Category Archive: 5.) Alhambra Investments

Weekly Market Pulse: The Market Did What??!!

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the current economic data would seem to dictate. I’ve been in this business for 30 years and I think I first heard that in year one. Or maybe even before I decided to lose my mind and start managing other people’s money. Because, of course, it has always been this way.

Read More »

Read More »

Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things.

Read More »

Read More »

Rechecking On Bill And His Newfound Followers

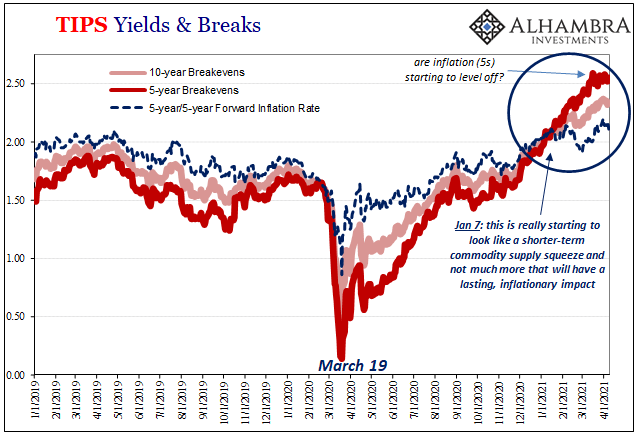

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard).

Read More »

Read More »

Real Dollar ‘Privilege’ On Display (again)

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime...

Read More »

Read More »

Jeff Snider On Salomon Brothers, Repo Market, Velocity, Shadow Money, Banks, FED (RCS Ep 117)

Topics- Salomon Brothers, the eurodollar market, treasuries, collateral, derivative market: Jeff tells the story of what happened in the early 90s with the Treasury, Warren Buffett, FED, Primary Dealer Banks, Repo market. Velocity: money supply, shadow money, measuring the monetary system. Repo market as a real monetary market: missing data in the FED’s measurements. FED funds rate, banking system, monetary details.

Read More »

Read More »

Don’t Be the Victim of These 20 IRA Mistakes

Hey! It’s just an IRA. What is there to know? You put money in and it’s a tax deduction, you get to take it out after 59 ½ without paying a penalty, and at 72 the IRS makes you take some out. What else could there be?

In reality, there’s a lot more.

Read More »

Read More »

Weekly Market Pulse: Buy The Rumor, Sell The News

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report.

Read More »

Read More »

57a Jeff Snider Reacts Live to Paul Krugman Column

Will Stagnation Follow the Biden Boom? So asks New York Times columnist (and Nobel memorial prize winner) Paul Krugman. Jeff Snider listens and reacts to Krugman's lament that though the relief bill is done, recovery may be harder.

Read More »

Read More »

