Category Archive: 4) FX Trends

FX Weekly Preview: Official Coordination or Is the Market Getting Ahead of Itself?

The consensus narrative sees a coordinated attempt by officials to prepare investors for less accommodative monetary policy. Data from the eurozone and UK may suggest the respective economies are not accelerating. Before getting to the jobs report, the US economic data, like auto sales, may be soft, while the prices paid in the manufacturing ISM may ease.

Read More »

Read More »

FX Weekly Review, June 26 – July 01: Normalization Ideas Weigh on Greenback

A virus has spread across the markets as the first half drew to a close. Many investors have become giddy. The low vol environment was punctuated by ideas that peak in monetary accommodation is past and that the gradual process of normalization is beginning.

Read More »

Read More »

FX Daily, June 30: Greenback Stabilizes

The US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB's annual conference. It is not really clear that Draghi or Carney gave new policy indications.

Read More »

Read More »

FX Daily, June 29: Run on Dollar and Yen Continues

The main driver of the foreign exchange market is the continued reassessment of the trajectory of monetary policy in the UK, EMU, and Canada. The OIS market does not show that higher rates are discounted for the next policy meeting (August, September, and July respectively), but rather there is greater confidence that, outside of Japan, peak monetary stimulus is behind us.

Read More »

Read More »

FX Daily, June 28: Draghi’s Sparks Mini Taper Tantrum, Euro Chief Beneficiary

Sounding confident, ECB President Draghi seemed prepared to reduce the asset purchases, and this overshadowed his explicit recognition that substantial accommodation is still necessary. This is very much in line with what many, including ourselves, anticipate: At the September ECB meeting, an extension of the asset purchases into the first part of next year, coupled with a reduction in the amounts being purchased.

Read More »

Read More »

Great Graphic: Dollar Breaks Out Against Yen

The dollar is at new lows for the year against the euro and Swiss franc. Draghi's comments earlier that transitory forces are dampening price pressures were seen as broadly similar to the Fed's leadership's assessment about US prices. The implication is that the ECB will announce tapering its purchases as it extends them into next year.

Read More »

Read More »

Great Graphic: US Wage Growth Exceeds Productivity Growth

One of the longstanding challenges to growth US aggregate demand has been that wages have not kept pace with inflation and productivity. The decoupling appears to have taken place in the late 1960s or early 1970s depending on exactly which metric one uses.In my book, the Political Economy of Tomorrow, I argue the decoupling of men's wages from productivity and inflation made it possible and necessary for women to enter the workforce in large...

Read More »

Read More »

FX Daily, June 27: Euro Surges on Draghi, While Yuan Rises on Suspected PBOC Action

ECB President Draghi told the audience at the annual ECB Forum transitory factors were holding back inflation. This was quickly understood to be bullish for the euro, and it rallied from near the session lows below $1.12 to around $1.1260, a nine-day high.

Read More »

Read More »

FX Daily, June 26: Italian Markets Shrug off Banking Morass and Local Election Results

The US dollar is mostly slightly firmer as North American dealers return to their posts. Ideas that the UK Tories are getting close to a deal with the DUP appears to be lending sterling a modicum of support, as it tries to extend its uptrend into a fourth session. The Japanese yen is the weakest of the majors, rising equities, and yields, spurs the dollar to re-challenge last week's high near JPY111.80.

Read More »

Read More »

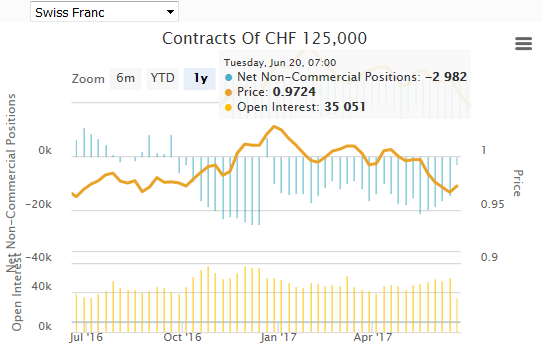

Weekly Speculative Positions (as of June 20): Surge in Positioning amid Currency Contract Roll

The net short CHF position has fallen from 14.5 short to 3K contracts short (against USD). The expiration of the June contracts and the roll into September positions appears to have boosted activity in the currency futures, and may obscure the signaling effect. Of the 16 gross positions we track, speculators add to exposure in all but four positions. There speculators covered gross short Swiss franc, Canadian, Australian, and New Zealand dollar...

Read More »

Read More »

FX Weekly Preview: Drivers A Couple Things that Aren’t on Your Economic Calendar

Fed, ECB and BOJ preferred inflation measures will be reported, but are unlikely to change views. Canada's Survey of Senior Loan Officers may be more important than April GDP. US healthcare bill in the Senate and likely action on steel could be the most significant events in the week ahead.

