Category Archive: 4) FX Trends

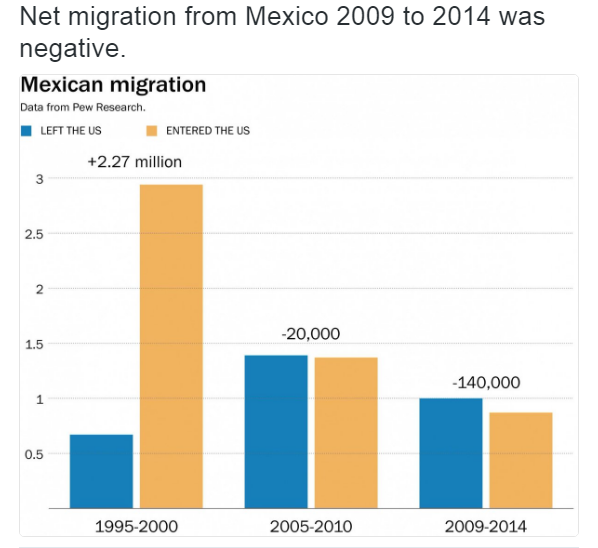

Great Graphic: Net Mexican Migration to the US–Not What You Might Think

Net migration of Mexicans into the US has fallen for a decade. The surge in Mexican migration into the US followed on the heels of NAFTA. Although Trump has bounced in the polls, and some see this as negative for the peso, rising US interest rates and the slide in oil price are more important drivers.

Read More »

Read More »

Thoughts on the Price Action

Global interest rates are rising. Something important is happening. It appears to be dollar positive.

Read More »

Read More »

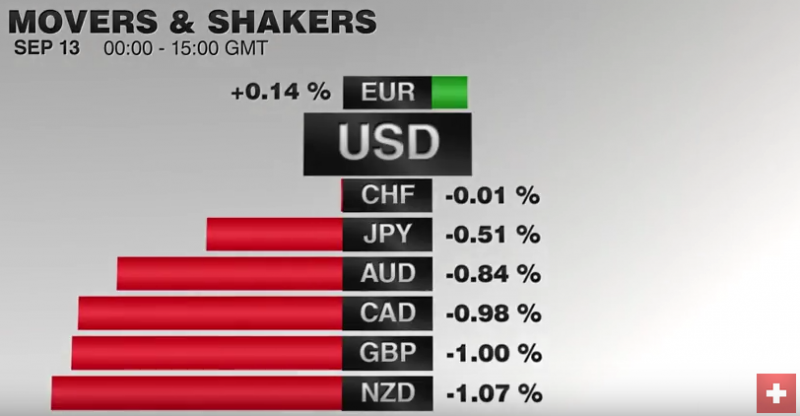

FX Daily, September 13: Much Noise, Weak Signal

The last ECB meeting and Dragh's hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth.

Read More »

Read More »

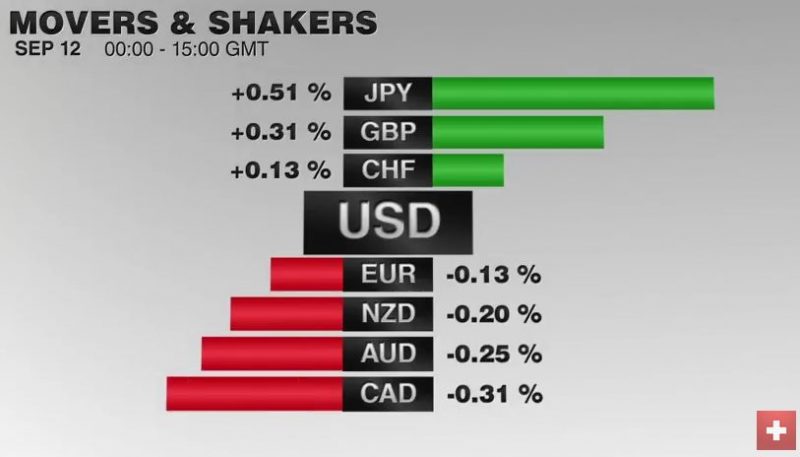

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

FX Weekly Preview: Capital Markets in the Week Ahead

Global bonds and global stocks ended last week on a weak note and this will likely carry into this week's activity. The Bank of England meets, but the data may be more important. Oil and commodity prices more generally look vulnerable, and this coupled with higher yields sapped the Australian ad Canadian dollar in the second half of last week.

