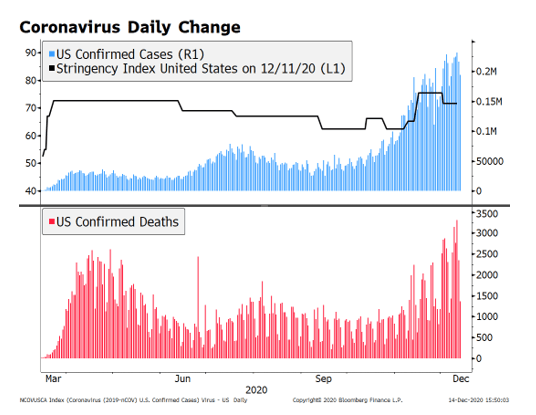

EM currencies took advantage of broad dollar weakness against the majors last week, with most gaining against the greenback. Yet the week ended on a bit of a risk-off note as concerns intensified about the resurgent virus and the impact on the still-weak global economy.

Read More »

Read More »

Dollar Weak Ahead of Likely Dovish Hold from the Fed

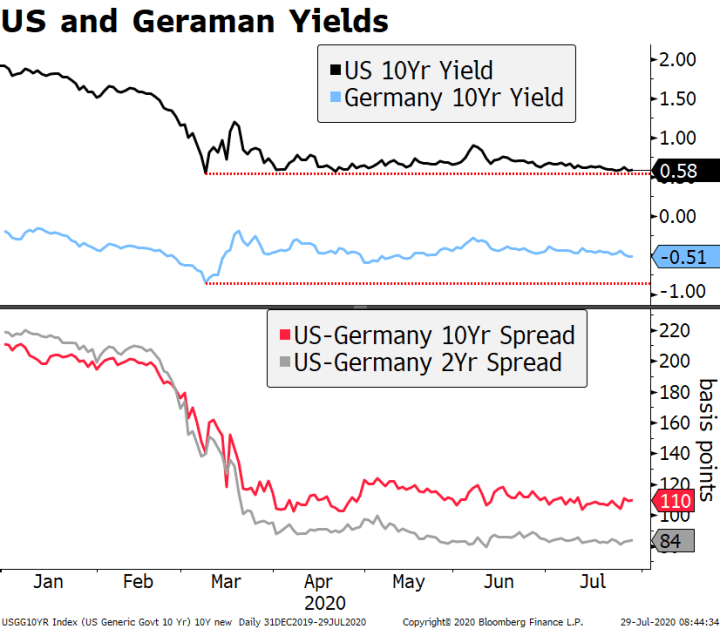

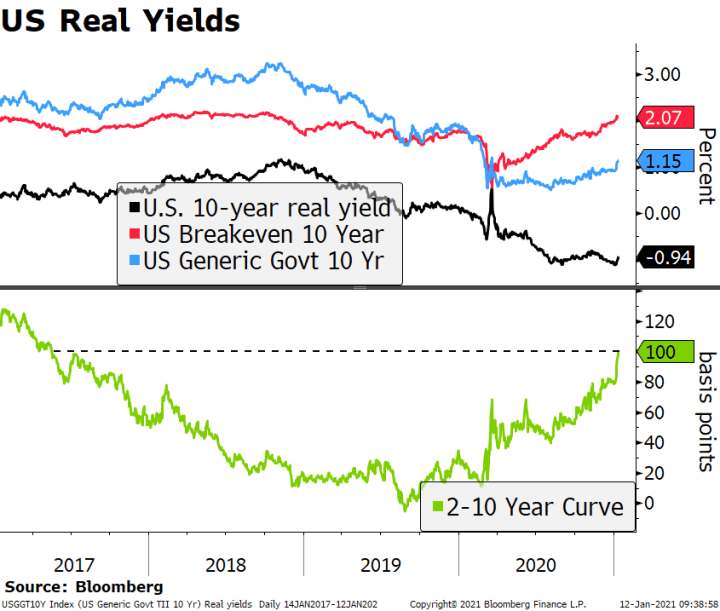

The FOMC decision today is likely to deliver a very dovish tone; the dollar tends to weaken on FOMC decision days. Tensions about the latest US stimulus bill are rising; core bond yields have been remarkably stable over the last several months.

Read More »

Read More »

Dollar Stabilizes but Further Losses Likely

The dollar is stabilizing today but further losses are likely. Senate Republicans have proposed a sharp cut to weekly unemployment benefits; Senator Collins will oppose Judy Shelton’s nomination to the Fed. Regional Fed manufacturing surveys for July will continue to roll out; early July reads for the US economy support our view that Q3 is off to a rocky start.