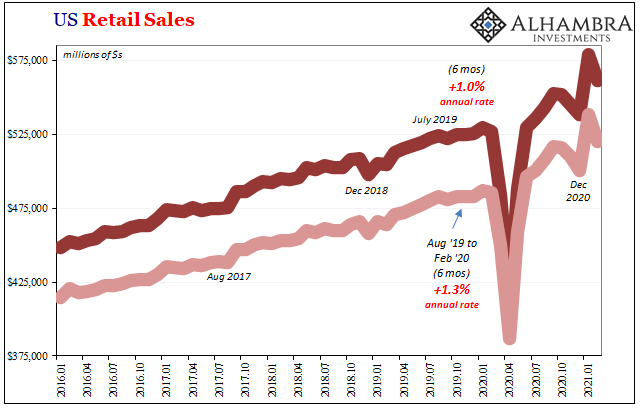

Spending Here, Production There, and What Autos Have To Do With It

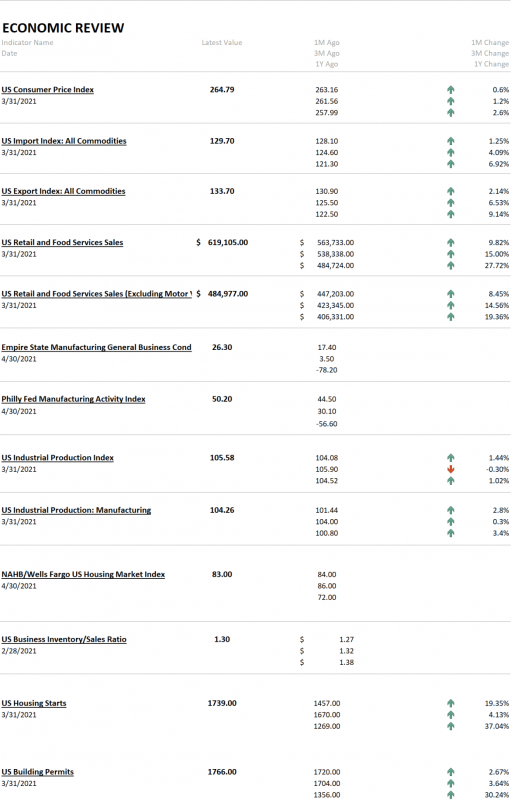

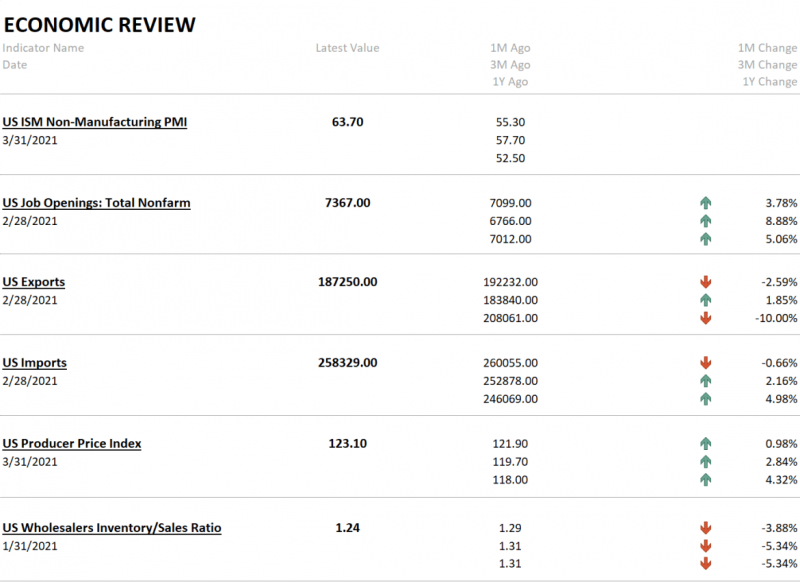

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise.

Read More »

Read More »

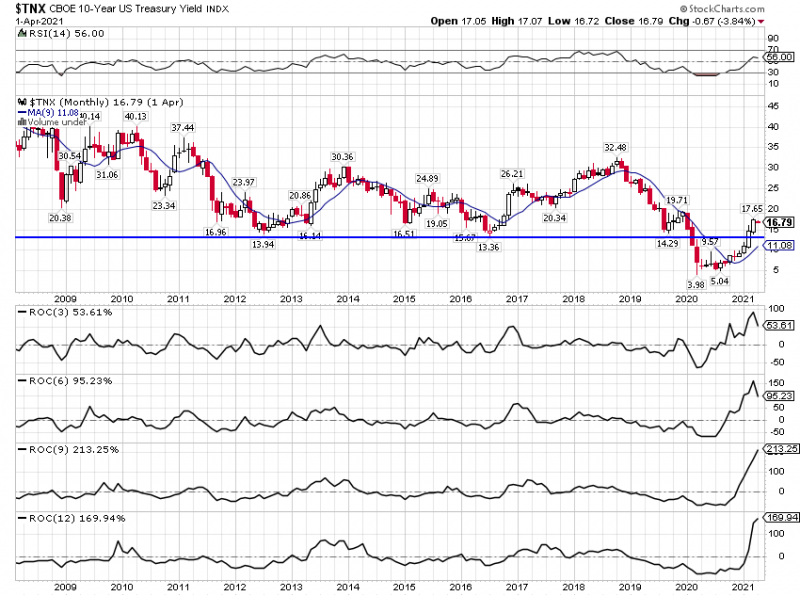

Ep 144- Yields Are Not Showing Inflation ft. Jeff Snider with Srivatsan Prakash

Jeff Snider is the Global Head of Research at Alhambra Investments, and well known for his disinflationary views and his Eurodollar University video. Here he talks about why yields' move higher isn't inflationary, why things are still not inflationary at all, and much more.

Read More »

Read More »

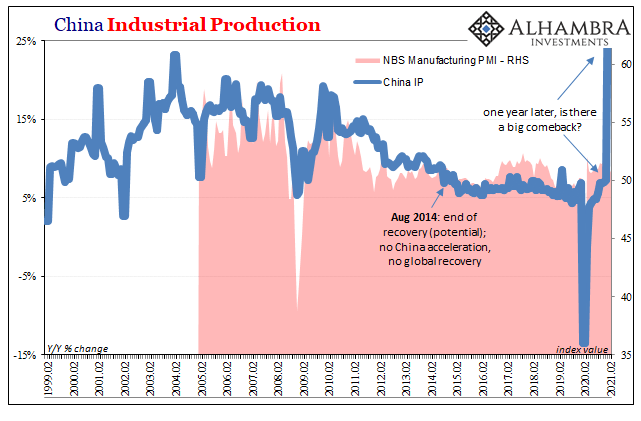

Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult.