Read More »

Read More »

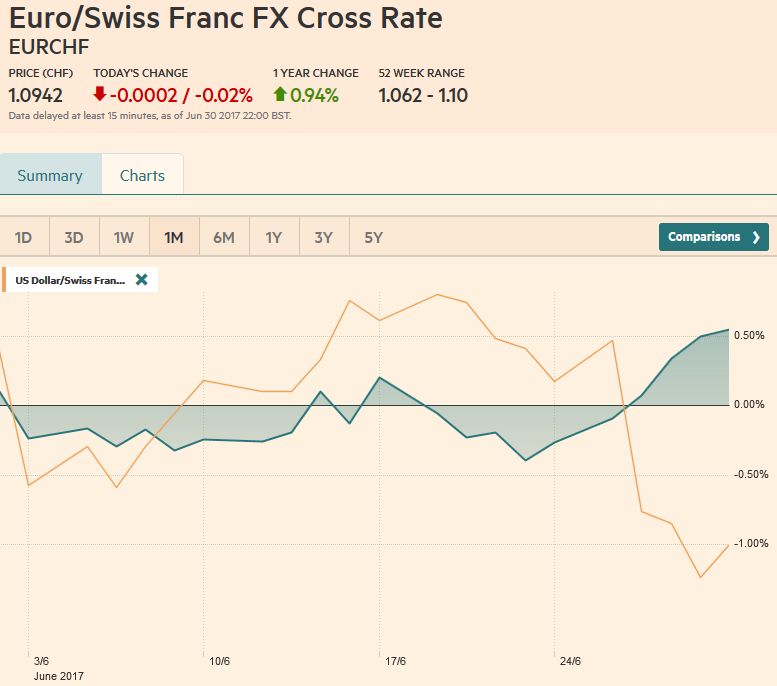

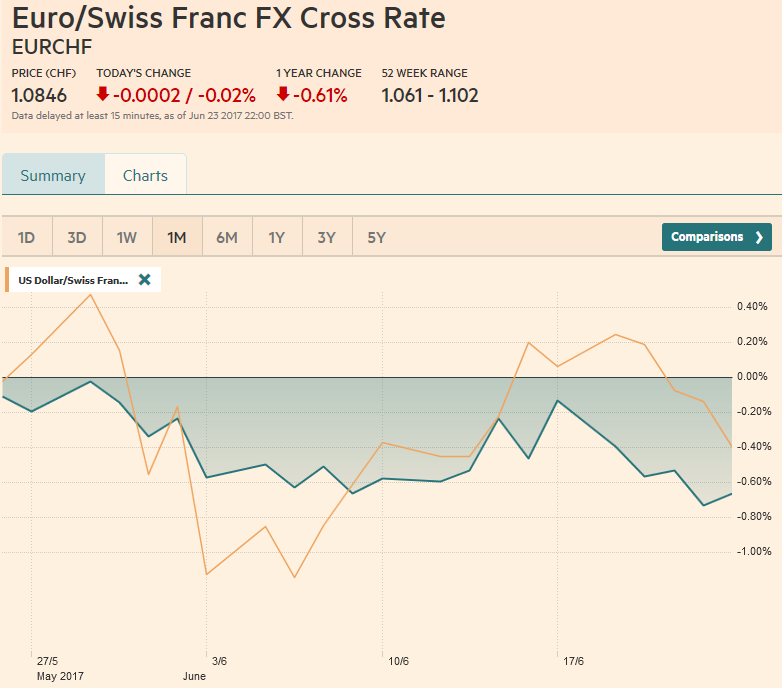

FX Weekly Review, June 19 – June 24: Stronger Franc with Fading Euro Enthusiam

Over the last month, the Swiss franc outpaced both EUR and USD. But the change is only little, the EUR fell by 0.60% and the dollar by 0.40%. The main reason for the stronger CHF is the fading enthusiasm after Macron's victory in the French elections and hence a weaker euro. Consequently SNB interventions are rising again.

Read More »

Read More »

Short Summary Weekly MOF Portfolio Flows

Japanese investors bought the third largest amount of foreign bonds this year last week, but still not enough to offset sales in first part of the year. Japanese investors are buying around the same amount of foreign equities as last year. Foreign investors are buying more Japanese stocks and bonds than they did on average last year.

Read More »

Read More »

Bond Yields, Inflation, and More

Falling oil prices pushing down inflation expectations and lowering bond yields is the conventional narrative. It ignores that survey-based measures of inflation expectations are stable. It ignores a host of other demand factors.

Read More »

Read More »

FX Daily, June 23: Dollar Pares Gains Ahead of the Weekend

The US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone.

Read More »

Read More »

Great Graphic: Fed, ECB, and BOJ Balance Sheets

This Great Graphic composed on Bloomberg shows the balance sheets of the Federal Reserve, the European Central Bank, and the Bank of Japan as a proportion of GDP.

Read More »

Read More »

FX Daily, June 22: Greenback Goes Nowhere Quickly, While Yen Remains Bid

The summer doldrums begin early. The US dollar is little changed against most of the major currencies. Bond yields are mostly one-two basis points lower, and equity markets are mixed but with a downside bias. Oil prices slump more than 2% on Tuesday and again on Wednesday. This is weighing on bond yields and equities.

Read More »

Read More »

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

FX Daily, June 21: Heavy Oil Weighs on Yields and Lifts Yen

The US dollar is narrowly mixed against the major currencies. The drop in oil prices (3.3% this week) is seen as one of the factors that may be underpinning the appetite for fixed income, and this, in turn, is lifting the yen. The greenback had approached JPY112 yesterday, but with the drop in oil prices and yields has seen it retreat toward JPY111.00.

Read More »

Read More »

FX Daily, June 20: Officials Fill Vacuum of Data to Drive FX Market

The light economic calendar has cleared the field to allow officials to clarify their positions. Yesterday it was NY Fed President Dudley and Chicago Fed Evans who argued that economic conditions continued to require a gradual removal of accommodation. The Fed's Vice Chairman Fischer did not address US monetary policy directly but did note that housing prices were elevated and that low interest rates

contributed.

Read More »

Read More »