Read More »

Read More »

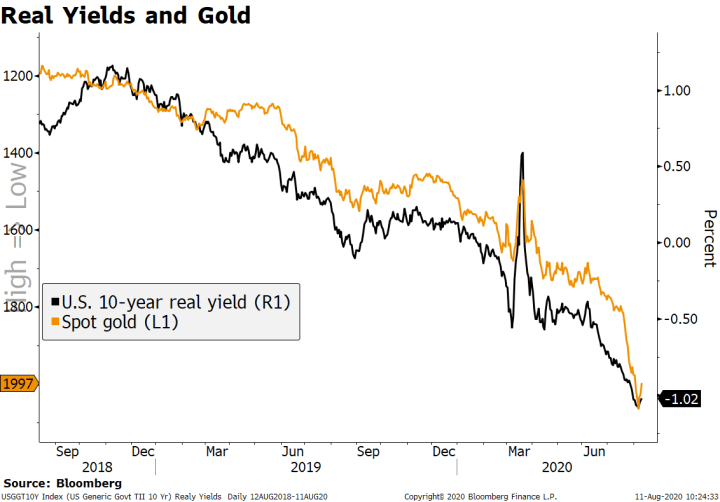

Dollar Remains Under Pressure as European Outlook Shines

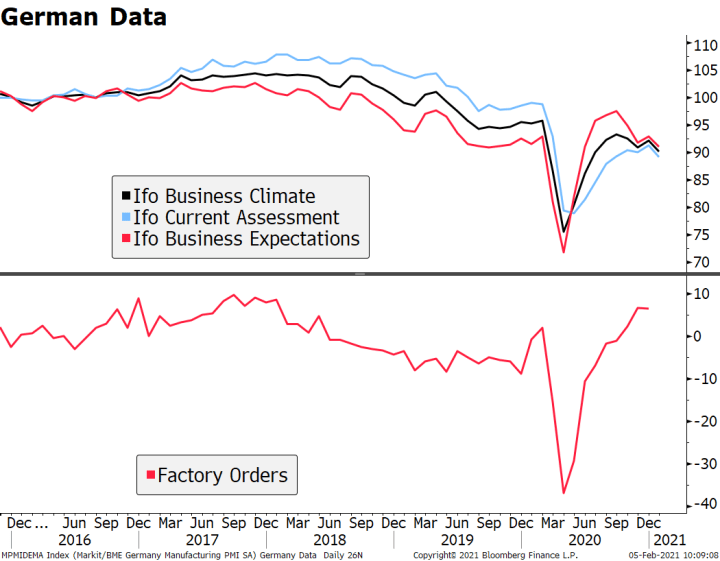

The outlook for risk assets remains uncertain; the dollar continues to make new lows; the uncertain outlook continues to propel gold and silver higher. The next round of stimulus in the US is proving to be difficult; regional Fed manufacturing surveys for July will continue to roll out. German July IFO survey came in better than expected; eurozone June M3 rose 9.2% y/y vs. 8.9% in May.

Read More »

Read More »

Market Sentiment Boosted by Stimulus Outlook

Today, it’s all about the stimulus; the dollar remains under pressure. Mnuchin and Pelosi kick off the first round of talks for the next stimulus package this afternoon; it’s another quiet day in terms of US data; Canada reports May retail sales

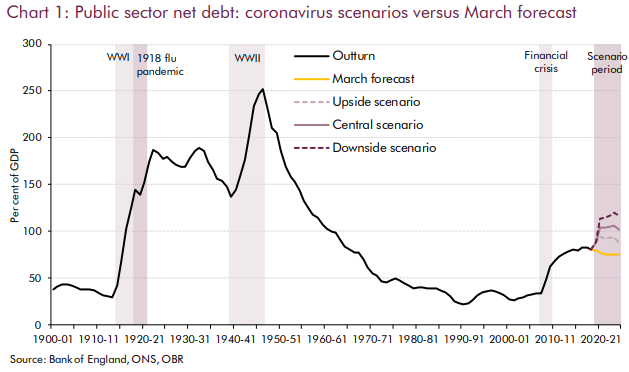

EU finalized its recovery package; UK reported June public sector net borrowing; Hungary is expected to cut rates 15 bp to 0.60%.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mixed last week, with most risk assets continuing to fight a tug of war between improving economic data and worsening virus numbers. Sentiment may be hurt early this week over lack of consensus in the EU and the US regarding further fiscal stimulus. Three of the four EM central banks meeting this week are expected to cut rates.

Read More »

Read More »

Market Sentiment Dented by Weak Data and Rising US-China Tensions

Market sentiment has been dented by more than just rising virus numbers; yet the dollar continues to trade within recent well-worn ranges. California’s decision to reverse partial reopening will likely have a huge economic impact; June CPI may hold a bit more interest in usual; June budget statement is worth a quick mention.

Read More »

Read More »

Dollar Rangebound in Quiet Start to an Eventful Week

Today marks a relatively quiet start to what is likely to be one of the most eventful weeks we’ve seen in a while; the dollar remains within recent well-worn ranges. The US continues to ratchet up trade tensions; the only US data report today is the June budget statement.

Read More »

Read More »

EM Preview for the Week Ahead

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit.

Read More »

Read More »

Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges. The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit.

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates.

Read More »

Read More »

Dollar Soft Ahead of Jobs Report

Re-shutdowns continue to spread across the US; the dollar has come under pressure again. Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported. FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill.

Read More »

Read More »

Dollar Begins the Week Under Pressure Again

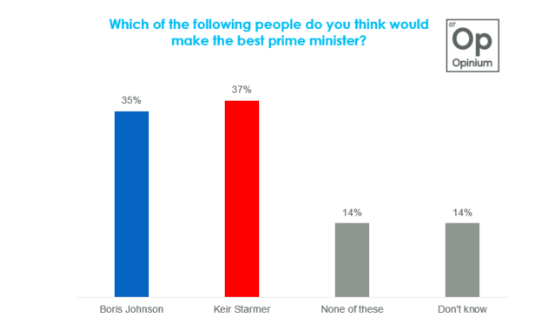

The virus news stream remains negative; pressure on the dollar has resumed. The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today. UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections.

Read More »

Read More »