Read More »

Read More »

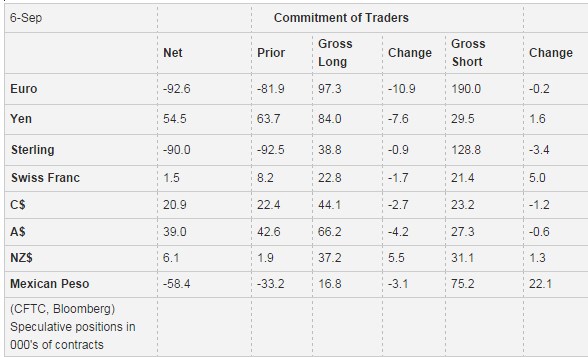

Weekly Speculative Postions: CHF net long positions down from 8.2K down to 1.5K

The Swiss Franc depreciated this week again. The euro rose to 1.960. One reason is the reduction in net long CHF speculative position from 8.2K to 1.6K contracts. Given the weak ISM non-manufacturing PMI, it remains unclear. why speculator now move into the dollar.

Read More »

Read More »

FX Weekly Review, September 05 – September 09: Dollar Proves Resilient as Market Rates Rise

It took the market a few days to overcome the shockingly poor non-manufacturing ISM (51.4 vs. 55.5). However, by the end of the week, the US dollar bulls had regained the upper end.

Read More »

Read More »

FX Daily, September 9: Ahead of the Weekend

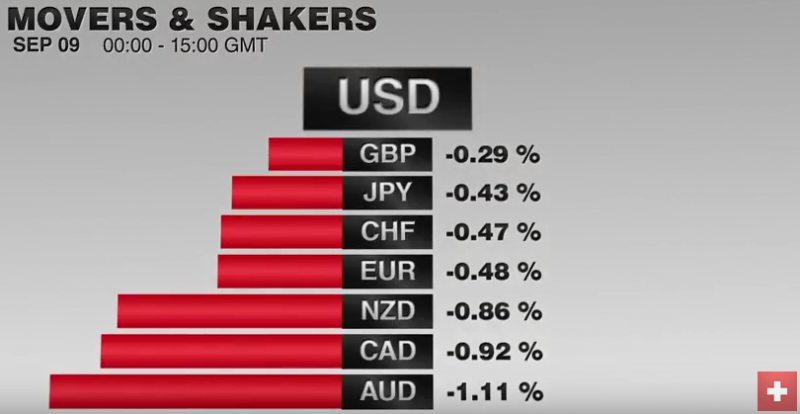

The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed.Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays. The streak may end today. The euro has found support nearly $1.1260, and the intraday technicals favor a move higher in the US morning.

Read More »

Read More »