Read More »

Read More »

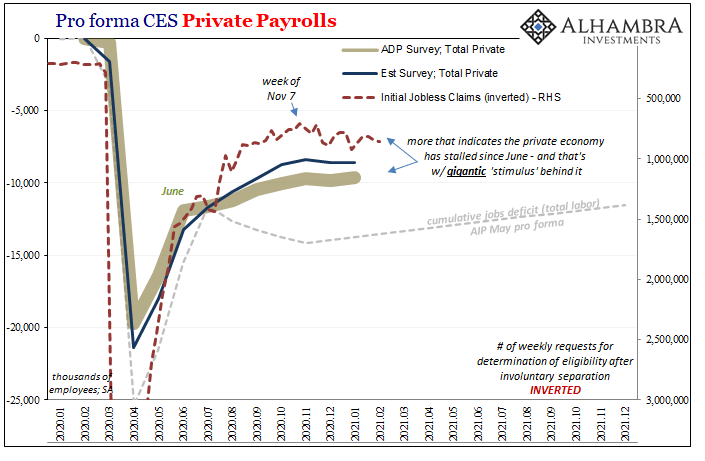

JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

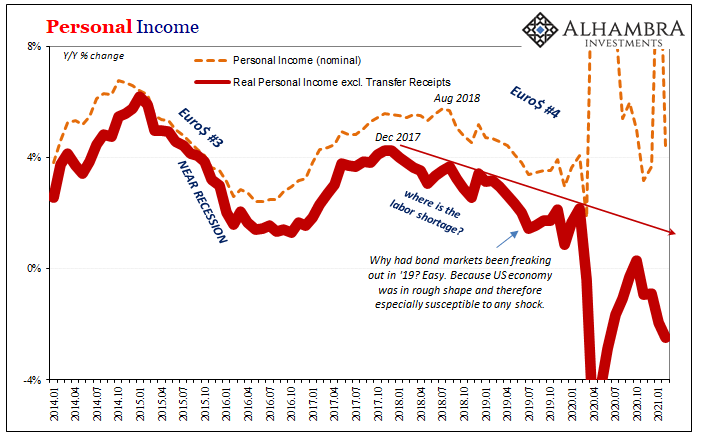

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again.

Read More »

Read More »

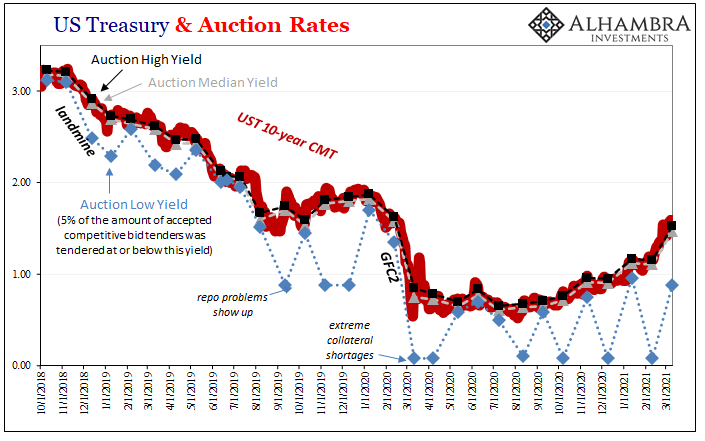

What Gold Says About UST Auctions

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first.

Read More »

Read More »

4 Social Security Planning Steps BEFORE You’re Ready to Retire

Social Security is an important part of almost every retirement plan, whether you’ve saved enough or not. That’s why it’s important to know as much about your Social Security situation as possible. And you don’t want to wait until you’re about to retire to gather the facts and take appropriate steps. Social Security planning needs to start 5 years before your target retirement date.

Read More »

Read More »

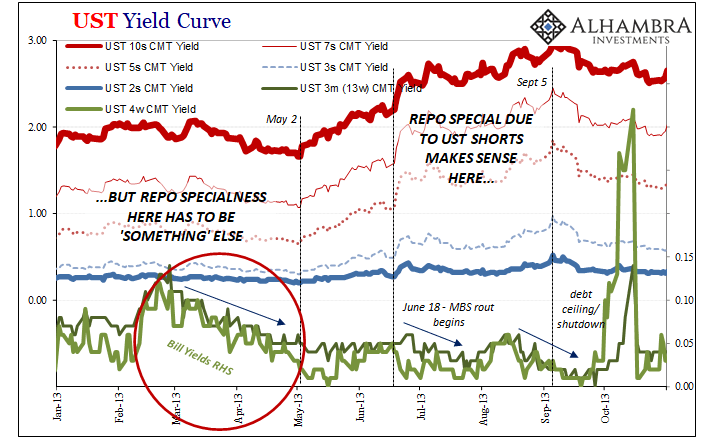

Deja Vu: Treasury Shorts Meet Treasury Shortages

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them.

