Category Archive: 4) FX Trends

FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

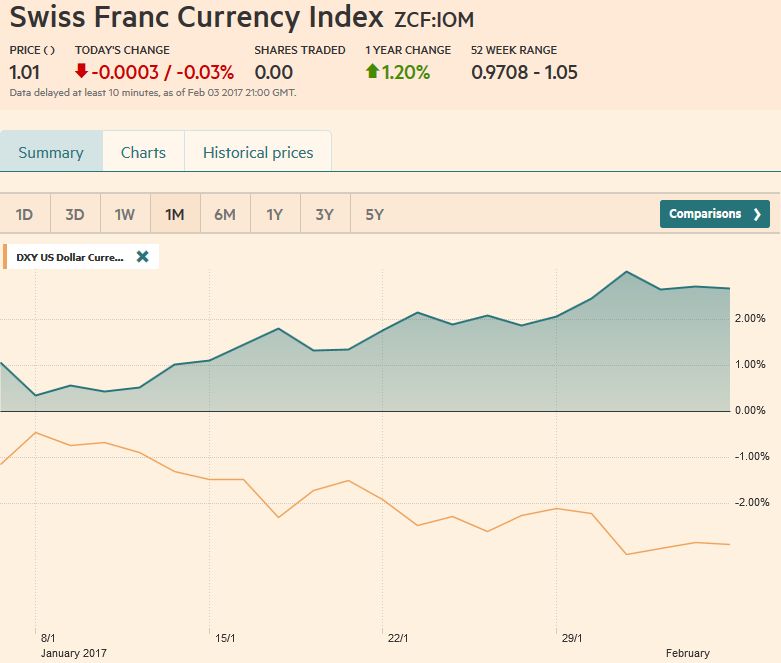

The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now - and with it the franc recovered.

Read More »

Read More »

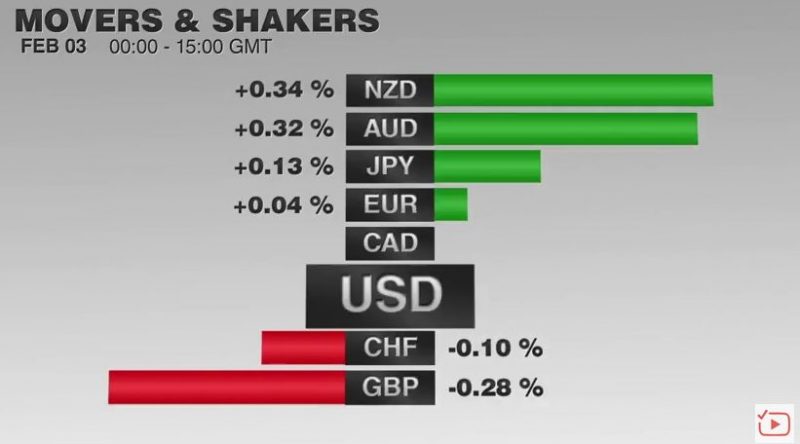

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

The Future of Globalization

antiglobalizationThe cross-border movement of goods, services, and capital increased markedly for the thirty years up to the Great Financial Crisis. Although the recovery has given way to a new economic expansion in the major economies, global trade and capital flows remain well below pre-crisis levels. It had given rise to a sense globalization is ending.

Read More »

Read More »

FX Daily, February 02: Dollar Remains on Back Foot After ADP and FOMC

The US dollar remains on its back foot despite the stronger than expected ADP job estimate and the FOMC that said nothing to dissuade investors that it will be gradually raising rates this year.

Read More »

Read More »

Great Graphic: French Premium over Germany Continues to Grow

European premiums over Germany typically increase in a rising interest rate environment. France's premium is at the most in two years. France is still set to turn back the challenge from Le Pen.

Read More »

Read More »

Thoughts about the Fed’s Balance Sheet

Several regional Fed presidents want to begin talking about shrinking Fed's balance sheet. Leadership does not appear to have great urgency, so don't expect anything in this week's statement. First step more hikes, then refrain from reinvesting payments and maturities, but slowly.

Read More »

Read More »

Defining and Limiting your Risk. Why is it so important in your trading?