FX Daily September 8: Draghi Says Little, Door Still Open for More

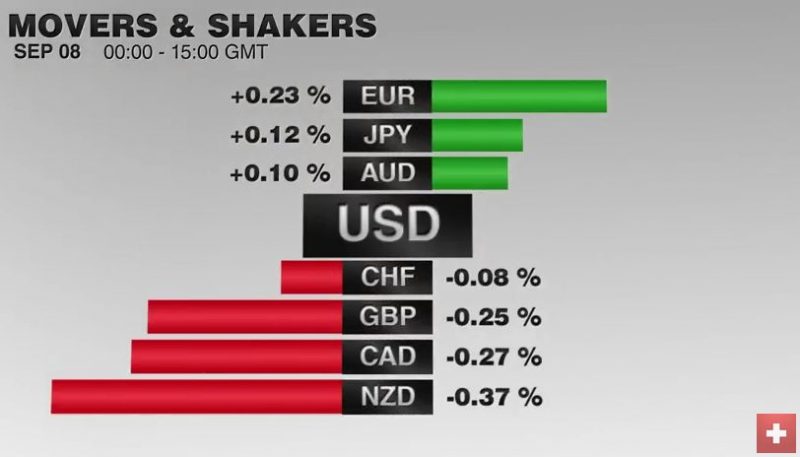

In the last two days, the euro moved upwards against CHF. Given that Swiss GDP was stronger than the one in the euro zone, this is surprising. But we must recognize that Draghi could be the reason. Inflation forecasts of 1.2% in 2017 and 1.8% in the euro zone would mean the ECB hikes rates maybe in 2018 or 2019. I personally do not believe it, given that wage inflation in Italy or Spain is clearly under 1%. This is lower than Swiss wage inflation...

Read More »

Read More »

FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

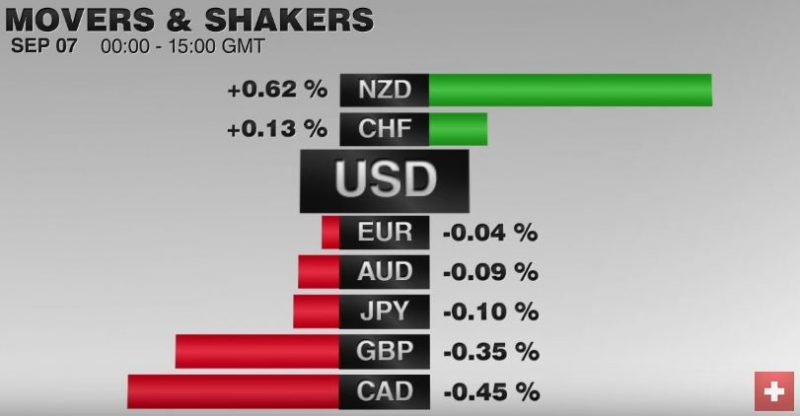

Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of...

Read More »

Read More »

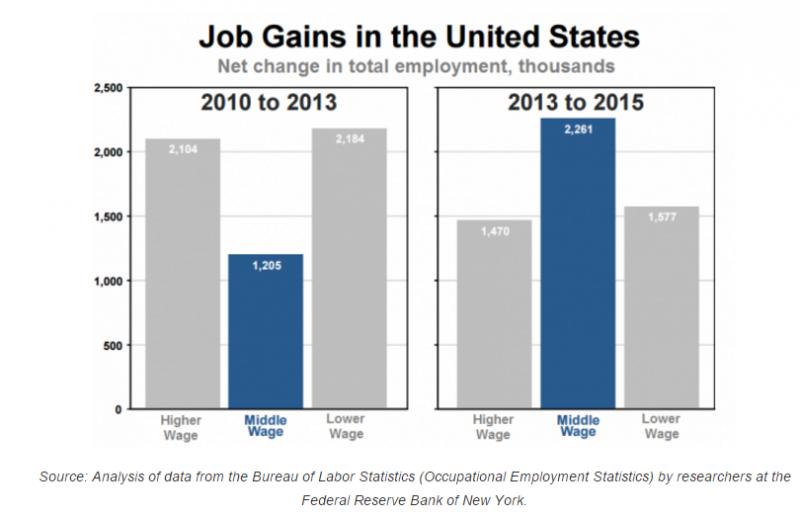

Great Graphic: What Kind of Jobs is the US Creating

The oft repeated generalization about the dominance of low paying jobs is not true for the last few years. This does note refute the disparity of wealth and income in the US. There is a restructuring taking place that favors educated and skilled workers.