Read More »

Read More »

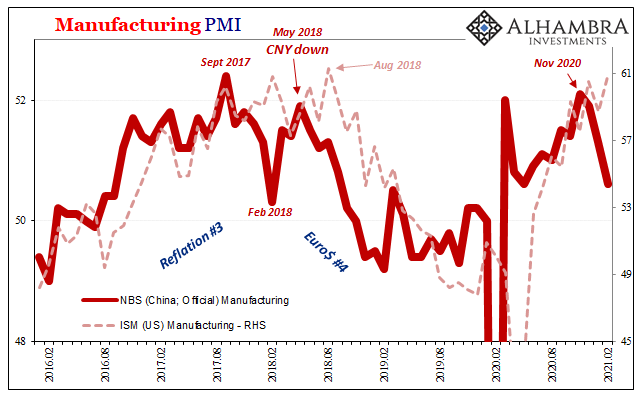

There’s Two Sides To Synchronize

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for.

Read More »

Read More »

Three Things About Today’s UST Sell-off, Beginning With Fedwire

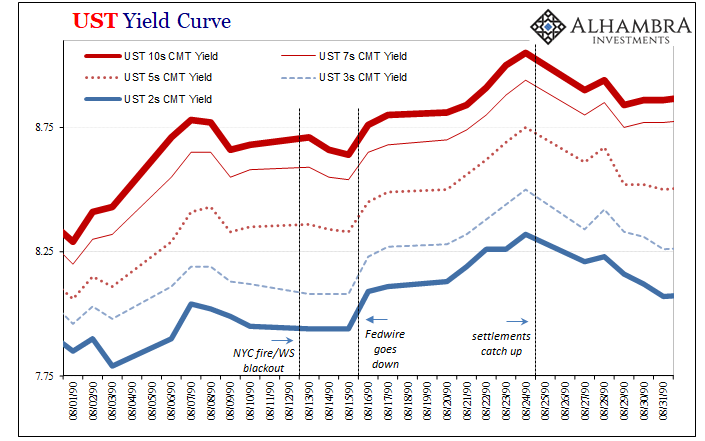

Three relatively quick observations surrounding today’s UST selloff.1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday.

Read More »

Read More »

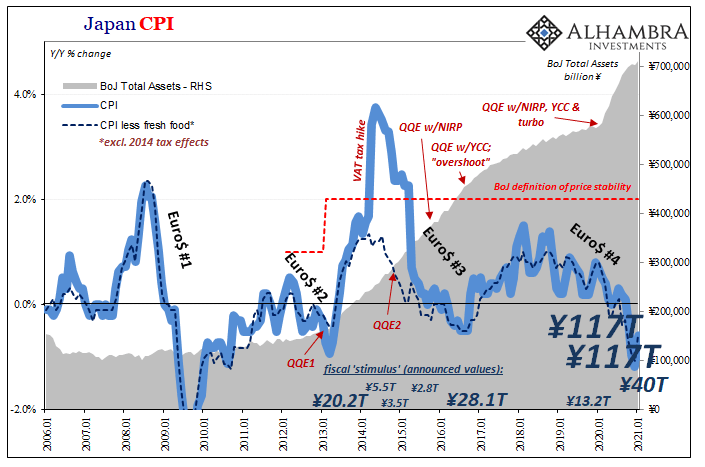

Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt.

Read More »

Read More »

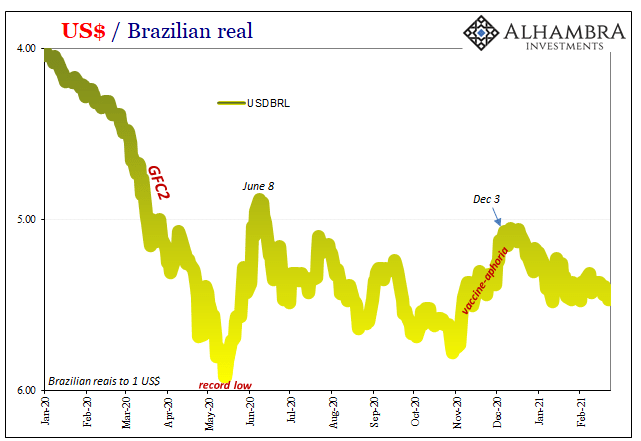

For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

What Might Be In *Another* Market-based Yield Curve Twist?

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago.

Read More »

Read More »