I talk a lot about defining and limiting risk in trading. Why is it so important. Watch this video and find out the importance.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

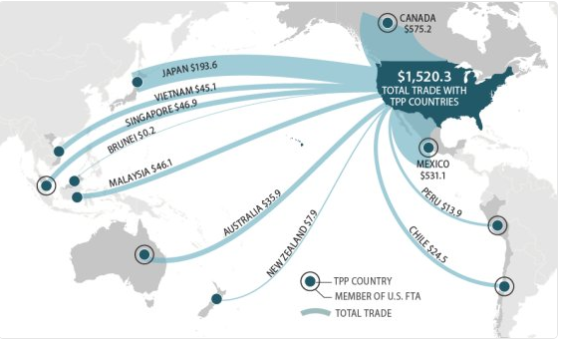

Trade is Trump’s Centerpiece

Investors are anxiously awaiting more details on the new US Administration's economic policies and priorities. Part of the challenge is that the cabinet represents a wide range of views and it is not clear where the informal power lies, or whose call is it. In terms of economic policy, trade is being given priority. It is seen as the key to the jobs and growth objectives.

Read More »

Read More »

Pressure on Greece Mounts, New Crisis Looms

Greece needs to implement its commitments in the next few weeks or it faces a new crisis. The more the government implements its commitments, the less public support it draws. New elections in Greece cannot be ruled out.

Read More »

Read More »

FX Daily, January 31: Markets Look for Solid Footing

The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday's drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar's losses yesterday, which it is consolidating today.

Read More »

Read More »

Trump and the Dollar

US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk.

Read More »

Read More »

How to trade the Trump White House right now

Way too many people have the Trump trade backwards, they’re focused on the wrong thing. Adam Button talks about what matters to the market and how to trade the US dollar in the first weeks of the Trump Presidency.

Read More »

Read More »

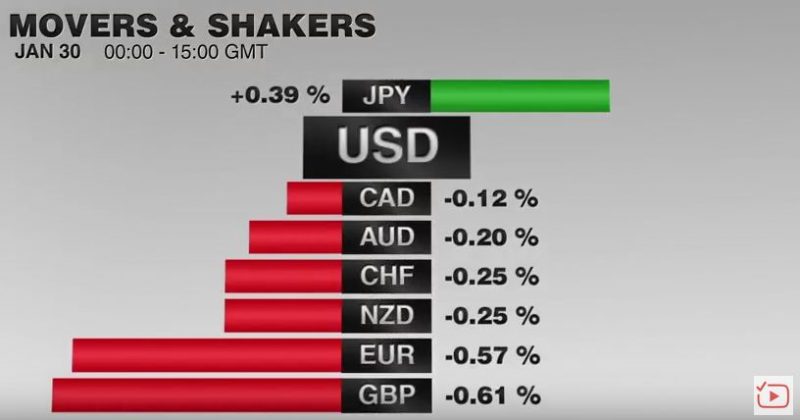

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

Weekly Speculative Position: Net Short Euro and Yen Are Falling. Short CHF Stable

Speculators are net short CHF with 13.6K contracts against USD. This is nearly unchanged. But net short of Euro and Yen are Diminishing.

Read More »

Read More »

FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China's PMI are among the data highlights.

Read More »

Read More »

FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

The US dollar spent the first month of the new year correcting lower after a strong advance in the last several months of 2016. We argue that the correction actually began in mid-December following the Federal Reserve's rate hike.

Read More »

Read More »

Great Graphic: Mexico and China Unit Labor Costs

Mexico has been gaining competitiveness over China before last year's depreciation of the peso. The depreciation of the peso, and other US actions can contribute to the destabilization of Mexico. An economically prosperous and stable Mexico has long been understood to be in the US interest.

Read More »

Read More »

Plan the trade: A technical look at the EURUSD for the trading week ahead

Non- trending transitions to trending The EURUSD traded in a 117 pip range in the last week. That represents the most narrow trading week going back to December 21, 2014. When ranges are narrow, the market is unsure of the direction it wants to go. That will logjam is eventually broken – one way or …

Read More »

Read More »