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

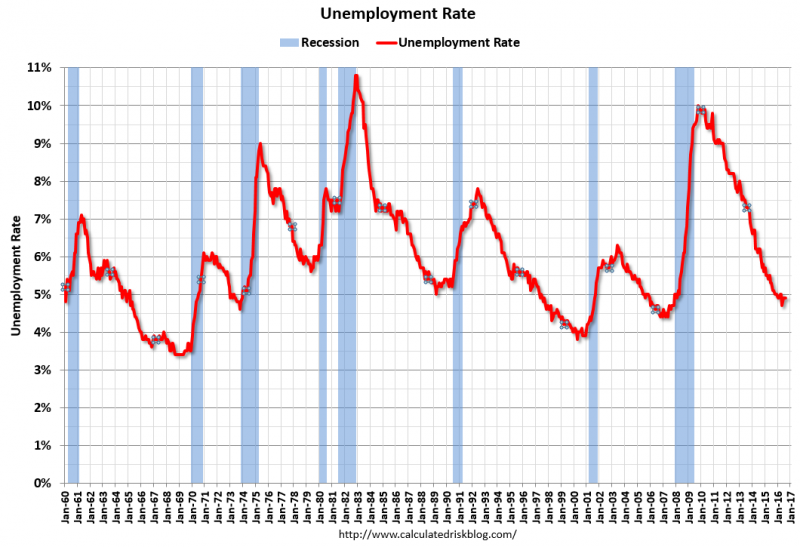

Services ISM Sends Greenback Reeling

ISM showed unexpected weakness in Aug non-mfg PMI. Markit measure slipped but not as much as ISM. Odds of a Sept Fed hike slip to about 15%. Watch trendline in Dollar Index near 94.45.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

FX Weekly Preview: Parsing Divergence: Focus Shifts from Fed to ECB

Net-net, the September Fed funds futures contract was little changed on the week. Four high-income central banks meet in the week ahead; the ECB is the only one in play. China accounted for a full three quarters of the US trade deficit in July.

Read More »

Read More »

FX Weekly Review, August 29 – September 2: Disappointing Jobs Data Doesn’t Break the Buck

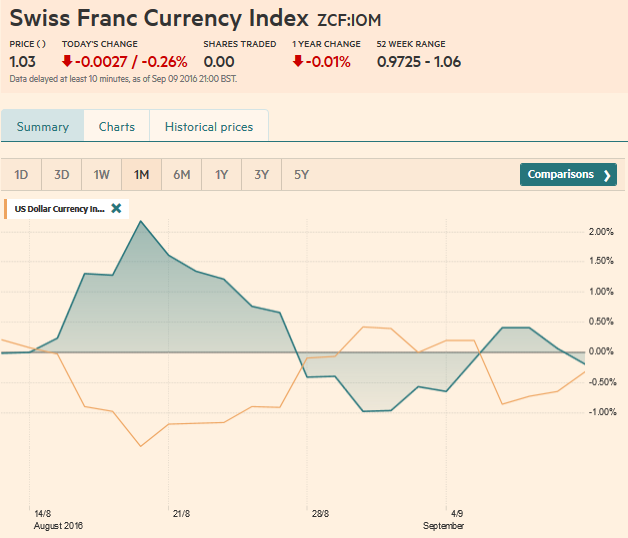

During this week the Swiss Franc index lost against both dollar and euro. The CHF index ended one percent down. Despite not convincing US jobs, the dollar index ended in positive territory.

Read More »

Read More »

Weekly Speculative Positions: Rising Swiss Franc Longs

Speculative activity remained light in the latest CFTC reporting period ending August 30. There were no gross position adjustments that we recognize as significant; 10k contracts or more. There were only three gross adjustments by speculators of more than 4k contracts. With the higher EUR/CHF FX rate and weaker U.S. jobs date, speculators went long CHF by 8.2K contracts.

Read More »

Read More »

Forex trading can be like football. You win some. You lose some.

Sometimes risking a little more, works out for you too In the US, the college football season is getting underway on Saturday. Yippee. A comment from an Attacking Currency Trend trader reminded me of conversations I have had with my son, a college football coach. The comment was about a trade that got stopped out …

Read More »

Read More »

US Jobs Disappoint, Risk of Sept Hike Recedes, Dollar Falls

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »