Category Archive: 4) FX Trends

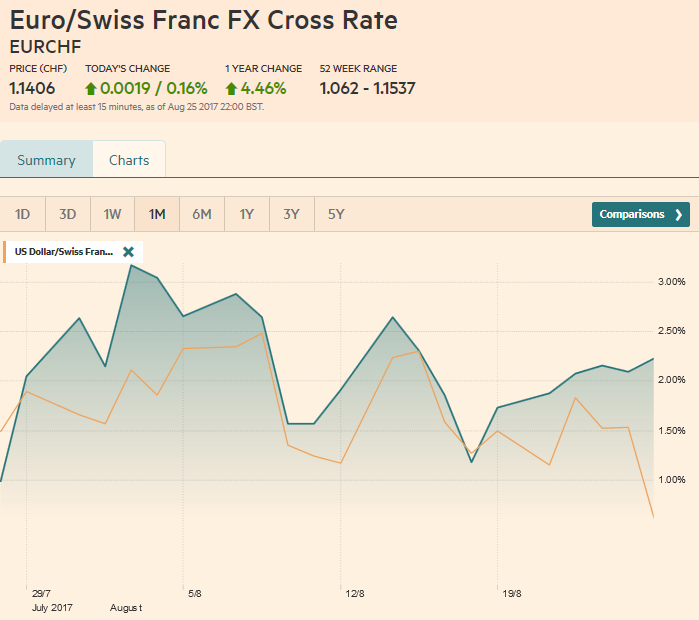

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

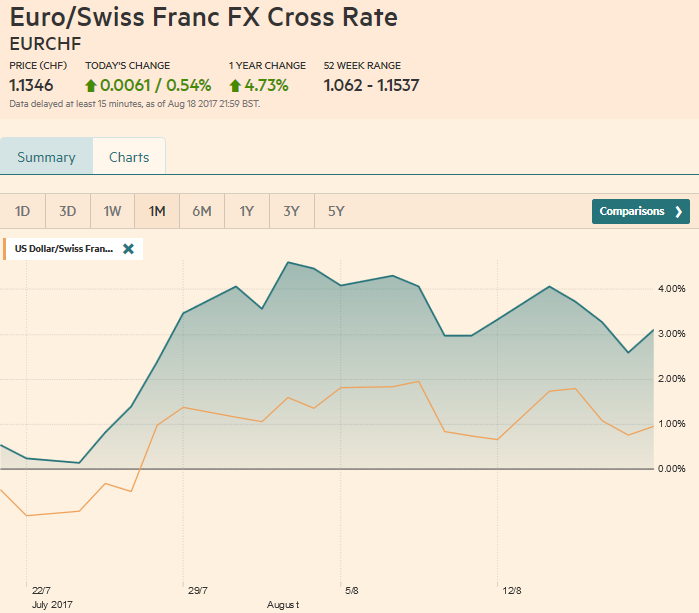

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »

Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market.

Read More »

Read More »

FX Daily, August 25: Is the Janet and Mario Show a New Episode or Rerun?

The event that investors have been waiting for and the media frequently linked to whatever price action has taken place has arrived: Yellen and Draghi's speeches later today. Yellen is first. She will speak at 10:00 am ET. This is toward the end of the European trading week. Draghi speaks late in the North American session--3:00 pm ET.

Read More »

Read More »

How will Yellen Address Fostering a Dynamic Global Economy?

Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

Euro Flirting with Near-Term Downtrend

North American traders began the week by selling dollars. Euro is testing a downtrend off the year's high. DXY is testing its uptrend.

Read More »

Read More »

FX Daily, August 23: Consolidation in Capital Markets Conceals Coming Turbulence

A mixed US dollar will greet the North American participants today. It is softer against the euro and yen, but firmer against the dollar-bloc currencies. Among the emerging market currencies, the eastern and central European currencies are moving higher in the euro's draft.

Read More »

Read More »

FX Daily, August 22: Turn Around Tuesday Sees Firmer Dollar, Rates, and Equities

The US dollar has recouped most of yesterday's declines. However, as we have seen over the past couple of sessions, he North American market appears more dollar negative than Europe or Asia. The dollar's rise through the European morning has left the intraday technical indicators a bit stretched, warning that this short-term pattern continues today.

Read More »

Read More »

FX Daily, August 21: Dollar Edges Higher, While Equities Trade Heavily to Start the New Week

The US dollar is mostly firmer against most of the major and emerging market currencies. The main impetus appears to be some position adjustment emanating from equities. The equity markets turned south in the second half of last week and are moving lower today. Foreign investors appeared to have sold around $100 bln of European equities in 2016 and bought around a third back this year.

Read More »

Read More »

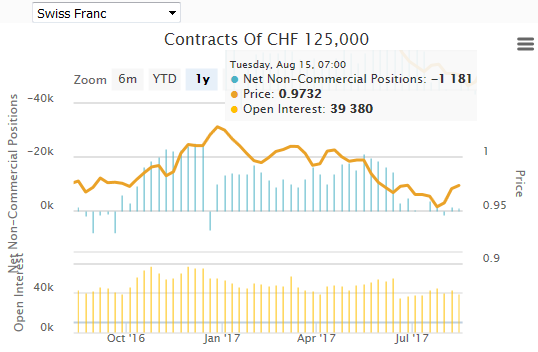

Weekly Speculative Positions (as of August 15): Speculators Add to Sterling and Peso Shorts, While Cutting Euro and Canadian Dollar Longs

The net speculative CHF position has fallen from -1.4K short to -1.2K contracts short (against USD). Speculators made several significant position adjustment in the CFTC reporting week ending August 15, that included an escalation of aggressive rhetoric by the US and North Korea.

Read More »

Read More »

FX Weekly Preview: Transitioning to a New Phase

Jackson Hole marks the end of the investors' summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump's advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand, "Fostering Dynamic Global Economy", which...

Read More »

Read More »

FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

The euro has lost some momentum, Draghi does not want to talk about an early end of his bond buying programming. Confirmed by economic data, 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swiss appreciated during the week.

Read More »

Read More »

Markets Exaggerate, That is what They Do

FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact.

Read More »

Read More »

FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week's gain in half. The Dow Jones Stoxx did not completely escape the US carnage yesterday, but losses are accelerating today, with a nearly 1% decline following a 0.6% decline yesterday.

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »

Is the Yen or Swiss Franc a Better Funding Currency?

Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution.

Read More »

Read More »

FX Daily, August 16: Swiss Franc and Yen Improve after Dovish Draghi Comments

Swiss Franc and Yen Improve after Dovish Draghi Comments, A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB's Draghi will not be discussing the central bank's monetary policy course at Jackson Hole confab, which will take place next week.

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »

FX Weekly Preview: Synthetic FX View — Macro and Prices

Economic data due out are unlikely to change macro views. Swiss franc's price action suggests some return to "normalcy" despite rhetoric remaining elevated. Sterling's 3.25 cent drop against the dollar looks over.

Read More »

Read More »