Category Archive: 4) FX Trends

FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump's "American First" rhetoric. Trump's earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump's use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism.

Read More »

Read More »

FX Weekly Review, April 10-14: Swiss Franc loses against the Yen, but wins against Dollar

Last week the Swiss Franc improved against both euro and dollar, but - compared to its safe-haven counterpart Japanese Yen - it had a bad performance. We expect strong SNB interventions.

Read More »

Read More »

Decoupling of Oil and US Interest Rates

US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top.

Read More »

Read More »

Euro’s Record Losing Streak Against the Yen

The euro has fallen for 11 consecutive sessions against the yen. Interest rates, US and German in particular, seem to be the main driver. Technicals are stretched, but have not signaled a reversal yet.

Read More »

Read More »

Cool Video: Making Sense of the New Administration

I was on Bloomberg TV earlier today, chatting with David Gura about how to try to make sense of new Trump Administration. I suggest that the decision-making style and practical concerns have created two wing to the Administration. There is a populist-nationalist wing that is home to America First ideas.

Read More »

Read More »

FX Daily, April 14: Holiday Markets Remain on Edge

The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar's strength from the sitting US President. While sending an "armada" toward the Korean peninsula, the US ordered a missile strike against Syria in retaliation for the use of chemical weapons and dropped the largest bomb in the world on Afghanistan.

Read More »

Read More »

Trade Notes: China and Prospects for a New Executive Order

China's trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive.

Read More »

Read More »

FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday.

Read More »

Read More »

FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was also initially extended in Asia before stabilizing and returning to levels seen in the US afternoon.

Read More »

Read More »

FOMC Minutes Suggest Balance Sheet May Begin Shrinking This Year

FOMC minutes increased likelihood that Fed will begin reducing its balance sheet late this year. There does not seem to be a consensus on other issues. The strength of the ADP report contrasts with softness seen in the ISM and PMI non-manufacturing surveys.

Read More »

Read More »

FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

The US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey.

Read More »

Read More »

Impressive Japanese Flows at the end of the Fiscal Year

Japanese investors bought foreign bonds in the last week of March for the first time in nine weeks. Foreigners bought the most Japanese stocks since last April. The pain trade is for a break of JPY110.

Read More »

Read More »

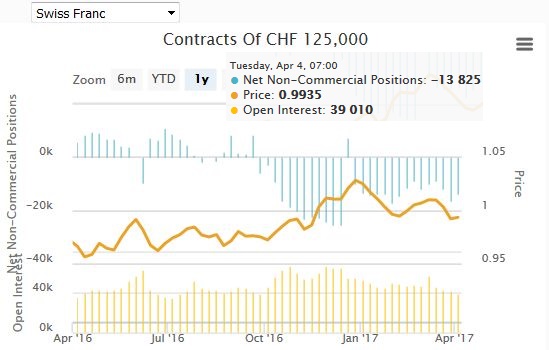

Weekly Speculative Positions (April 4 Data): Reduction in CHF Net Shorts

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure. In the last week, finally they increased their Euro shorts again.... and reduced their CHF shorts.

Read More »

Read More »

FX Daily, April 10: Dollar Narrowly Mixed at Start of Holiday Week

The US dollar is narrowly mixed after a brief attempt in Asia to extend its pre-weekend gains fizzled, and a consolidative tone has emerged. The news stream is light and largely limited to the current Japanese account and the Sentix survey from Europe.

Read More »

Read More »

FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors' willingness to look past Q1 economic data.

Read More »

Read More »

FX Weekly Review, April 03-08: Dollar Recovery Can Continue, 10-year Yield Set to Rise

The US dollar appreciated against most of the major currencies last week. The Japanese yen was the chief exception. It rose about 0.5% as US yields remained heavy and equities were mostly softer. The Dollar Index did not fall in any session last week. It has had one losing session over the past nine, and that was the last day in March when the Dollar Index slipped less than 0.1%. It finished the week a bit above thee 61.8% retracement objective of...

Read More »

Read More »

US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job.

Read More »

Read More »

Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate.

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »

Inclusion in SDR Does Not Spur Official Demand for the Yuan

China's share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves - valuation, portfolio decisions, and China's gradual inclusion in allocated reserves. The Swiss franc's as a reserve asset diminished, but the "other" category appeared robust.

Read More »

Read More »