Category Archive: 4) FX Trends

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

What is Good for the Dollar is Bad for Gold

The Dollar Index is powering ahead, moving higher for the eighth consecutive session. Over the past 100 sessions, gold and the Dollar Index move in the opposite direction more than 90% of the time. The technical condition of gold is deteriorating.

Read More »

Read More »

FX Daily, February 13: Quiet Start of Busy Week

With inflation and growth reports due out this week and Federal Reserve Chair Yellen's testimony before Congress, it promises to be a busy week for investors. However, the week has begun off fairly quietly, while the recent rally in equities continues.

Read More »

Read More »

New Book: Political Economy of Tomorrow

My new book,Political Economy of Tomorrowhas just been published, and it is available onAmazon. The book is not so much of a sequel to my first book,Making Sense of the Dollar. There is very little about the foreign exchange market in the new book. However, it is not wholly new cloth either.

Read More »

Read More »

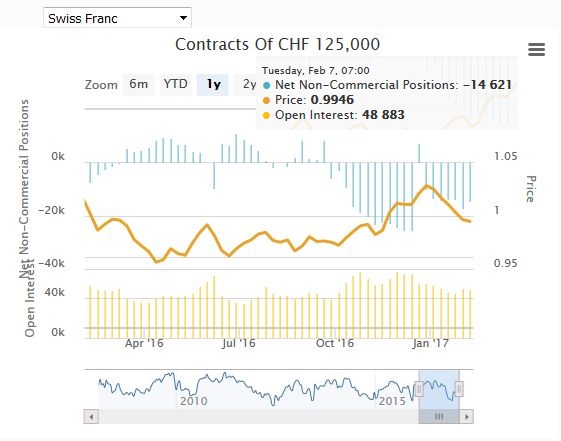

Weekly Speculative Position: Speculators are long all currencies of the dollar bloc

Speculators are net short CHF with 14.6K contracts against USD. This is less than the 17K last week.

Read More »

Read More »

FX Weekly Preview: Yellen’s Path Cleared by Trump’s Moderation

Trump has moderated in several areas, he is being checked in others, and less impactful in others. This will underscore the focus on Yellen's testimony this week. At same time, many will be reluctant to short the dollar ahead of the tax reform plans that may be unveiled in Trump's upcoming speech to Congress.

Read More »

Read More »

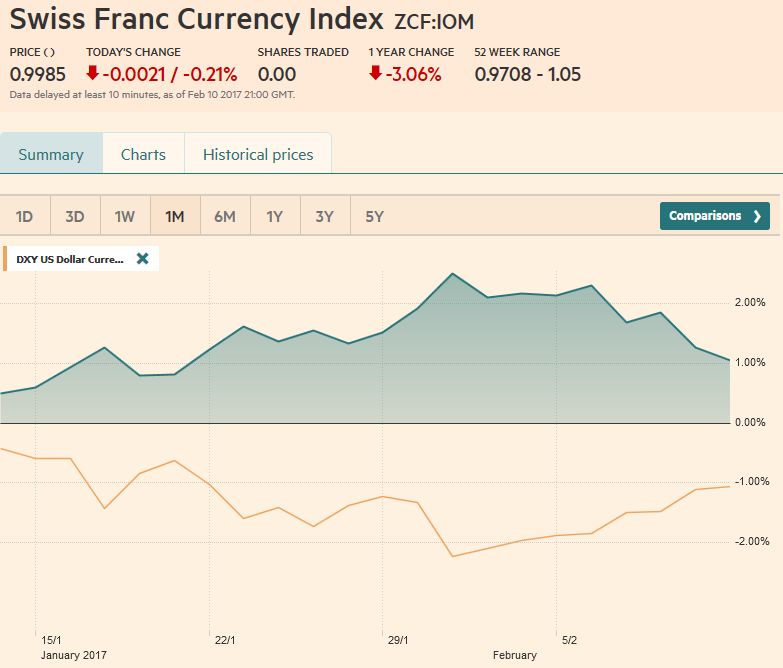

FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

We are expecting a further strengthening of both dollar and Swiss Franc against the euro over the next 3 months. Reason is the rising Swiss demand the continued dovishness of the ECB, despite rising inflation.

Read More »

Read More »

Fake News. Fake Breaks. What do they have in common? How to deal with them?

When I hear the word “fake:, I cannot help but think of “fake news”. Fake news has become so pervasive, I combat it by waiting for the dust to settle, fact checking and making logical judgments. In trading there are a number of times when you will get a fake break. Coincidentally, I deal with …

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

FX Daily, February 10: US Dollar Holding on to Week’s Gains

The US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week's decline. The Aussie is the strongest on the day, up about 0.2% to trim the week's loss to about 0.45%.

Read More »

Read More »

Cool Video: Bearish Case for Euro and Prospect of Currency Wars

Still in London as this part of the business trip is winding down. I had the privilege of going over to the Bloomberg office today and spoke with Vonnie Quinn and Mark Burton about the euro's outlook and whether the US should have a strong or weak dollar.

Read More »

Read More »

Trump’s New Dollar Policy

Adam Button at ForexLive talks about a generational change in US currency policy and what it could mean if Trump abandons the strong dollar policy. What are the forex trades if it happens? When could we expect it?

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

Is a Strong or Weak Dollar Good for the US? The $16 trillion Question

Dollar movement helps some economic interest and hurts others. From a strategic point of view, the best thing for the US is the market-generated rate. It was an important achievement that the forex market was de-weaponized. Many observers have been crying wolf about a currency war for many years, which may have de-sensitized investors to the threat of a real one.

Read More »

Read More »

Cool Video: Around the World with Katie Martin of the Financial Times

I am in London as part of a larger business trip. I had the chance today to talk to Katie Martin, who runs Fast FT and is often writing about foreign exchange. They show was live on Facebook. It is about a 22 minute interview and although foreign exchange is the key issue, to get to it we end up talking about many things, including US interest rates, Trump, and even cooking frogs.

Read More »

Read More »

FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come.

I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015.

Read More »

Read More »

Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the US.

Read More »

Read More »

Great Graphic: Interesting Sterling Price Action

Sterling is having an interesting day. It fell in the face of the US dollar's bounce but has recovered fully. It has not yet traded above yesterday's high (~$1.2510) but it may. It does appear to be tracing out a hammer in Japanese candle stick terms.

Read More »

Read More »

The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations.Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan's consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the inflation-linked, or protected...

Read More »

Read More »

FX Weekly Preview: Politics Not Economics is Driving the Markets

The Fed is more confident this year of stable growth and rising inflation. The new US Administration's economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy.

Read More »

Read More »